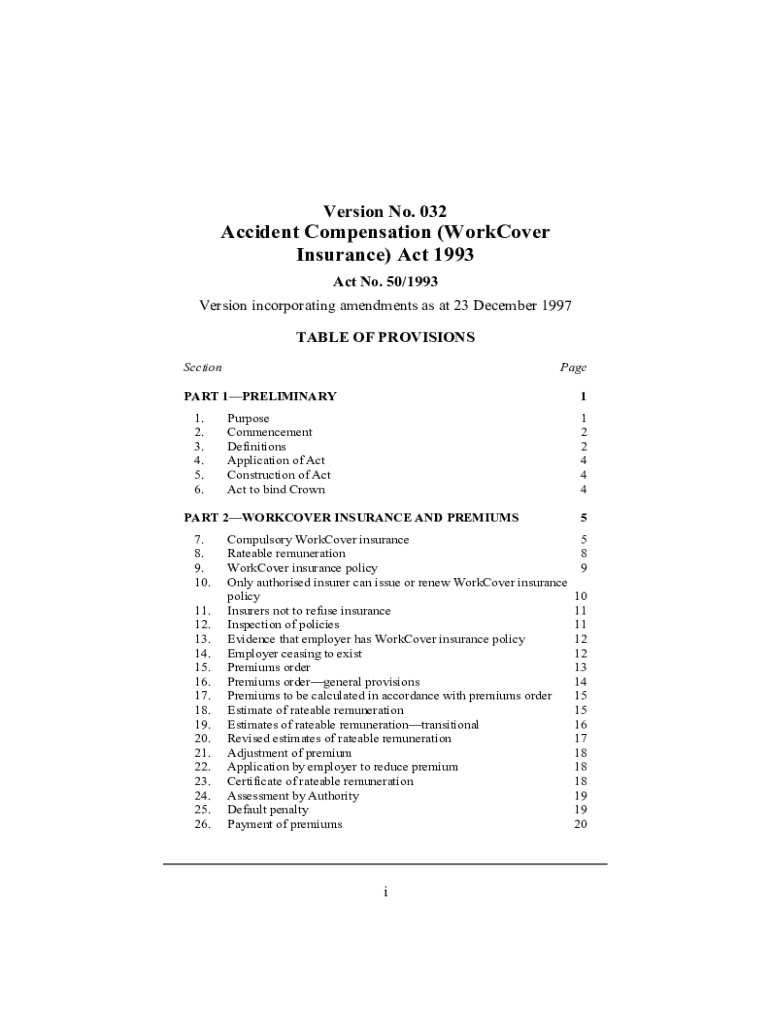

Get the free Accident Compensation (workcover Insurance) Act 1993

Get, Create, Make and Sign accident compensation workcover insurance

How to edit accident compensation workcover insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out accident compensation workcover insurance

How to fill out accident compensation workcover insurance

Who needs accident compensation workcover insurance?

