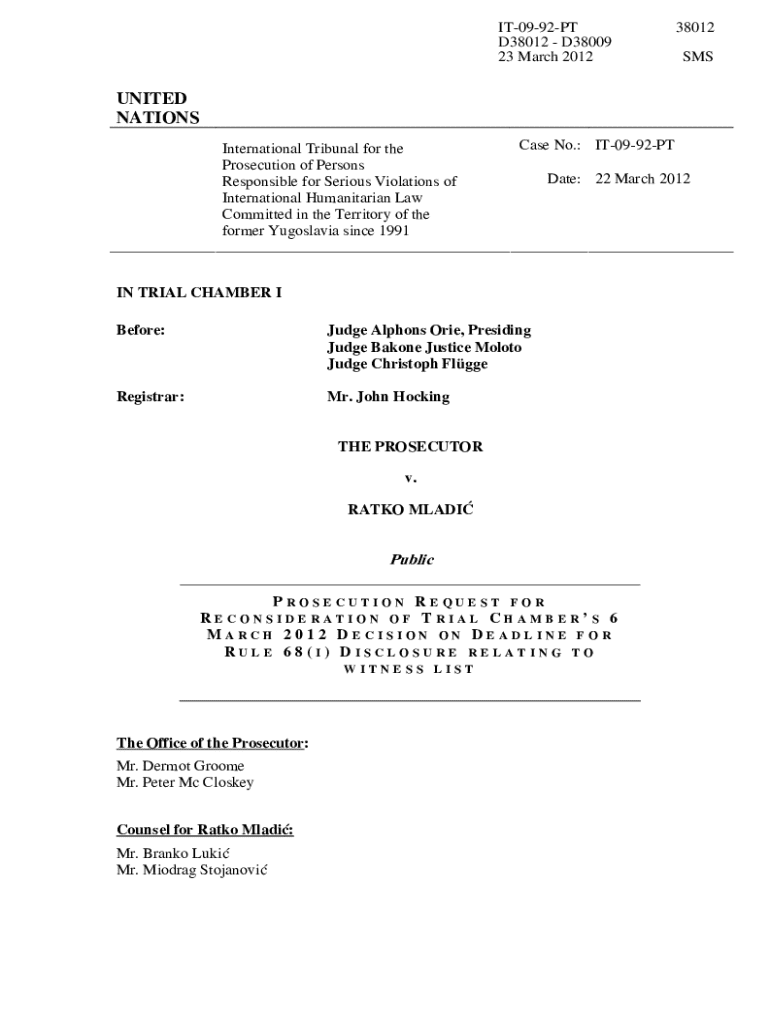

Get the free It-09-92-pt

Get, Create, Make and Sign it-09-92-pt

How to edit it-09-92-pt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out it-09-92-pt

How to fill out it-09-92-pt

Who needs it-09-92-pt?

A Comprehensive Guide to the it-09-92-pt Form

Understanding the it-09-92-pt form

The it-09-92-pt form is an essential document used predominantly in various financial contexts, often for tax reporting or applications for grants and subsidies. Its primary purpose is to gather detailed information regarding an individual's or organization's financial position to ensure compliance with legal requirements and eligibility for various programs.

Accurate completion of the it-09-92-pt form is crucial, as it can influence the processing time and overall outcome of submissions. Mistakes can lead to delays, rejections, or even legal consequences, making it imperative to understand each section thoroughly before submission.

This form is typically used by individuals, businesses, or financial institutions navigating complex tax rules, applying for governmental assistance, or reporting income. Understanding who needs this form and when it should be completed can significantly ease the burden of financial documentation.

Key features of the it-09-92-pt form

The it-09-92-pt form consists of several critical information fields that must be filled out accurately. Below are the primary components required:

In terms of formatting specifications, submitting the it-09-92-pt form usually needs to adhere to specific guidelines. Acceptance is often limited to particular file types, such as PDF or DOCX, and it’s essential to follow submission protocols laid out by the authorities to avoid delays.

Step-by-step instructions for completing the it-09-92-pt form

Effective preparation is the foundation for a successful submission. Prior to filling out the it-09-92-pt form, you should:

After doing your groundwork, proceed to fill out the form by following these steps:

Once the form is complete, reviewing your submission is essential. Double-check for accuracy to prevent any errors that could affect processing.

