Get the free Property Tax Bill

Get, Create, Make and Sign property tax bill

Editing property tax bill online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax bill

How to fill out property tax bill

Who needs property tax bill?

Comprehensive Guide to Property Tax Bill Forms

Understanding property tax bills

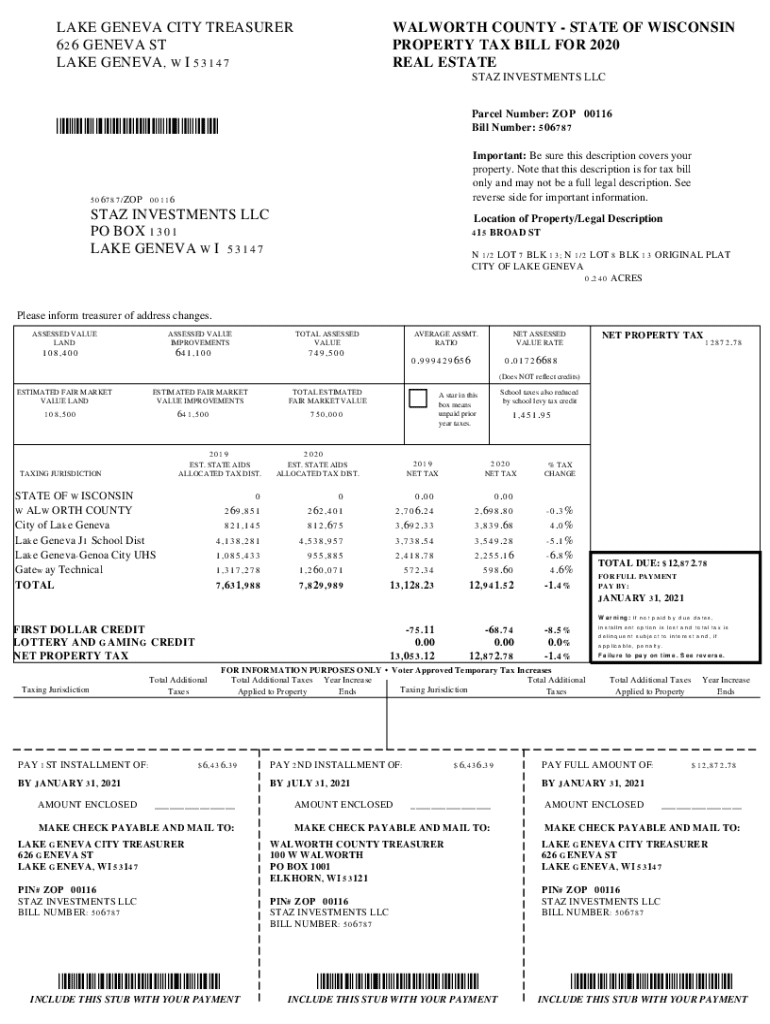

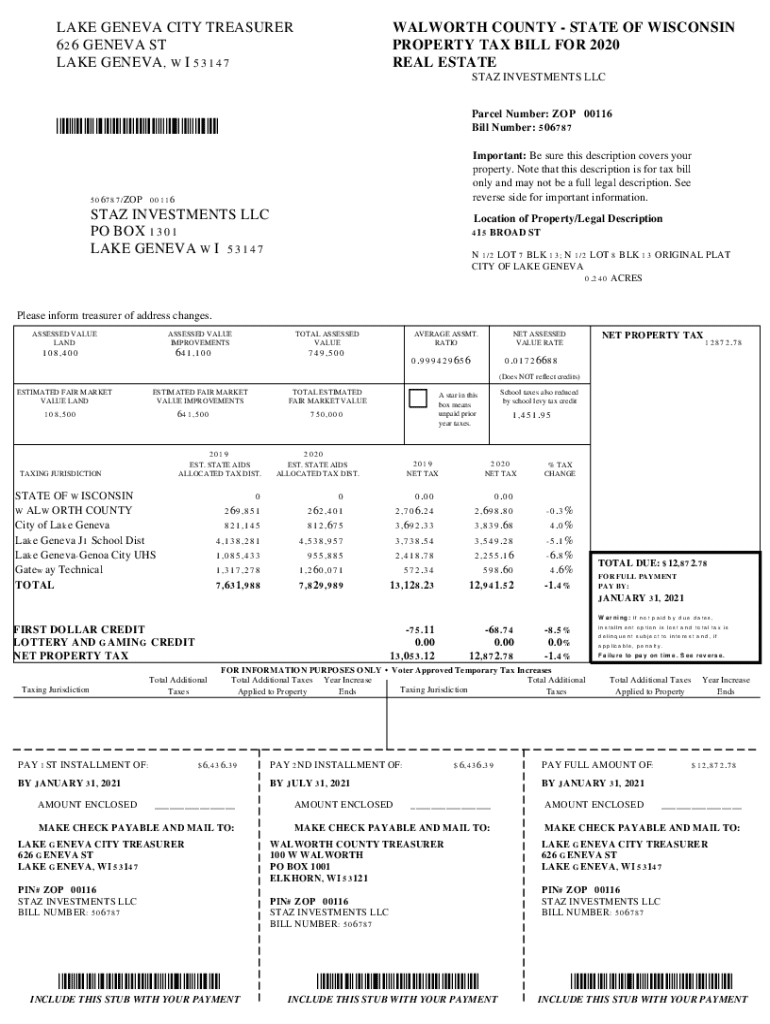

A property tax bill is an official statement issued by local government entities, detailing the amount of tax owed on a specific piece of property. This document is crucial for homeowners and real estate investors as it serves not only as a reminder of their financial obligations but also as a reflection of the property’s assessed value and the local tax rate.

Understanding property tax bills is essential because these taxes directly contribute to public services, schools, and infrastructure development within the community. Often viewed as a mundane aspect of property ownership, a property tax bill can significantly impact personal finances. Therefore, knowledge of how these taxes are calculated, assessed, and billed can empower property owners to engage actively in local tax discussions and appeals.

Types of property tax bills

Property tax bills vary considerably in their structure and timing. The two most common forms are annual and semi-annual bills. An annual bill is a one-time payment expected at a specific time of the year, while semi-annual bills allow property owners to pay their tax obligations in two installments, typically separated by a few months.

Tax assessment notices and special assessment bills are additional categories worth noting. Tax assessment notices inform property owners of their property's assessed value and can fluctuate yearly based on local market conditions. Special assessment bills, on the other hand, may be issued for particular improvements in the community, such as road repair or utility upgrades, reflecting a unique tax obligation to fund these projects.

Quick links to property tax bill resources

Accessing your property tax bill online can streamline your payments and improve management of your obligations. Many local tax authorities offer convenient platforms for viewing and managing property tax information.

Breakdown of the property tax bill form

A property tax bill form includes several key pieces of information critical for understanding your tax liability. This begins with the property description, providing specific details about the location and type of property. The assessed value follows, indicating how much the property is worth according to local authorities, which substantially affects the tax owed.

The tax rate applied to your property is another essential element, typically displayed as a percentage. The total amount due combines these factors, reflecting what you are expected to pay. Being aware of tax rate changes and updates is also vital, as these rates can vary annually based on local budget requirements and funding for public services.

How to fill out your property tax bill form

Filling out your property tax bill form properly is essential for ensuring accurate processing and avoiding penalties. Start by gathering all necessary documentation and information, such as your property's assessment notice, prior tax bills, and any relevant correspondence from local tax officials.

Next, fill in personal and property details, including your name, address, and the recognized parcel number from the assessment notice. Carefully calculate the total tax due by applying the tax rate to the assessed value, as indicated on your bill. Once completed, reviewing your form for accuracy is crucial to prevent common mistakes that can lead to discrepancies in your tax obligations.

