Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

A Comprehensive Guide to Filling Out the W-9 Form

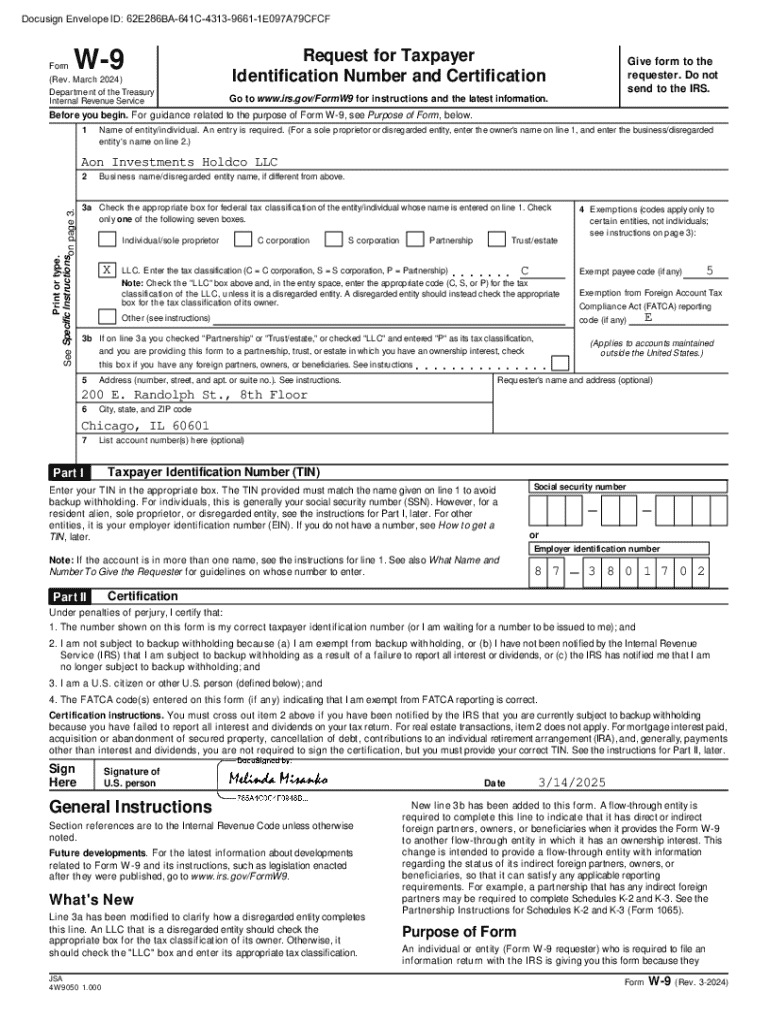

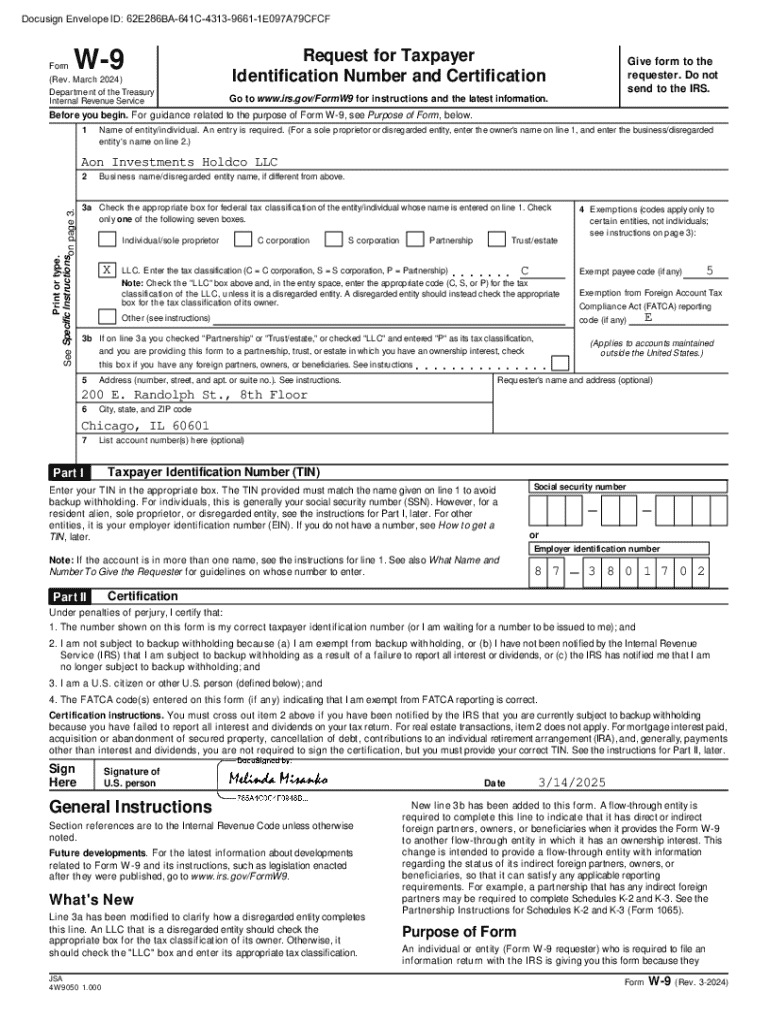

Understanding the W-9 form

The W-9 form, officially titled 'Request for Taxpayer Identification Number and Certification', is a vital document for both individuals and businesses in the United States. Its primary purpose is to collect accurate taxpayer information for reporting income to the Internal Revenue Service (IRS). This form serves as a way for entities that pay non-employees—like freelancers and contractors—to request the taxpayer identification number (TIN) of the individual or organization providing them with services.

Filling out the W-9 form accurately is crucial, as this information helps ensure that the payer can correctly report payments to the IRS, and it prevents any potential issues regarding tax withholding or penalties for both parties involved.

Who needs to fill out a W-9?

Individuals and certain businesses must fill out a W-9 form in specific scenarios. For individuals, this document is often required when providing services as an independent contractor. Additionally, sole proprietors and single-member limited liability companies (LLCs) may also need to submit a W-9 to clients who are paying them for services rendered.

Businesses, particularly those in finance, real estate, or healthcare, require their vendors, service providers, and contractors to complete a W-9 for tax reporting purposes. This includes any entity that is required to report payments made in the form of commission or non-employee compensation to the IRS.

How to access the W-9 form

To obtain the W-9 form, you can visit the IRS website, where the form is available for download in PDF format. Here’s a step-by-step guide on how to download it:

In addition to the IRS website, online platforms like pdfFiller offer interactive tools that allow users to fill out the W-9 form digitally. These platforms not only provide access to the form but also streamline the process by enabling users to edit, sign, and store documents securely in the cloud.

Step-by-step instructions for completing the W-9 form

Completing the W-9 form properly is crucial to avoid delays or issues with tax reporting. The form is divided into several sections that require careful input of information. Here’s a line-by-line breakdown:

Common mistakes to avoid include: neglecting to sign the form, entering incorrect TINs, and not updating the form after changes in personal or business circumstances.

Filing methods for the W-9 form

Once you have completed the W-9 form, it needs to be submitted to the requester. There are several methods to provide your W-9 including:

Understanding how the W-9 fits into the larger tax reporting framework is essential. The information provided on the W-9 helps the payer accurately report payments made to you on the appropriate tax forms, primarily the 1099 series. Furthermore, providing inaccurate information can lead to backup withholding, where the payer is required to withhold a percentage of payments to cover tax obligations.

