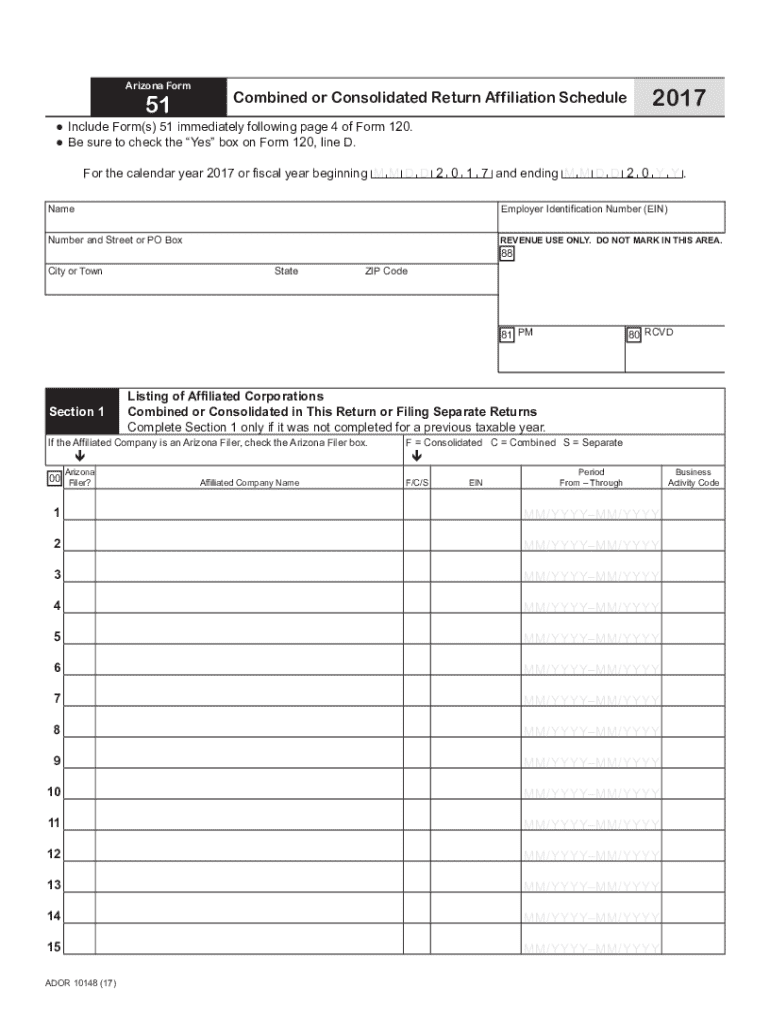

Get the free Arizona Form 51

Get, Create, Make and Sign arizona form 51

How to edit arizona form 51 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 51

How to fill out arizona form 51

Who needs arizona form 51?

