Get the free Third Party Premium Payment Declaration Form

Get, Create, Make and Sign third party premium payment

How to edit third party premium payment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out third party premium payment

How to fill out third party premium payment

Who needs third party premium payment?

Third Party Premium Payment Form: A Comprehensive Guide

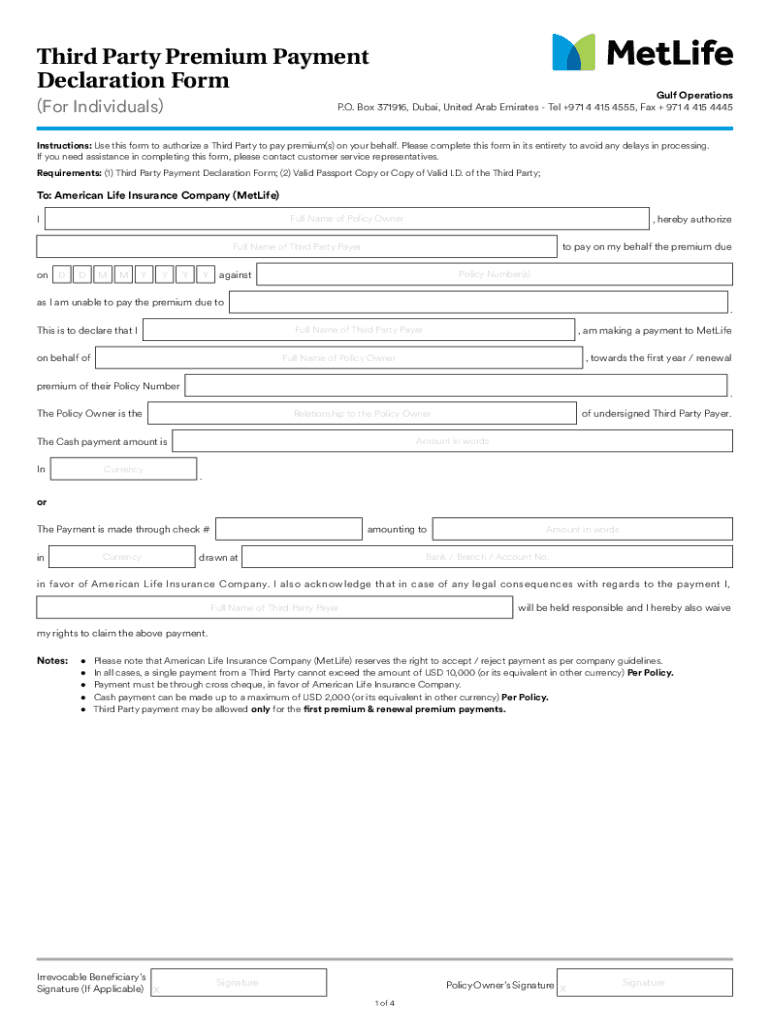

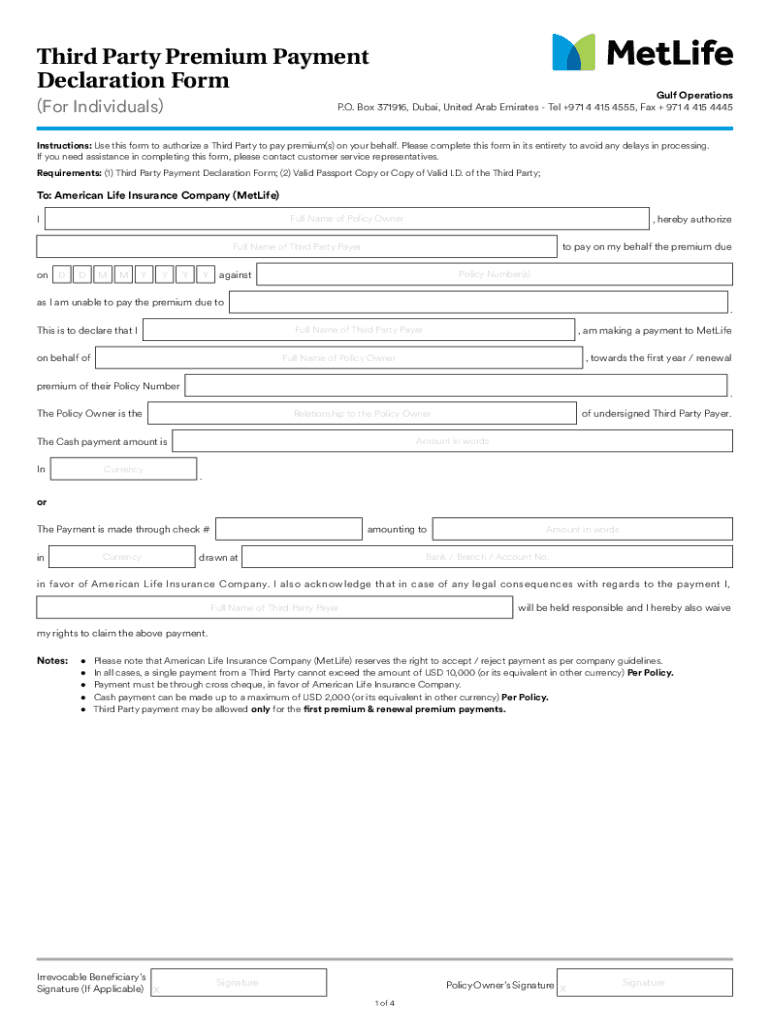

Overview of third party premium payment forms

A third party premium payment form serves as a crucial document within the insurance landscape, allowing parties other than the policyholder to remit premium payments for insurance coverage. Designed primarily to facilitate the financial process, these forms ensure that premiums are paid consistently, regardless of who covers the cost. Businesses often rely on third-party payments for various reasons, from corporate benefits to personal circumstances. This flexibility is essential in ensuring that policyholders retain valuable coverage during critical times.

