Get the free Teton County Property Tax Refund Program

Get, Create, Make and Sign teton county property tax

Editing teton county property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out teton county property tax

How to fill out teton county property tax

Who needs teton county property tax?

Teton County Property Tax Form: A Comprehensive How-to Guide

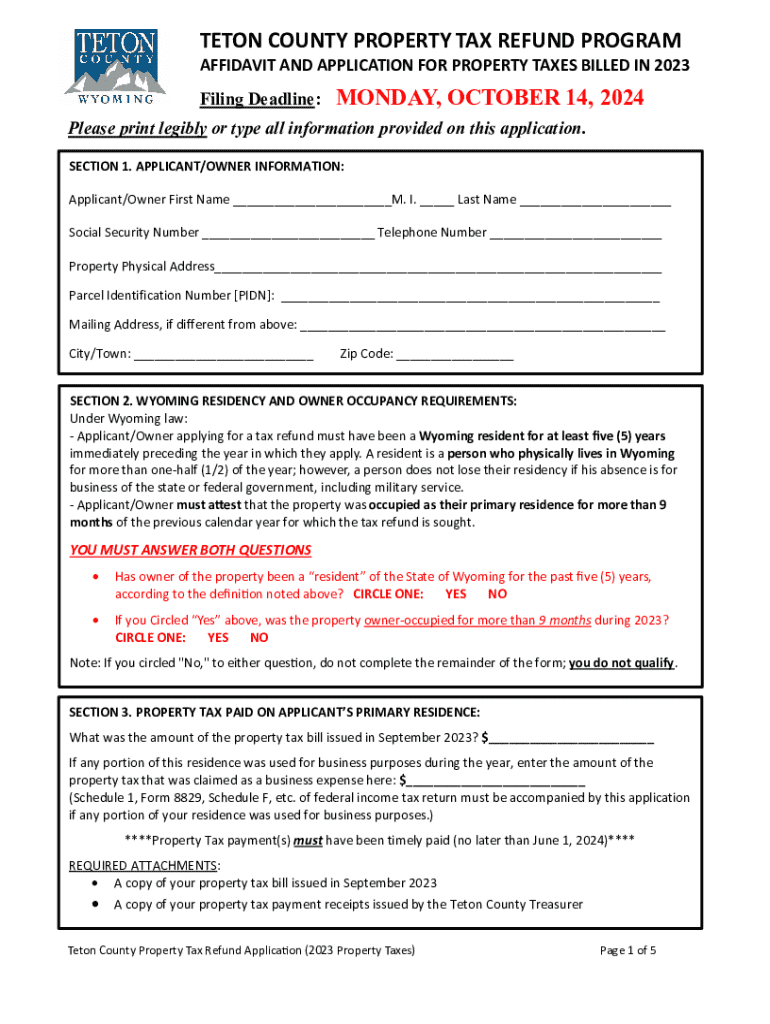

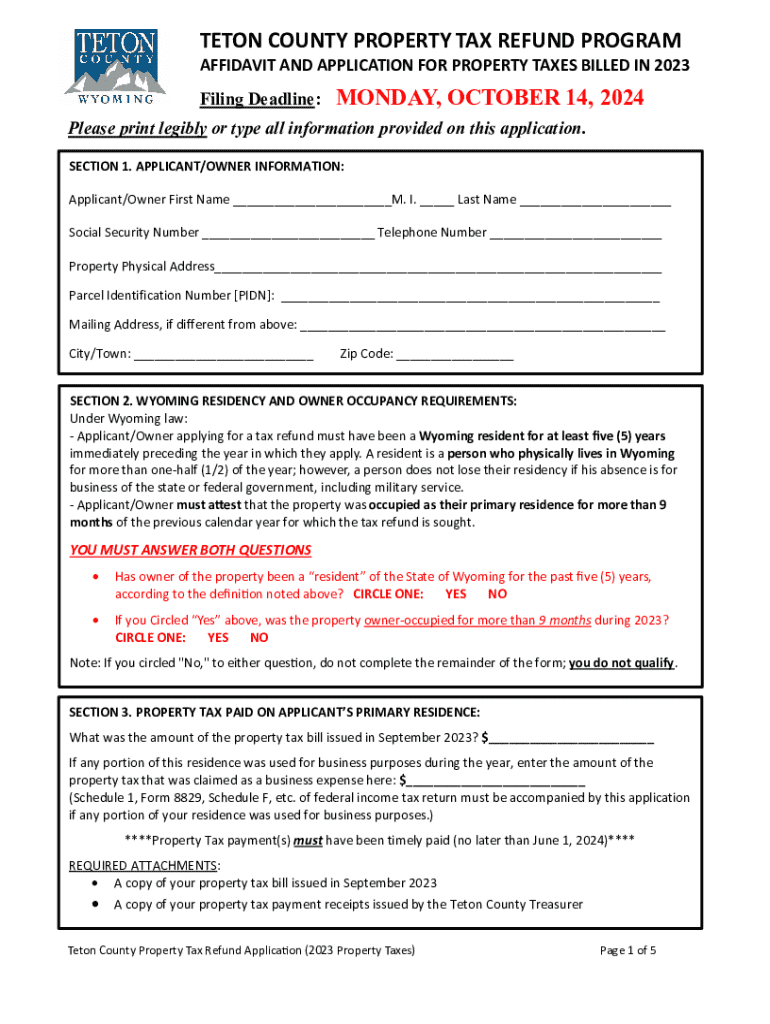

Overview of Teton County Property Tax Form

The Teton County Property Tax Form is a crucial document for property owners in the county. It serves to assess the value of properties for taxation purposes and ensures that local governments have the necessary revenue to provide essential services. Accurately completing this form is critical, as errors can lead to miscalculations in property taxes, potentially resulting in penalties or overpayment.

