Get the free Pre-approval Form

Get, Create, Make and Sign pre-approval form

How to edit pre-approval form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pre-approval form

How to fill out pre-approval form

Who needs pre-approval form?

Complete Guide to Pre-Approval Forms: Streamline Your Requests

Understanding the pre-approval process

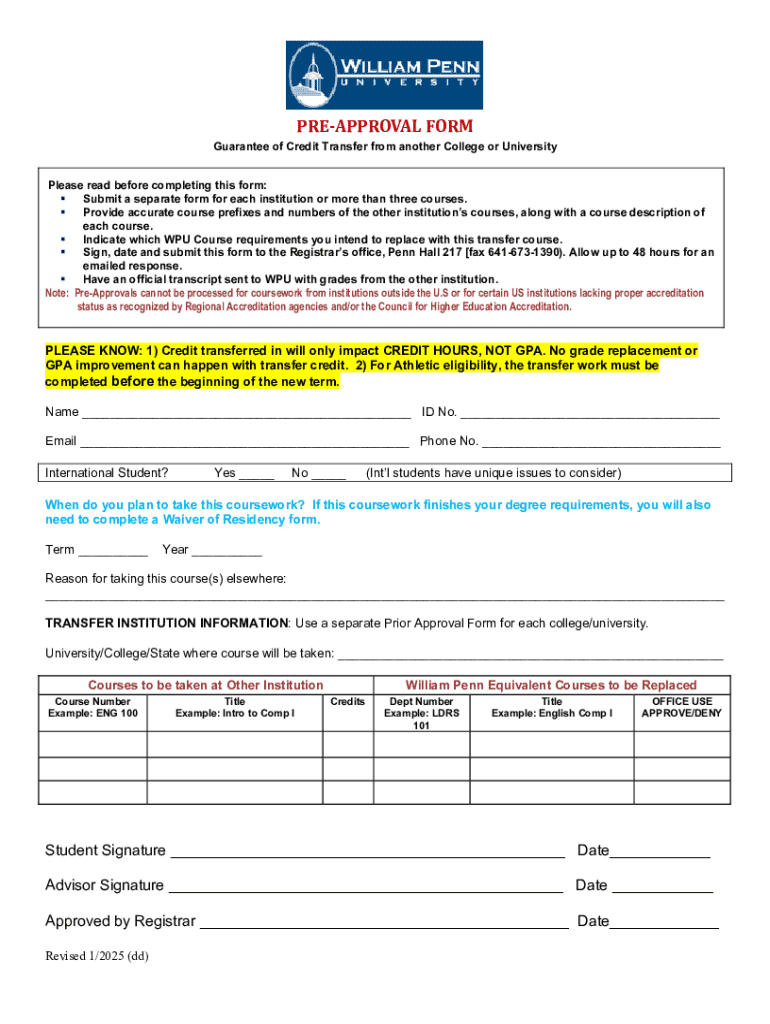

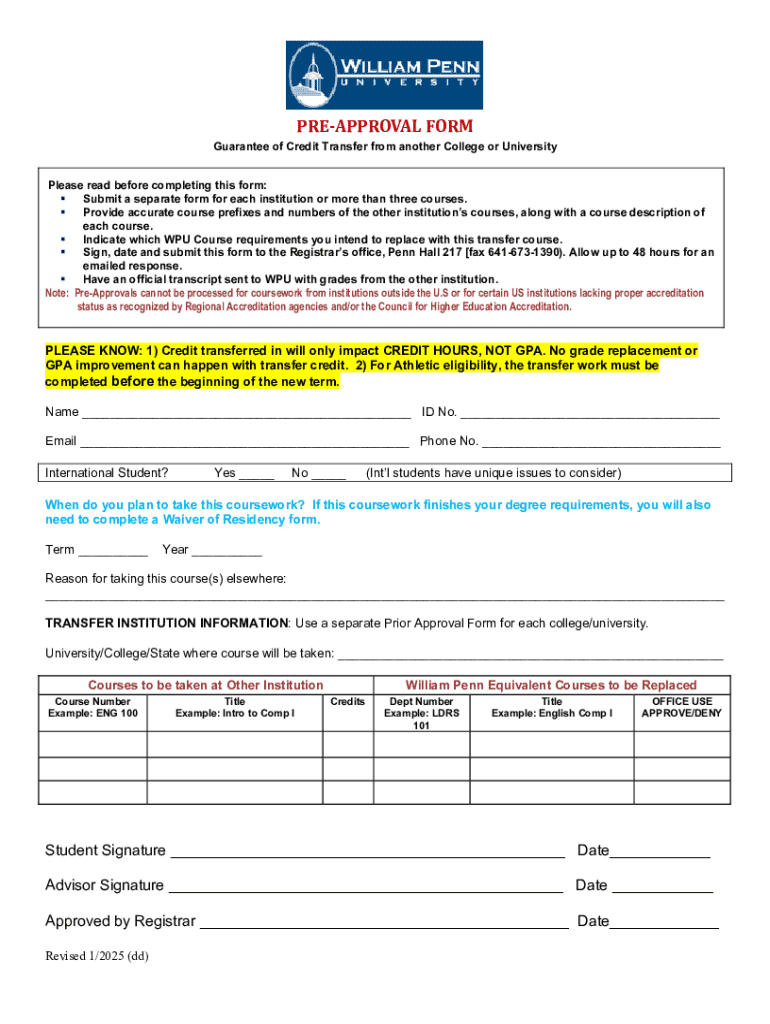

A pre-approval form is an essential document used by organizations to gain prior authorization for specific requests, whether for budget allocations, expenses, projects, or even personal development opportunities. The purpose of this form is to ensure that all necessary approvals are secured before committing resources or proceeding with a plan. It acts as a safeguard, allowing organizations to maintain control over spending and resource allocation.

