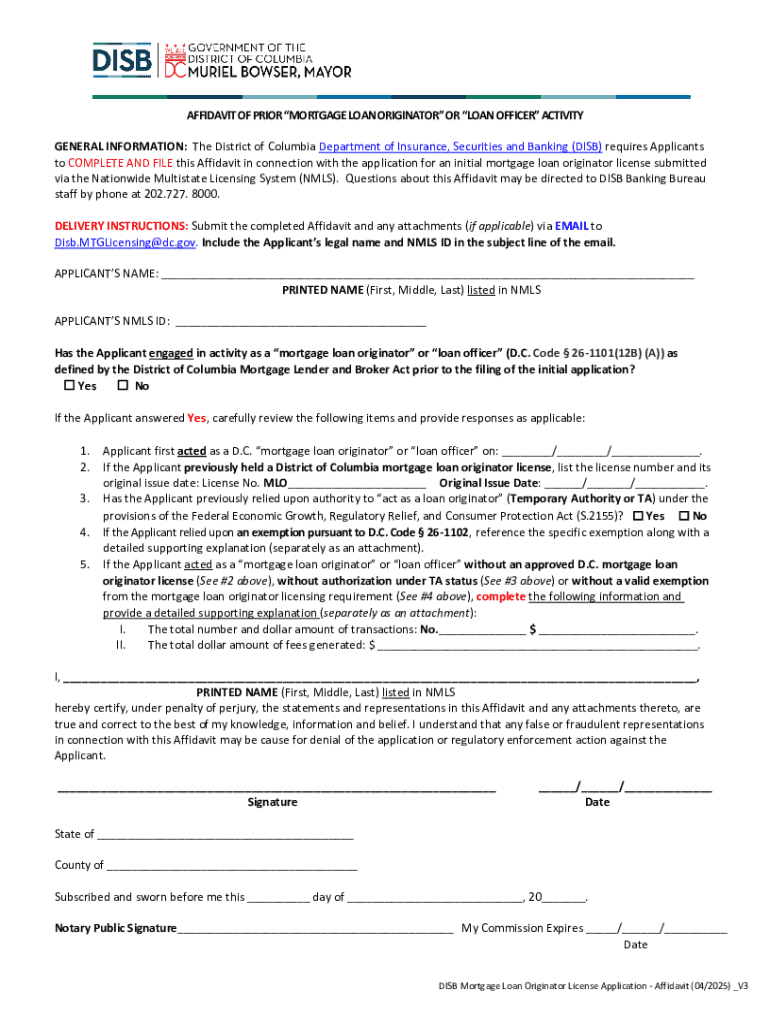

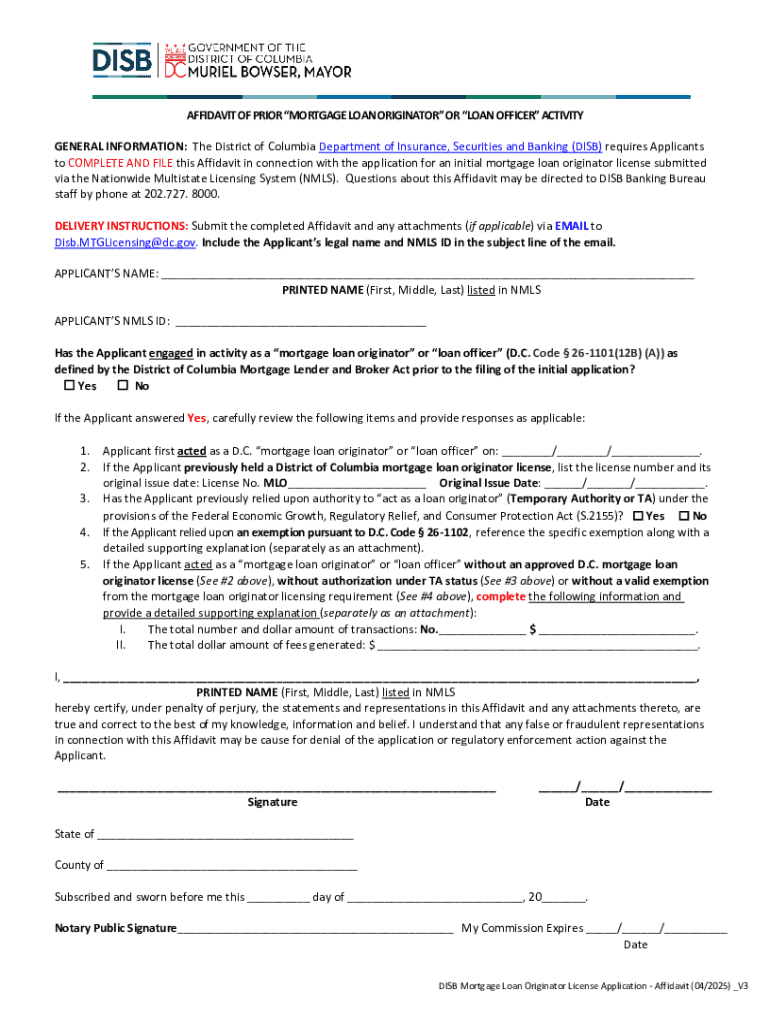

Get the free Affidavit of Prior “mortgage Loan Originator” or “loan Officer” Activity - disb dc

Get, Create, Make and Sign affidavit of prior mortgage

How to edit affidavit of prior mortgage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out affidavit of prior mortgage

How to fill out affidavit of prior mortgage

Who needs affidavit of prior mortgage?

Understanding the Affidavit of Prior Mortgage Form

Understanding the affidavit of prior mortgage form

The affidavit of prior mortgage form is a legal document that serves as a sworn statement by a borrower regarding their previous mortgage obligations. This document is crucial in the mortgage process, especially when a borrower seeks a new loan or mortgage refinancing. This affidavit provides lenders with essential information about outstanding mortgage obligations, clarifying that all prior loans have been disclosed.

The importance of the affidavit cannot be overstated; it helps ensure transparency between the borrower and the lender. If undisclosed mortgages exist, they could lead to complications in the lending process, potentially derailing the financing stages. In many cases, lenders will require this document to assess risk and ensure that all financial obligations are accurately represented.

Common scenarios where the affidavit of prior mortgage form is used include when a homeowner is applying for a new mortgage on a property that has previously been mortgaged, during loan refinancing processes, or even when selling a property to certify the status of prior loans.

Key components of the affidavit of prior mortgage form

Completing the affidavit requires understanding its essential components. The form generally includes several critical sections that must be filled out accurately to meet legal and lender requirements.

Verification requirements often accompany the information provided in this affidavit, ensuring that any statements made can be substantiated with documents such as previous mortgage statements or satisfaction letters from the lenders.

Step-by-step guide to completing the affidavit of prior mortgage form

Completing the affidavit involves several steps to ensure accuracy and compliance with lender requirements. Here’s a structured approach.

Tools for creating and editing your affidavit

Leveraging technology can significantly simplify the process of creating and managing your affidavit of prior mortgage form. A platform like pdfFiller offers various features for seamless document management.

