Get the free Invoice

Get, Create, Make and Sign invoice

How to edit invoice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out invoice

How to fill out invoice

Who needs invoice?

Invoice form: Your comprehensive how-to guide

Understanding the invoice form

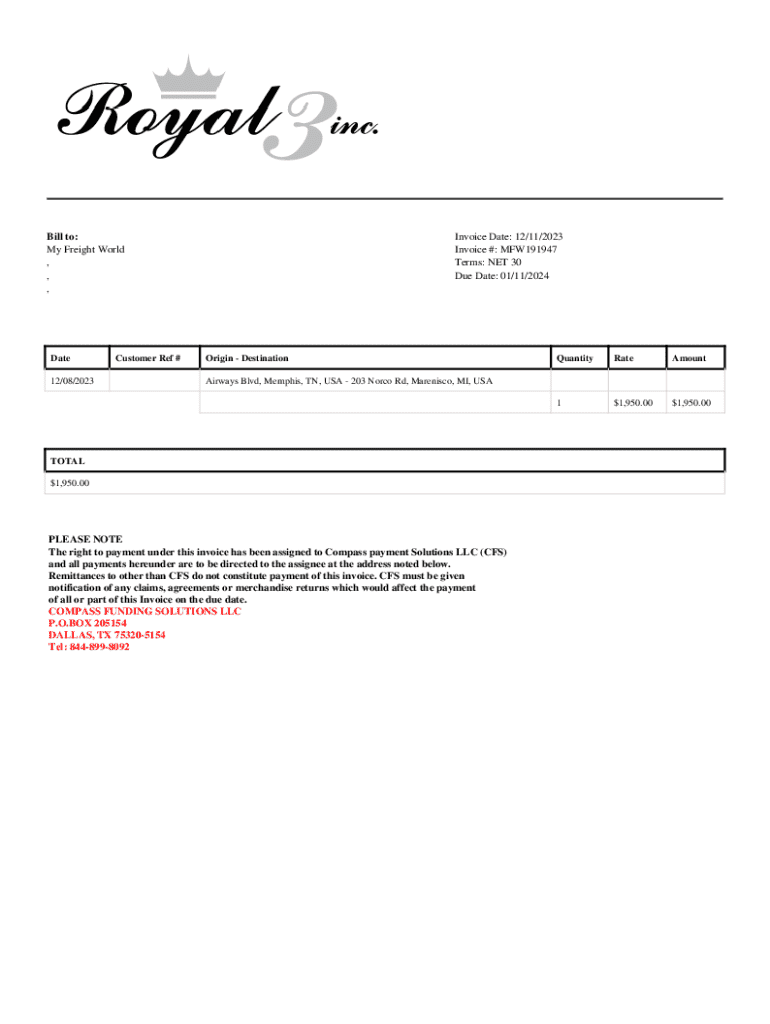

An invoice form is a crucial document used in business transactions. It not only specifies the goods or services sold but also establishes the amount payable by a customer. The clarity in an invoice form helps uphold trust between the supplier and the buyer, ensuring smooth financial exchanges.

The importance of an invoice form goes beyond simple documentation. It serves as a legal record that can be referenced in case of disputes, tax calculations, and business audits. Without a properly generated invoice, a business may face difficulties proving sales transactions or collecting payments.

Legal requirements for invoices can vary by jurisdiction; however, all invoices generally need to include specific information such as the seller's details, transaction date, duly itemized list, and total due. It's essential that businesses familiarize themselves with these requirements to avoid penalties.

Different types of invoice forms serve various purposes, catering to diverse business scenarios. Common categories include: 1. **Standard invoice** – The most common form, detailing products/services sold. 2. **Pro forma invoice** – Issued before goods/services are provided, outlining estimated costs. 3. **Recurring invoice** – Automates billing for repeat customers on a regular basis. 4. **Credit invoice** – Used to provide a refund or credit to a customer's account.

Key components of an invoice form

Creating an effective invoice form involves including several essential elements. Each component plays a vital role in ensuring clarity and preventing miscommunication. The main components to include are: - **Header** with business name, logo, and contact information, which establishes your brand identity. - **Invoice number and date**, necessary for tracking and organizing invoices. - **Bill-to information** detailing customer name and address, ensuring correct delivery. - **Itemized list of goods/services**, where each entry includes a description, quantity, rate, and total amount. This section outlines exactly what the customer is paying for. - **Subtotal, taxes, and total amount due** provide a clear breakdown of the payment structure. - **Payment terms**, including due date and late fees, set clear expectations for payment timelines. - **Additional notes or disclaimers** may offer further clarity or terms regarding services.

While the above elements are crucial, optional components can enhance your invoice form. These may include: - **Payment methods**, providing bank details or links for easier transactions. - **Discounts or promotional codes**, which can incentivize quick payment or return customers.

