Get the free Payroll Deductions Authorization Form

Get, Create, Make and Sign payroll deductions authorization form

Editing payroll deductions authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll deductions authorization form

How to fill out payroll deductions authorization form

Who needs payroll deductions authorization form?

Payroll Deductions Authorization Form Guide

Understanding payroll deductions

Payroll deductions are amounts withheld from an employee's gross pay for various purposes, primarily taxes and benefits. They serve to ensure compliance with federal and state laws, as well as to facilitate certain employee benefits. The importance of payroll deductions cannot be overstated, as they play a crucial role in managing both employee finances and employer responsibilities.

Types of payroll deductions

Understanding the different types of payroll deductions is key to managing your finances effectively. There are two main categories: mandatory deductions and voluntary deductions.

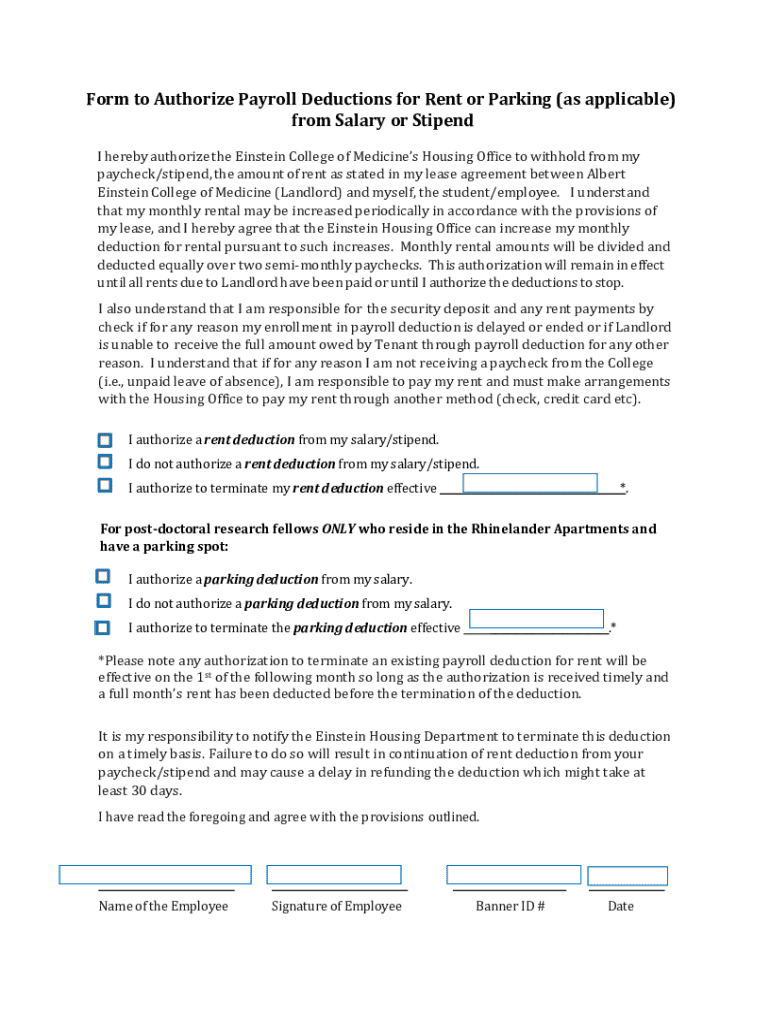

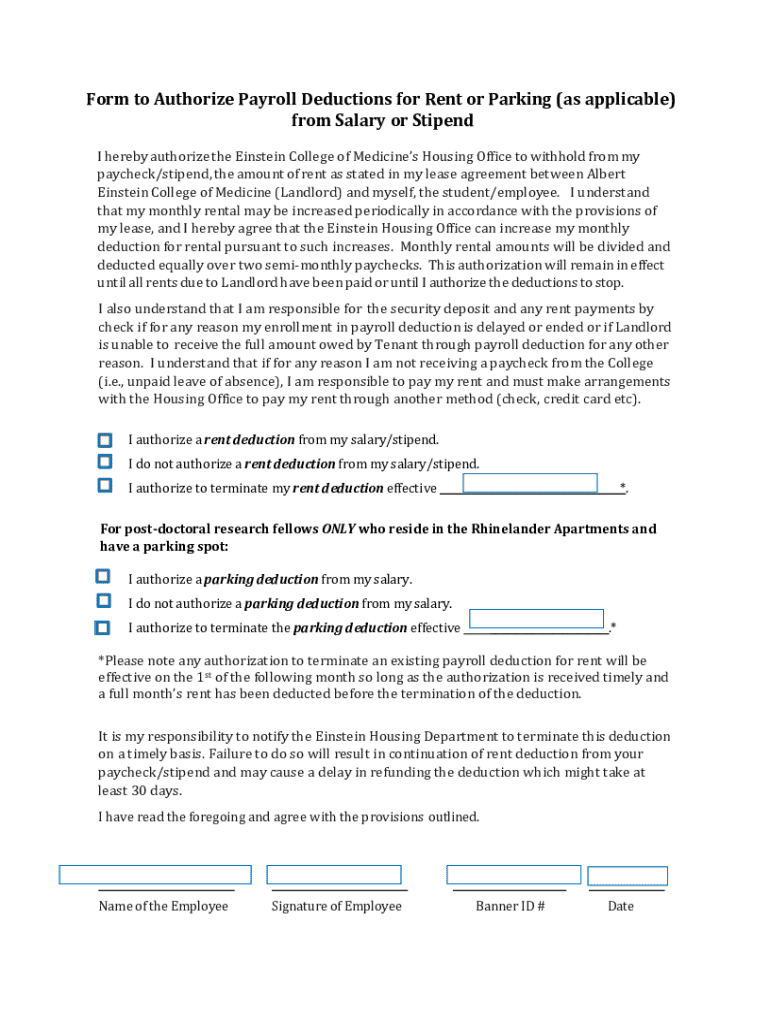

The importance of a payroll deductions authorization form

The payroll deductions authorization form is a critical document that ensures compliance with legal regulations regarding employee salaries. It serves as a formal request for an employee to authorize specific deductions from their paycheck, reinforcing the principle of informed consent.

Without this authorization, employers may face legal penalties, and employees may find themselves unexpectedly underpaid. Ensuring all parties are properly informed and agree to the deductions is not just a courtesy but a necessity in modern payroll management.

Key components of the payroll deductions authorization form

A well-structured payroll deductions authorization form should contain essential information that both the employee and employer need to ensure accurate deductions. This includes identifying both parties clearly and detailing the specific deductions authorized.

How to fill out the payroll deductions authorization form

Filling out the payroll deductions authorization form correctly is essential to prevent any misunderstandings or mistakes. Here’s a step-by-step guide to make the process easy.

It’s important to avoid common mistakes such as missing signatures or entering incorrect amounts, as these can cause delays in processing.

Editing and customizing the form with pdfFiller

With pdfFiller, you can easily edit and customize your payroll deductions authorization form, ensuring it's tailored to your specific situation. This online platform offers a user-friendly experience that allows you to make changes directly.

