Get the free Form 6-k

Get, Create, Make and Sign form 6-k

How to edit form 6-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 6-k

How to fill out form 6-k

Who needs form 6-k?

Understanding the Form 6-K Form: A Comprehensive Guide

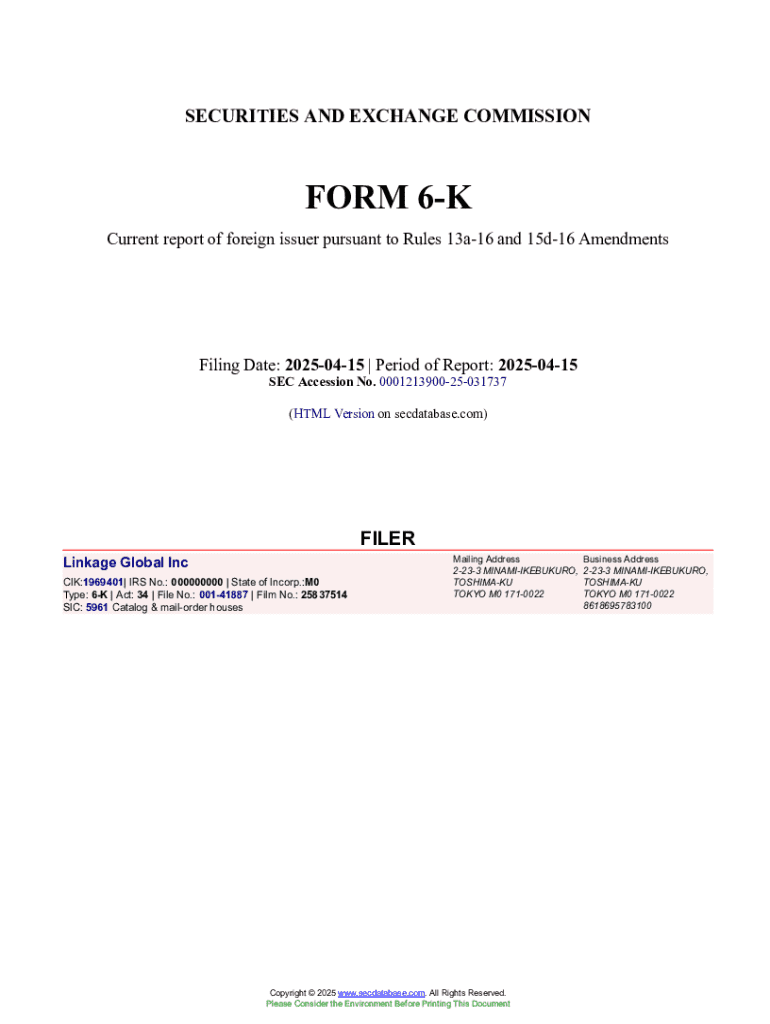

Understanding the Form 6-K

Form 6-K is a critical document used by foreign companies with securities listed in the United States. Its primary purpose is to inform the U.S. investors about major events affecting the foreign issuer, ensuring transparency and compliance with U.S. securities regulations.

This form acts as a bridge for foreign entities, allowing U.S. investors to receive timely information about significant developments that could affect the company's performance. Understanding Form 6-K is essential for both investors and foreign companies to maintain compliance and foster transparent communication.

Who Needs to File Form 6-K?

Any foreign company that has issued securities and is listed on U.S. exchanges is required to file Form 6-K. This includes companies from countries like Canada, the UK, Japan, and other international regions that wish to attract American investors. The filing ensures that these companies uphold the same level of information dissemination as their U.S. counterparts.

In addition to issuers, mutual funds and exchange-traded funds (ETFs) that invest in foreign securities may also file Form 6-K to provide additional context and updates to U.S. investors.

Key differences between Form 6-K and other SEC forms

Form 6-K is distinct from several other forms regulated by the SEC, particularly Form 10-K, Form 10-Q, and Form 8-K. While Form 10-K and Form 10-Q are comprehensive reports that U.S. companies must file annually and quarterly, respectively, they are tailored specifically for U.S. businesses.

In contrast, Form 6-K focuses specifically on foreign issuers and is often filed more frequently. Notably, Form 8-K is used for triggering events related to U.S. companies, while Form 6-K can cover a broad range of important events for foreign companies, like earnings announcements or mergers.

