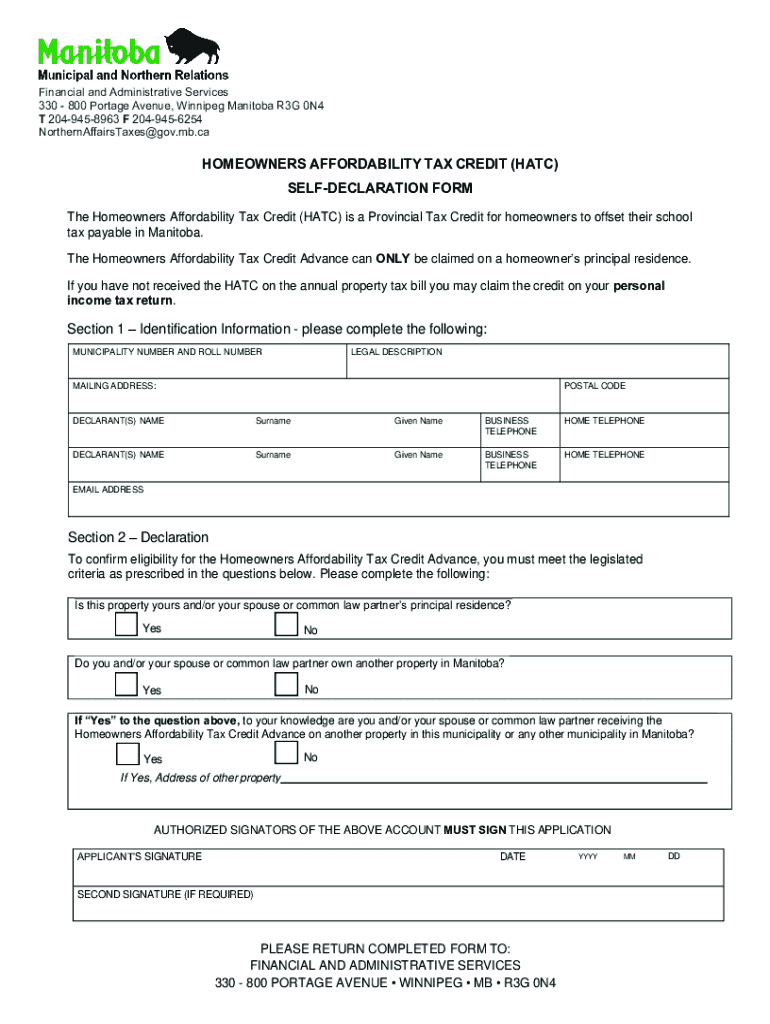

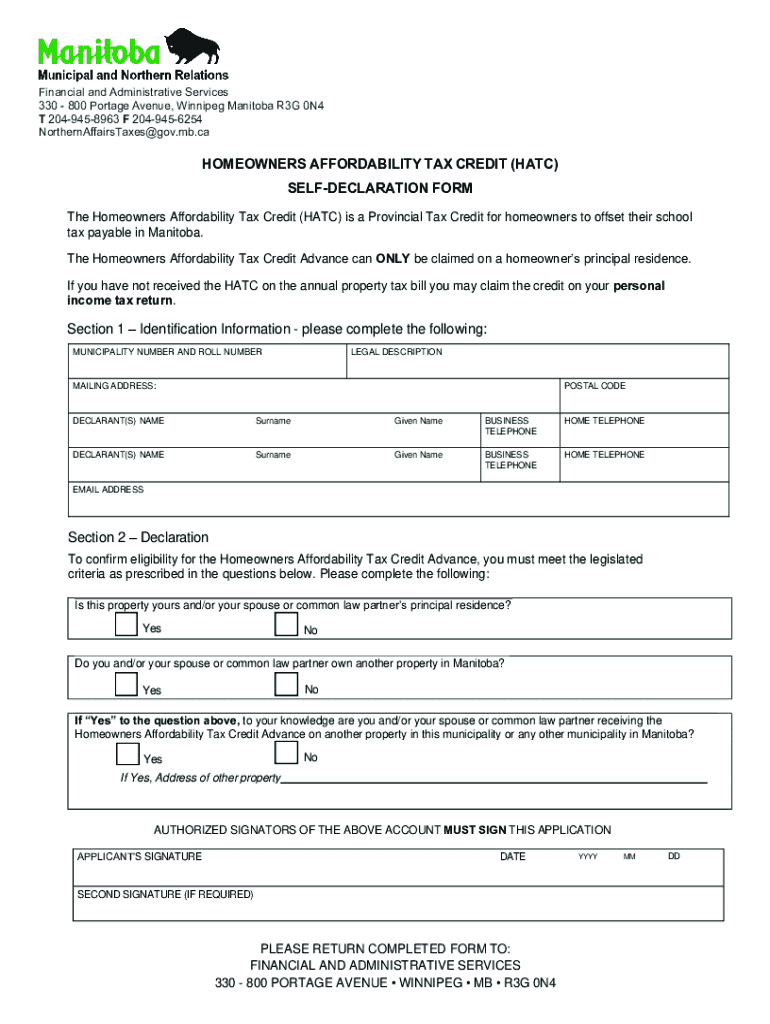

Get the free Homeowners Affordability Tax Credit (hatc) Self-declaration Form

Get, Create, Make and Sign homeowners affordability tax credit

Editing homeowners affordability tax credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out homeowners affordability tax credit

How to fill out homeowners affordability tax credit

Who needs homeowners affordability tax credit?