Keeping your W-9 information up-to-date

It's essential to keep your W-9 form updated, especially after significant life changes. This includes changes like:

Establishing a schedule to review and, if necessary, update your W-9 once a year can be beneficial. Moreover, using pdfFiller for digital storage not only keeps your documents organized but also allows for easy version control, ensuring you always have the most current and compliant forms readily available.

Digital signatures and the W-9 form

The IRS has recognized the legitimacy of digital signatures on tax forms, including the W-9. Electronic signature laws allow taxpayers to sign forms digitally, given they comply with specific regulations.

Using platforms like pdfFiller allows users to eSign and submit their W-9 forms easily. Ensure that any digital signature used conforms to IRS guidelines, specifically around user authentication and record-keeping practices. This creates an efficient workflow and facilitates compliance when submitting necessary tax documentation.

W-9 usage across business arrangements

The W-9 form plays different roles depending on your business arrangement. For employer-employee scenarios, the W-4 form is typically used to provide withholding information, while the W-9 is primarily relevant for independent contractor arrangements.

When dealing with financial institutions, businesses must often present the W-9 form for loans, accounts, or credit applications. Providing an accurate W-9 ensures that the institution can report income correctly to the IRS and enables a smooth transaction process.

Helpful guides and resources related to the W-9 form

For those looking for detailed guidance and official instructions related to the W-9 form, several resources are available. The IRS website provides comprehensive FAQs, instructions, and updates regarding the use of the W-9. Here are some direct links:

In addition, pdfFiller provides customer support for users needing assistance with filling out their W-9 forms, ensuring that you can navigate the process smoothly and efficiently.

Quick links to related topics

In addition to the W-9 form, understanding related tax forms is essential for anyone managing independent contractor relationships or business transactions. Quick references for related forms include:

Contact us for personalized assistance

Should you have specific questions or require technical assistance with the W-9 form, the pdfFiller support team is ready to help. Resources are available for booking personalized demonstrations of pdfFiller’s document management features and guidance for effective use of forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete w-9 online?

How can I fill out w-9 on an iOS device?

Can I edit w-9 on an Android device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.