Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 form: A Comprehensive How-to Guide

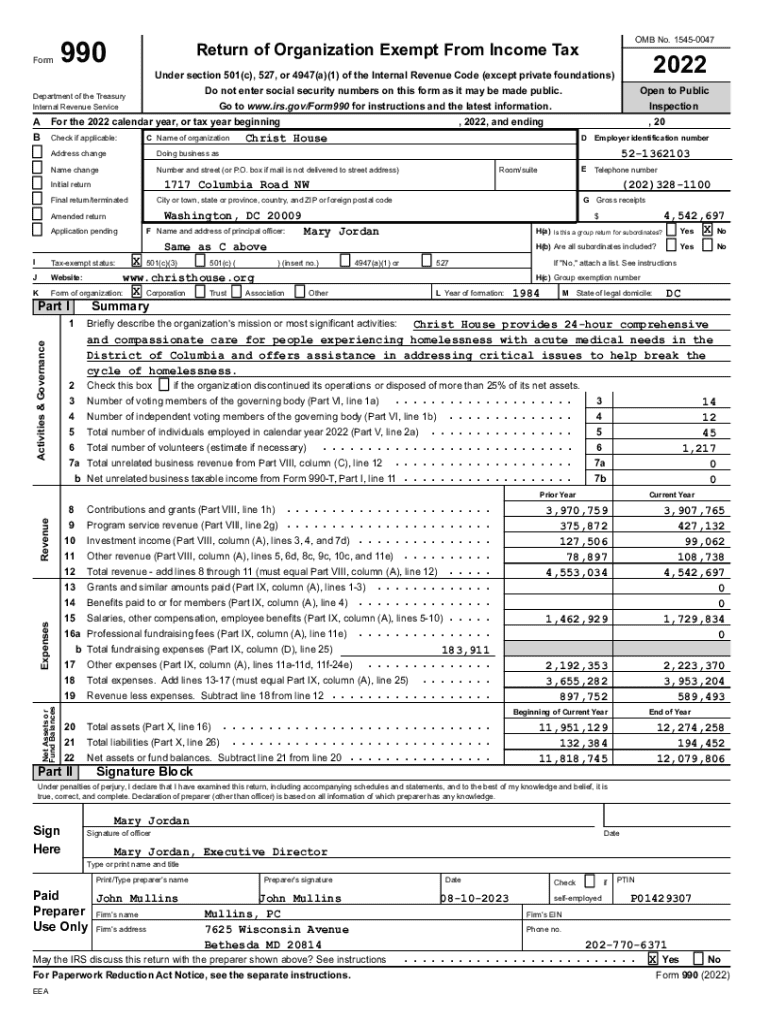

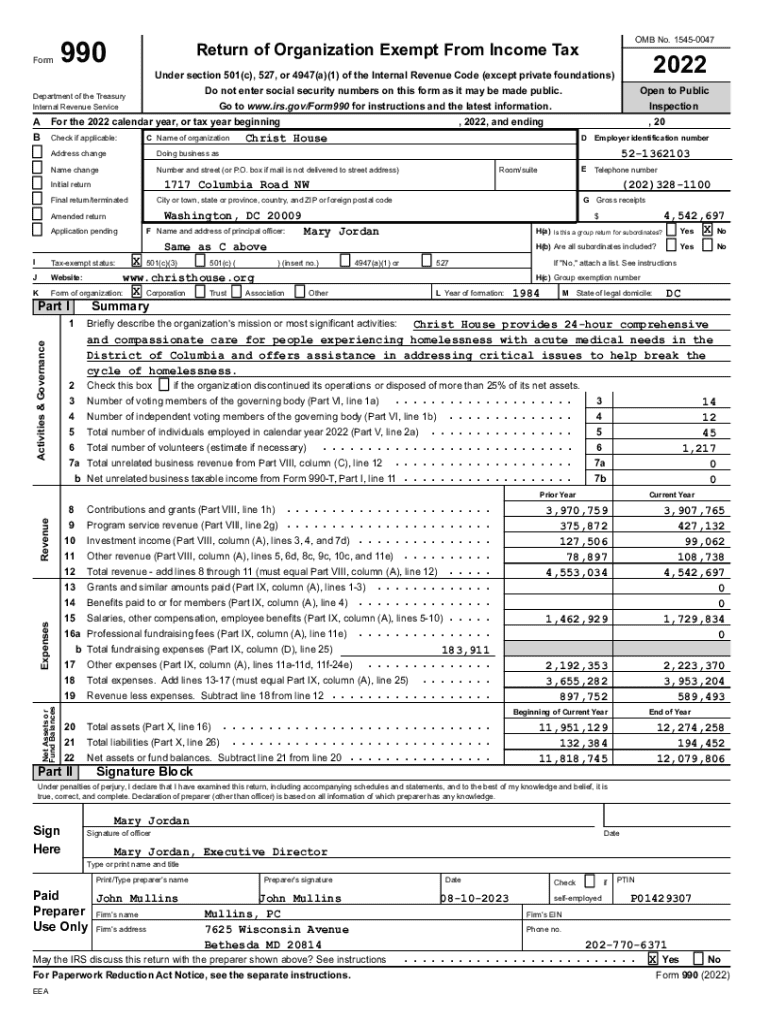

Understanding Form 990

Form 990 serves as an essential instrument for transparency among tax-exempt organizations in the United States. Its primary purpose is to provide the Internal Revenue Service (IRS), stakeholders, and the public with a comprehensive overview of an organization's financial health, governance, and operations. This form is crucial for maintaining tax-exempt status as it demonstrates compliance with IRS regulations and promotes accountability.

Key stakeholders affected by Form 990 include nonprofit organizations, potential donors, transparency advocates, and regulatory bodies. By requiring detailed disclosures of financial information, governance practices, and program service accomplishments, Form 990 plays a vital role in promoting informed giving and enhancing the credibility of nonprofits.

Who must file Form 990?

Certain organizations must file Form 990, primarily based on their gross annual revenue or type. Most tax-exempt organizations, including charities, foundations, and educational institutions, are generally required to submit this form annually. Organizations with a gross revenue of $200,000 or more or those with total assets exceeding $500,000 must file the standard Form 990. Smaller organizations, with gross receipts under $200,000, may qualify to file Form 990-EZ, a streamlined version of the form.

Notable exceptions exist for certain types of organizations, such as churches, integrated auxiliaries, and certain governmental entities. Understanding these exceptions is critical for small organizations that may be operating under the impression that they need to comply with these filing requirements.

Filing modalities for Form 990

Form 990 can be filed either electronically or on paper. Electronic filing is highly encouraged by the IRS as it expedites processing times and reduces the likelihood of errors. e-Postcard (Form 990-N) is another option for small organizations with less than $50,000 in annual revenue and can be submitted online.

The submission deadlines vary depending on the organization’s fiscal year. A standard due date for Form 990 is the 15th day of the 5th month after the end of the organization’s accounting year, with extensions available. Additionally, certain states may impose unique requirements relating to filing or additional forms that need to be submitted along with Form 990.

