Get the free Monthly Return of Equity Issuer on Movements in Securities

Get, Create, Make and Sign monthly return of equity

How to edit monthly return of equity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly return of equity

How to fill out monthly return of equity

Who needs monthly return of equity?

Understanding the Monthly Return of Equity Form: A Comprehensive Guide

Overview of monthly return of equity

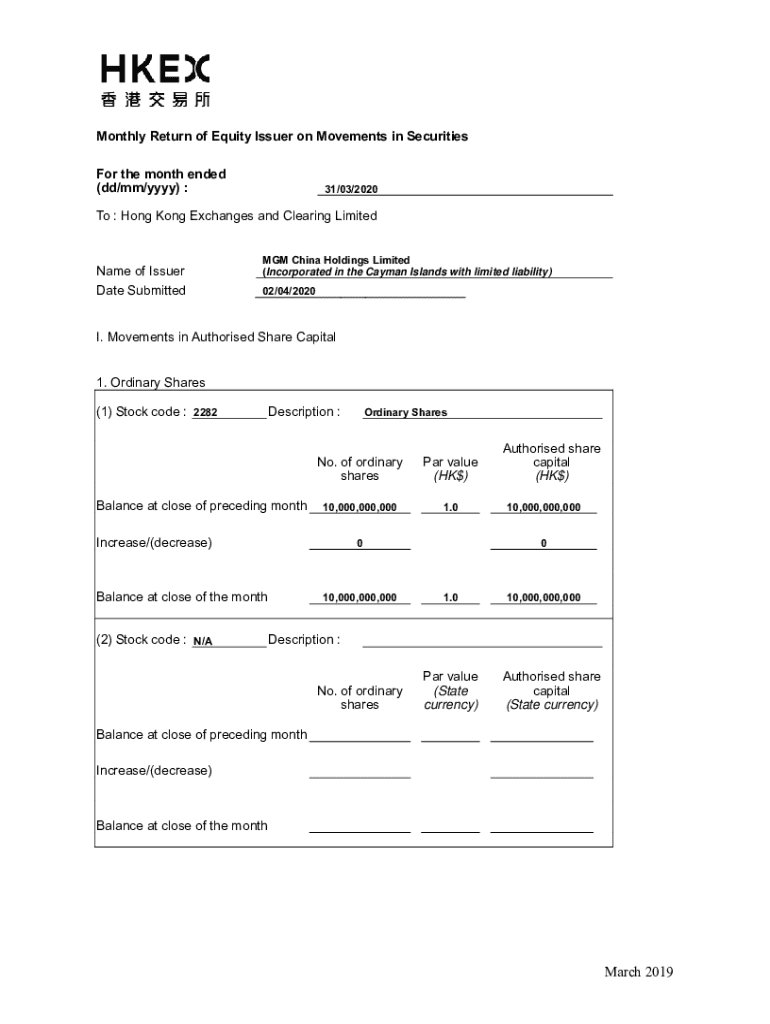

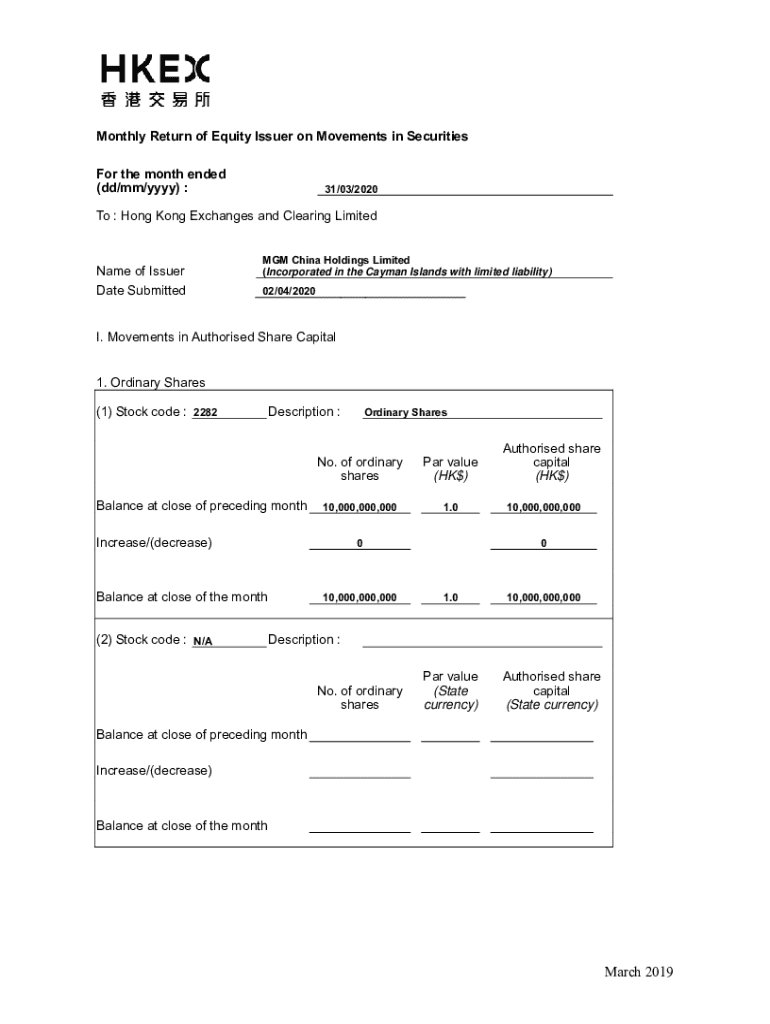

The Monthly Return of Equity form is a crucial document utilized by organizations to report their equity movements on a monthly basis. This form records essential information regarding equity securities, including stock issuances, repurchases, and transfers, thereby serving as an operational overview of a company's equity status.