The pre-approval process plays a vital role in financial planning and project management, as it provides a framework within which proposals can be evaluated against the organization’s objectives, policies, and available finances. When submitted appropriately, a pre-approval form fosters transparency and accountability, which is critical for resource management.

Key components of a pre-approval form

A well-structured pre-approval form typically includes essential details such as the purpose of the request, cost estimates, timelines, and breakdowns of expected expenses. Common sections found in pre-approval forms may include:

When do you need a pre-approval form?

Pre-approval forms are generally required in various business situations. Some of the most common scenarios for utilizing pre-approval forms include travel expenses, project funding requests, and operational expenditures. Each of these instances often requires careful financial scrutiny, thus warranting a formal request for approval.

For example, when team members plan business trips or attend conferences, submitting a pre-approval form helps ensure that the travel will align with the organization’s budget and travel policies. Similarly, when embarking on new projects that require funding, presenting a well-structured pre-approval form can bolster the chances of receiving the necessary financial backing.

Understanding organizational policies

Different companies might have varying policies regarding the need for pre-approval forms. Organizations may dictate specific processes based on their size, industry standards, or internal management practices. It is crucial to familiarize yourself with these policies to ensure compliance with financial regulations and avoid potential pitfalls.

How to fill out a pre-approval form

Filling out a pre-approval form requires attention to detail and clear, concise communication. Here’s a step-by-step guide to help you complete the form effectively:

Common mistakes to avoid

Being aware of common pitfalls can help streamline your pre-approval request. A few frequent mistakes include:

Editing and updating your pre-approval form

Once a pre-approval form is submitted, changes might be necessary as circumstances evolve. Here's how to effectively manage revisions:

How to revise submitted forms

If you need to make changes to a submitted form, follow your organization's process for requesting modifications. Ensure all revisions are well documented and justified, as this maintains the integrity of the records.

Utilizing pdfFiller for easy edits

Digital solutions such as pdfFiller can significantly simplify this process. With features that allow seamless editing and document management, users can quickly access forms, make changes, and resubmit them. The advantages of using pdfFiller include enhanced collaborative capabilities and the ability to maintain a clear audit trail of all document interactions.

Signing the pre-approval form

Once the pre-approval form is accurately filled out, obtaining the necessary signatures from authorized personnel is the next step. This process ensures that all requests have been reviewed and vetted by relevant stakeholders.

Understanding eSignatures

Electronic signatures (eSignatures) have gained legal acceptance across many jurisdictions, simplifying the signing process. By using pdfFiller, users can securely sign forms electronically, which saves time and eliminates paper trails.

Steps to secure signatures

To successfully gather signatures on your pre-approval form, follow these steps:

Collaborating with teams on pre-approval forms

Effective collaboration is crucial when dealing with pre-approval forms, especially in larger teams or organizations. It ensures that all necessary insights and approvals are gathered for the best outcomes.

Sharing pre-approval forms

Utilizing features within pdfFiller, such as comments and annotations, promotes collaborative discussions around pre-approval requests. This can highlight potential issues early on, enabling adjustments before formal submission.

Leveraging cloud solutions for team access

Cloud-based document management solutions like pdfFiller foster a centralized document library. By allowing real-time updates and notifications, team members remain synchronized on changes and approvals, significantly enhancing productivity.

Best practices for managing pre-approval forms

To ensure smooth operation and compliance, organizations should adopt specific best practices for managing pre-approval forms.

Storing and organizing your documents

Implementing systematic storage solutions, both physical and digital, is essential. Here are some tips for efficient management:

Reviewing pre-approval requests

For managers and finance teams, establishing clear guidelines for reviewing pre-approval requests is key. Factors such as relevance, financial implications, and alignment with company goals should be thoroughly assessed to facilitate informed decisions.

Frequently asked questions

Addressing common queries about the pre-approval process can assist users in navigating ambiguity effectively.

Common queries about the pre-approval process

Addressing technical issues with pdfFiller

In case of difficulties while using pdfFiller, customers can access robust support resources to troubleshoot common issues quickly.

Additional tools and resources

Integrating pre-approval forms into organizational workflows can enhance efficiency and effectiveness. Utilize various templates and tools to streamline the process.

Integrating pre-approval forms into your workflow

Look for templates that support your specific needs to maintain consistent documentation practices across your team. Regular training sessions ensure that everyone is updated on best practices and policy changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pre-approval form for eSignature?

How do I edit pre-approval form online?

How do I fill out pre-approval form on an Android device?

What is pre-approval form?

Who is required to file pre-approval form?

How to fill out pre-approval form?

What is the purpose of pre-approval form?

What information must be reported on pre-approval form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.