Key components of Form 990

Form 990 is structured into major sections that reveal critical aspects of an organization's operations. Key sections include parts that outline basic organizational information, governance practices, financial data, and program accomplishments. For instance, the core financial information helps stakeholders assess the organization's financial health, including revenue, expenses, and changes in net assets.

Filing this form requires careful attention to detail. Each line demands accurate and truthful disclosures to ensure compliance. For example, organizations must provide insight into governance structures by detailing board policies, conflict-of-interest procedures, and the diversity of board members. This information is crucial not only for IRS compliance but also for fostering public trust.

Penalties for non-compliance

Failing to file Form 990 can lead to serious consequences, including financial penalties and potential loss of tax-exempt status. The IRS imposes fines starting from $20 per day for small organizations but can reach up to $100 per day for larger entities, with a maximum penalty cap based on the organization's revenues.

In addition to financial penalties, non-compliance can damage an organization's reputation. The absence of public accountability can deter potential donors, who may rely on the transparency provided by Form 990 before deciding to contribute. Thus, adhering strictly to filing deadlines and requirements is paramount for tax-exempt organizations.

Public inspection regulations

Form 990 is not only an important document for organizations but also a vital resource for the public. Nonprofits must make their filed forms available for public inspection, typically within their offices, and numerous online platforms offer access to these forms. This transparency requirement is a cornerstone of compliance that helps build trust between organizations and their stakeholders.

To access Form 990 records, individuals can utilize databases such as the IRS website or third-party platforms like GuideStar. These resources simplify the process of retrieving organizational information, thus aiding potential donors and researchers in making informed decisions.

