Get the free Property Tax Bill

Get, Create, Make and Sign property tax bill

How to edit property tax bill online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax bill

How to fill out property tax bill

Who needs property tax bill?

Property Tax Bill Form - How-to Guide Long-Read

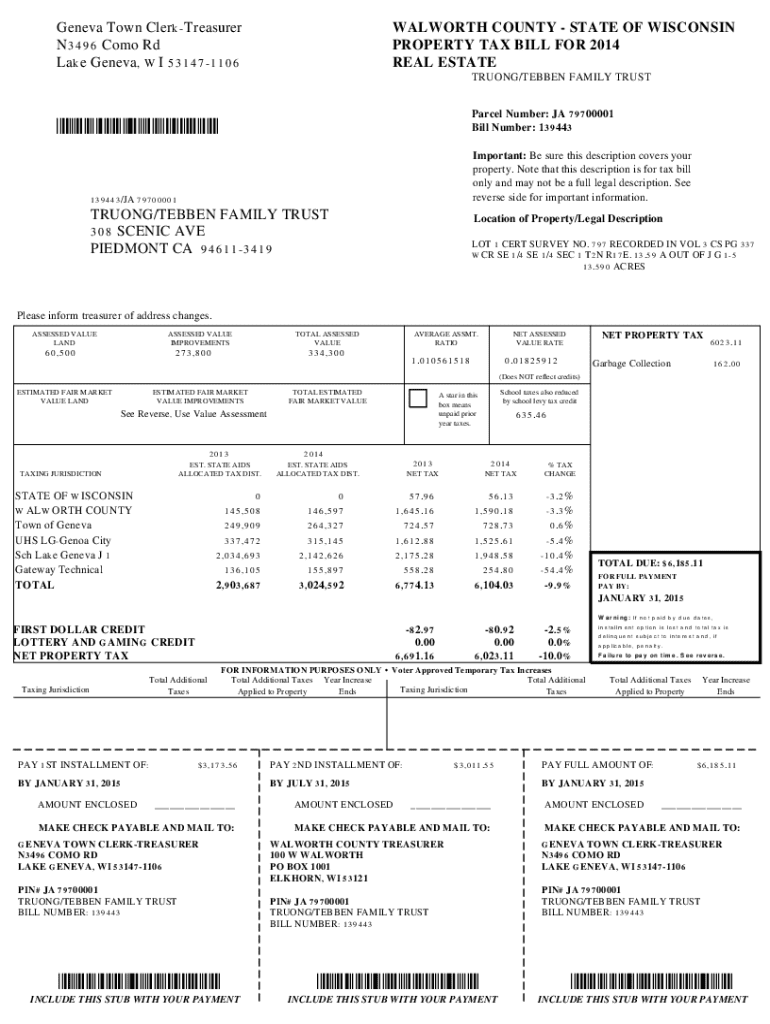

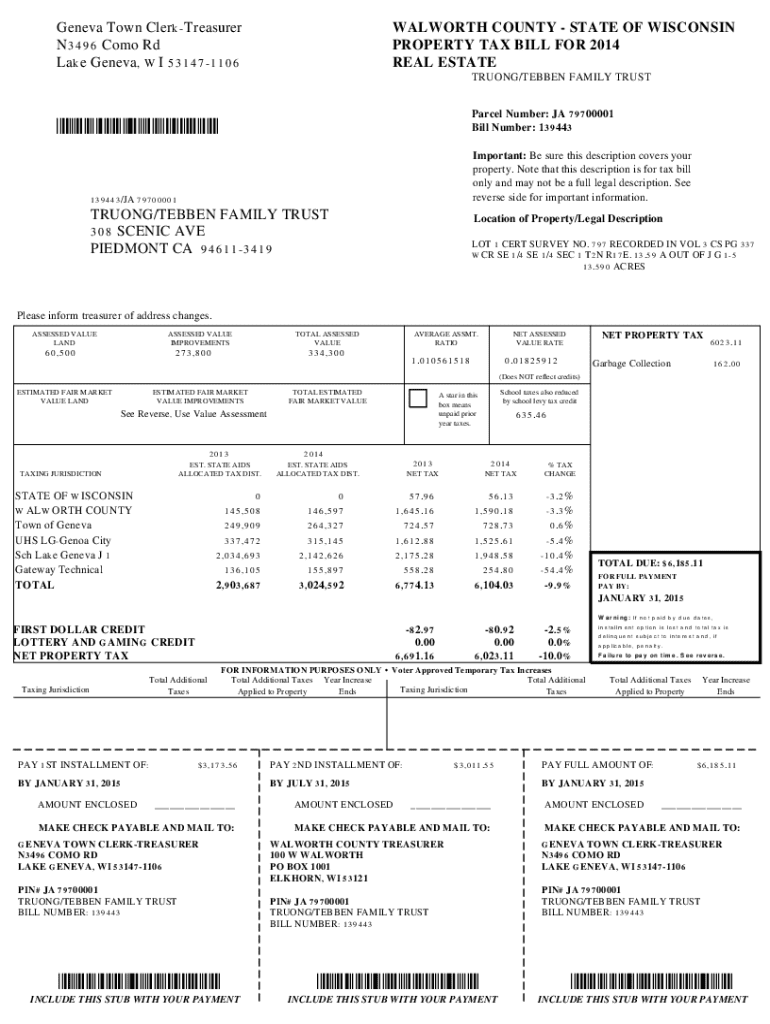

Understanding property tax bills

Property tax is a levy imposed by local governments on real estate properties. This tax is a critical financial contribution that funds essential services such as public education, road maintenance, and emergency services in your community. Each property owner is responsible for paying these taxes based on the assessed value of their property, which is determined by local assessors, often using a combination of standardized evaluation methods.

Timely payment of property taxes is crucial to avoid penalties or interest charges. Local governments typically have strict deadlines; missing a payment can lead to severe consequences, including liens against your property. Understanding how property taxes are calculated can empower homeowners to manage their obligations and potentially identify discrepancies in assessments.

A typical property tax bill includes several components: the assessed property value, tax rate, exemptions, and total tax due. Familiarizing yourself with these elements will help you navigate your financial responsibilities effectively.

Navigating the property tax bill form

The property tax bill form is essential for property owners to accurately report information to local tax authorities. It typically consists of various key sections that each serve specific purposes. Understanding these segments can simplify the process significantly.

Moreover, common terms found within the document, such as 'assessed value', 'mill rate', and 'exemption', can often be confusing. Understanding these terms is vital to make informed decisions regarding your property taxes.

Important dates, such as the tax payment deadline and assessment appeal periods, also play a critical role in managing your taxes. Being aware of these dates can prevent unnecessary penalties and ensure that your rights as a taxpayer are respected.

Step-by-step guide to filling out the property tax bill form

Filling out your property tax bill form can seem daunting, but breaking it down into manageable steps can alleviate much of the stress. Before starting, gather necessary documentation that will facilitate the process.

Start with Step 1 by inputting taxpayer information, including your full name, address, and contact information. In Step 2, accurately fill in property details, such as the property identification number and location.

Next, in Step 3, calculate and enter the tax amount, ensuring all figures accurately reflect your assessment. Move to Step 4, where you'll review the available payment options, such as bank transfers or credit card payments. Finally, don’t forget Step 5, which emphasizes double-checking all information before submission to minimize any errors.

Options for editing and managing your property tax bill form

