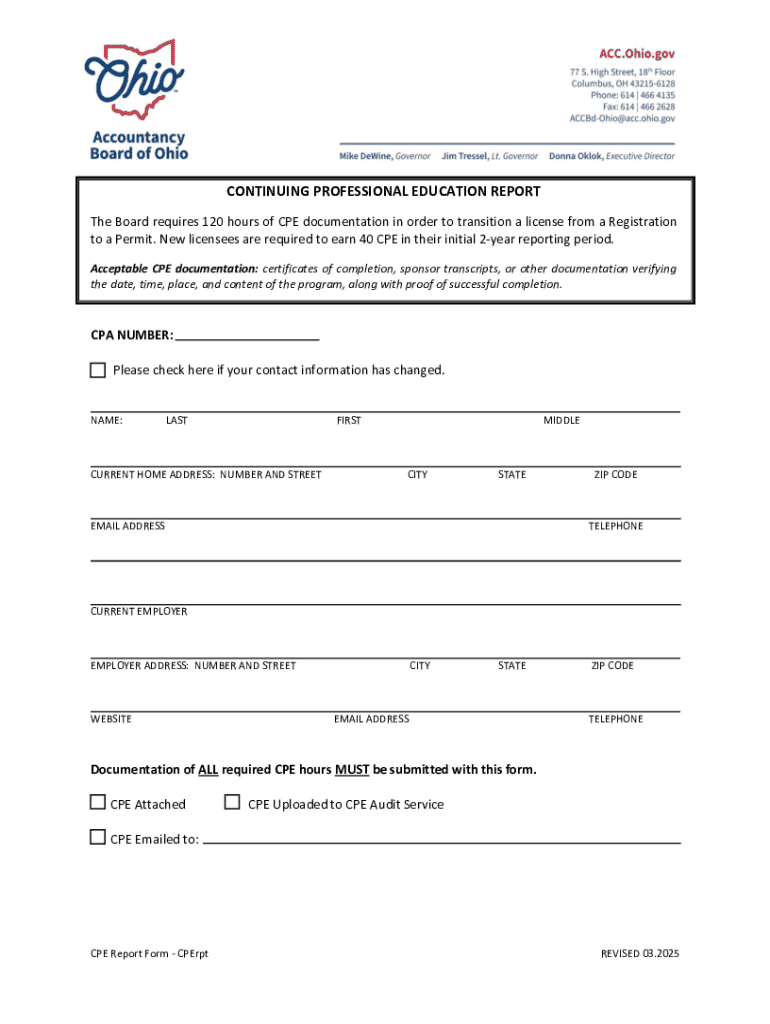

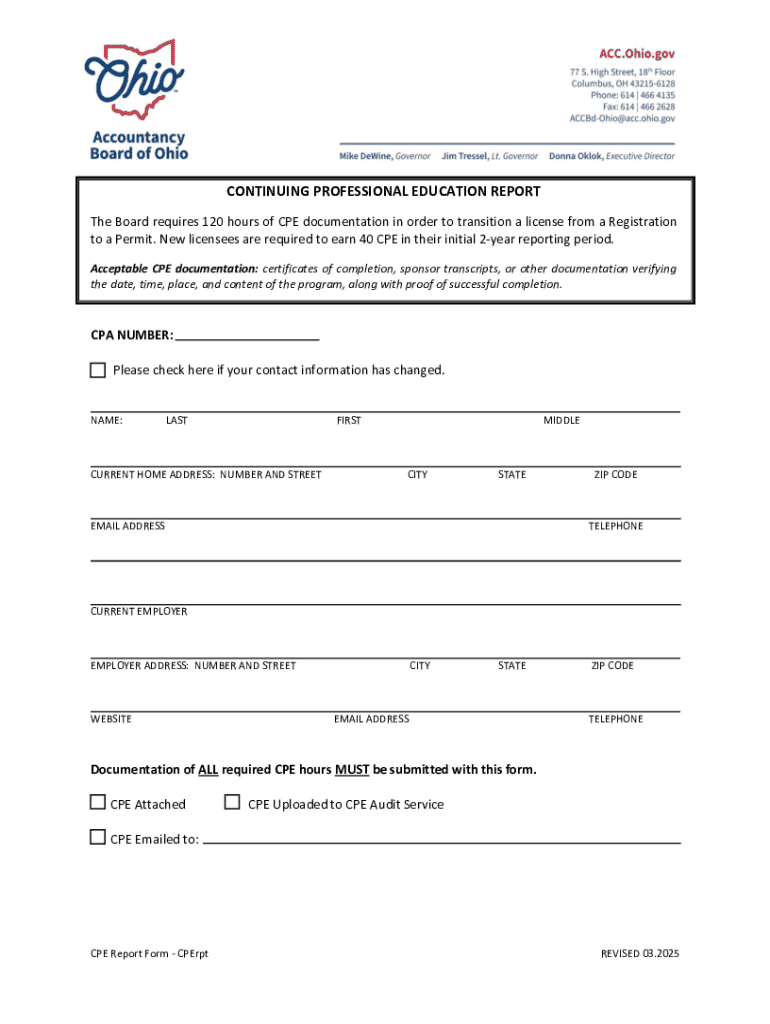

Get the free Continuing Professional Education Report

Get, Create, Make and Sign continuing professional education report

How to edit continuing professional education report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out continuing professional education report

How to fill out continuing professional education report

Who needs continuing professional education report?

