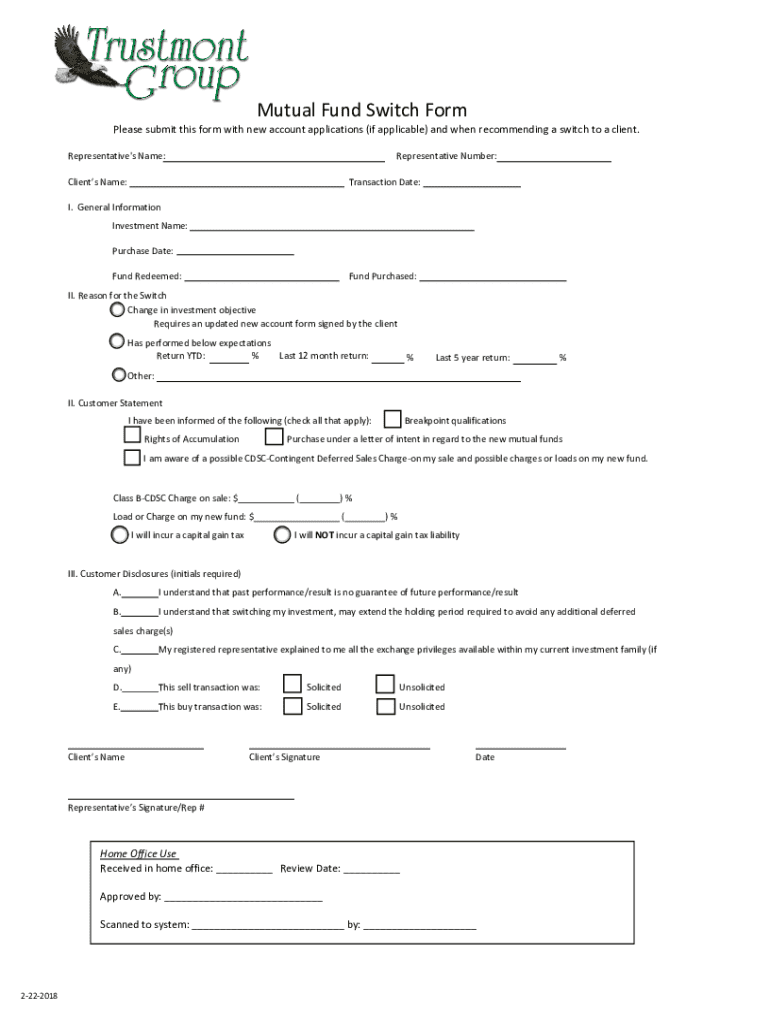

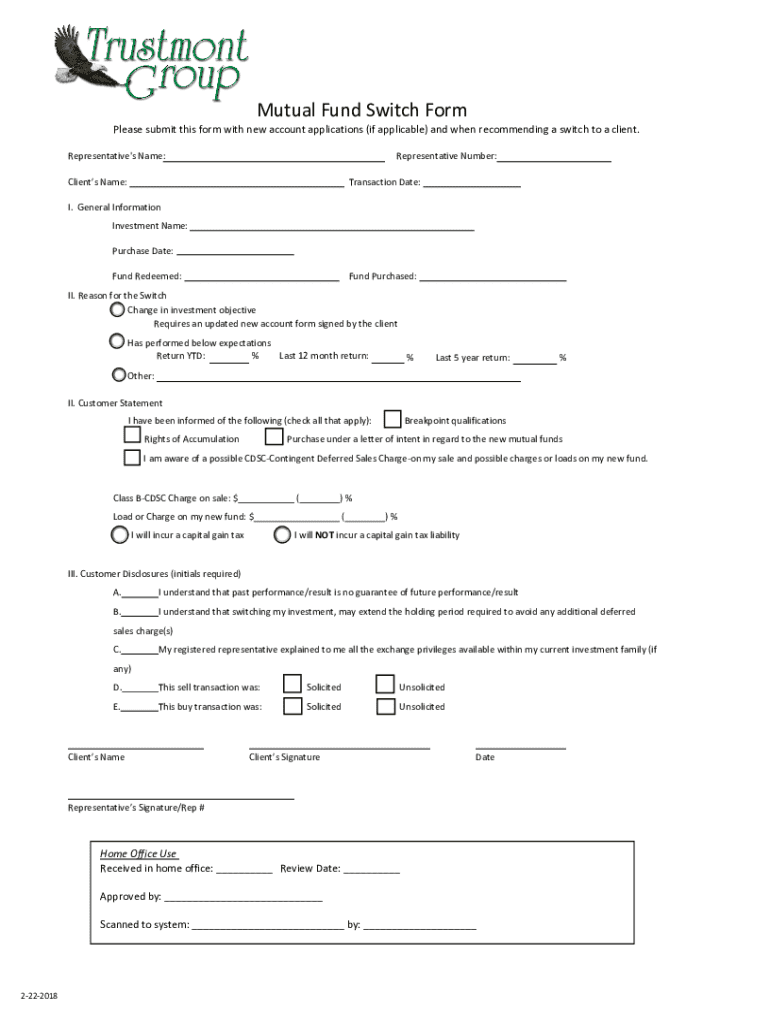

Get the free Mutual Fund Switch Form

Get, Create, Make and Sign mutual fund switch form

How to edit mutual fund switch form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual fund switch form

How to fill out mutual fund switch form

Who needs mutual fund switch form?

A comprehensive guide to mutual fund switch forms

Understanding the mutual fund switch form

A mutual fund switch form is a document used by investors to transfer their investments from one mutual fund to another within the same fund family. This process allows investors to realign their portfolios in response to changing financial goals or market conditions while maintaining the benefits and tax-advantaged status of their investments.

The purpose of the mutual fund switch form is to facilitate a smooth transition between mutual funds. Investors use this form to communicate their intent to switch, ensuring that the transfer is executed correctly and efficiently. Understanding the purpose and implications of the switch form is essential for making informed investment decisions.

Reasons for switching mutual funds

Investors may switch mutual funds for various reasons, primarily to ensure their investment strategy is aligned with their financial goals. A common reason is the need to adapt to changing market conditions. For instance, if an investor initially chose a fund based on past performance and market trends, they might switch to a different fund if the market outlook changes.

Another reason people consider switching is performance issues. If the current mutual fund consistently underperforms relative to its benchmark or peers, switching may be necessary. Additionally, diversification is vital in investment strategies. If an investor feels overexposed to a particular sector or asset class, switching funds can help mitigate this risk.

Preparing to switch mutual funds

Before initiating a switch, investors should conduct a thorough assessment of their current mutual fund's performance. Reviewing the fund's returns, management style, and portfolio composition can help identify whether a switch is warranted. Furthermore, it's essential to learn about any associated fees or penalties stemming from the switch, as these could affect the overall returns.

When evaluating new fund options, investors should consider criteria such as past performance, expense ratio, manager reputation, and alignment with their strategy. Research sources like financial news sites, fund rating services, and consultation with financial advisors can be invaluable. Additionally, tax implications should be explored since switching funds may trigger capital gains taxes, depending on the investor's overall financial situation.

Our step-by-step guide to completing the mutual fund switch form

Completing the mutual fund switch form requires careful attention to detail. Here’s a straightforward guide to ensure everything is filled out correctly.

Step 1: Gathering required information

Start by collecting all necessary personal details, including your full name and account number. Next, record specific information about your current mutual fund, such as fund name, account number, and amount being switched. Finally, prepare details regarding the new mutual fund, including its name and intended investment amounts.

Step 2: Accessing the mutual fund switch form

To access the mutual fund switch form, navigate to pdfFiller's platform. pdfFiller offers a user-friendly interface to download or fill in forms online, providing you with optimal access to the necessary documents.