How to create your invoice form

Creating an invoice form has never been easier, especially with online tools like pdfFiller. The benefits of cloud-based solutions are abundant; they allow for easy access, collaboration, and retention of document states across devices. To get started with pdfFiller, follow these steps: 1. Visit pdfFiller's website and sign up or log in to your account. 2. Choose the invoice template that best fits your needs from their library. 3. Customize the template by entering your business information and adding your logo. 4. Fill in essential fields, including the bill-to information and item details.

Customizing your invoice template is an important step. Selecting or designing your form based on your brand's identity not only enhances your professional image but also allows you to incorporate branding elements that customers can easily recognize. Adding logos, specific colors, or fonts consistent with your branding guidelines can further solidify your company's identity.

Another notable feature is incorporating fillable fields and interactive elements. This enables your customers to easily engage with the invoice. You can add data input fields for specific entries and dropdowns for products or services, streamlining the process.

Editing and revising your invoice form

Accurate information on an invoice form is essential; mistakes can lead to delayed payments, misunderstandings, or even financial losses. Thus, ensuring precision is critical. Utilizing pdfFiller's editing tools allows you to amend information readily and keep track of changes and versions, providing an efficient workflow.

When editing your invoice in pdfFiller, it's essential to thoroughly review all entries. You can highlight key updates and ensure that all changes are documented. One great feature is the ability to send invoices for team review, allowing other members to provide input before finalizing.

Collaboration features enable seamless teamwork. Inviting teammates to review and comment on the invoice form fosters a dynamic atmosphere and can lead to enhanced accuracy in your final document.

E-signing your invoice form

The inclusion of electronic signatures on your invoice form can expedite the approval process. Electronic signatures hold legal weight in many jurisdictions, making them a practical alternative to traditional signing methods, especially for remote transactions. It's important to ensure that both parties are aware of the legal standing of e-signatures in their area.

To eSign your invoice on pdfFiller, follow this straightforward process: 1. Open your invoice document within the platform. 2. Select the option to add a signature field where your signature is needed. 3. Choose your preferred method of signing: drawing, typing, or uploading an image of your signature. 4. Send the invoice for client signature directly through pdfFiller, tracking the status efficiently through the platform.

Managing and storing your invoice forms

Efficiently organizing your invoices can significantly enhance your workflow. Developing a consistent filing system is key. Some best practices include creating folders for different clients and applying tags to distinguish between types of invoices. In pdfFiller, you can create a hierarchy of folders to categorize your invoices, ensuring swift access when needed.

Data security is also paramount when managing invoice forms. Understanding the security features of pdfFiller helps you safeguard sensitive financial information. Always ensure that only authorized personnel have access to invoice documents and regularly back-up your files to mitigate the risks of data loss.

Tracking payments and follow-ups

Tracking invoices post-issue is essential to avoid missed payments. By using pdfFiller's payment tracking features, you can monitor outstanding invoices seamlessly. This ensures you’re aware of overdue payments and can take prompt action.

Incorporating effective communication strategies in your follow-up processes enhances payment efficiency. Sending reminders before the due date can prompt customers to prioritize your invoice. Be polite yet assertive in communication—email templates can also help streamline your follow-up messaging.

Common mistakes to avoid when using invoice forms

Avoiding common pitfalls when creating invoice forms is critical for smooth business operations. Some frequent errors include: - **Miscalculations** in totals that may confuse clients or lead to payment disputes. - **Incomplete information**, such as missing customer addresses or item details that may delay processing. - **Delayed delivery** of the invoice, which can extend payment timelines, affecting cash flow.

To prevent these errors, consider implementing the following tips: - **Double-check entries** before sending invoices to ensure accuracy. - **Utilize automation features**, like templates in pdfFiller, to reduce the chances of human error.

Frequently asked questions (FAQs) about invoice forms

Understanding common inquiries regarding invoice forms provides additional clarity for users. Here are some frequently asked questions: 1. **What is the typical turnaround time for receiving payment after sending an invoice?** Depending on terms set, businesses typically set payment timelines between 15-30 days. 2. **Can I use an invoice form for freelance work?** Yes, freelancers often utilize invoice forms to receive payments for their services, establishing professional protocol. 3. **What should I do if a client disputes an invoice?** Engage the client directly to understand their concerns, and provide clarity and supporting documentation to resolve the issue amicably.

Case studies and examples of effective invoice forms

Examining well-designed invoice forms offers insights into effective practices. Notable characteristics include: - Clear layout with easy-to-read fonts that highlight essential information. - Color-coding specific sections to improve navigation and facilitate understanding. - Consistent branding elements that enhance recognition and trust.

Success stories from users of pdfFiller reveal cutting-edge solutions and techniques. Many businesses showcase their unique take on the invoice form, utilizing the extensive customization capabilities offered by the platform. These examples not only elevate brand image but also communicate professionalism, reflecting positively on client perceptions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete invoice online?

How do I edit invoice on an iOS device?

Can I edit invoice on an Android device?

What is invoice?

Who is required to file invoice?

How to fill out invoice?

What is the purpose of invoice?

What information must be reported on invoice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.