Get the free Heterogenous Rates of Return on Homes and Other Real Estate

Get, Create, Make and Sign heterogenous rates of return

Editing heterogenous rates of return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out heterogenous rates of return

How to fill out heterogenous rates of return

Who needs heterogenous rates of return?

Understanding heterogeneous rates of return form

Understanding heterogeneous rates of return

Heterogeneous rates of return refer to varying rates of returns across different investments or asset classes. This concept acknowledges that investments do not produce uniform returns consistently; instead, they can fluctuate based on a myriad of factors. It's essential for investors to comprehend these differences, as they significantly impact financial planning and investment strategies. Heterogeneous rates of return come into play during financial analysis, helping investors make informed decisions tailored to their risk tolerance and investment goals.

Factors influencing heterogeneous rates of return

Several critical factors influence the rates of return across various assets. Economic conditions play a vital role — inflation, for instance, can erode purchasing power and affect nominal returns on investments. Similarly, interest rates dictate the cost of borrowing, which influences corporate profits and thus their stock values. Additionally, the type of asset significantly impacts returns; real estate might yield consistent cash flows but isn't as liquid as stocks or bonds, which can offer more immediate returns but at higher volatility.

Geographic considerations also contribute to heterogeneous returns. Investments in urban areas tend to reflect higher appreciation due to demand surges, while rural investments might face stagnation. Socioeconomic factors, such as income disparity, can exacerbate these differences, affecting market access and the resulting returns. Understanding how these aspects interact provides a critical foundation for investors looking to navigate complex financial landscapes.

Analyzing the patterns

Identifying trends in historical data related to heterogeneous rates of return helps investors understand patterns and make informed decisions. For instance, a study of returns during economic recessions compared to booming economies can shed light on which sectors are resilient or vulnerable. A comparative analysis of returns also reveals the experiences of various demographics, indicating how different groups may benefit or suffer from investment choices.

Tools for visualizing returns, such as charts and graphs, can significantly enhance comprehension. Interactive dashboards allow investors to see real-time data, highlighting variations in returns across assets, sectors, and demographic segments. This data enables a more strategic approach to investment, fostering a proactive mindset in planning and executing financial strategies.

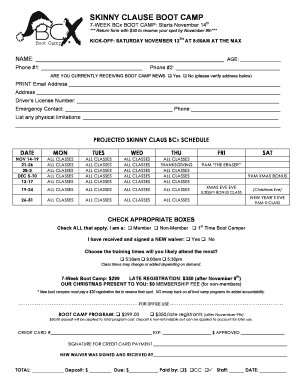

Completing the heterogeneous rates of return form

Filling out the heterogeneous rates of return form is a crucial step for documenting your investment returns accurately. The process begins with gathering the necessary financial data. Essential documentation includes transaction records, bank statements, and evidence of capital gains or losses. Additionally, it's important to have key performance metrics at hand, such as annualized return rates, benchmarks, and asset valuations to complete the form effectively.

Once data is collected, fill out the form by breaking down the specific fields. Ensure that each section is completed accurately, as even minor errors can lead to significant discrepancies in reporting. Common mistakes include mislabeling investments or failing to include all relevant documents. After filling out the form, perform a thorough check for errors before submitting, whether digitally or through traditional mail. It’s essential to keep a copy of the completed form for your records.

Enhancing your document management with pdfFiller

pdfFiller provides powerful tools for editing and customizing your heterogeneous rates of return form. With interactive features, users can modify form contents as needed, ensuring that the document meets specific requirements. This versatility allows you to adjust investment details, reports, or structures directly within the platform.

Additionally, eSigning your documentation through pdfFiller offers a secure method for executing financial forms. The steps are straightforward; simply upload your document, add signature fields, and use electronic signing options to finalize the process. Collaboration is seamless within pdfFiller's cloud environment, enabling teams to share, review, and manage documents collectively. This efficiency can be especially useful when multiple stakeholders are involved in the investment process.

Maximizing returns on investments

To enhance your investment outcomes, identifying high-yield assets is vital. This involves rigorous research and due diligence to assess potential returns against their respective risks. It’s essential to analyze trends, examine financial statements, and even consult expert opinions to gain insights into which assets are likely to perform well.

The role of diversification cannot be overstated. By spreading investments across various asset classes, geographic locations, and sectors, investors can mitigate risks associated with market volatility. This approach helps stabilize returns over time, even in turbulent markets. Moreover, timing the market is crucial; knowing when to enter or exit positions can make a significant difference in overall investment performance.

Interactive tools and calculators

Utilizing pdfFiller's extensive resources can greatly enhance your understanding of heterogeneous rates of return. Accessing calculators for real-time ROI estimates allows investors to simulate potential outcomes based on varying parameters. This provides insights into how different investment decisions might pan out under changing market conditions.

Moreover, pdfFiller offers interactive tools to visualize scenarios that affect your investments. By manipulating variables, investors can see how alterations in rates affect overall returns, providing a clearer picture of risk and reward. These resources empower users to make data-driven decisions, improving their financial strategies.

Common misconceptions about rates of return

Misconceptions regarding heterogeneous rates of return often stem from misunderstandings of statistical principles. For instance, many investors believe that past performance guarantees future results, which is misleading. Just because a specific asset performed well in the past does not assure similar outcomes in the future.

Furthermore, the impact of media narratives can skew perceptions about investments. Headlines highlighting skyrocketing stock prices can create a false sense of security, while downturns can generate undue panic. Understanding these biases is crucial for investors to navigate decisions with clarity and awareness.

Legal and compliance considerations

Complying with regulations regarding the disclosure of returns is vital for transparency in financial reporting. Investors must ensure accuracy and integrity when completing their heterogeneous rates of return forms, as discrepancies can lead to serious consequences. Legal obligations often vary by jurisdiction, underscoring the importance of being well-informed about the specific requirements in your area.

Failure to adhere to compliance standards can result in penalties or legal repercussions. This highlights the necessity for investors to not only focus on maximizing returns but also to maintain ethical and lawful practices in their reporting and documentation.

Real-life success stories

Analyzing real-life success stories of individuals or teams that effectively utilized heterogeneous return analysis can provide valuable insights. These case studies highlight how strategic decisions led to maximized returns and risk mitigation. For example, a diversified investment portfolio that included a mix of stocks, bonds, and real estate often demonstrated resilience during economic fluctuations, ensuring steadier returns over time.

Lessons learned from these experiences underscore best practices in the investment realm. Careful analysis of data, understanding market indicators, and remaining adaptable in strategies can lead to more successful investment journeys, showcasing the importance of leveraging heterogeneous rates of return assessments.

Future outlook on investment returns

Moving forward, the landscape of investment returns is likely to evolve due to various factors, including technological advancements, demographic shifts, and changes in global economics. Predictions suggest that understanding heterogeneous rates of return will become even more crucial as investors seek to navigate complex market conditions. As traditional asset classes face pressures, innovative investments, such as sustainable energy and technology startups, may offer new opportunities for varied returns.

Preparing for these market changes involves strategic planning and an openness to adapting investment strategies. Utilizing tools like pdfFiller can streamline the process of form management associated with reporting and documentation of heterogeneous returns, ultimately empowering users to take control of their financial futures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in heterogenous rates of return?

How do I fill out heterogenous rates of return using my mobile device?

How do I complete heterogenous rates of return on an Android device?

What is heterogenous rates of return?

Who is required to file heterogenous rates of return?

How to fill out heterogenous rates of return?

What is the purpose of heterogenous rates of return?

What information must be reported on heterogenous rates of return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.