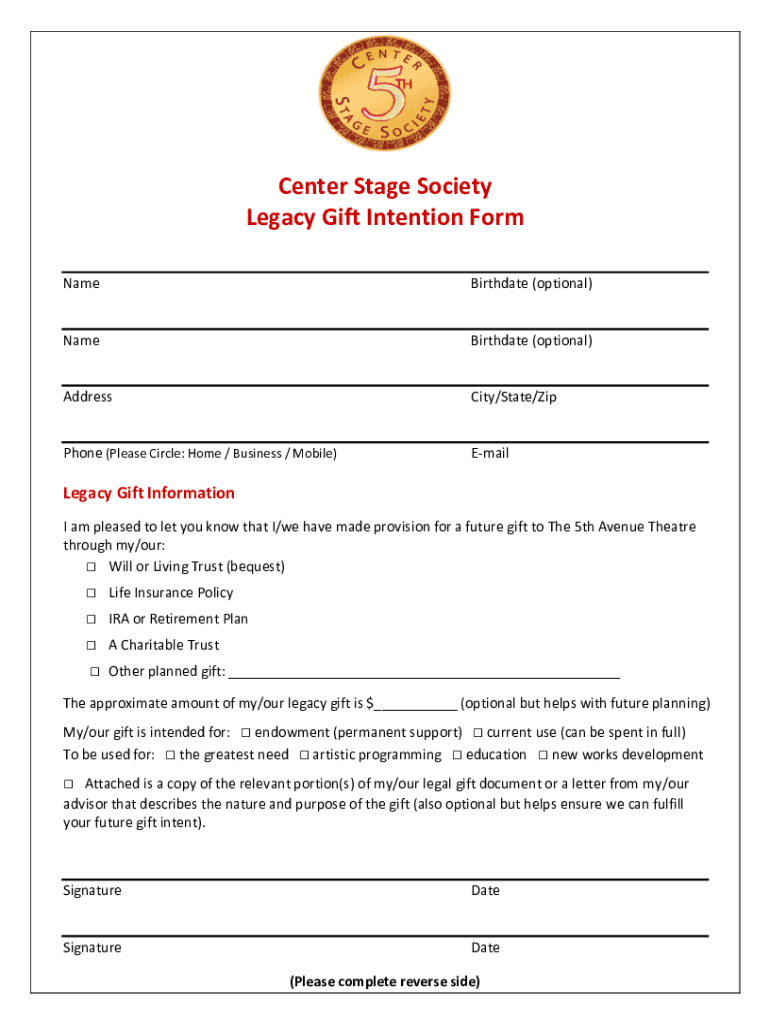

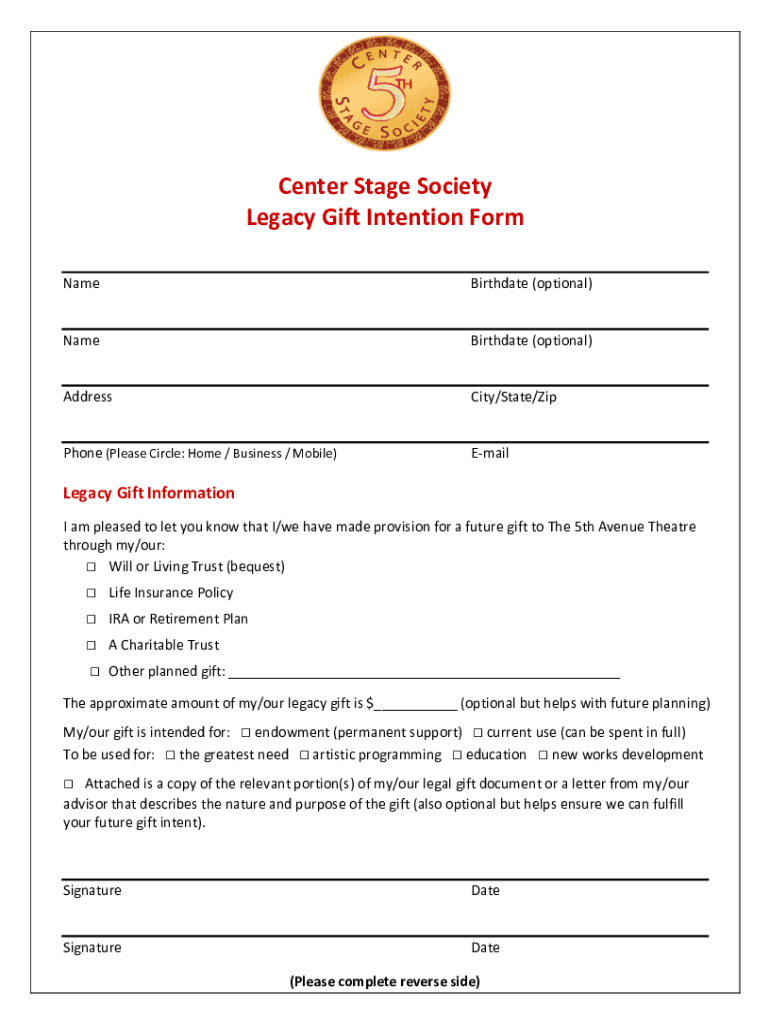

Get the free Legacy Gift Intention Form

Get, Create, Make and Sign legacy gift intention form

Editing legacy gift intention form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out legacy gift intention form

How to fill out legacy gift intention form

Who needs legacy gift intention form?

Understanding the Legacy Gift Intention Form: Your Guide to Leaving a Meaningful Impact

Understanding legacy giving

Legacy giving is a powerful facet of philanthropy where individuals or families commit to making a significant donation to a cause or organization after their lifetime. These gifts can take various forms, including bequests in wills, designated funds, or life insurance policies. Beyond the monetary aspect, legacy giving signifies the values, beliefs, and aspirations of the donor, often reflecting a lifelong commitment to a cause close to their heart.

The importance of legacy gifts in philanthropy cannot be overstated. They ensure continuity in support for charitable organizations, allowing them to plan long-term initiatives based on anticipated future funding. Despite the power of legacy gifts, misconceptions exist. Many people believe that only wealthy individuals can leave a legacy gift, while in reality, anyone can make an impact, regardless of their financial situation.

Purpose of the legacy gift intention form

Completing a legacy gift intention form is an essential step for anyone wishing to leave a lasting impact through their charitable giving. This form serves as a vehicle for individuals to articulate their intentions regarding future gifts, making their choices concisely and clearly known to the designated organizations and their families. The purpose of this form extends beyond mere documentation; it assures that your wishes are respected and facilitates smoother transitions for the recipient organizations.

Articulating your legacy intentions via the form provides numerous benefits. It helps in planning and strengthens your connection with charitable organizations, enabling them to prepare for future contributions. By formalizing your intentions, you set the groundwork for meaningful changes, ensuring that your values and passions continue to benefit others even after you're no longer here.

How to access the legacy gift intention form

