Get the free 2025 W-4mn

Get, Create, Make and Sign 2025 w-4mn

Editing 2025 w-4mn online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 w-4mn

How to fill out 2025 w-4mn

Who needs 2025 w-4mn?

2025 W-4MN Form: A Comprehensive How-To Guide

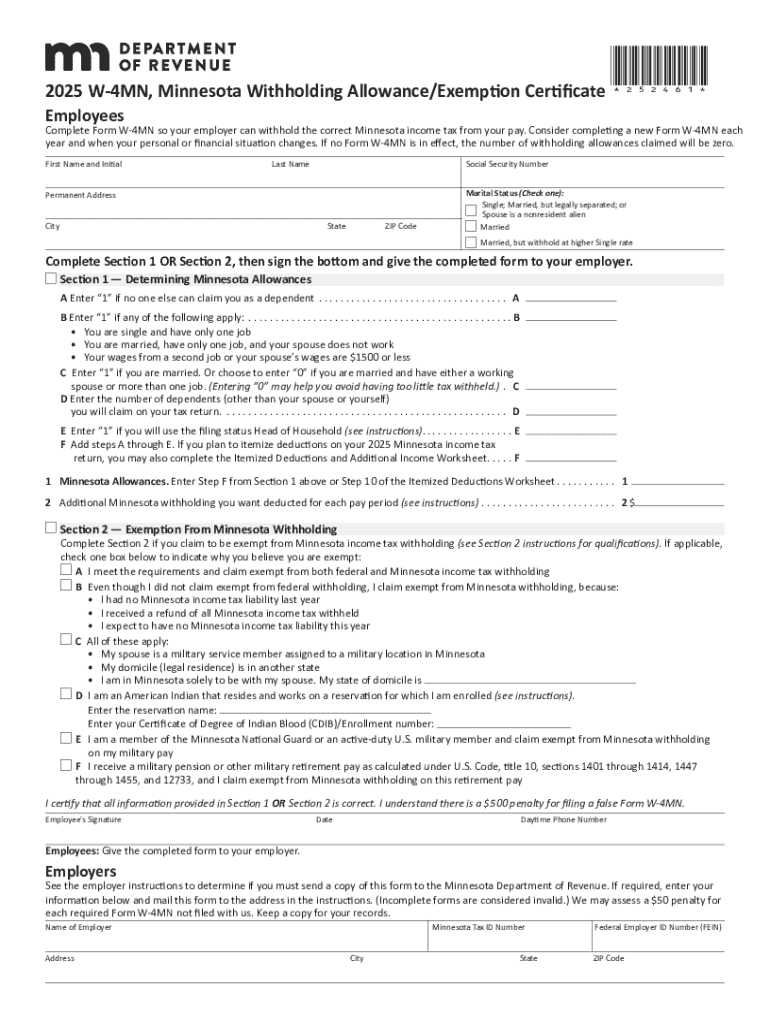

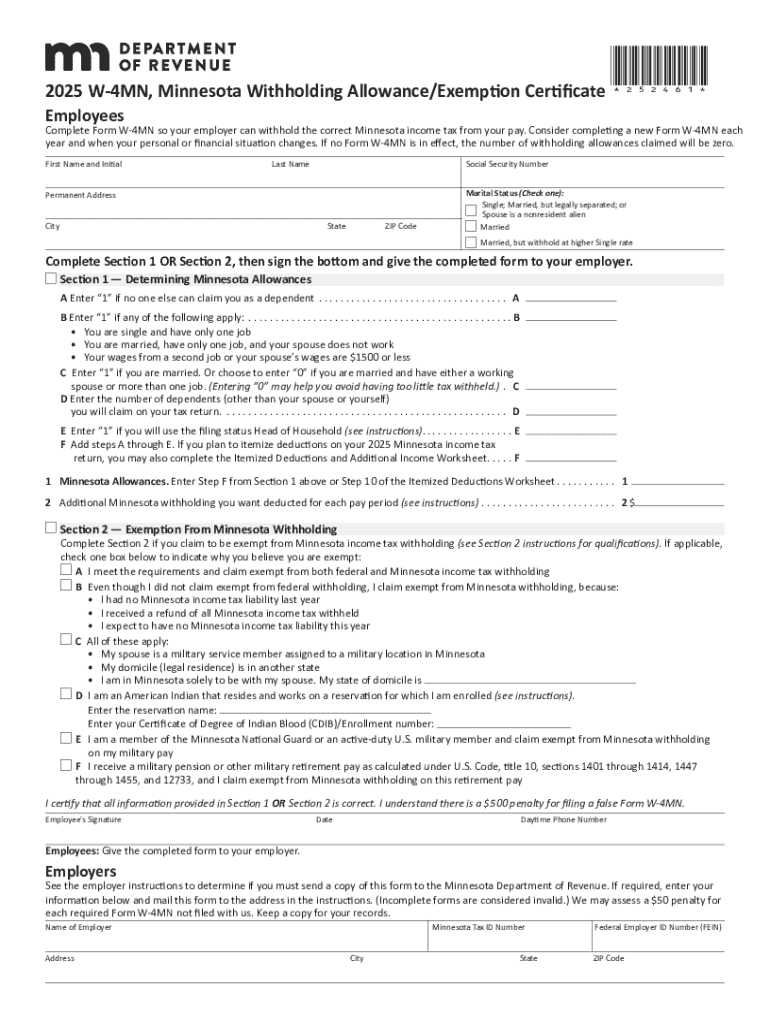

Understanding the 2025 W-4MN form

The 2025 W-4MN form is a vital document used by employees in Minnesota to determine the amount of state withholding tax that should be deducted from their paychecks. This state-specific form is essential for individuals to ensure that they are meeting their tax obligations without overpaying or underpaying taxes throughout the year. The W-4MN form includes several key elements: personal information, exemptions, and withholding allowances, which all play a crucial role in determining the correct withholding amount.

