Get the free Audit and Compliance Committee Meeting Minutes - bot ucf

Get, Create, Make and Sign audit and compliance committee

How to edit audit and compliance committee online

Uncompromising security for your PDF editing and eSignature needs

How to fill out audit and compliance committee

How to fill out audit and compliance committee

Who needs audit and compliance committee?

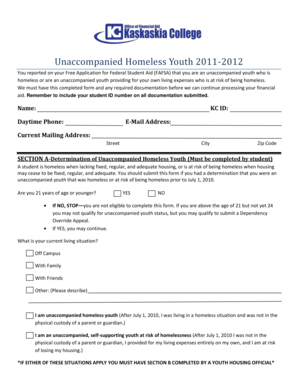

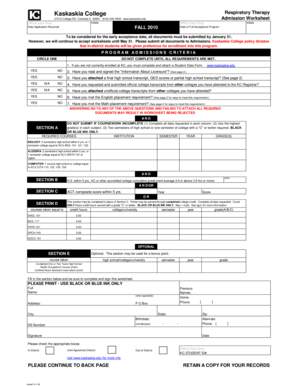

Understanding the Audit and Compliance Committee Form

Understanding the Audit and Compliance Committee Form

An audit and compliance committee form is crucial for organizations striving to uphold integrity, transparency, and accountability in their operations. Audit committees typically oversee financial reporting, risk management, and compliance with regulatory requirements. Their purpose is to ensure that the organization adheres to established policies and procedures while assessing potential risks. This form acts as a foundational tool facilitating the documentation, organization, and reporting of these activities.

Maintaining compliance is not only about following legal requirements; it is also about fostering trust among stakeholders, including employees, customers, and investors. The committee form provides a structured way to track compliance efforts, manage audits, and document the committee's activities, thus facilitating smoother interactions and improved accountability within the organization.

Key components of the audit and compliance committee form

The audit and compliance committee form encompasses various sections, each serving a specific purpose. Common sections include basic information about the organization, objectives of the committee, member details, meeting schedules, and compliance documentation. Understanding the significance of each section is crucial for effective utilization of the form.

The basic information section helps identify the organization and its relevant details, while the committee objectives section outlines the goals and functions of the committee. Listing member details is essential for accountability and establishing roles, and the meeting schedule facilitates timely audits and compliance checks. Lastly, the compliance documentation section ensures that all necessary evidence and reports are readily accessible, crucial for both internal reviews and external audits.

Benefits of using the audit and compliance committee form

Utilizing an audit and compliance committee form brings multiple advantages to organizations. One of the key benefits is the streamlining of documentation processes. By adopting a standardized format, the form simplifies the collection of information, which enhances efficiency. Teams can easily input data and locate necessary details without wading through disparate documentation.

Moreover, this form enhances transparency and accountability within the organization. Clear communication is achieved through the consistent documentation of committee activities, allowing stakeholders to remain informed about compliance efforts and any potential issues. This transparency fosters trust among stakeholders, which is essential in maintaining long-term relationships.

How to fill out the audit and compliance committee form

Filling out the audit and compliance committee form effectively requires attention to detail and understanding of its sections. Here’s a step-by-step guide to ensure each section is completed accurately.

Additionally, to fill out complex fields effectively, consider using clear and concise language. It’s essential to avoid jargon unless it’s industry-standard terminology. This not only improves readability but also helps in fostering clear understanding among all committee members and stakeholders involved.

Editing and managing your audit and compliance committee form

After filling out the audit and compliance committee form, managing and editing it is key to maintaining accurate records. pdfFiller provides a suite of tools that aid in effective document management. These capabilities include editing features that allow you to make necessary adjustments at any time easily.

Collaboration is also a breeze with pdfFiller’s platform. Users can share forms with team members, enabling real-time feedback and suggestions. Tracking changes and revisions is straightforward, ensuring that everyone stays on the same page throughout the compliance process.

eSigning the audit and compliance committee form

Incorporating electronic signatures (eSigning) offers distinct advantages for finalizing the audit and compliance committee form. eSigning not only expedites the approval process but also ensures the security and authenticity of the document. pdfFiller makes the eSigning process user-friendly and efficient, allowing users to send and receive signed forms swiftly.

By using pdfFiller's platform for eSigning, organizations can reduce their reliance on physical paperwork, save time, and minimize errors associated with manual signatures. This convenience is particularly beneficial when multiple stakeholders need to sign off on compliance documents in a timely manner.

Common FAQs about the audit and compliance committee form

Addressing frequently asked questions regarding the audit and compliance committee form assists organizations in understanding its utility and relevance. One common query is, 'Who should use the form?' Typically, this form is intended for audit and compliance committees within companies, non-profits, and various institutions requiring compliance oversight.

Another frequently asked question revolves around addressing changes in information. Organizations should have a clear protocol for updating the form to reflect any changes in membership, objectives, or compliance documentation. Lastly, remaining compliant with regulatory changes requires organizations to stay informed and proactively adapt their forms and processes to reflect new requirements.

Case studies: Successful implementation of the audit and compliance committee form

Examining real-life examples sheds light on how the audit and compliance committee form can streamline processes. For instance, a mid-sized healthcare organization effectively implemented the form to enhance their compliance tracking after facing compliance issues. By standardizing documentation practices, they reduced errors and expedited audits, leading to a stronger compliance framework.

Another example can be seen in a financial services company that adopted the audit and compliance committee form to improve communication among their teams. The structured format allowed for better tracking of compliance activities and increased accountability among committee members, ultimately leading to an increase in stakeholder trust.

Best practices for maintaining an effective audit and compliance committee

Maintaining an effective audit and compliance committee requires continuous improvement strategies. Regular training sessions for committee members can ensure they stay updated with compliance requirements and industry changes. This proactive approach cultivates a well-informed team able to tackle unexpected compliance challenges.

Additionally, it’s vital to regularly review and update the audit and compliance committee form to align with best practices and organizational needs. An outdated form can lead to compliance risks that could affect the organization negatively. By fostering a culture of ongoing improvement, organizations can ensure their compliance mechanisms are effective and up to date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send audit and compliance committee to be eSigned by others?

Can I create an electronic signature for the audit and compliance committee in Chrome?

How do I fill out audit and compliance committee on an Android device?

What is audit and compliance committee?

Who is required to file audit and compliance committee?

How to fill out audit and compliance committee?

What is the purpose of audit and compliance committee?

What information must be reported on audit and compliance committee?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.