Editing and signing your property tax bill form

Utilizing pdfFiller’s tools for editing PDF forms makes it easy to fill out your property tax bill with accuracy and efficiency. Once you upload your document to pdfFiller, you can easily edit text, adjust fields, and add necessary information without any hassle. Making use of electronic signatures and initials can streamline the entire process, particularly if multiple parties need to sign off on the document.

Collaborating with team members on form accuracy can also be significantly improved with pdfFiller's sharing features. This enables users to work together in real-time, ensuring that everything is accurate before submission. Properly reviewing the completed tax bill form with your collaborators can save time and ensure compliance with local regulations.

Managing your property tax bills effectively

Effectively managing your property tax bills can alleviate the stress associated with unexpected expenses. One practical method is to set up payment plans based on your financial situation, ensuring affordability while maintaining good standing with tax authorities. Most jurisdictions allow for flexible payment options that cater to various income levels.

Understanding lien sales and their implications can also safeguard your property from tax-related challenges. If property taxes fall significantly into arrears, your property may be subjected to a lien sale, where it’s sold to satisfy owed taxes. Keeping track of payment deadlines and notifications through digital reminders can help ensure that you never miss a due date.

Frequently asked questions about property tax bills

Property tax bills often spark confusion, leading to various inquiries from homeowners. One common question is how to dispute a property tax assessment if you believe it does not accurately reflect your property’s value. Typically, this involves filing an appeal with your local assessor's office, providing supporting documents that justify your claim for a lower assessment.

Another concern is what a homeowner should do if they don’t receive their property tax bill. Often, you can contact your local tax office to ensure that your mailing information is correct. Additionally, many jurisdictions offer electronic delivery options for property tax bills, allowing those who prefer a digital format to receive their notices promptly.

Resources for further assistance

For personalized and localized assistance regarding your property tax bills, contacting your local county assessor and treasurer is crucial. They can provide detailed explanations regarding property value assessments, potential exemptions, and the nuances of applying for tax relief. It may also be beneficial to familiarize yourself with the roles of property tax administrators, as they possess detailed knowledge of local regulations.

Various online resources are available, including the Department of Revenue's website, which offers additional forms, publications, and general guidance on property tax management. These resources are valuable in helping you navigate complex tax issues and ensuring compliance with regulatory requirements.

Relevant tools and interactive features on pdfFiller

pdfFiller offers a suite of interactive tools designed for seamless property tax management. For instance, using interactive tax bill calculators, users can estimate their property taxes more accurately based on specific inputs regarding their property’s assessed value and local tax rates. This feature eliminates confusion and helps prepare for budget impacts.

Additionally, pdfFiller ensures users can store, access, and manage documents from anywhere, providing a cloud-based solution that increases accessibility. The platform’s mobile features allow users to manage their property tax obligations while on the go, ensuring that you can always be prepared and organized.

Understanding property tax regulations and your rights

Navigating property tax regulations requires awareness of state and local laws that govern property taxation. Understanding your rights as a property owner, such as eligibility for homeowner's exemptions, can significantly reduce your tax burden. Many jurisdictions provide assistance programs aimed at offering tax deferrals or reductions based on criteria like age, disability, or income level.

Homeowners must also be familiar with the value adjustment board process and tax appeals, enabling them to contest property assessments deemed unfair. Engaging with local government during this process can provide greater insight and possibly lead to successful claims.

Community resources and engagement

Engaging with community resources regarding property taxes can foster a better understanding of your responsibilities and opportunities as a property owner. Many local governments offer educational programs focused on property taxes that explain the processes, rates, and how they affect community development. Participating in these workshops can sharpen your knowledge and inform your decision-making.

Networking with other property owners can also enhance your approach to managing property taxes. By sharing experiences and strategies, you can learn from others' successes and challenges, building a collective knowledge that benefits all community members.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in property tax bill without leaving Chrome?

How do I fill out property tax bill using my mobile device?

How do I edit property tax bill on an iOS device?

What is property tax bill?

Who is required to file property tax bill?

How to fill out property tax bill?

What is the purpose of property tax bill?

What information must be reported on property tax bill?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.