Get the free Appropriation Limit Calculation Report

Get, Create, Make and Sign appropriation limit calculation report

Editing appropriation limit calculation report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out appropriation limit calculation report

How to fill out appropriation limit calculation report

Who needs appropriation limit calculation report?

Understanding the Appropriation Limit Calculation Report Form

Understanding the appropriation limit

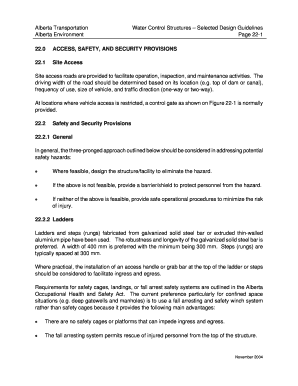

The appropriations limit is a crucial fiscal concept that defines the maximum amount of money that local governments or agencies can spend in a given fiscal year without violating legal constraints. This limit is tightly linked to fiscal responsibility and public transparency, serving to ensure that agencies don’t overspend beyond their means.

For Local Education Agencies (LEAs), understanding this limit is essential in order to effectively plan and allocate their budgets. The appropriations limit calculation directly impacts how education funds are distributed, making it vital for LEAs to adhere to these restrictions while still meeting their funding needs.

Components of the appropriation limit calculation

Calculating the appropriation limit involves analyzing various components that include revenues and expenditures. An accurate calculation allows LEAs to ensure compliance with financial regulations while making well-informed decisions on spending.

Typically, the calculation considers prospective revenues, which may include state funding, federal funds, grants, and local resources, as well as projected expenditures. Each of these elements plays a significant role in determining the extent to which spending can be legally executed, balancing budgetary needs with strict legal constraints.

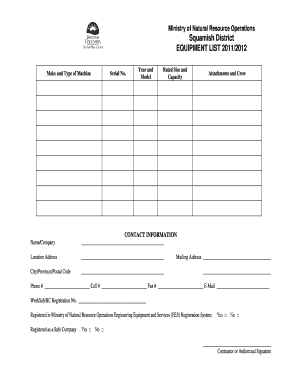

Step-by-step guide to completing the appropriation limit calculation report form

Completing the Appropriation Limit Calculation Report Form requires meticulous attention to detail. The process begins with accessing the form, which can typically be found on fiscal oversight websites or platforms like pdfFiller.

Once you have accessed the form, proceed through the various sections with precaution. Each section requires specific information that will affect the final report.

To ensure accuracy in entries, be aware of common pitfalls such as the misreporting of revenues or expenditures. Double-check numbers to validate the figures you're providing, and ensure that all supporting documents align with the data presented in the form.

How to edit and sign your appropriation limit calculation report

When handling the Appropriation Limit Calculation Report Form, it’s essential to have a reliable method for editing and signing the document. With tools like pdfFiller, you can easily modify your report before final submission.

One of the most significant advantages of using pdfFiller is its comprehensive editing capabilities. Users can add text, annotations, and even customize the layout using templates and formatting options.

Once your report is finalized, using e-signature features ensures that your document meets compliance standards while providing a digital footprint of authentication.

Collaborating on the appropriation limit calculation report

Collaboration plays an essential role in accurately filling out the Appropriation Limit Calculation Report. When working in teams, utilize pdfFiller’s sharing capabilities to disseminate the report amongst team members.

Real-time collaboration features enable multiple users to edit the document simultaneously. This not only enhances efficiency but also promotes accuracy by allowing stakeholders to address any discrepancies as they arise.

Tracking changes and managing your document

Maintaining an organized record of your Appropriation Limit Calculation Report is crucial for accountability and future reference. With pdfFiller, users can access version history to monitor changes that have been made.

This feature allows users to revert to previous versions if necessary, offering a safety net for data integrity. Additionally, understanding when and why revisions are made can be incredibly insightful for future budgeting cycles.

Frequently asked questions (FAQs)

Navigating the intricacies of the appropriations limit can lead to questions, especially when discrepancies arise or regulations change. Here’s a compilation of frequently asked questions related to the Appropriation Limit Calculation Report.

Current legislative updates impacting appropriation limits

Legislation can frequently affect how appropriation limits are calculated. One significant update, for example, is AB 130, which introduced various amendments affecting local funding and budgetary policies.

For Local Education Agencies, these legislative changes imply the necessity of staying current with regulations that could alter budget forecasts or limitations. Familiarity with such updates ensures that reports are accurately reflecting the legal landscape.

Related resources and confidence in report preparation

While preparing your Appropriation Limit Calculation Report, tapping into related resources can enhance your confidence and understanding of the process. pdfFiller provides a resource library filled with templates and guides to assist users.

Engaging with community support around budget management can also offer insights and practical tips for successfully navigating financial forms and reports.

Popular content and program areas relevant to appropriation limits

The Appropriation Limit Calculation Report is not an isolated form; it often intersects with broader budget management strategies. Exploring related forms and templates can offer a more comprehensive understanding of fiscal management.

pdfFiller offers various tools and templates that often cater to budget management, enabling a more accessible and integrated approach to document creation and collaboration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find appropriation limit calculation report?

Can I create an eSignature for the appropriation limit calculation report in Gmail?

Can I edit appropriation limit calculation report on an iOS device?

What is appropriation limit calculation report?

Who is required to file appropriation limit calculation report?

How to fill out appropriation limit calculation report?

What is the purpose of appropriation limit calculation report?

What information must be reported on appropriation limit calculation report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.