Understanding third parties in premium payments

In the context of premium payments, third parties can include family members, employers, or even financial institutions that take responsibility for making premium payments on behalf of the insured. Notably, anyone who is not the primary policyholder yet has the authority or relationship to pay premiums qualifies as a third party. There are various types of third-party premium payments, including those made through employer-sponsored plans or family arrangements where a relative pays the premiums to ensure coverage.

Utilizing a third party can offer several benefits. For instance, it can help enhance trust between both parties, leading to timely payments that maintain the policy in good standing. This method is particularly advantageous in scenarios where the primary policyholder may encounter financial difficulties yet still wishes to ensure uninterrupted coverage for their dependents. Moreover, using third-party payments is a strategic move to improve cash flow management for individuals and enterprises alike.

Preparing to fill out the third party premium payment form

Before filling out a third party premium payment form, ensure that all essential information is readily available. Effective preparation involves gathering vital personal information of the payor, such as their name, address, and contact details, as well as specific information about the beneficiary, including their insurance policy number and relationship to the payor. Furthermore, include relevant details about the insurance provider, as it establishes the authoritative pathway for the transaction.

Additionally, certain documentation is necessary during form submission. Proof of identification may be required for verification, alongside relevant policy documents that outline the terms of the policy being paid. Previous payment receipts can also serve as important references when establishing the history of payments made.

Step-by-step guide to completing the third party premium payment form

To effectively complete the third party premium payment form, start by accessing the official version. Most insurance providers offer downloadable templates via their websites, or you can leverage services like pdfFiller for instant access. It's vital to familiarize yourself with different versions, as some variations may cater specifically to health, auto, or life insurance, impacting how you fill out the form.

As you fill out the form, pay close attention to special instructions regarding errors. If amendments are necessary, utilize correction fluid thoughtfully and ensure that updated information is correctly logged; some forms may also allow for corrections electronically through tools like pdfFiller.

Editing and customizing your third party premium payment form

Editing a third party premium payment form has never been easier, especially when utilizing tools from pdfFiller. By uploading your form directly onto the platform, you can seamlessly make changes to any part of the document. Whether you need to adjust contact information, add new payment instructions, or restructure the form, pdfFiller provides a user-friendly interface that simplifies the editing process.

Ensuring compliance and accuracy is pivotal, particularly when handling sensitive financial information. Use features that highlight errors, are easy to double-check, and can provide digital audits of changes made to maintain a clear transaction record.

Submitting the third party premium payment form

With your third party premium payment form completed, the next step involves submission. Depending on the insurance provider’s specified preferences, you can opt for digital submission methods. This includes emailing the form directly to the designated contact or submitting it via a secure online portal, which significantly reduces processing time.

To stay informed post-submission, make sure to track your submission status. Whether it’s by checking online or calling customer service, this proactive approach ensures timely follow-ups on your payment status.

Post-submission management

Once the submission of the third party premium payment form occurs, confirming receipt of payment becomes paramount. Keep an eye on your email for confirmation notices and collect any payment receipts for your records. This documentation will assist in tracking your financial commitments and provide evidence in cases where disputes arise.

Strong post-submission management not only helps maintain compliance but also fortifies your overall financial organization.

Understanding the implications of third party payments

Understanding the implications of third-party payments is incredibly important for policyholders and payors alike. While this payment method generally offers convenience, it also introduces potential challenges. Non-compliance with payment protocols can lead to delays or rejections in processing, which may jeopardize policy coverage. It’s vital to stay informed about any legal stipulations governing third party transactions.

From a broader viewpoint, understanding these implications prevents adverse financial impacts on policyholders. Establishing clear communication between all involved parties is essential in promoting a smooth payment process.

Frequently asked questions (FAQs)

Many common queries arise surrounding third-party premium payments. For instance, individuals often wonder about the confidentiality of their financial information when submitting payments through a third party. It’s essential to clarify that reputable insurance providers adhere to strict privacy policies, protecting your sensitive data diligently.

To assist in addressing these concerns, many insurance providers offer dedicated help lines and online resources that demystify the process, making it easier for users to navigate.

Leveraging pdfFiller for managing insurance documents

Utilizing cloud-based solutions like pdfFiller offers a host of benefits for managing insurance documents, including third party premium payment forms. One major advantage is accessibility; you can create, edit, and store documents from virtually anywhere. This flexibility is particularly valuable for teams that require collaboration on payments or documentation.

Overall, leveraging pdfFiller enhances efficiency and makes managing complex insurance transactions straightforward.

Case studies and real-world applications

Numerous instances of successful third-party premium payments illustrate the procedure's effectiveness. One notable case involved a corporate entity that managed health insurance payments for employees through a dedicated team, leading to improved employee satisfaction and retention rates. Such examples underscore the potential for strategic, third-party management to create beneficial outcomes across various scenarios.

Lessons from these case studies further reinforce the essential roles that effective communication, clarity, and strategic oversight play in navigating the complexities of insurance premium payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send third party premium payment for eSignature?

How do I make edits in third party premium payment without leaving Chrome?

How do I edit third party premium payment on an Android device?

What is third party premium payment?

Who is required to file third party premium payment?

How to fill out third party premium payment?

What is the purpose of third party premium payment?

What information must be reported on third party premium payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.