After filling out your property tax bill form, managing it effectively is essential. Using online tools like pdfFiller can simplify this process significantly, offering users various editing capabilities.

By leveraging these tools, managing your documentation becomes less overwhelming, allowing you more time to focus on other important aspects of homeownership.

Making payments: understanding your options

Understanding the various payment options available for your property tax bill can enhance your financial strategy. Property owners typically have several methods to choose from to ensure timely payment.

Additionally, setting up a payment plan can help manage larger bills over time, offering a more manageable way to fulfill tax obligations. It's also essential to know how to request a refund if you’ve overpaid your taxes, as well as being prepared to address common payment issues.

Frequently asked questions about property tax bills

Navigating property tax obligations can lead to questions surrounding assessed values and payment responsibilities. If you disagree with your property tax assessment, promptly contact your local assessor to discuss your concerns. They often provide avenues for appeals or adjustments.

Being informed and proactive can make a significant difference in handling property tax bills.

Resources for further assistance

Accessing the right resources can enhance your understanding of property tax processes. Many local tax offices provide comprehensive information on their websites regarding property tax bills and assessments.

Utilizing these resources will prepare you for a smooth property tax season.

How pdfFiller supports your document needs

At pdfFiller, we provide tools that simplify the editing and management of property tax bill forms. Our cloud-based platform allows users to access their documents anywhere, which eliminates the hassle of maintaining paper records.

By leveraging these capabilities, property tax documentation becomes streamlined, reducing the overhead that often accompanies traditional filing methods.

Engaging with your county assessor and treasurer

Actively engaging with your local tax officials can enhance your understanding of property taxation in your area. Knowing how to find your local office allows you to ask questions directly related to your specific situation.

Maintaining open lines of communication with these officials can also provide insights into upcoming changes that may affect your tax situation.

Additional tools and services for property tax management

Many other relevant forms can assist property owners in managing their tax responsibilities. Understanding these can further enhance your financial planning.

Utilizing a variety of tools and forms will empower property owners to navigate their financial obligations with greater confidence and effectiveness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit property tax bill straight from my smartphone?

How can I fill out property tax bill on an iOS device?

How do I fill out property tax bill on an Android device?

What is property tax bill?

Who is required to file property tax bill?

How to fill out property tax bill?

What is the purpose of property tax bill?

What information must be reported on property tax bill?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.