Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: How-to Guide

Overview of Form 10-Q

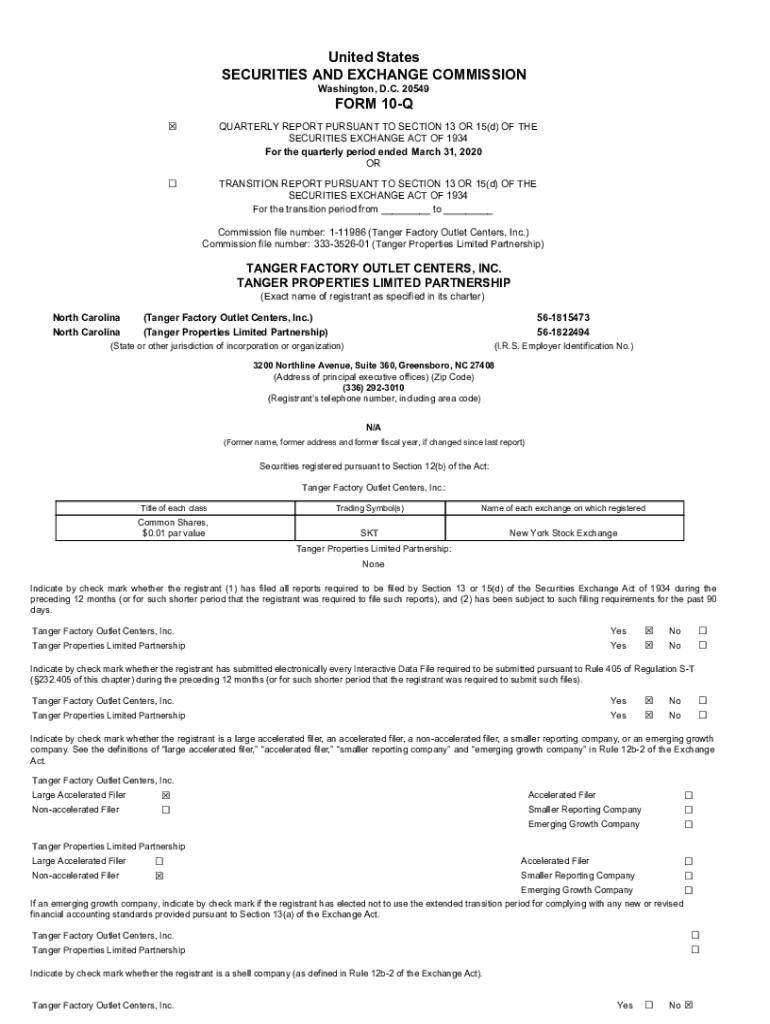

A Form 10-Q is a comprehensive report filed quarterly by public companies to the Securities and Exchange Commission (SEC). This form provides an ongoing financial status of the company during the fiscal year, detailing significant financial updates, market risks, and any material changes that could affect the business’s performance. One of the primary purposes of the Form 10-Q is to ensure transparency in financial reporting, allowing investors and stakeholders to make informed decisions based on the company's financial health.

The importance of Form 10-Q in the broader regulatory framework cannot be overstated. It offers stakeholders insights into the company’s operational performance between annual reports, which are more extensive and submitted through Form 10-K. This ensures a consistent and periodic flow of information that underpins market confidence and aligns with regulatory requirements.

Key features of Form 10-Q

Public companies must file Form 10-Q on a quarterly basis, hence the designation of the form. Unlike the annual Form 10-K, the 10-Q is less comprehensive, focusing on recent developments. The frequency of these filings offers an ongoing narrative of a company's financial activities, making it vital for investors and analysts who monitor real-time market conditions. Furthermore, while the 10-Q provides essential quarterly updates, it is paired closely with the Form 10-K, which includes a full year’s financial statement and deeper insights into the business’s overall conditions.

The contrast with other SEC filings is notable. For example, while Form 10-K encompasses a complete overview of a company's annual performance, the Form 10-Q acts as a timely summary that captures recent trends and interim financial positions. Additionally, companies must provide detailed qualitative information about risk exposures and legal proceedings, helping stakeholders gauge any potential challenges on the horizon.