Editing forms online brings several benefits, including time saved and reduced risk of errors. You can fill out the form yourself or collaborate with team members using efficient tools available at pdfFiller.

Signing and submitting the payroll deductions authorization form

Once you have filled out the payroll deductions authorization form, the next step is the signing process. This is where pdfFiller shines, offering a convenient eSigning feature.

Electronic signing simplifies the traditionally cumbersome process of manual signatures. With pdfFiller, you can sign the form using your mouse or touchscreen, making it accessible from any device.

Managing your payroll deductions

Managing payroll deductions effectively is integral to ensuring ongoing compliance and satisfactory employee management. With tools like pdfFiller, tracking your deductions can be smooth and hassle-free.

Keeping your records updated and making adjustments when necessary is key. Should you need to change or cancel a deduction, pdfFiller facilitates this with ease.

Frequently asked questions about payroll deductions authorization

Navigating payroll deductions can raise various questions. Here are clarifications on some of the most common inquiries regarding the payroll deductions authorization form.

Engaging with payroll deductions via pdfFiller

pdfFiller enhances the payroll deductions process by fostering better collaboration among team members. Users can share forms, make suggestions, and edit documents in real-time, making communication seamless.

Furthermore, since pdfFiller is cloud-based, it offers the flexibility to access forms from anywhere, whether in the office or working remotely. This ensures that you can manage your payroll deductions without a hitch.

Best practices for payroll deductions management

Implementing best practices in payroll deductions management ensures compliance and enhances employee satisfaction. Regular reviews and updates of your payroll deductions can prevent issues down the line.

Understanding changes in tax laws or benefits can also help in maintaining compliance with current regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send payroll deductions authorization form for eSignature?

How do I make edits in payroll deductions authorization form without leaving Chrome?

How can I edit payroll deductions authorization form on a smartphone?

What is payroll deductions authorization form?

Who is required to file payroll deductions authorization form?

How to fill out payroll deductions authorization form?

What is the purpose of payroll deductions authorization form?

What information must be reported on payroll deductions authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.