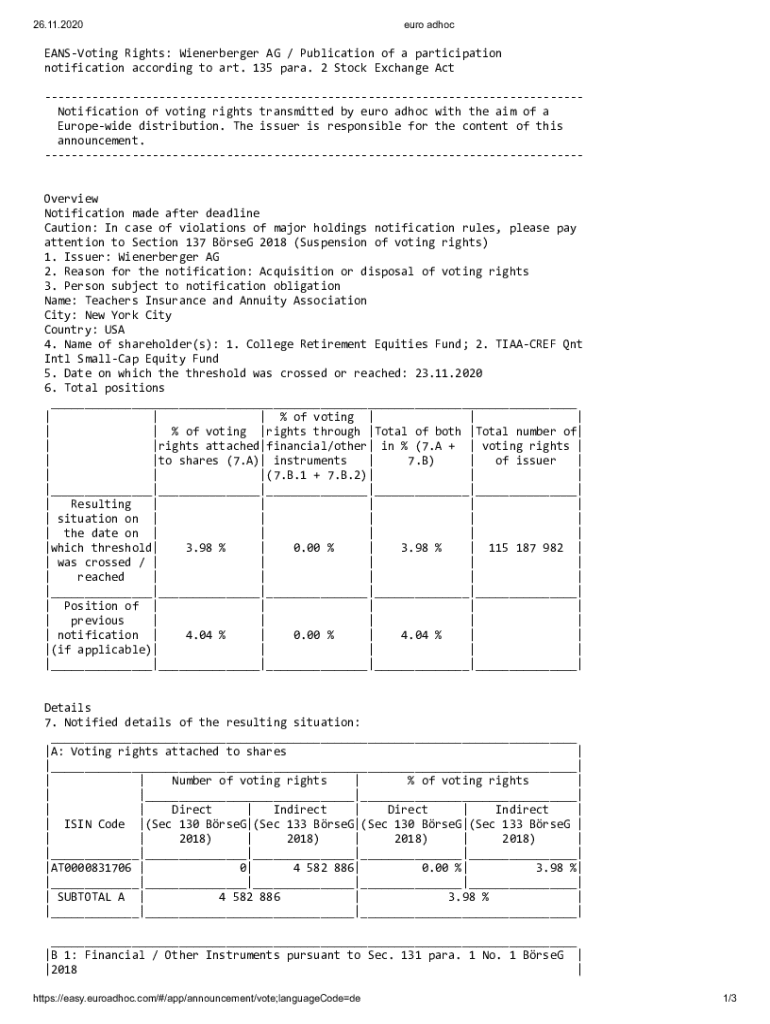

Get the free Teachers Insurance and Annuity Association ...

Get, Create, Make and Sign teachers insurance and annuity

How to edit teachers insurance and annuity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out teachers insurance and annuity

How to fill out teachers insurance and annuity

Who needs teachers insurance and annuity?

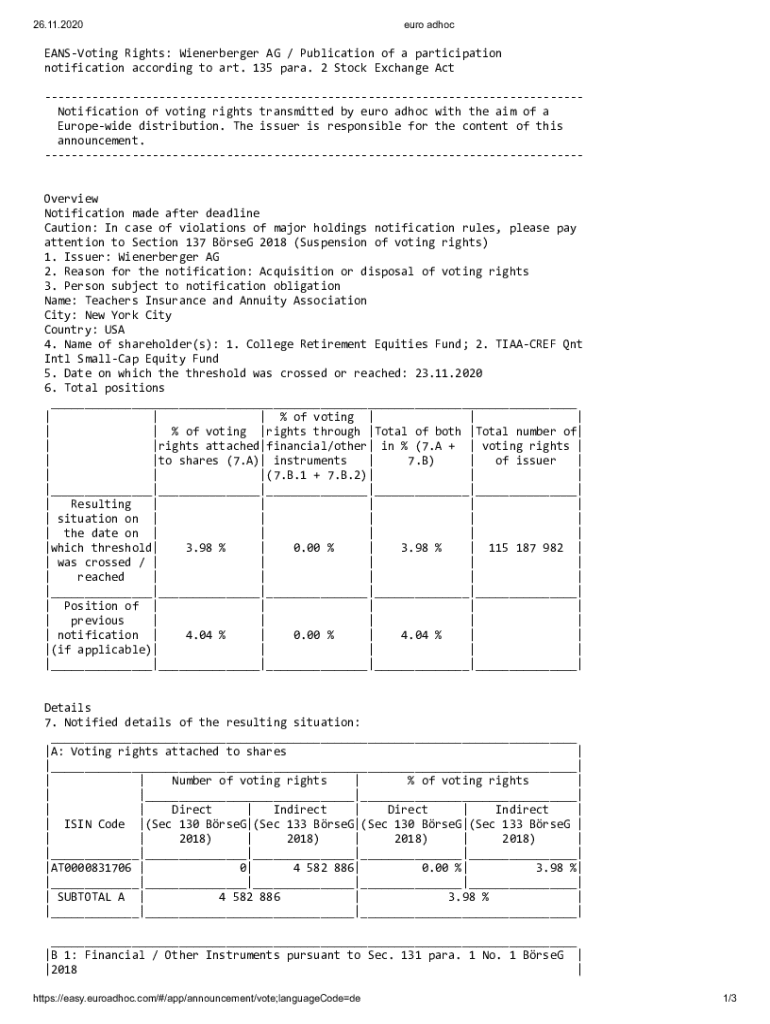

Understanding Teachers Insurance and Annuity Form

Overview of Teachers Insurance and Annuity

Teachers Insurance and Annuity refers to a specialized financial product that provides retirement plan benefits specifically for educators. It plays a crucial role in ensuring teachers have the financial security they need during their retirement years.

