Get the free Annex 4: Sme Declaration V1.1

Get, Create, Make and Sign annex 4 sme declaration

Editing annex 4 sme declaration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annex 4 sme declaration

How to fill out annex 4 sme declaration

Who needs annex 4 sme declaration?

Understanding the Annex 4 SME Declaration Form

Understanding the Annex 4 SME Declaration Form

The Annex 4 SME Declaration Form is a crucial document for small and medium-sized enterprises (SMEs) in the European Union. This form serves as a declaration of an enterprise's status as an SME, which can open doors to various funding opportunities, grants, and support programs designed specifically for smaller businesses. Its primary purpose is to verify eligibility for financial incentives and government assistance tailored for SMEs.

Completing this declaration accurately can be the difference between acquiring essential funding or missing out. Therefore, understanding the significance of the Annex 4 SME Declaration Form is paramount for any business striving to leverage resources dedicated to SMEs.

Eligibility criteria for completing the Annex 4 form

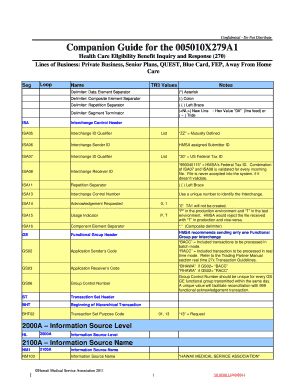

Determining whether your business qualifies as an SME is the first step in completing the Annex 4 SME Declaration Form. According to the EU's criteria, SMEs are categorized based on their number of employees and annual turnover. Specifically, an SME is defined as an enterprise with fewer than 250 employees and an annual turnover not exceeding €50 million. Alternatively, the business must have a balance sheet total of not more than €43 million.

Navigating the complexities of these criteria can be challenging for many businesses. Owners may mistakenly believe that larger companies or those with higher revenues can still qualify. It’s essential for any SME to understand these thresholds to ensure accurate declarations and avoid complications during the approval process.

Step-by-step guide to completing the Annex 4 SME Declaration Form

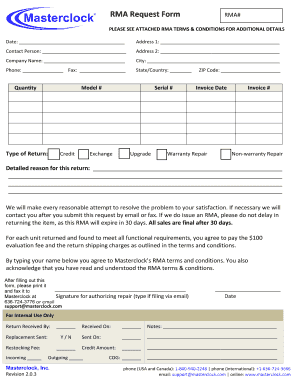

Successfully filling out the Annex 4 SME Declaration Form requires collecting the right information beforehand. Essential business identification details include the full name of the enterprise, its registration number, and VAT ID. Additionally, financial metrics like annual revenue, employee counts, and balance sheet total must be compiled. These figures directly impact whether your business meets SME eligibility.

Once you gather the necessary data, it’s time to dive into the form itself. The form consists of several sections, each requiring specific information. For example, the first section typically asks for general company information. Then, subsequent sections will inquire about financial metrics and operational details. Pay close attention to these areas to inputs accurately, as discrepancies can lead to rejection.

Submitting the Annex 4 SME Declaration Form

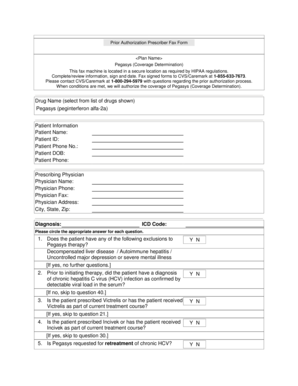

After completing the Annex 4 SME Declaration Form, understanding the submission process is critical. Typically, completed forms can be submitted electronically through designated EU portals or by mail to the relevant governmental department. Alongside your form, it’s essential to include any required supporting documents, such as financial statements and identification proof.

Choosing electronic submission offers several advantages, including increased speed of processing and lower chances of errors in document handling. Using tools like PDFfiller makes electronic submission seamless, enabling you to edit, eSign, and manage your forms efficiently without the hassle of physical paperwork.

After submission: what to expect

Once you submit your Annex 4 SME Declaration Form, the processing time can vary based on the volume of applications being handled. Generally, you can expect a notification regarding the status of your application within a few weeks. During this time, it’s crucial to monitor your email and be prepared to provide any additional information if requested.

Understanding the feedback process is also important. If your application is rejected, you should receive a letter explaining the reasons for denial. Often, this presents an opportunity to amend the application and resubmit. Utilizing platforms like PDFfiller allows you to quickly adjust information and resubmit without starting from scratch.

Managing your SME status after declaration

Once your SME status is confirmed through the Annex 4 Declaration, it’s vital to maintain this status. This includes monitoring your business's financial performance and employee count regularly. Significant changes in your operations, such as rapid growth or layoffs, could impact your eligibility for SME support initiatives.

Renewing your Annex 4 SME Declaration is equally important, ensuring you remain compliant with the latest thresholds established by the EU. As regulations and criteria can evolve, staying informed about these changes helps you to proactively manage your eligibility.

Leveraging PDFfiller’s tools for enhanced document management

Managing the Annex 4 SME Declaration Form can be streamlined significantly with PDFfiller. This platform offers an array of editing options, enabling users to customize their forms easily. Not only can you fill out the form digitally, but also affix an electronic signature to ensure authenticity. Furthermore, collaboration features enable teams to work together seamlessly on form completion.

PDFfiller allows real-time updates and tracking of document changes, ensuring everyone involved in the process stays informed. The platform’s user-friendly interface makes it accessible for individuals and teams, catering to diverse document management needs while maintaining compliance with EU regulations.

FAQs on the Annex 4 SME Declaration Form

Many questions arise regarding the Annex 4 SME Declaration Form. Common inquiries include how to accurately fill out specific sections, the required supporting documents, and troubleshooting issues encountered while using PDFfiller. It’s also essential to clarify details around the SME criteria and compliance to minimize errors in submissions.

Having a solid understanding of these FAQs can significantly aid in the form-filling process. Furthermore, seeking assistance or clarification on specific points can enhance the likelihood of successful application submissions.

Related content and further exploration

For businesses looking to expand their knowledge beyond the Annex 4 SME Declaration Form, various relevant templates and forms are available on PDFfiller. Additionally, staying updated with related EU legislation that affects SMEs ensures compliance and maximizes the benefits of available funding.

Utilizing these resources can help SMEs navigate their status and opportunities effectively while fostering long-term growth and sustainability.

Share your experience

We want to hear from you! Sharing your experience with the Annex 4 SME Declaration Form can help others navigate this essential process. Whether you’ve successfully completed the form using PDFfiller or faced challenges along the way, your insights can be invaluable.

Don't forget to leverage social media to share this guide with fellow entrepreneurs and business owners looking for a reliable document solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send annex 4 sme declaration to be eSigned by others?

How do I fill out the annex 4 sme declaration form on my smartphone?

How can I fill out annex 4 sme declaration on an iOS device?

What is annex 4 sme declaration?

Who is required to file annex 4 sme declaration?

How to fill out annex 4 sme declaration?

What is the purpose of annex 4 sme declaration?

What information must be reported on annex 4 sme declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.