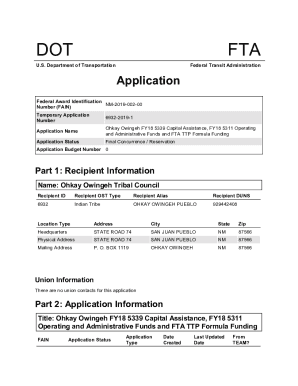

Get the free Invoice

Get, Create, Make and Sign invoice

How to edit invoice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out invoice

How to fill out invoice

Who needs invoice?

The Complete Guide to Invoice Forms: Creation, Management, and Best Practices

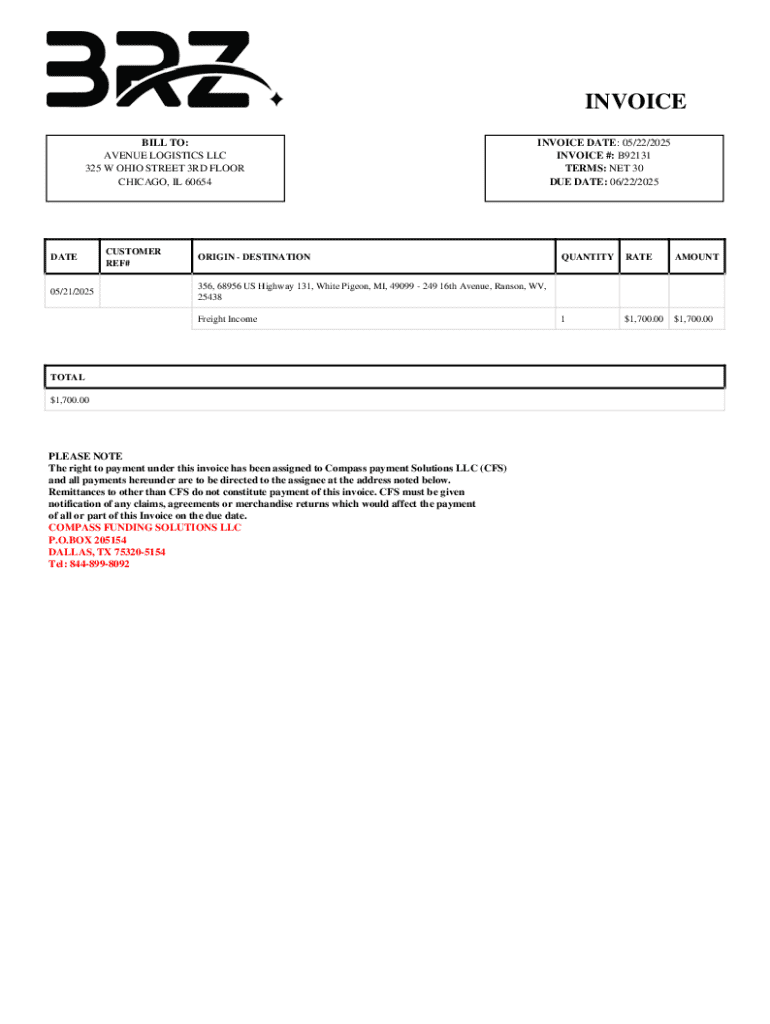

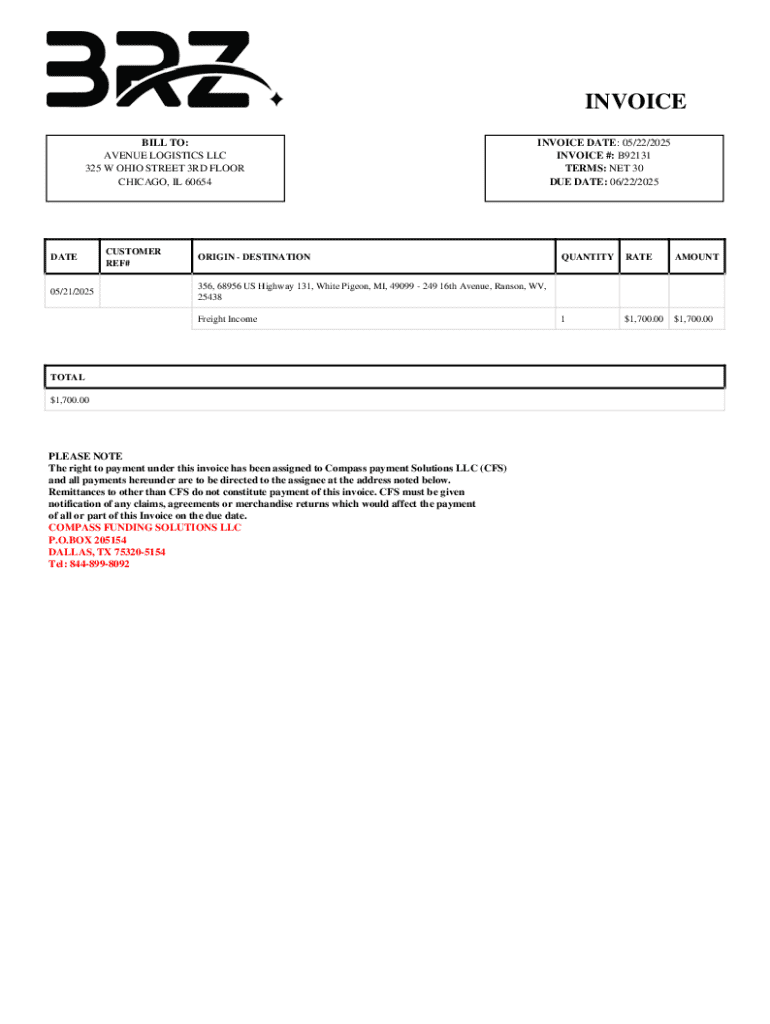

Understanding invoice forms

An invoice form is a crucial document that serves as proof of a transaction between a seller and a buyer. Its primary purpose is to outline the sale of goods or services, specifying what was provided, the cost, and the payment terms. An effective invoice is more than just a bill; it reflects the professionalism of a business and aids in transparent financial practices.

There are four principal types of invoice forms commonly used:

Importance of using invoice forms

Using invoices is vital for both legal and financial reasons. They hold legal significance in business transactions, serving as a record that protects both parties in case of disputes. In addition to offering protection, invoices help businesses manage cash flow by providing clear insights into outstanding payments, thereby aiding in financial planning and operations.

Moreover, invoices enhance professionalism and transparency within a business. They instill confidence in clients, as organized documentation signifies that the business is legitimate and trustworthy. Customers are more likely to be loyal to companies that present their operations professionally and with integrity.

Key components of an invoice form

Creating a well-structured invoice is critical for effective communication. Here are the essential elements to include:

Additionally, you may consider including optional features such as tax information, late payment policies, and discounts to enhance clarity and motivate timely payments.

How to create an invoice form

Creating an invoice form can be straightforward, whether you opt for a digital or paper format. If you choose digital, platforms like pdfFiller offer user-friendly templates to streamline the process. A step-by-step guide to designing your invoice includes:

Filling out an invoice form correctly

Accuracy is vital when filling out an invoice form. Best practices include double-checking entries and ensuring consistency. Common mistakes often involve incorrect totals or missing information, which can lead to payment delays.

To enhance clarity and readability, use clear typography and ensure adequate spacing between elements. Consistency in formatting helps recipients quickly understand the information presented, thereby promoting timely payments.

Editing and customizing invoice forms