Filling out the W-4MN accurately is imperative, not just for compliance, but also for effective financial planning. A well-completed form provides employers with the information they need to calculate correct payroll deductions, directly impacting take-home pay.

When to complete the 2025 W-4MN form

Several life events can trigger the need to complete or update the 2025 W-4MN form. Key occasions include starting a new job, experiencing changes in marital status, or undergoing significant fluctuations in income. Each of these changes can have a substantial impact on your tax situation, making it essential to review and update your withholding setup accordingly.

Moreover, it's advisable to conduct an annual review of your W-4MN form with each new tax year. Even if your circumstances haven't changed, reevaluating your withholding can help you align it with any shifts in tax law or personal financial goals.

How to access the 2025 W-4MN form

Accessing the 2025 W-4MN form is straightforward. The form can be easily downloaded from the pdfFiller website, a user-friendly platform designed for document creation and management. To obtain a copy, follow these steps:

Additionally, if you’re looking for an editable version of the W-4MN, pdfFiller offers interactive tools that allow users to fill out the form conveniently online. This feature helps eliminate the hassle of paper forms and enhances accuracy.

Detailed instructions for filling out the form

The first step in filling out the W-4MN form involves accurately entering your personal information. This includes your full name, address, email, and Social Security number. Double-check this section, as any inaccuracies could lead to complications with your payroll and potential tax issues.

Next, you need to determine your allowances and exemptions. Understanding the difference between the two is crucial; allowances reduce your taxable income, while exemptions exempt certain income from taxation. To ascertain how many allowances you should claim, consider factors such as dependents and other tax deductions you might qualify for.

Completing the signature section is just as important—this includes signing and dating the form correctly. By signing the form, you affirm that the information you provided is true to the best of your knowledge, completing your obligations as a taxpayer.

Common mistakes to avoid

Even simple oversights can create issues when filling out the W-4MN form. Common mistakes often include leaving sections incomplete, misunderstanding allowances versus exemptions, or failing to adjust withholding based on recent life changes. Attention to detail is key.

To ensure accuracy, utilize pdfFiller's validation tools that catch errors before submission. Proofreading your entries can save you from significant future headaches.

Submitting the 2025 W-4MN form

Once you have completed the W-4MN form, submission to your employer is the next step. Be sure to provide it to your HR or payroll department in a timely manner to allow for adjustments in withholding on your next paycheck.

It’s wise to keep copies of your completed W-4MN form for your own records, both digitally and physically. This preserves a benchmark you can refer back to if any discrepancies arise concerning your tax withholdings down the line.

Managing your W-4MN and tax withholding

Managing your W-4MN form shouldn’t end once you submit it. Throughout the year, as your personal or financial circumstances change, you may find it necessary to adjust your withholding. This could relate to life events such as a new job, a promotion, marriage, or the birth of a child.

Utilizing pdfFiller can streamline this process. The platform features tools that allow you to track changes effectively and receive reminders to review your W-4MN form, ensuring you stay on top of your tax obligations.

Frequently asked questions about the 2025 W-4MN form

When navigating tax forms such as the W-4MN, it's natural to have questions. Common inquiries revolve around how to accurately fill out the form, when it needs updating, or the implications of various exemptions. For deeper clarity, it’s advisable to consult resources provided on the pdfFiller site or reach out to tax professionals who can provide tailored advice.

Related documents and templates

In addition to the 2025 W-4MN form, there are other related documents you might encounter, such as W-2 forms, which summarize your earnings and taxes withheld for the year, or 1099 forms for reporting freelance or contract income. Understanding the interconnectedness of these documents can better prepare you for tax season.

pdfFiller provides comprehensive support for handling various documents, enabling easy management and access to a wide range of tax and legal templates, enhancing your overall document management experience.

Get email updates and stay informed

Subscribing for email updates through pdfFiller opens the door to receiving timely information about tax laws and any changes to the forms you need to complete. Staying informed can help you avoid pitfalls and ensure compliance with tax regulations.

To subscribe, simply visit the pdfFiller site, locate the newsletter subscription option, and enter your email address. This ensures you won’t miss crucial updates that could impact your tax preparation.

Automatic translation disclaimer

For those who may require the W-4MN form in languages other than English, pdfFiller’s automatic translation services support multi-language use, allowing broader accessibility. This feature ensures that language barriers do not obstruct compliance with tax requirements.

Current changes in tax law affecting the 2025 W-4MN

Recent legislative updates can impact how the 2025 W-4MN form is filled out. Staying abreast of these changes is crucial for ensuring that your tax withholdings remain relevant and accurate. Tax credits, deductions, and new filing regulations may emerge each year, necessitating a close examination of your withholding form.

Regularly checking reliable sources will enable you to approach tax season confidently, informed about your rights and responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2025 w-4mn online?

How do I edit 2025 w-4mn online?

How can I fill out 2025 w-4mn on an iOS device?

What is 2025 w-4mn?

Who is required to file 2025 w-4mn?

How to fill out 2025 w-4mn?

What is the purpose of 2025 w-4mn?

What information must be reported on 2025 w-4mn?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.