Tracking equity returns monthly is of paramount importance for a variety of reasons. It helps in maintaining transparency within the financial markets, ensuring that stakeholders such as investors, board members, and regulatory authorities are kept informed of the company’s financial health. Moreover, regular reporting can enhance investor confidence, facilitate informed decision-making, and promote corporate accountability.

Understanding the monthly return of equity form

The Monthly Return of Equity Form serves multiple purposes. Primarily, it ensures compliance with regulatory requirements set forth by financial authorities. Companies are often mandated to provide this information to prevent fraudulent activities and maintain market integrity.

Additionally, this form facilitates accurate reporting for various stakeholders. By providing a comprehensive overview of equity activities, it allows for better decision-making and strategic planning within the organization.

Key components of the monthly return of equity form

To complete the Monthly Return of Equity Form, different components must be accurately filled out. This includes critical identification details of the company, such as its name and registration number, alongside a summary of movements within equity securities for the reporting period.

The form typically details new issuances, repurchases, and any transfers of equity. Adhering to specific formatting and presentation guidelines is essential to ensure that the report is in compliance and readily interpretable.

Step-by-step guide to filling out the monthly return of equity form

When preparing to complete the Monthly Return of Equity Form, it's crucial to start by gathering the necessary documentation. This may include previous reports, internal records of equity transactions, and relevant financial statements. Understanding the specific data points required will help streamline the process.

The form typically consists of several sections that require careful attention. Each part needs accurate input to ensure compliance and validity.

Common mistakes to avoid when completing the form

Misreporting figures stands out as a frequent error that can lead to significant consequences, including penalties and reputational damage. Ensuring accurate reporting right from the start can mitigate these risks.

Furthermore, omitting required sections or failing to follow formatting guidelines can result in delays or rejections of the submission. It's essential to carefully review the entire form before submission to catch any possible mistakes.

Tools and resources for effective form management

Utilizing tools like pdfFiller can significantly enhance the experience of completing the Monthly Return of Equity Form. With features that allow easy editing and electronic signing, collaboration among team members becomes seamless.

Companies can also take advantage of interactive templates available on pdfFiller, ensuring that they are utilizing the most current and compliant versions of the form. The benefits of a cloud-based document management system include the ability to access forms anytime and anywhere, promoting flexibility and efficiency.

Frequently asked questions (FAQs) about monthly return of equity forms

Understanding common questions can alleviate concerns associated with completing the Monthly Return of Equity Form. Many companies wonder what happens if the form is submitted late. A late submission can lead to penalties, but specific consequences depend on the regulatory authority's rules.

Companies that need to amend a submitted return can typically do so by filing a corrected form indicating changes clearly. Staying informed about key dates and deadlines for submission ensures firms remain compliant and avoid unnecessary complications.

Case studies and examples

Examining real-world examples of Monthly Return of Equity Forms can provide insights into best practices. Many organizations have successfully streamlined their reporting processes through meticulous documentation and the use of technology. By leveraging tools like pdfFiller, they can avoid common pitfalls and enhance overall accuracy.

Testimonials from companies that transitioned to efficient reporting methods often highlight time savings and improved compliance as key benefits. These insights not only reinforce the importance of proper reporting but also encourage others to adopt similarly efficient practices.

Compliance and regulatory considerations

Compliance with regulations governing equity reporting is non-negotiable for any organization handling equity securities. Regulatory authorities typically set out specific requirements regarding the frequency, formats, and details that must be included in the Monthly Return of Equity Form.

Failure to comply can lead to severe consequences, including financial penalties, legal repercussions, and damage to the organization’s reputation. Therefore, keeping abreast of changes in the regulatory landscape and maintaining rigorous compliance procedures is vital for any company.

Navigating post-submission processes

Once the Monthly Return of Equity Form has been submitted, understanding the review and approval procedures is essential. Regulatory bodies typically carry out a thorough review process to verify the accuracy of the information provided.

After submission, keeping track of the status is advisable. Companies should utilize available channels for status updates and follow up if necessary. This proactive approach ensures that any potential issues are identified and addressed promptly.

Comparative analysis

It's valuable to compare the Monthly Return of Equity Form with other financial reporting requirements. Companies often also need to compile annual returns, which require a more comprehensive overview of financial activity over a longer time span.

Understanding how monthly reporting integrates with annual returns can provide insights into overall financial management. This holistic view facilitates better planning and coordination of financial activities across different reporting timelines.

Interactive section: using pdfFiller for your monthly return

Using pdfFiller to create and manage your Monthly Return of Equity Form can dramatically simplify the process. The platform provides user-friendly tools for form creation and editing, along with a step-by-step tutorial ensuring that users can navigate the system seamlessly.

By following best practices and utilizing the robust features offered, such as automatic formatting and eSigning capabilities, users can create accurate reports efficiently, thus empowering them to focus on other critical business tasks.

Conclusion and insights

The importance of the Monthly Return of Equity Form cannot be overstated; it plays a vital role in ensuring transparency and compliance within the financial markets. Companies that take proactive steps in reporting will likely experience enhanced stakeholder confidence and smoother operational compliance.

By leveraging advanced document management tools like pdfFiller, organizations can streamline their reporting processes and maintain meticulous compliance, ultimately contributing to their long-term success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in monthly return of equity?

How do I edit monthly return of equity straight from my smartphone?

How do I complete monthly return of equity on an iOS device?

What is monthly return of equity?

Who is required to file monthly return of equity?

How to fill out monthly return of equity?

What is the purpose of monthly return of equity?

What information must be reported on monthly return of equity?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.