With tools like pdfFiller, editing and customizing invoice forms is easy and efficient. You can add or remove fields to tailor the document to specific client needs or service requirements.

eSigning invoice forms with pdfFiller

The integration of digital signatures is revolutionizing the invoicing process. eSigning invoices enhances security and speeds up the approval process. To eSign your invoice using pdfFiller:

Combining eSigning with collaboration tools can facilitate smoother operations within your team, ensuring that everyone can contribute without excessive back-and-forth communication.

Managing invoice forms

Efficient organization and storage of invoices is key to a streamlined invoicing process. Cloud solutions like pdfFiller allow you to organize and store invoices securely. Implementing a tracking system for payments and outstanding invoices can also mitigate cash flow issues.

Interactive tools for invoice management

Utilizing interactive tools can greatly enhance your invoice management strategy. pdfFiller offers live usage demonstrations that show the process from start to finish, giving users practical insight into the platform’s capabilities.

Troubleshooting common issues with invoice forms

Every business encounters challenges with invoices at some point, from payment disputes to errors post-submission. A well-organized approach can help resolve these issues swiftly.

Case studies: Successful implementation of invoice forms

Businesses that have embraced digital invoice forms have reported significant improvements in operational efficiency. For example, a small marketing agency transitioned to electronic invoicing and witnessed a reduction in payment processing times by 40%.

Testimonials from clients highlight the ease of use and efficiency of pdfFiller for invoicing, emphasizing how streamlined processes enhance client satisfaction and improve cash flow.

Future trends in invoice management

As technology evolves, so does invoice management. Innovations such as artificial intelligence and machine learning are poised to automate many processes traditionally handled manually. The shift towards automated systems is set to reduce human error and free up time for more strategic activities.

Businesses will benefit from staying ahead of the curve, embracing these automated solutions to not only enhance operational efficiency but also to stand out in an increasingly competitive landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit invoice from Google Drive?

How do I execute invoice online?

Can I edit invoice on an Android device?

What is invoice?

Who is required to file invoice?

How to fill out invoice?

What is the purpose of invoice?

What information must be reported on invoice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.