Accessing the legacy gift intention form through pdfFiller is straightforward. Start by visiting the pdfFiller website, where you'll find a search tool available on the homepage. In the search bar, type 'legacy gift intention form' to locate the specific document. The platform's interface is user-friendly and designed for easy navigation, even for first-time users.

The form is compatible with various devices, whether you're using a smartphone, tablet, or computer. This accessibility makes it easy to fill out the form anytime, anywhere, ensuring flexibility and convenience as you finalize your legacy giving intentions.

Detailed breakdown of the form sections

To facilitate accurate and effective legacy planning, the legacy gift intention form is divided into several sections, each focusing on different crucial aspects of your gift.

Personal information

The personal information section includes the essential details that identify you as the donor. Required fields include:

Optional fields are also available for you to provide additional insights about your giving philosophy and motivations, helping the organization to honor your legacy effectively.

Gift information

This section allows you to specify the type of gift you wish to leave, such as cash, stocks, real estate, or other forms of donations. It's essential to articulate the estimated value of the gift, allowing the organization to plan for future expenditures appropriately.

You will also choose the recipient organization and articulate how you hope your gift will create an impact. This may involve answering targeted questions that help frame your vision for the future.

Motivation for giving

Sharing your personal story enhances the emotional weight of your intent. This section allows you to reflect on what inspired your decision to donate. You may want to express how particular experiences shaped your views on philanthropy and the specific cause you are supporting.

Adding this insightful information can motivate organizations and their supporters by illustrating the reason behind your gift. This connection can foster deeper relationships and further enhance the impact of your legacy.

Filling out the form: tips and best practices

When filling out the legacy gift intention form, providing accurate information is paramount. Take your time to ensure all details are correct, as this will support the organization’s planning efforts and respects your legacy. Carefully read each section of the form to ensure you understand what's required, which can reduce errors.