Completing the Teachers Insurance and Annuity Form is the first step toward securing these benefits. It captures essential information about the educator's employment history and financial situation, allowing the insurance providers to tailor plans that best suit individual needs.

Eligibility to fill out the form generally includes current and former educators, administrative staff, and faculty members within educational institutions. It ensures that individuals who have dedicated their careers to teaching can take advantage of retirement plans designed with their specific needs in mind.

Common uses of the Teachers Insurance and Annuity form

The Teachers Insurance and Annuity Form serves several functions that are pivotal for educators. One of the most common uses involves enrolling in a retirement plan, allowing educators to set aside funds for their future.

Additionally, educators can use the form to claim benefits when they retire, making it essential for managing the transition from active employment to retirement.

The form can also be utilized for making changes to an existing policy, such as updating personal information or adjusting beneficiaries. Moreover, understanding annuity options is crucial, as it allows educators to choose between different payment plans that can affect their financial stability.

Detailed breakdown of the Teachers Insurance and Annuity form

The Teachers Insurance and Annuity Form is organized into several sections, each requiring specific information to ensure accuracy and completeness.

Section 1: Personal Information

This section requires details such as your name, address, and Social Security number. Ensuring that these details are correct is vital as any discrepancies can lead to delays in processing your application.

Section 2: Employment History

In this part of the form, it's essential to include your work history in a clear, chronological format. Accurate reporting of service credit affects your pension benefits and overall retirement funds.

Section 3: Financial Details

This section focuses on your current financial situation, requesting information about any existing annuities and insurance policies. Be prepared to clarify the necessary financial documents to support your claims and preferences.

Step-by-step instructions for completing the form

Step 1: Gathering necessary documentation

Before sitting down to complete the Teachers Insurance and Annuity Form, it's vital to gather all necessary documentation. This includes identification, previous insurance papers, and any additional records pertinent to your employment and financial situation.

Step 2: Filling out the form online

Accessing the digital form through pdfFiller simplifies the process of completing your Teachers Insurance and Annuity Form. Navigating the form fields smoothly is crucial; ensure your entries are complete and clearly readable for processing.

Step 3: Reviewing the completed form

Once you've filled out the form, take the time to proofread your entries methodically. Look for common mistakes, such as typos in your personal information or discrepancies in your employment history.

Editing and managing your form with pdfFiller

pdfFiller offers cloud-based tools for easy editing, allowing you to manage your Teachers Insurance and Annuity Form from anywhere. Utilize collaboration features to gather inputs from relevant parties, such as financial advisors or family members.

Additionally, secure eSignature options streamline the submission process, ensuring that your form is submitted digitally and safely.

Frequently asked questions (FAQs)

Navigating the Teachers Insurance and Annuity Form can raise several questions. If you are struggling to find the form, it's available on the official site or within the resources provided by your educational institution.

Updating a submitted form typically involves contacting customer service or utilizing the online portal provided by the insurance company. If you realize an error after submitting, don't panic; many organizations allow for corrections and re-submissions.

Extra tips for navigating teachers insurance and annuity

Maximizing your annuity benefits can significantly enhance your retirement lifestyle. Consider speaking with a financial advisor to tailor your retirement plan to your specific goals.

Utilizing resources for financial planning is also advantageous. Numerous online tools and seminars focus on teaching educators about strategically managing their retirement benefits.

Troubleshooting common issues

Should you experience difficulty accessing the Teachers Insurance and Annuity Form, verify that you are using the correct link or visiting the right site. For issues related to online submission, ensure your internet connection is stable.

If problems persist, contacting customer support directly is advisable. Many institutions have dedicated help teams for addressing questions about retirement forms and benefits.

Conclusion of the form process

Completing the Teachers Insurance and Annuity Form correctly requires attention to detail from start to finish. Take the necessary final steps to ensure a smooth submission process, including double-checking all information for accuracy.

Once submitted, monitoring your application status through pdfFiller can provide peace of mind and keep you informed about your benefits and any required steps moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete teachers insurance and annuity online?

Can I create an electronic signature for the teachers insurance and annuity in Chrome?

How do I edit teachers insurance and annuity on an Android device?

What is teachers insurance and annuity?

Who is required to file teachers insurance and annuity?

How to fill out teachers insurance and annuity?

What is the purpose of teachers insurance and annuity?

What information must be reported on teachers insurance and annuity?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.