How to read Form 990

Understanding how to read and interpret Form 990 is essential for anyone analyzing an organization’s financial state. Key elements include total revenue, expenses, net assets, and changes to these figures over time. For instance, significant revenue fluctuations or high expenses relative to income can signal potential operational challenges.

Evaluating the governance information is equally critical. Details about board composition, types of policies in place, and executive compensation can provide insight into the organization’s leadership effectiveness and ethical practices. Analyzing these sections helps stakeholders gauge operational transparency and accountability.

Use of Form 990 in charity evaluation research

Form 990 serves as a fundamental tool for donors and researchers engaged in evaluating charitable organizations. By providing detailed financial and operational insights, it allows users to assess transparency, accountability, and sustainability. Comprehensive analysis of these forms can lead to well-informed philanthropic decisions, ensuring that funds are directed toward organizations demonstrating sound financial practices.

Utilizing resources such as Charity Navigator and the National Council of Nonprofits enables donors and researchers to perform comparative analyses among nonprofit organizations. These platforms aggregate Form 990 data, making it easier to determine which organizations are effectively utilizing their resources while adhering to best practices in governance.

Fiduciary reporting requirements

Board members of tax-exempt organizations bear fiduciary responsibilities that extend to complying with reporting requirements, including Form 990. They must be aware of the legal implications arising from incomplete or inaccurate reporting, which can put the organization at risk of penalties and harm its reputation. Engaging in regular training and discussions about compliance can promote transparency.

Ensuring that accurate data is reported in Form 990 is pivotal for maintaining the public’s trust and the organization’s operational integrity. Board members are advised to routinely review financial statements and governance practices—and be proactive in understanding the form's requirements to provide guidance effectively.

How pdfFiller streamlines the Form 990 filing process

pdfFiller simplifies the Form 990 filing process through innovative document management tools. Users can easily edit, manage, and sign Form 990 digitally, ensuring all information is accurate and compliant with IRS standards. This platform streamlines the overall documentation process, reducing administrative burdens and allowing organizations to focus on their mission.

Collaboration capabilities enabled by pdfFiller facilitate teamwork during the filing process, ensuring that various departments can contribute their expertise. Teams can work concurrently on the document, mitigating mistakes and enhancing the quality of the submitted form.

Moreover, the cloud accessibility benefits provided by pdfFiller allow users to manage their documents from any location, ensuring that filing deadlines are met regardless of the organization’s physical location. This flexibility is invaluable for nonprofits, which often work remotely or require remote collaboration.

Best practices for managing and storing Form 990

Effectively organizing and storing Form 990 ensures that vital documents are easily retrievable for reference or audit purposes. Implementing a systematic approach to documentation—such as creating categorized folders for years, types of forms, and supporting evidence—can greatly enhance efficiency. Digitally storing these files also reduces physical storage needs.

Furthermore, adhering to compliance with recordkeeping requirements is non-negotiable. Organizations should maintain copies of filed forms, along with applicable supporting documents, for at least three to four years. This ensures readiness for potential audits or inquiries while also fostering good governance practices.

Third-party sources for Form 990

Several reliable platforms and tools specialize in Form 990 filings and analyses, aiding organizations in compliance and informing stakeholders. Websites like the IRS site, Guidestar, and the Foundation Center provide searchable databases where users can access Form 990s, allowing for independent evaluations.

Additionally, community resources such as local nonprofits, associations, and support groups can provide guidance and assistance with the filing process. Leveraging these resources helps organizations navigate the complexities involved in filing Form 990 while fostering networking opportunities.

Frequently asked questions about Form 990

Many organizations grapple with several common concerns regarding Form 990. For example, questions often arise about what to do if an organization fails to file on time or how to correct errors after submission. Understanding the necessary steps in these scenarios can mitigate anxiety and ensure compliance.

Interactive tools and resources on pdfFiller

pdfFiller's platform offers interactive tools designed to enhance the user experience while filling out Form 990. These features include guided tours that walk users through the process of creating, editing, and managing the form efficiently. Such resources demystify the filing process, making it accessible to individuals and teams alike.

Testimonials from users demonstrate the efficiency of pdfFiller in simplifying the complexities associated with Form 990. Many users have reported experiencing reduced stress when preparing their filings, highlighting the platform’s commitment to empowering organizations in achieving their compliance obligations seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 990 in Chrome?

How do I edit form 990 straight from my smartphone?

How do I complete form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.