Confidentiality and privacy are common concerns when completing such documents. Ensure that you use secure channels when submitting or sharing your legacy gift intention form. A platform like pdfFiller recognizes these needs, offering various privacy features to safeguard your information. It’s also wise to be cognizant of common mistakes, such as leaving required fields blank or making errors in your contact information, which can lead to significant misunderstandings.

Editing and signing the legacy gift intention form

One of the significant benefits of using pdfFiller is the ability to edit your legacy gift intention form easily. Changes can be made in a few simple steps, allowing you to add, delete, or modify any information as your wishes evolve. This flexibility is especially important since life circumstances and intentions can change over time.

Additionally, pdfFiller provides eSigning options, enabling you to sign your form electronically without the need for printing. Collaborating with family members or financial advisors is made easier as well, as you can share the form with others for their input before finalizing your intentions. Doing this ensures clarity and understanding among all parties involved, promoting a smoother transition of your legacy.

Managing your legacy gift intention form

Once your legacy gift intention form is completed, managing it properly is crucial. pdfFiller offers secure document storage, allowing you to keep your intentions safe and easily accessible when needed. This ensures that you can revisit and modify your document as your circumstances change. It's advisable to review your legacy gift intentions regularly to ensure they still align with your wishes and to update the form as necessary.

Equally important is sharing your completed form with trusted parties, such as family members or legal advisors. This helps ensure that your gifts are honored as you intended and that your loved ones are aware of your philanthropic aspirations.

FAQs about legacy gift intentions

Addressing common questions and concerns can demystify the process of completing a legacy gift intention form. First, many potential donors ask if this form is legally binding. While it articulates your intentions, the form serves as a guideline rather than a legal obligation; hence, it's always good to consult a legal advisor if you're looking for formal binding language.

Next, many wonder what happens if they change their mind about a gift. The beauty of the legacy gift intention form is its flexibility; you can update or revoke your intentions at any given time. Lastly, concerns around the security of information are valid. pdfFiller prioritizes user privacy and employs various measures to ensure that your details remain protected.

Ensuring your legacy gift is fulfilled

Once you submit your legacy gift intention form, several steps are necessary to ensure the fulfillment of your gift. First, communicate your intentions clearly with your legal and financial advisors. This proactive communication ensures everyone involved understands your wishes, which can prevent confusion down the road.

It's also imperative to maintain ongoing communication with the recipient organizations. Keep them informed of any changes in your circumstances or intentions. These conversations will help ensure that your legacy gift contributes to the intended purposes and resonates with your philanthropic vision.

Testimonials and success stories

Real-life examples can illustrate the profound impacts legacy gifts can have. Many individuals find fulfillment in sharing their journey, with testimonials highlighting their motivations and the results of their contributions. For instance, a donor who made a significant contribution to a local environmental organization reported how their legacy gift enabled large-scale reforestation efforts, demonstrating a tangible positive outcome from their decision.

In similar stories, families choose to establish scholarship funds in memory of loved ones, ensuring that their legacy lives on through education. These experiences inspire others to consider their legacies and the potential changes they can effectuate, underscoring the need to articulate these intentions clearly through a gift intention form.

Navigating the legacy giving landscape

Navigating the legacy giving landscape can initially seem overwhelming. However, various resources and tools can assist potential donors in this process. Many organizations provide informational sessions online, and resources highlighting the steps involved in legacy giving can be helpful. Additionally, pdfFiller simplifies document creation and management for individuals and teams, enhancing your legacy giving experience.

By utilizing practical tools such as pdfFiller, you can streamline the creation and management of necessary documents while ensuring your intentions are documented professionally. This platform can ease the overall process of legacy giving, making it a more accessible endeavor for all.

Staying engaged in supporting legacy causes

Engagement with your chosen causes extends beyond simply filling out a legacy gift intention form. Opportunities to volunteer or contribute beyond financial gifts are available, and many organizations appreciate active participation. Your involvement can enhance your understanding of the organization and its needs, thus allowing you to align your legacy gift more closely with their mission.

Consider attending events, participating in discussions, or contributing time and skills to further support your legacy intentions. Engaging with the organizations you care about creates a fuller picture of your philanthropic impact, ensuring that your legacy is not just a financial commitment, but a lifelong relationship with a cause.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit legacy gift intention form online?

How do I fill out legacy gift intention form using my mobile device?

Can I edit legacy gift intention form on an Android device?

What is legacy gift intention form?

Who is required to file legacy gift intention form?

How to fill out legacy gift intention form?

What is the purpose of legacy gift intention form?

What information must be reported on legacy gift intention form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.