Your Comprehensive Guide to Arizona Form 51

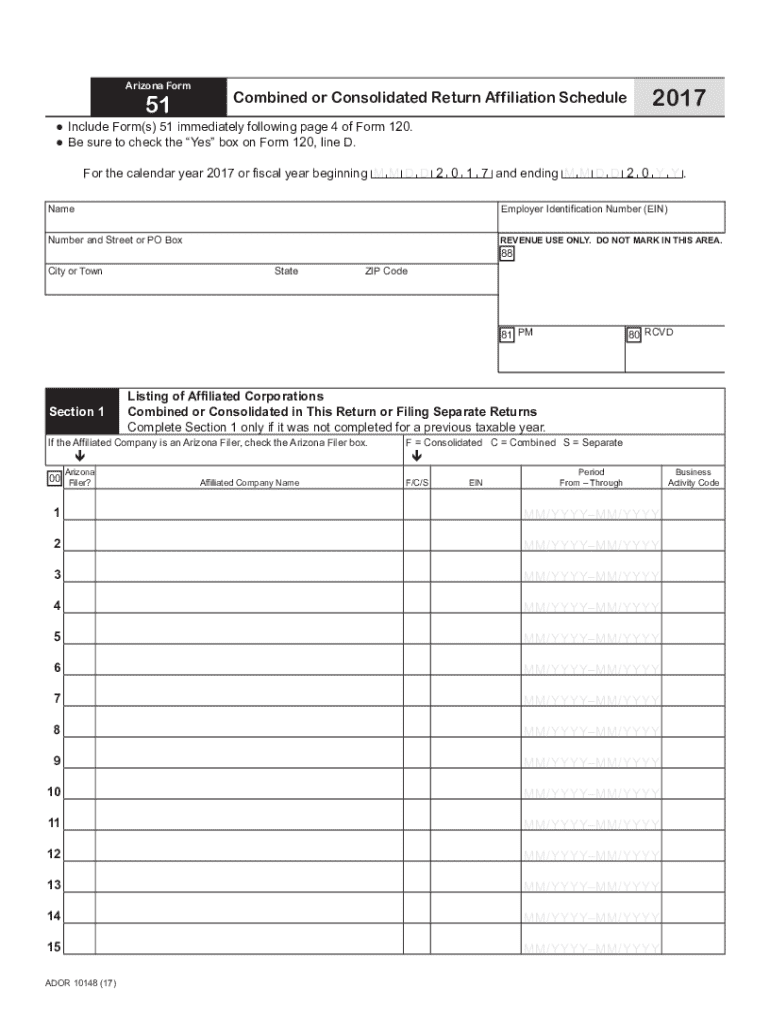

Understanding Arizona Form 51: Overview

Arizona Form 51 is an essential document used by residents of Arizona for income tax reporting. This form allows individuals and teams to declare their income, along with any applicable deductions and credits. Understanding the nuances of Arizona Form 51 is critical for accurate tax reporting and compliance with state tax regulations.

The primary purpose of Arizona Form 51 is to provide the Arizona Department of Revenue with a comprehensive overview of a taxpayer's financial situation. Properly filing this form ensures not only compliance with state laws but also maximizes potential tax benefits. Failure to submit it accurately may lead to legal implications and penalties.

Components of Arizona Form 51

Arizona Form 51 consists of several key components that taxpayers must complete accurately. Each section plays a significant role in determining the taxpayer's financial responsibilities and potential benefits. Understanding what information is required in each section is vital for successful completion of the form.

The main sections of Arizona Form 51 include:

Step-by-step instructions for filling out Arizona Form 51

Filling out Arizona Form 51 can seem daunting at first, but following a step-by-step approach simplifies the process significantly. Here’s how to navigate it effectively:

Editing and managing your Arizona Form 51 with pdfFiller

pdfFiller offers a robust platform for editing your Arizona Form 51, providing users with sophisticated yet user-friendly tools that simplify the document management process. Utilizing pdfFiller can maximize accuracy and efficiency when completing this important form.

With pdfFiller, you can easily edit your form directly in the cloud, ensuring that your information is always up-to-date. Key features include:

Working collaboratively is made simpler with pdfFiller's real-time collaboration features, allowing team members to contribute their input seamlessly. This makes managing feedback and revisions effective, ensuring the final submission is both polished and accurate.

eSigning Arizona Form 51

eSigning your Arizona Form 51 streamlines the signing process while enhancing efficiency. The benefits of eSigning over traditional methods are numerous, including speed of processing and reduced paper usage.

To eSign your form with pdfFiller, follow this simple guide:

Common FAQs about Arizona Form 51

Having questions about Arizona Form 51 is normal, especially when filing for the first time. Here are some frequently asked questions to help clarify common concerns regarding the form:

Troubleshooting common issues

Despite careful planning, issues may arise when filing Arizona Form 51. Here are tips for resolving common filing issues that may occur:

If persistent problems continue, contacting the appropriate Arizona state agency can provide further assistance tailored to your specific issue, ensuring you remain on track with your filing.

Tips for efficiently managing your forms and templates

Efficient management of your forms and templates is essential for smooth documentation processes. Here are some actionable tips:

Navigating legal implications related to Arizona Form 51

Understanding the legal framework surrounding Arizona Form 51 is crucial to ensure that you abide by all regulations. The responsibilities tied to this form include providing accurate information to avoid legal repercussions.

It’s essential to be aware of the potential penalties that can result from incorrect filing, which might include fines or more severe legal consequences.

Advanced features in pdfFiller for Arizona Form 51

pdfFiller goes beyond basic document management, offering advanced features that enhance the overall experience when dealing with Arizona Form 51. These features can improve workflow efficiencies significantly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the arizona form 51 in Chrome?

Can I create an electronic signature for signing my arizona form 51 in Gmail?

How can I fill out arizona form 51 on an iOS device?

What is arizona form 51?

Who is required to file arizona form 51?

How to fill out arizona form 51?

What is the purpose of arizona form 51?

What information must be reported on arizona form 51?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.