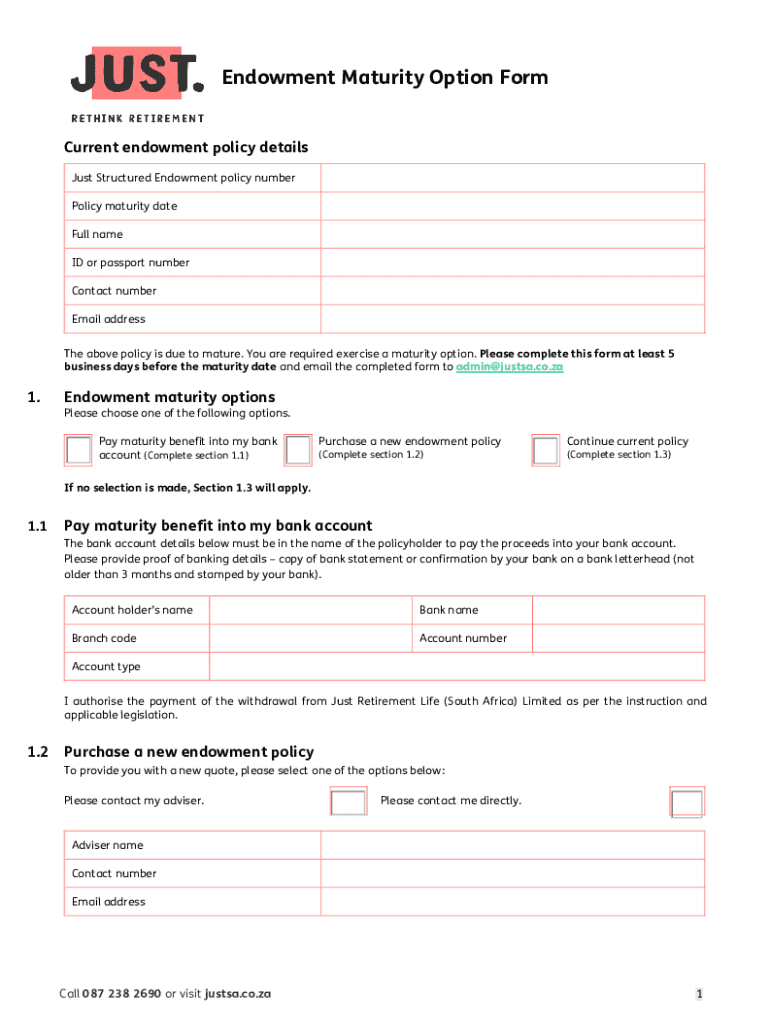

Get the free Endowment Maturity Option Form

Get, Create, Make and Sign endowment maturity option form

Editing endowment maturity option form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out endowment maturity option form

How to fill out endowment maturity option form

Who needs endowment maturity option form?

