Get the free New Account Application

Get, Create, Make and Sign new account application

Editing new account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account application

How to fill out new account application

Who needs new account application?

New account application form: Your comprehensive how-to guide

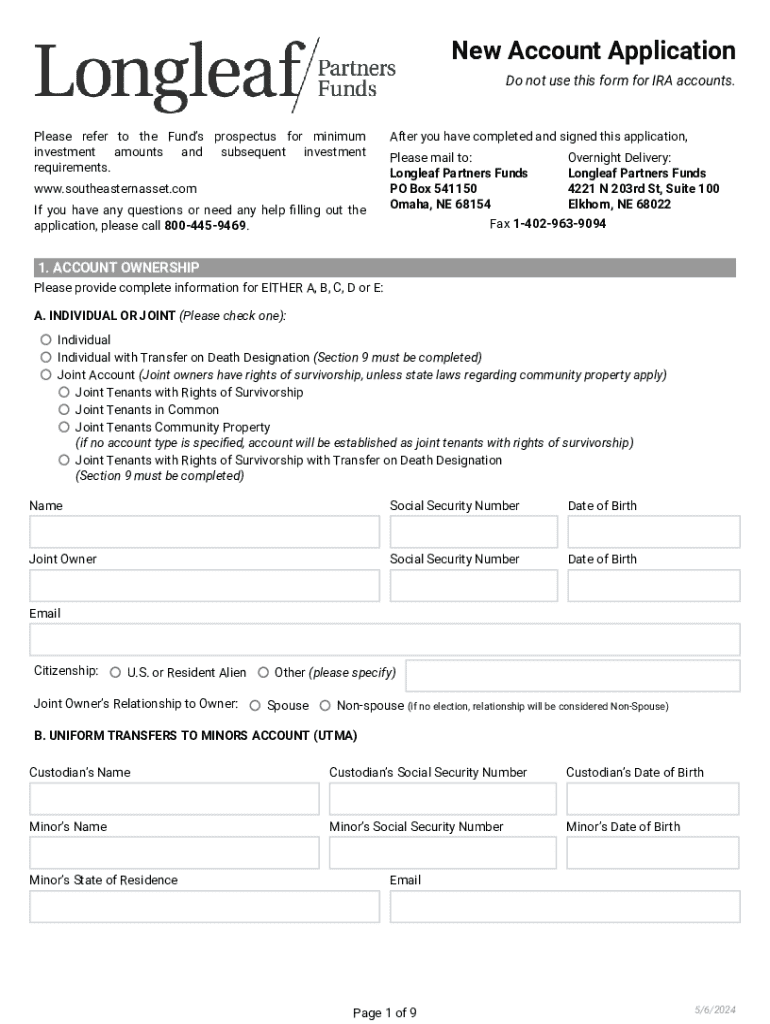

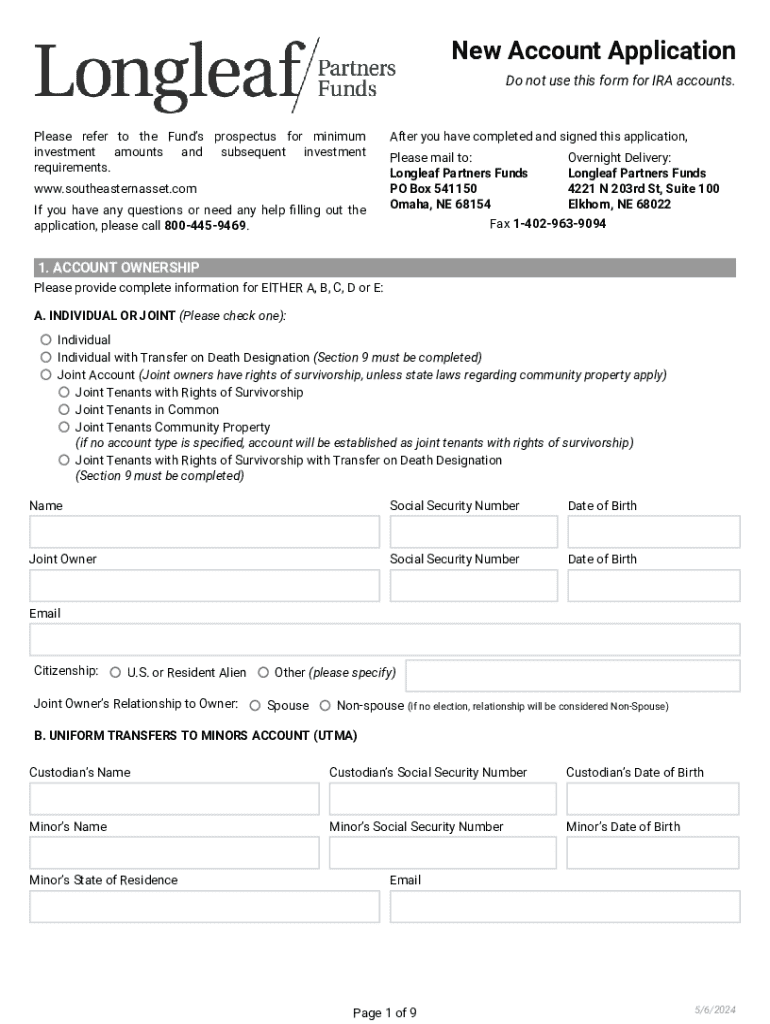

Understanding the new account application form

A new account application form serves as a crucial document for individuals and businesses looking to establish a relationship with a financial institution or service provider. This form gathers necessary personal and financial details to facilitate the onboarding process and ensure compliance with legal regulations.

