Get the free June 1, 2025 - John Patrick Publishing Church Bulletin Archive

Get, Create, Make and Sign june 1 2025

How to edit june 1 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out june 1 2025

How to fill out june 1 2025

Who needs june 1 2025?

Comprehensive Guide to the June 1, 2025 Form

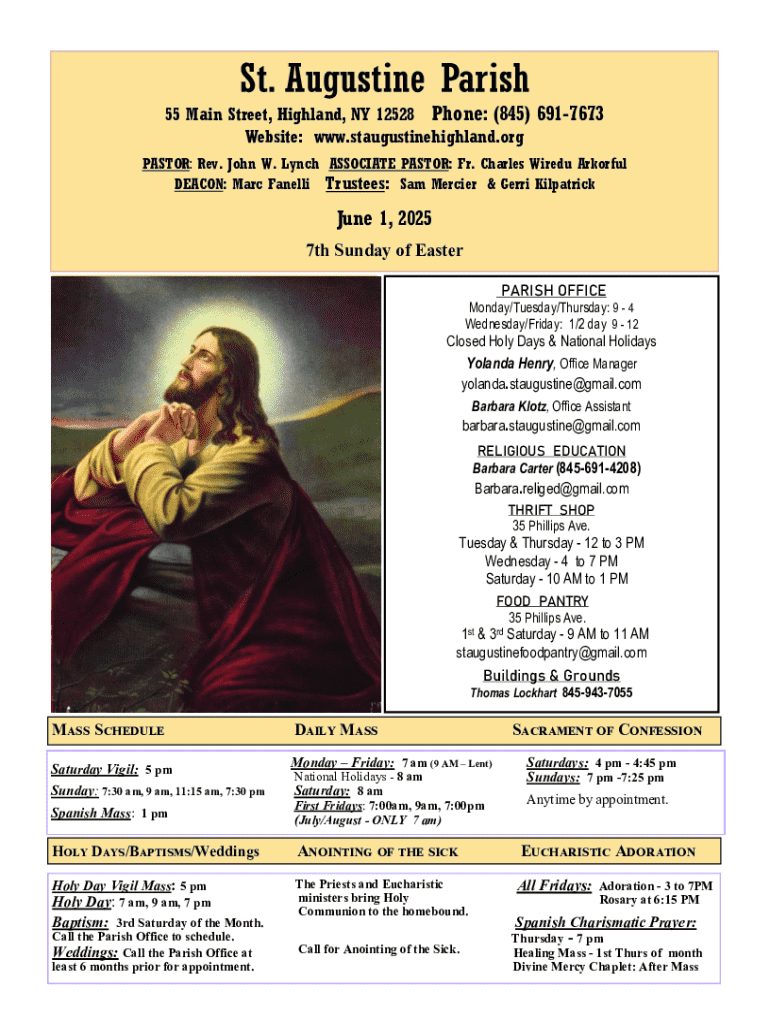

Overview of the June 1, 2025 form

The June 1, 2025 Form is a critical document designed to streamline specific legal and regulatory processes. This form plays a pivotal role for both individuals and teams as it outlines essential information required for compliance during this designated date, serving as a reference point for various applications and submissions.

Understanding the importance of the June 1, 2025 Form is vital for effective planning and timely submissions. It encompasses essential data that influences decisions within business operations and legal frameworks, ensuring a structured approach to documentation and filing.

Who needs to use the June 1, 2025 form?

Eligibility for using the June 1, 2025 Form typically encompasses a range of stakeholders, including businesses, non-profits, and individuals engaged in activities governed by specific regulations. Anyone who is accountable for reporting or documenting information relevant to this date will find the form necessary for compliance.

Common scenarios where the June 1, 2025 Form might be applicable include tax submissions, regulatory reporting for operational licenses, or compliance with legal obligations. Each stakeholder’s engagement will necessitate adherence to this form to facilitate smooth operation and accurate reporting.

Key features of the June 1, 2025 form

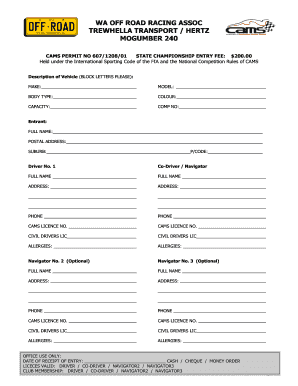

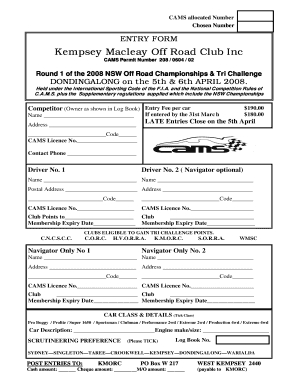

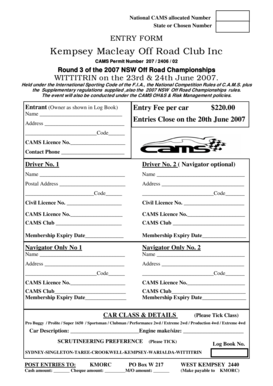

The June 1, 2025 Form is segmented into several distinct sections, each designed to collect specific types of information. These sections play a critical role in providing a complete picture of the individual or entity submitting the form. Some core components typically required include personal information, financial data, and formal certifications.