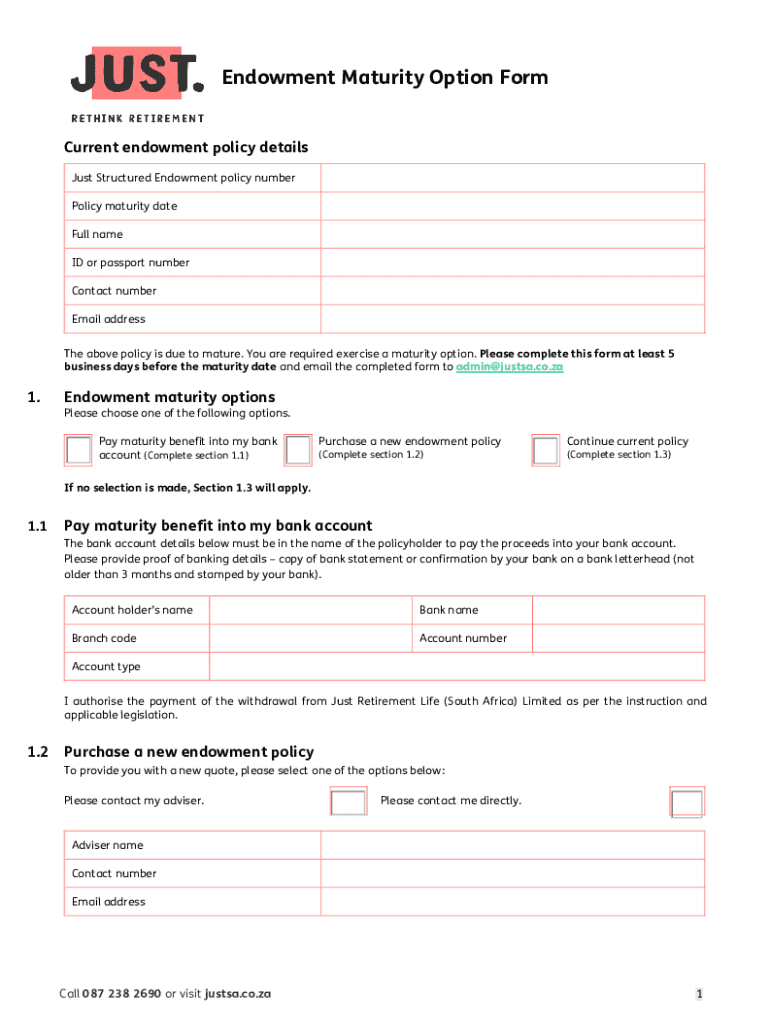

Understanding the Endowment Maturity Option Form

Overview of endowment maturity option

The endowment maturity option refers to a financial mechanism that allows policyholders to receive a lump sum payment at the maturity date of their endowment policies. Typically, endowments combine life insurance with savings, ensuring that the insured amount is either paid out upon the maturity date or in the event of the insured's untimely demise. Understanding the endowment maturity option is crucial for policyholders as it provides clarity on their potential returns and decisions on funds management.

The significance of the endowment maturity option lies in its capability to enhance financial planning. For individuals or teams using these options, the maturity forms can help outline their choices regarding payouts, investments, and reinvestment strategies. Engaging with the endowment maturity option form allows stakeholders to formalize their decisions and understand the implications on their financial future.

Key features of the endowment maturity option form

The endowment maturity option form is equipped with a variety of features designed to improve user interaction and streamline the document management process. By leveraging advanced functionalities, users can efficiently complete and manage their endowment policy paperwork.

One of the primary enhancements of the form includes interactive tools that facilitate ease of use. These functions allow users to edit documents on their devices, integrate electronic signatures seamlessly, and collaborate in real-time with team members. This is particularly beneficial for individuals or teams seeking comprehensive document solutions.

Interactive tools available

Document management solutions

Additionally, the endowment maturity option form offers robust document management solutions. Users can benefit from features such as access-from-anywhere functionality and abundant storage options to keep all documents organized and easily retrievable. This accessibility is ideal for individuals managing multiple policies or teams needing to collaborate across different locations.

Understanding the endowment maturity option process

Completing the endowment maturity option form involves a systematic approach, starting with understanding the prerequisites. Before diving into the form, it is important to gather all necessary information and documents that you will need for submission. This often includes personal identification, policy details, and any related financial documentation.

Familiarity with the common terminology associated with endowment maturity is also essential. Terms such as maturity date, policyholder, payout, and 'life cover' should be well understood to avoid confusion during the process.

Step-by-step instructions

Common issues and solutions

While completing the endowment maturity option form, users may encounter some issues. These could range from technical glitches in the software to misunderstandings of form requirements. It is essential to maintain calm and systematically troubleshoot the issues.

If errors occur during form completion, checking for typos or missing information is a good first step. Additionally, making use of the auto-save function can help prevent loss of unsaved work, giving reassurance while filling out the document.

Understanding rejections

Form rejections can occur for various reasons, such as incomplete details or discrepancies in the provided information. Common rejection triggers include mismatches between the policy number and personal information. To address these issues, it’s advisable to have a second person review the form before final submission. Ensuring all details are correct will enhance approval chances, allowing users to move forward without delays.

Frequently asked questions (FAQs)

The endowment maturity option form serves a crucial purpose in making policyholders aware of their options concerning maturity payouts. This form is instrumental for anyone involved in endowment policies, including individuals and teams managing financial resources.

Tips for maximizing your experience with pdfFiller

To enhance your experience while using the endowment maturity option form, take advantage of pdfFiller’s advanced features. Consider customizing templates to suit specific needs or integrating tools that allow for better document formatting.

Best practices for collaboration include setting clear roles and responsibilities for team members involved in the document creation process. Utilize the communication features within pdfFiller to ensure everyone is aligned and that input is collected efficiently.

Ongoing management of your documents is equally essential. Regularly reviewing and organizing your stored forms can prevent confusion and help maintain a clear overview of your endowment policies.

Real-world applications of the endowment maturity option

The endowment maturity option form is vital in numerous scenarios, particularly for individuals planning for retirement. For example, a policyholder might opt to receive a lump sum payout to invest in a real estate venture, ensuring financial security in their later years.

Testimonials from satisfied users highlight the form’s effectiveness. One user, after successfully filling out the endowment maturity option form through pdfFiller, reported how the streamlined process enabled them to invest their funds wisely, reaping significant returns on investment within a few years. These real-life applications and experiences demonstrate the value of understanding and utilizing the endowment maturity option form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit endowment maturity option form on an iOS device?

How do I complete endowment maturity option form on an iOS device?

How do I complete endowment maturity option form on an Android device?

What is endowment maturity option form?

Who is required to file endowment maturity option form?

How to fill out endowment maturity option form?

What is the purpose of endowment maturity option form?

What information must be reported on endowment maturity option form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.