Property owners, whether residential or commercial, must fill out this form annually. The process is designed to maintain transparency in tax assessments and provide an avenue for owners to contest their property's valuation if they believe it is inaccurate.

Understanding the property tax process in Teton County

The property tax process in Teton County begins with an assessment of the property’s value. Assessors evaluate properties based on various factors, including location, size, and recent sales of comparable properties. Once values are established, property tax rates are applied.

Key dates in the property tax calendar include assessment deadlines and payment due dates. For example, taxpayers typically need to file their assessment forms by March 15 each year while the property taxes must be paid by December 31.

Accessing the Teton County Property Tax Form

Property owners can easily obtain the Teton County Property Tax Form through several methods. One of the most convenient ways is online access via pdfFiller, which allows users to fill out and submit their forms electronically. This not only saves time but also provides a secure way to store tax documents.

For those who prefer a more traditional approach, the form can also be obtained in person at the Teton County Tax Collector's Office or by requesting it through the mail. Regardless of the method chosen, ensuring that the form is correctly filled out is of utmost importance.

Step-by-step instructions for filling out the Teton County Property Tax Form

Filling out the Teton County Property Tax Form can be straightforward if you follow a step-by-step approach. The form typically consists of various sections that need to be completed accurately. Start with your personal information, including your name, address, and contact details. This section is crucial for identifying the property owner.

Next, provide detailed descriptions of the property. Include information like the type of property (residential or commercial), size, and location. Following that, you’ll need to fill in the tax assessment details, which may require data about the estimated value of the property as determined by local assessors.

Be sure to double-check for common mistakes such as missing signatures or incorrect property descriptions, and always include any supporting documents that might be required.

Editing and signing the form using pdfFiller

Once you have filled out the Teton County Property Tax Form, editing is simple with pdfFiller’s user-friendly interface. Users can access the platform to add, delete, or modify any information on the PDF. This flexibility ensures that any last-minute changes can be made without hassle.

The platform also supports electronic signatures, which provide several benefits such as reducing paperwork and speeding up the submission process. To eSign the Teton County Property Tax Form, users can follow a straightforward process within pdfFiller, ensuring a legally binding signature without the need for printing and scanning.

Submitting the Teton County Property Tax Form

Submitting your completed Teton County Property Tax Form can be done through a few different methods. The most efficient way is to take advantage of the online submission option through pdfFiller, which saves time and eliminates the need for physical paperwork.

If you decide to submit the form through the mail, be sure to follow the required mailing instructions to ensure timely delivery. There is also an option to submit in person at designated county offices. After submission, it's vital to confirm receipt of your form which can typically be done through tracking options provided by the platform or by following up with county offices.

Managing property tax documents in pdfFiller

One standout feature of pdfFiller is its capability to help you manage all your property tax documents in one place. Users can organize tax documents efficiently by creating folders and tagging important files, making retrieval easy during tax season or when needed for audits.

Additionally, pdfFiller allows for collaborative features that are especially beneficial for teams. You can share documents and manage permissions with ease, enabling real-time editing and commenting on the property tax form, which promotes teamwork and reduces the potential for oversights.

Frequently asked questions (FAQs)

Navigating property tax forms can raise many questions for homeowners. A common query is about the protocols if an error is made on the form. It's essential to address mistakes promptly by contacting the Teton County Tax Collector's Office for guidance.

Another frequently asked question pertains to appealing property tax assessments. Homeowners have the right to appeal, and the process can be initiated by submitting an appeal form through the appropriate channels. Lastly, the payment options for property taxes vary, including online payments, checks, and potentially payment plans for eligible homeowners.

Additional resources and contacts for Teton County tax queries

For any further queries regarding property taxes in Teton County, the Tax Collector's Office is your first contact point. They provide comprehensive support regarding tax assessments and submissions.

You may also reach out to the Assessor's Office for specific valuation-related questions or contact the Board of County Commissioners for broader inquiries about tax policy. Utilizing online resources through the county's official websites can also offer valuable information and guidance.

Conclusion and encouragement for efficient document management

Leveraging pdfFiller for managing the Teton County Property Tax Form optimizes the filing experience. The platform not only adequately addresses the needs of homeowners regarding tax documentation but also promotes efficient management through its wide array of features.

In conclusion, maintaining documentation integrity is essential for both compliance and peace of mind. By utilizing a comprehensive solution like pdfFiller, property owners can ensure that their forms are filled out accurately and are easily accessible whenever needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify teton county property tax without leaving Google Drive?

How can I send teton county property tax to be eSigned by others?

How do I fill out teton county property tax using my mobile device?

What is teton county property tax?

Who is required to file teton county property tax?

How to fill out teton county property tax?

What is the purpose of teton county property tax?

What information must be reported on teton county property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.