Understanding the contents of Form 10-Q

The structure of a Form 10-Q is pivotal for users who wish to extract essential insights efficiently. The form generally comprises four key itemized sections: financial statements, Management's Discussion and Analysis (MD&A), risk factors, and updates on legal proceedings. Each of these parts serves a purpose, providing necessary assessments of both quantitative and qualitative data, ensuring comprehensiveness in reporting.

For instance, the MD&A section is particularly crucial, as it highlights key performance indicators and metrics that reveal the company’s trajectory during the quarter. A best practice is to compare these figures not only against previous quarters but also against industry benchmarks to gauge relative performance.

Filing requirements for Form 10-Q

Legal obligations dictate that all public companies must file Form 10-Q. This requirement helps maintain a level playing field in the marketplace, ensuring all investors have access to the same information. The filing responsibilities extend beyond merely completing the form; companies must also adhere to specific accounting standards, primarily Generally Accepted Accounting Principles (GAAP) in the U.S., or International Financial Reporting Standards (IFRS) for foreign entities.

Filing deadlines are stipulated by the SEC, typically ranging from 40 to 45 days after the close of the fiscal quarter, depending on the company's public float. Organizations that fail to meet these deadlines may face penalties, including fines and increased scrutiny from regulators. Understanding and adhering to these timelines is crucial for compliance and maintaining investor trust.

Steps to complete and submit a Form 10-Q

Preparation for Form 10-Q involves gathering relevant financial data from various internal departments, ensuring that information is accurate and current. This requires collaboration across financial, legal, and operational teams, as it’s critical that the submission reflects the actual state of affairs within the company.

Utilizing platforms like pdfFiller can streamline the editing and management of Form 10-Q. With features for electronic signatures and comprehensive collaboration tools, pdfFiller enhances the efficiency of document preparation and submission while providing a secure space to store and retrieve forms efficiently.

Common challenges in preparing Form 10-Q

Companies may encounter various challenges when preparing their Form 10-Q. A significant issue is understanding the SEC guidelines, as these may change and affect the information required for filing. Regulatory adjustments can complicate compliance and necessitate staying current with new rules to avoid penalties.

Additionally, technical difficulties associated with document management could arise, such as submission errors or platform issues. To mitigate these challenges, companies should utilize support resources available through editing platforms like pdfFiller. Understanding how to troubleshoot common submission issues can ensure smoother filing processes.

Best practices for reviewing and managing Form 10-Q

Quality control is essential in the preparation of Form 10-Q, particularly in verifying the accuracy of financial reports. Implementing error-checking mechanisms, such as automated tools or peer review processes, can significantly reduce the likelihood of mistakes slipping through before submission.

By maintaining quality control and an awareness of compliance post-filing, companies can build trust with stakeholders and mitigate risks associated with inaccuracies and potential legal repercussions.

Additional resources and tools

Utilizing document management solutions can simplify the ongoing process of filing and managing Form 10-Q. Products offered by pdfFiller provide interactive tools for creating and editing documents, ensuring companies can handle their regulatory responsibilities with efficiency. By tapping into the features designed for document collaboration and eSigning, financial teams can streamline their workflows.

Keeping apprised of updates and new features developed by pdfFiller can enhance the filing experience and ensure that users are maximizing the platform’s capabilities. Engaging with the pdfFiller community can provide additional insights and strategies for effective document management.

Frequently asked questions (FAQs)

Understanding the consequences of failing to file a Form 10-Q is paramount for public companies. Failure to comply could lead to hefty fines and increased scrutiny from regulators, potentially damaging the company’s reputation and investor confidence.

The differences between a Form 10-Q and a 10-K are significant; while a 10-Q is filed quarterly and focuses on recent financial data, the 10-K provides an annual summary that includes in-depth analysis and comprehensive disclosures. Proper knowledge and management of both documents are critical for corporate transparency.

After submission, companies often wonder whether they can edit their Form 10-Q. Generally, once filed, the form is considered final, though companies may be able to amend specific sections under certain circumstances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 10-q online?

How do I edit form 10-q online?

Can I edit form 10-q on an iOS device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.