Robust reviewing involves looking for completeness, correct information placement, and proper documentation attached. Employing a checklist can be helpful for effective review.

Interactive tools for managing the it-09-92-pt form

Modern technology has made handling forms like the it-09-92-pt much more manageable. Tools available on platforms like pdfFiller empower users in numerous ways.

Collaboration is also enhanced with pdfFiller, allowing teams to work together efficiently on document creation. Utilizing sharing options for political or legal review ensures that input can be easily incorporated before final submission.

Common mistakes to avoid when completing the it-09-92-pt form

When filling out the it-09-92-pt form, certain pitfalls can lead to significant issues during processing. Common errors include:

Best practices for document management with it-09-92-pt form

To streamline the process surrounding the it-09-92-pt form, best practices in document management should be adopted. Consider the following strategies:

Implementing these practices not only simplifies document management but also augments overall productivity, particularly when groups collaborate on submissions.

Frequently asked questions (FAQ) about the it-09-92-pt form

To assist users navigating the it-09-92-pt form, several frequent inquiries arise. Here are answers to common questions:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify it-09-92-pt without leaving Google Drive?

Where do I find it-09-92-pt?

How do I edit it-09-92-pt on an iOS device?

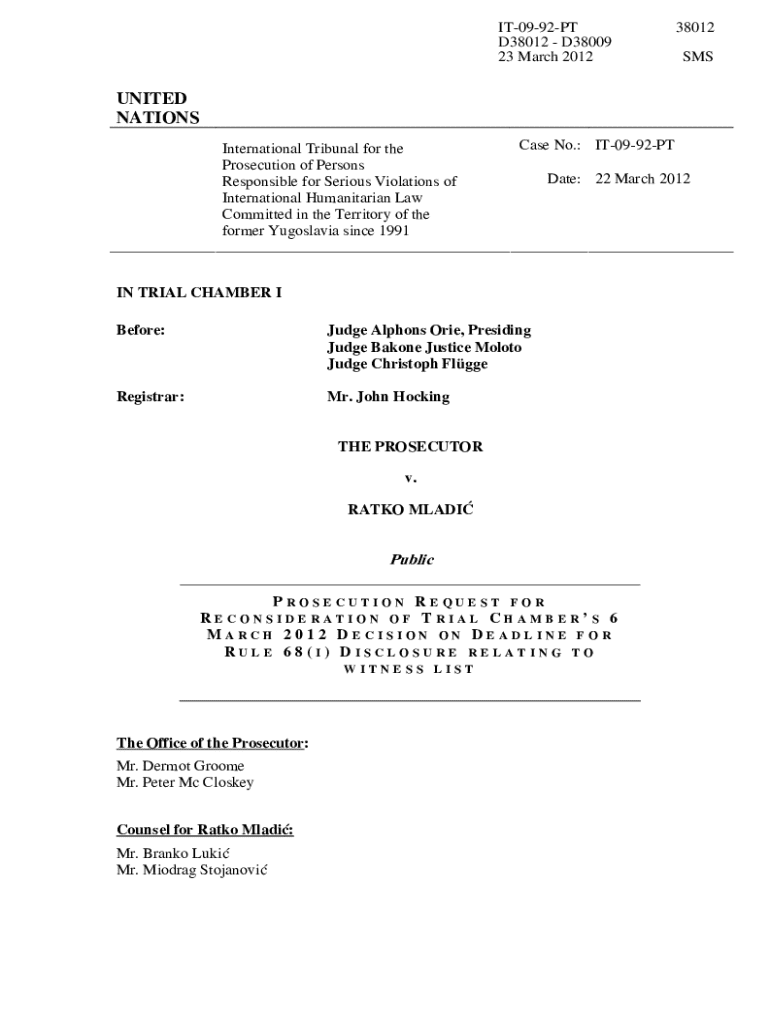

What is it-09-92-pt?

Who is required to file it-09-92-pt?

How to fill out it-09-92-pt?

What is the purpose of it-09-92-pt?

What information must be reported on it-09-92-pt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.