Get the free Drafting Escrow Agreements in Business and Real Estate

Get, Create, Make and Sign drafting escrow agreements in

How to edit drafting escrow agreements in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out drafting escrow agreements in

How to fill out drafting escrow agreements in

Who needs drafting escrow agreements in?

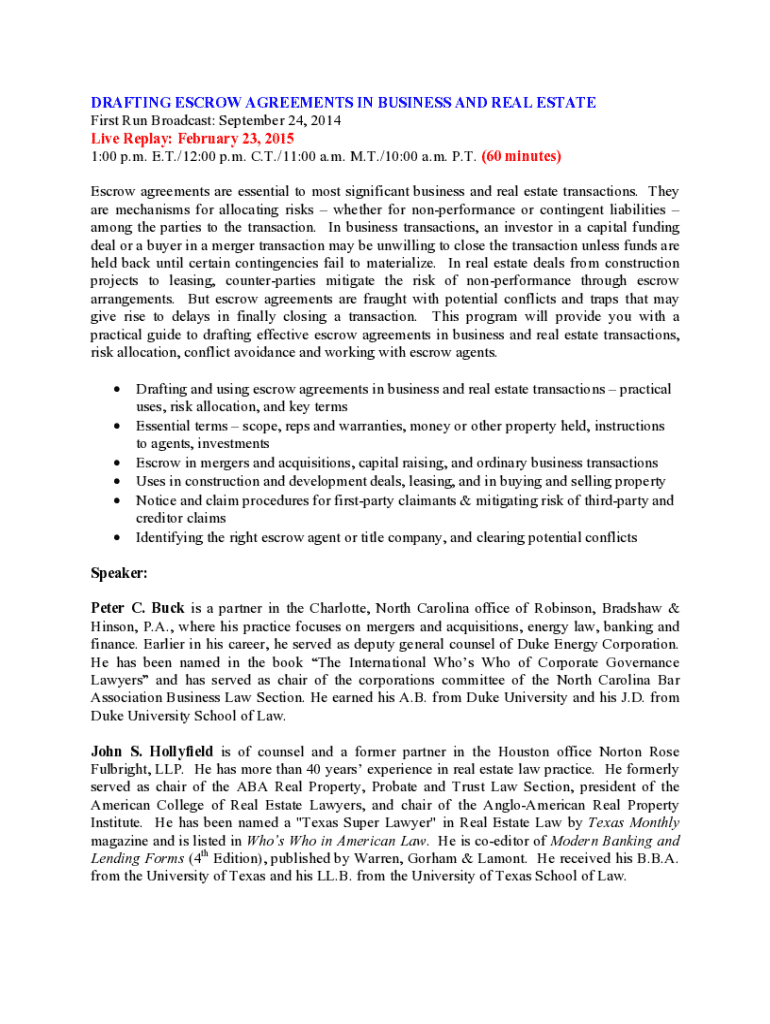

Drafting Escrow Agreements in Form: A Comprehensive Guide

Understanding escrow agreements

An escrow agreement is a legal instrument that facilitates a transaction by involving a neutral third party, known as the escrow agent, who holds assets until certain conditions are met. This arrangement is crucial in ensuring that both the buyer and seller fulfill their obligations before the transfer of funds or assets takes place. Escrow agreements are particularly important in complex transactions, minimizing risks and enhancing trust between parties.

The purpose of escrow in transactions ranges from safeguarding funds to ensuring compliance with contractual obligations. Key concepts include the escrow agent's role, the conditions for release, and the responsibilities of involved parties. Understanding these foundational elements is essential for anyone considering drafting escrow agreements in form, as clarity in these agreements can help prevent disputes and ensure smooth transactions.

Types of escrow agreements

Different types of escrow agreements cater to diverse transaction needs. They include:

Choosing the right type of escrow agreement involves considering the specific needs of the transaction, the nature of the assets, and regulations applicable in the jurisdiction of the parties involved.

Essential components of an escrow agreement

Each escrow agreement should clearly define several critical components to avoid ambiguities:

Step-by-step guide to drafting escrow agreements

Drafting an effective escrow agreement involves several critical steps:

Common mistakes to avoid in drafting escrow agreements

A few common pitfalls can compromise the integrity of escrow agreements:

Leveraging technology for escrow agreement management

Incorporating modern technology into the management of escrow agreements can streamline various processes.

Cloud-based document solutions like pdfFiller offer numerous benefits for drafting and managing escrow agreements:

Best practices for effective escrow agreements

Creating effective escrow agreements requires adherence to best practices, which include:

Case studies: Successful use of escrow agreements

Real-world applications of escrow agreements demonstrate their value in various industries:

Frequently asked questions (FAQs)

Potential users often have specific questions regarding escrow agreements:

Tools and resources for drafting escrow agreements

Utilizing the right tools can significantly enhance the drafting process. pdfFiller’s escrow agreement template offers a solid foundation for creating effective documents.

Additionally, there are various online resources and tools for document management that can support drafting and collaboration efforts. Consulting with legal professionals can also provide tailored support for unique situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send drafting escrow agreements in to be eSigned by others?

How do I complete drafting escrow agreements in on an iOS device?

How do I fill out drafting escrow agreements in on an Android device?

What is drafting escrow agreements in?

Who is required to file drafting escrow agreements in?

How to fill out drafting escrow agreements in?

What is the purpose of drafting escrow agreements in?

What information must be reported on drafting escrow agreements in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.