Homeowners Affordability Tax Credit Form: A Comprehensive How-To Guide

Understanding the Homeowners Affordability Tax Credit

The Homeowners Affordability Tax Credit is a significant tax break designed to support homeowners who may be struggling with their mortgage payments. This credit aims to alleviate some of the financial burdens by offering a reduction in the amount of taxes owed, enabling homeowners to allocate their resources more efficiently.

Benefits of the Homeowners Affordability Tax Credit include immediate reductions in tax liabilities, which can result in lower overall property costs. The credit may also enhance cash flow, providing homeowners with more flexibility in their monthly budgets.

Eligibility criteria for applicants typically include income limits based on household size, ownership of a primary residence, and filing status. Homeowners should review local regulations to ensure compliance before applying.

Preparing to fill out the Homeowners Affordability Tax Credit form

Before you complete the Homeowners Affordability Tax Credit form, gather all necessary documents and information. This preparation phase is crucial to ensure a smooth filing process and can help you avoid complications later on.

Common mistakes to avoid during preparation include failing to double-check personal information and miscalculating income. Additionally, ensure that all relevant sections of the form are completed to eliminate delays in processing.

Step-by-step guide to completing the form

Accessing the Homeowners Affordability Tax Credit Form through pdfFiller is straightforward. Their user-friendly interface allows for easy navigation, ensuring that you can focus on filling out the necessary information accurately.

The interactive form features on pdfFiller enable users to fill out the document digitally, saving time and reducing the probability of errors. Each section of the form is clearly delineated, which helps applicants focus on individual requirements without feeling overwhelmed.

Once you've filled out the sections, pdfFiller allows for easy collaboration. You can share the form with a tax advisor or partner for review, streamlining the process of double-checking for accuracy.

Tips for signing and submitting your Homeowners Affordability Tax Credit form

After completing the Homeowners Affordability Tax Credit form, you’ll need to sign it before submission. pdfFiller offers various eSigning options, allowing you to electronically sign the form with ease. This feature eliminates the hassle of printing and scanning, making it possible to finalize your submission quickly.

Where and how to submit the completed form can vary by state. Generally, you will send your form to your local revenue office or submit it through state-specific online platforms. It's essential to check your local guidelines for any additional submission requirements.

To track the status of your submission, keep a copy of your completed form and any corresponding reference numbers. Many states offer online portals where you can check the status of submitted forms.

Common questions & challenges

Frequently asked questions about the Homeowners Affordability Tax Credit often revolve around eligibility, application procedures, and how long it takes to process the forms. Understanding these common queries can help facilitate a smoother filing experience.

Addressing common challenges includes ensuring that your documentation is complete and accurate. Applicants may also face delays due to processing times at local tax offices, so it’s wise to apply well in advance of any tax deadlines.

If you encounter errors during the submission process, refer back to the pdfFiller platform for helpful tips and troubleshooting resources that can guide you through corrections.

Managing your Homeowners Affordability Tax Credit records

Once you have submitted your Homeowners Affordability Tax Credit form, it’s vital to manage your documents effectively. Using pdfFiller, you can organize and store your completed documents securely within their cloud-based environment. This means you can access your forms anytime and from any location.

Tips for effective document management include labeling files clearly and setting reminders for follow-ups or any potential updates that might be required. This way, you can ensure all your important documents are at your fingertips whenever you need them.

If you need to retrieve or update your form, pdfFiller's interface allows for easy navigation and editing. You can seamlessly make necessary adjustments to your submission, ensuring that your records reflect accurate and current information.

Additional resources for homeowners

In addition to direct guidance on the Homeowners Affordability Tax Credit, various government resources and tax assistance programs offer further help to homeowners. Consider visiting your local housing authority's website for updates on related programs or community assistance initiatives that may be available.

Engaging with community support networks can also be helpful. Connect with local homeowner associations or online communities to share experiences and gather additional insights into the application process.

Interactive tools offered by pdfFiller

pdfFiller provides an array of document management features that enhance the experience of filing the Homeowners Affordability Tax Credit form. The platform allows users to edit PDFs, collaborate in real-time, and securely store documents in a convenient cloud-based environment, setting it apart from traditional filing methods.

Unlike traditional methods, pdfFiller offers flexible access to your documents 24/7, empowering users to work from anywhere. This level of convenience can significantly streamline the overall process of preparing and submitting tax forms.

By leveraging these tools, you can enhance your efficiency and ensure greater accuracy as you navigate the complexities of tax-related documentation.

Staying informed: Updates and changes to tax credit policies

Keeping abreast of updates and changes to the Homeowners Affordability Tax Credit policies is crucial for homeowners. Changes may occur annually, and understanding these adjustments can greatly influence your financial strategy.

Utilizing these resources can help ensure you are well-informed about any changes that may affect your eligibility or the benefits associated with the Homeowners Affordability Tax Credit.

Feedback and community engagement

Engaging with the homeowner community can provide invaluable insights and support. By sharing your experiences and tips related to the Homeowners Affordability Tax Credit form, you contribute to a wealth of knowledge that can assist other homeowners in navigating this process.

Connecting with others facing similar challenges can also lead to shared strategies for overcoming hurdles, making the process of dealing with tax credits less daunting and more manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit homeowners affordability tax credit from Google Drive?

How do I edit homeowners affordability tax credit on an iOS device?

Can I edit homeowners affordability tax credit on an Android device?

What is homeowners affordability tax credit?

Who is required to file homeowners affordability tax credit?

How to fill out homeowners affordability tax credit?

What is the purpose of homeowners affordability tax credit?

What information must be reported on homeowners affordability tax credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.