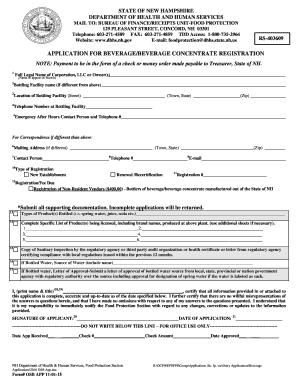

The filing process for Form 6-K

Filing Form 6-K may appear daunting, but with the right preparation, it can be a straightforward process. Initially, any foreign issuer should gather all necessary documentation concerning the required disclosures. This includes financial statements, audit reports, and significant related-party transactions that need to be disclosed.

Once you have prepared your documents, begin filling out Form 6-K meticulously. Make sure to provide accurate information as it is critical for compliance with U.S. securities regulations. Common mistakes to avoid include omitting disclosures and failing to report timely information, which may lead to penalties.

Reviewing your form before submission

Before submitting your Form 6-K, it’s vital to double-check all entries for accuracy and compliance. Errors can result in rejections or penalties, which may tarnish the company’s reputation. Use tools such as pdfFiller to layout and verify your documents to avoid miscommunication and ensure total clarity.

Engaging verification tools aids in meticulous checking of fields and templates, thus maximizing the integrity of the information contained in the Form 6-K.

Submitting your form 6-K

The submission of Form 6-K is typically done electronically via the SEC’s EDGAR system. This online procedure facilitates quicker filing and reduces the likelihood of delays associated with paper submissions. To access the EDGAR system, users must register and follow step-by-step procedures to ensure that entries are accurately depicted.

Be mindful of filing deadlines; late submissions can attract penalties that vary depending on the extent of the delay. Regularly reviewing SEC deadlines helps keep the company in good standing with securities regulations.

Keeping records of your submission

After filing Form 6-K, maintaining accurate records of submissions is essential. Best practices include keeping copies of filed documents and records of all communication related to the filings. Using cloud-based platforms such as pdfFiller not only aids in document retention but also enables easy sharing and updating of forms if needed.

Staying organized with your documents ensures that you have a streamlined approach to managing submissions and provides an easy reference point for future filings.

Editing and managing your Form 6-K

Should there be any significant errors or new developments after submission, amending the Form 6-K is a straightforward process. It’s important to clearly disclose why changes were made to maintain transparency with investors.

Utilizing pdfFiller can facilitate making these amendments quickly while allowing for collaboration among team members.

Frequently asked questions about Form 6-K

Many individuals have questions regarding the filing of Form 6-K. For instance, the rejection of a form can happen due to inaccuracies, and the company must address these issues promptly. Additionally, while it is not typical to file multiple disclosures on one Form 6-K, it is permissible provided all relevant information for each event is accurately processed.

Dealing with discrepancies and errors is critical; companies can rectify these through amendments filed promptly to the SEC. It is also advisable to contact the SEC for assistance if needed.

Benefits of using pdfFiller for Form 6-K management

Using pdfFiller enhances the efficiency of managing Form 6-K. Its user-friendly interface allows for easy editing, ensuring that documents are comprehensive and up to date with the necessary disclosures. This streamlining of the editing process helps prevent common filing errors.

Moreover, pdfFiller incorporates eSigning capabilities, allowing you to comply with regulatory requirements digitally and deliver timely submissions to the SEC. By following a simple guide to eSign your Form 6-K, users save time and avoid complications.

Enhancing your understanding of SEC filings

Staying informed about related SEC forms such as Form S-1, Form D, and Form 40-F can provide context and complement your knowledge of Form 6-K. Each form serves a different purpose, and understanding these differences can be advantageous for stakeholders within the expanding global marketplace.

Furthermore, recent trends and changes in SEC filing requirements underscore the importance of keeping abreast of regulatory updates. This adaptability ensures that companies maintain compliance amid evolving regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 6-k?

How do I make edits in form 6-k without leaving Chrome?

How do I complete form 6-k on an Android device?

What is form 6-k?

Who is required to file form 6-k?

How to fill out form 6-k?

What is the purpose of form 6-k?

What information must be reported on form 6-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.