Accurate submission of the new account application form is vital for a smooth onboarding experience. Any discrepancies or incomplete information can lead to processing delays or outright rejections, leaving applicants frustrated and without the access they need. Therefore, understanding the form's requirements and filling it out thoroughly is imperative.

Common scenarios requiring a new account application include opening personal checking or savings accounts, applying for business accounts, or creating investment accounts. Each scenario may have distinct requirements, making it essential to carefully review the application details.

Key features of the new account application process

The modern new account application process has evolved significantly, particularly with the integration of technology through platforms like pdfFiller. One of the most notable features is streamlined online forms that can be accessed anytime, anywhere. This flexibility allows users to complete their application at their convenience, whether at home or on the go.

Additionally, pdfFiller offers interactive tools for real-time assistance. Users can access help guides and customer support directly through the application platform, providing answers to any concerns or questions while filling out the form. Furthermore, comprehensive user guides are available, detailing each step for successful application completion.

Steps to complete the new account application form

Accessing the form

To begin, locate the new account application form on pdfFiller by searching in their extensive template library or through a quick search option. The application interface is designed to be user-friendly, providing a structured format that guides users through each section logically.

Filling out the form: essential information required

Completing the new account application form involves submitting essential personal information, including:

Tips for gathering required documentation

Gathering required documentation is also a critical step. Typically, applicants need to provide:

Using pdfFiller’s document management tools simplifies the uploading process for these documents, ensuring you can complete your application efficiently.

Editing and customizing your new account application

Before final submission, utilize pdfFiller’s editing tools to refine your application. These features include the ability to add comments or notes for better clarification and the option to use templates for common fields to save time.

Another notable feature is the auto-save function, allowing users to save their progress periodically. This way, you don’t have to start from scratch if you get interrupted. Additionally, pdfFiller provides options to download your application at various stages, ensuring you always have a copy on hand.

Signing the new account application form

Understanding eSigning in pdfFiller

Signing your application has never been easier, thanks to pdfFiller’s eSigning feature. eSigning is legally valid and streamlines the process of finalizing your application. To eSign your application, simply follow the guided prompts on the platform.

Collaborating with team members

For those applying on behalf of a team or organization, pdfFiller allows you to invite others to review and sign the document easily. Best practices include ensuring all parties have clarified their roles before initiating the signing process to avoid confusion.

Submitting your new account application

Before final submission, review your application using a checklist to confirm that all required fields are completed and documents are attached. Users can submit their new account application either online directly through pdfFiller or through email, depending on the preferred submission method.

After submission, you can expect a confirmation from the financial institution or service provider. Tracking your application status is also straightforward, as many providers offer online portals where you can monitor the progress of your submission.

Managing your new account post-application

Once your new account application is approved, you’ll want to access your new account promptly. The first steps often include setting up online banking and familiarizing yourself with the features offered by your new institution. Regular monitoring is advisable to ensure your account is functioning efficiently.

Using pdfFiller, users can also keep track of their application status with relative ease. Should any issues arise post-approval, familiarizing yourself with common challenges and their resolutions can save you time and ensure a seamless banking experience.

FAQs about new account applications

Throughout the new account application journey, questions often arise regarding processing times or reasons for rejections. Understanding typical timeframes can set realistic expectations. Common concerns include how long it will take for approval or steps to take if your application is denied.

For further assistance, pdfFiller provides access to customer support services. Their platform is designed to guide you throughout the good times and the bumps along the way, ensuring a successful application and speedy troubleshooting.

Additional useful forms related to new accounts

In addition to the new account application form, exploring related templates is beneficial, especially if you're looking to apply for loans or other financial services. pdfFiller offers a variety of forms catered to these needs, allowing for easy filling and document management.

Using pdfFiller for additional forms can streamline your entire financial journey, from account setup to loan applications, ensuring all your documents are easily accessible and editable.

Conclusion of the application process

To sum up, completing a new account application form involves a series of steps from gathering personal information to submitting your application. Utilizing tools offered by pdfFiller enhances this experience, providing seamless editing, eSigning, and document management.

By following the aforementioned guidelines and leveraging pdfFiller’s comprehensive document solutions, you can approach your new account application with confidence, ensuring you're well-prepared for your financial endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new account application to be eSigned by others?

How can I get new account application?

How do I fill out the new account application form on my smartphone?

What is new account application?

Who is required to file new account application?

How to fill out new account application?

What is the purpose of new account application?

What information must be reported on new account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.