Cloud-based solutions like pdfFiller provide the flexibility to access your affidavit from anywhere, ensuring you can always manage your important documents with ease.

Frequently asked questions (FAQs)

The affidavit of prior mortgage form can bring about several questions and clarifications. Here are some of the most commonly asked questions.

Legal considerations of the affidavit of prior mortgage form

Legal implications surrounding the affidavit of prior mortgage form are significant. This document is considered a legal declaration, meaning it must be filled out truthfully and accurately.

Understanding compliance requirements and state-specific regulations is essential. Different states have varying requirements concerning notarization, signature witnessing, and document submission. Familiarizing yourself with local laws will help ensure that your affidavit meets all necessary criteria, thereby avoiding legal pitfalls during the mortgage process.

Related documentation and additional forms

In addition to the affidavit of prior mortgage form, there are several other common mortgage documents you may encounter during the lending process.

For sample templates and more related resources, consider exploring the offerings on pdfFiller, which streamlines access to various necessary forms.

Explore more on document management and creation

With pdfFiller, creating and managing documents goes beyond just the affidavit of prior mortgage form. The platform offers comprehensive tools tailored for efficiently handling all your document needs.

Support and assistance

If you have questions or face challenges while completing your affidavit of prior mortgage form, pdfFiller support is readily available to assist you.

Legal disclaimer

It’s essential to consult with a legal professional when dealing with any formal documents like the affidavit of prior mortgage form. This disclaimer highlights the limitation of liability and underscores the importance of personalized legal advice tailored to your specific situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my affidavit of prior mortgage directly from Gmail?

Where do I find affidavit of prior mortgage?

How can I edit affidavit of prior mortgage on a smartphone?

What is affidavit of prior mortgage?

Who is required to file affidavit of prior mortgage?

How to fill out affidavit of prior mortgage?

What is the purpose of affidavit of prior mortgage?

What information must be reported on affidavit of prior mortgage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.