Step 3: Filling out the mutual fund switch form

Begin by inputting your personal information accurately. Next, outline the current investment details, including fund names and investment amounts. For the new investment section, specify the funds you wish to switch into, along with the amounts allocated to each. Be vigilant in avoiding common mistakes, such as incorrect fund names or amounts.

Step 4: Review and edit your form

Once you've completed the form, take advantage of pdfFiller’s editing tools to ensure accuracy and clarity. Double-check all information and make necessary edits to avoid any potential errors that could delay the switching process.

Step 5: eSigning and final submission

Finally, eSign your mutual fund switch form using pdfFiller’s electronic signature feature, which is legally valid and accepted in various jurisdictions. Ensure that you submit the form according to the instructions, paying attention to any specific timelines to ensure a smooth transition.

Tracking your mutual fund switch request

After submission, investors should know what to expect regarding their mutual fund switch request. Typically, the fund company will process the request, but the timeline may vary depending on the company’s procedures. To stay informed, consider tracking the status of your switch through the investment firm’s platform or customer service.

Should you experience any delays or issues, don’t hesitate to contact customer support for updates. Having your confirmation number or details handy will expedite the inquiry process, ensuring you stay up to date on your investment status.

Leveraging pdfFiller’s tools for document management

pdfFiller offers a comprehensive suite of document management features that simplify handling the mutual fund switch form. With comprehensive document editing capabilities, users can efficiently fill out and customize their forms without stress. The platform also facilitates collaboration, allowing users to share and work on documents with financial advisors or team members.

Security is prime in document management, and pdfFiller ensures that your files are stored securely in the cloud. This enables easy access from anywhere, further enhancing the user experience and making document retrieval seamless.

Case studies: successful mutual fund switches

Real-life examples of successful mutual fund switches can provide valuable insights for investors. For instance, Sarah switched from a high-fee growth fund to a low-cost index fund after realizing her performance was below par. Within a year, her portfolio rebounded, reflecting the power of effective fund-switching strategies.

Another example is John's transition from a bond fund to an emerging markets equity fund during a period of rising interest rates. This switch aligned with his long-term growth objectives, resulting in significant appreciation as the newly selected fund outperformed his prior investment.

FAQs about mutual fund switching and pdfFiller

Investors frequently have questions regarding the mutual fund switching process and how to leverage pdfFiller. Common inquiries include concerns about switching fees, timeline expectations for processing, and the ease of use of the platform. pdfFiller aims to address these questions through a robust FAQ section, helping users navigate the essential aspects of form completion and submission.

Another common question revolves around troubleshooting issues with the form. If you encounter difficulties while filling out the mutual fund switch form on pdfFiller, guidance is readily available through their support resources, ensuring a smooth experience.

Expanding your investment knowledge

For those looking to enhance their understanding of mutual funds and investment strategies, a wide array of resources is available. Websites offering educational content, webinars, and investment strategy guides can empower investors to make informed decisions moving forward. Additionally, following reputable financial news can provide timely insights into market conditions and investment outlooks.

Understanding both the fundamental principles and advanced strategies of mutual fund investing will aid investors in identifying when and why to switch. Continuous learning in the financial sector can lead to smarter investment choices that align with one's financial objectives.

User testimonials

Users have shared their experiences with pdfFiller while navigating the mutual fund switch process. Many highlight the convenience of real-time collaboration with advisors, fostering an environment where informed decisions can be made swiftly. Others appreciate the intuitive nature of the platform, simplifying what could be a complex process into a seamless experience.

Testimonials reveal that the ease of accessing, editing, and submitting mutual fund switch forms has empowered users to react promptly to market changes, thereby improving their investment outcomes. The reliability of pdfFiller’s tools is underscored in each review, emphasizing the platform’s role in achieving better investment management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mutual fund switch form from Google Drive?

How do I fill out the mutual fund switch form form on my smartphone?

How do I edit mutual fund switch form on an iOS device?

What is mutual fund switch form?

Who is required to file mutual fund switch form?

How to fill out mutual fund switch form?

What is the purpose of mutual fund switch form?

What information must be reported on mutual fund switch form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.