Significant changes may have been made in this edition of the form, reflecting modifications in regulatory requirements or enhancements based on user feedback. Understanding these changes is crucial not only for compliance but also for recognizing the evolving landscape in which these documents operate.

Detailed instructions for completing the form

Filling out the June 1, 2025 Form requires a systematic approach to ensure all necessary details are accurately provided. Begin by gathering your personal information, which should include your full name, address, identification numbers, and any relevant contact information.

As you continue, financial data may also be needed, particularly for businesses and organizations reporting their fiscal status. Ensure you have all required figures and documentation ready. The form also requires formal signatures and certifications verifying the authenticity of the information provided, ensuring that all statements made are legally binding.

Common mistakes to avoid include failing to sign the form, leaving sections incomplete, and submitting incorrect information. Double-checking entries and potentially having a second pair of eyes review your submission can help ensure accuracy and completeness.

Electronic filing requirements

Electronic filing has emerged as a convenient option for submitting the June 1, 2025 Form. The ability to file online allows users to complete and submit their forms efficiently, reducing the chances of logistical errors typically associated with paper submissions.

Utilizing platforms dedicated to electronic filing simplifies the process. These platforms often provide user-friendly interfaces, guiding users through the submission steps while ensuring that all requirements are met.

Important information regarding the June 1, 2025 form

When dealing with the June 1, 2025 Form, understanding the legal and regulatory landscape is essential. Legal requirements dictate the information that must be included, ensuring compliance with relevant laws. Familiarizing yourself with these regulations can prevent potential complications during the submission process.

Additionally, late submissions can trigger interest and penalties, emphasizing the importance of adhering to set deadlines. To navigate potential questions or concerns, refer to FAQs sourced from the authorities overseeing the form to clarify common inquiries surrounding its submission.

Helpful hints for users

Completing the June 1, 2025 Form can be streamlined using efficient methodologies. Preparing necessary documentation ahead of time, checking your internet connection when filing online, and consulting guides can enhance your experience in submitting the form.

Utilizing trusted channels for assistance, such as professional forums or customer support available through platforms like pdfFiller, can save time and reduce stress in navigating the complexity of form completion.

Related document management strategies

Proper document organization and storage are vital when working with the June 1, 2025 Form. Utilizing digital document management solutions streamlines processes such as retrieval, sharing, and editing, while promoting collaboration within teams.

Implementing best practices for document management—such as categorizing files based on type, maintaining consistent naming conventions, and utilizing cloud-based solutions—enables efficient collaboration and ensures that all team members can access necessary forms when required.

Troubleshooting and resolution

Encounters with technical difficulties during filing shouldn’t deter you from completing the June 1, 2025 Form. Understanding potential issues—such as system outages or submission errors—allows users to proactively address challenges that could arise.

In cases of rejection, reviewing feedback provided can clarify the factors that led to issues. By ensuring all corrections are made and re-submitting accurately, users can reduce the risk of facing repeated complications.

Multilingual support and accessibility options

Understanding the need for inclusivity, the June 1, 2025 Form may offer multilingual options to accommodate users from diverse backgrounds. This ensures that language barriers do not hinder individuals from submitting their forms effectively.

Accessibility features integrated within the form aid users with disabilities, allowing them to engage with the document on an equitable basis. Contacting user support for assistance in these matters ensures everyone can navigate the filing process successfully.

Final thoughts on managing your June 1, 2025 form

Efficiently managing the June 1, 2025 Form not only helps in staying compliant but also streamlines individual and business operations. Through careful attention to detail, organization, and proactive outreach for support, users can navigate this process with confidence.

Leveraging pdfFiller's robust document management features will also enhance the user's workflow, offering tools for easy editing, electronic signatures, and collaborative options that enrich the overall experience around managing this essential form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find june 1 2025?

How can I edit june 1 2025 on a smartphone?

How do I complete june 1 2025 on an Android device?

What is June 1, 2025?

Who is required to file June 1, 2025?

How to fill out June 1, 2025?

What is the purpose of June 1, 2025?

What information must be reported on June 1, 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.