Your Ultimate Guide to the Continuing Professional Education Report Form

Understanding continuing professional education (CPE)

Continuing Professional Education (CPE) refers to the educational programs and activities designed to enhance the professional knowledge and skills of individuals, primarily in regulated professions. The importance of CPE cannot be overstated, as it ensures that professionals remain competent and up-to-date with industry standards and practices. Regulatory bodies require licensed professionals to complete a certain number of CPE hours annually, ensuring ongoing proficiency.

Regulatory requirements for CPE reporting vary by profession and location. These regulations outline the number of hours required, acceptable activities, and the reporting process. For instance, the American Institute of Certified Public Accountants (AICPA) mandates CPE for CPAs to maintain their licenses. The impact of CPE on professional development is significant; it not only satisfies regulatory requirements but also enhances career prospects, builds confidence, and fosters a sense of community among peers.

The continuing professional education report form

The Continuing Professional Education Report Form is a crucial document that professionals must complete to report their CPE activities. This form serves as a summary of the educational experiences that contribute to meeting the required CPE hours. A properly filled form is essential, as it can prevent complications during license renewals or audits by regulatory bodies.

Key components of the CPE Report Form typically include:

How to complete the CPE report form

Completing the CPE Report Form is straightforward if you follow these step-by-step instructions:

Tips for effective documentation submission include understanding the types of acceptable proof of completion. Certificates of attendance, transcripts from accredited organizations, or letters from sponsors are common forms of proof. Additionally, be mindful of common mistakes to avoid, such as not keeping thorough records of your activities throughout the year or submitting forms late.

Frequently encountered challenges

It’s common to face challenges when submitting CPE documentation. For example, some users may encounter upload issues. If you are unable to upload documents, ensure that your file format and size conform to the requirements specified in the form instructions.

Document size and format requirements can often lead to confusion. Typically, documents should be in PDF or JPEG format not exceeding a certain size limit. To facilitate a smooth submission process, verify your documents and ensure they meet these criteria before uploading.

Tracking your CPE submission status should be carried out through the online portal or system you used for submission. It's essential to know how you can view uploaded documents and confirm whether your submission has been successfully received, which will help avoid surprises during audits.

CPE calculations and requirements

Understanding CPE hour requirements is vital for fulfilling your professional educational obligations. The number of required CPE hours can differ significantly from one profession to another. Most regulatory bodies define CPE in terms of hours, where one CPE credit is typically equal to 50 minutes of participation in a learning activity.

To calculate your CPE hours, list all completed activities and the respective hours earned. Here's a sample calculation example: if you attended a 2-hour workshop and a 3-hour online seminar, your total would be 5 CPE hours. Remember that not all activities may count equally towards your CPE requirement, so check the regulatory body's guidelines.

Different types of CPE activities recognized can include live webinars, conferences, self-study courses, and professional workshops, ensuring a range of opportunities for continuous learning.

FAQs regarding CPE reporting

Many common questions arise regarding the CPE Reporting process. For instance, it’s essential to know what documentation is needed. Generally, most regulatory bodies request proof from accredited sources, such as certificates or attendance letters.

How many CPE credits are required? This will depend on your specific profession. Additionally, understanding the differences between group study and self-study courses is crucial as they may be accounted for differently in your report.

Don't overlook special considerations for non-resident licensees, as regulations may differ. Keep abreast of any unique requirements that may apply to your situation.

Resources for continued learning and CPE

There’s an abundance of resources available to professionals looking to meet their CPE requirements. A list of recommended CPE activities can often be obtained from industry-specific organizations and platforms that specialize in professional development.

Ethics CPE requirements are also a crucial aspect of ongoing education, requiring legal and ethical components in coursework. Therefore, it's imperative to incorporate these into your CPE plan. Understanding where to find additional FAQs and help resources can make navigating your CPE journey much easier.

Utilizing pdfFiller for CPE reporting

pdfFiller streamlines the CPE reporting process by providing tools that simplify the completion and submission of the CPE Report Form. Users can easily edit, sign, and manage their forms—eliminating the hassle of paperwork and ensuring compliance with CPE requirements.

Advantages of using a cloud-based solution like pdfFiller include the ability to access your forms from anywhere and collaborate with your team effortlessly. This functionality is especially beneficial for professionals who are constantly on the go or need to coordinate with colleagues on their CPE documentation.

Preparing for a CPE audit

Understanding what to expect during a CPE audit is crucial for compliance. Typically, auditors will review your submitted forms and supporting documentation to ensure all reported CPE credits are legitimate and comply with regulatory requirements.

Best practices for organizing your CPE documents include maintaining a file or digital folder for all supporting materials and ensuring documentation is complete and easily accessible. Maintaining accurate records not only prepares you for audits but also assists in future reporting needs.

Engaging with CPE opportunities

The pursuit of CPE doesn’t have to be mundane. Innovative ways to earn CPE credits include workshops, webinars, and interactive online courses that can energize your professional growth. Engaging with learning communities can also enhance your experience and broaden your professional network.

Staying updated on changes to CPE reporting requirements is another essential aspect of this process. Building a personal CPE plan tailored to your career goals not only fulfills your professional obligations but also sets you on a path for continuous career advancement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in continuing professional education report without leaving Chrome?

How can I edit continuing professional education report on a smartphone?

How do I complete continuing professional education report on an Android device?

What is continuing professional education report?

Who is required to file continuing professional education report?

How to fill out continuing professional education report?

What is the purpose of continuing professional education report?

What information must be reported on continuing professional education report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.