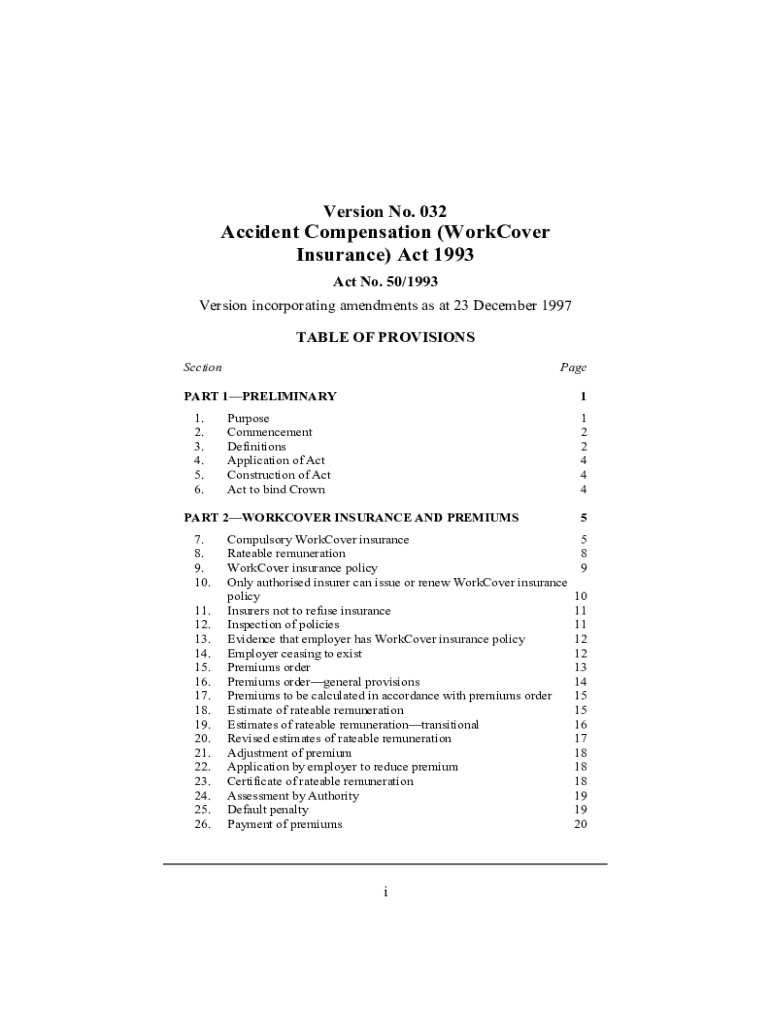

Accident Compensation WorkCover Insurance Form: A Comprehensive Guide

Understanding the accident compensation WorkCover insurance form

The accident compensation WorkCover insurance form is a critical document for workers seeking compensation for injuries sustained in the workplace. This form serves as the initial step in accessing the benefits provided under the WorkCover scheme, ensuring that employees receive the necessary financial and medical support they may require in the aftermath of an accident. It is pivotal for safeguarding workers' rights and ensuring they can return to their roles without the added burden of financial strain.

The form’s importance extends beyond just documentation; it lays the groundwork for the entire compensation process. Properly filling it out can significantly expedite the review process, ultimately leading to quicker resolution of claims. Workers eligible for compensation include those who suffered physical injuries, mental health issues due to work conditions, and long-term health conditions that have been aggravated by their work environment.

Key components of the WorkCover insurance form

Completing the WorkCover insurance form requires careful attention to detail, particularly in several crucial sections designed to gather comprehensive information about the incident and the injured worker. The first part of the form collects personal information, which includes essential details such as the worker’s name, address, contact information, and date of birth. This section ensures that the compensation team can identify and communicate with the claimant efficiently.

Providing complete and accurate information in each of these sections is vital for a successful claim. Incomplete or vague submissions can lead to delays or denials.

How to fill out the WorkCover insurance form

Filling out the accident compensation WorkCover insurance form need not be a daunting task if approached methodically. The following step-by-step guide will help ensure that all necessary details are captured efficiently and accurately.

After filling out the form, it may also be beneficial to ask a trusted colleague or advisor to review it for clarity and completeness before submitting.

Submitting the WorkCover insurance form

Once the WorkCover insurance form is complete, the next step is submission. Depending on local regulations and the convenience of the claimant, there are typically two main options for submitting the form: online or by mail.

It is crucial to be aware of submission deadlines, which can affect the ability to claim for compensation. Keeping copies of the submitted form is recommended for personal records and in case follow-up is necessary.

Post-submission process

After the accident compensation WorkCover insurance form is submitted, claimants can expect a review period where the claims team evaluates the application. During this time, about 4 to 12 weeks is typical for processing, but it can vary based on the complexity of the claim.

Claimants should receive correspondence regarding the status of their application, and it's crucial to keep track of this communication. If necessary, workers can reach out to the claims office for updates regarding the progress of their claim.

Handling claims with mental injuries

Workers suffering from mental injuries related to their employment often face unique challenges in the compensation process. These claims can involve intricate assessments, and additional documentation is necessary to establish the connection between workplace conditions and mental health impacts.

Due to the subjective nature of mental health claims, it may require extra effort to substantiate them, making thoroughness vital in documentation.

Common challenges and solutions

Despite the well-structured process, challenges can arise when submitting the accident compensation WorkCover insurance form. Understanding the common pitfalls can help workers avoid them. Claim denials often occur due to insufficient documentation, late submissions, or lack of clear causation between the injury and work.

If claims are denied, workers have the right to appeal the decision, and it can often help to consult with legal resources or compensation experts.

Understanding your rights as a worker

Navigating the intricacies of accident compensation can seem daunting; however, it is crucial for workers to understand their rights during this process. Under the accident compensation scheme, employees are entitled to claim for injuries sustained in the course of their employment, and employers have a legal obligation to ensure the safety and wellbeing of their staff.

When submitting a claim, workers also have responsibilities, such as providing accurate information and reporting accidents promptly. Resources are available, such as worker advocacy groups and legal assistance services, to help guide individuals in understanding their rights.

Additional information and support

Filling out the accident compensation WorkCover insurance form can be challenging, but assistance is available. Many workplaces have dedicated resources for employees needing help or guidance through the form completion process. Moreover, pdfFiller offers online tools to facilitate document management, including features for e-signing and editing PDFs, making it easier to navigate complex forms.

Additionally, thorough reading materials about worker compensation rights can empower individuals with the knowledge they need to advocate for themselves effectively.

Frequently asked questions

While navigating the accident compensation WorkCover insurance form, various questions often arise for users. Understanding the differences between temporary and permanent incapacity claims is vital, particularly as these can affect the type of compensation or benefits received. Temporary incapacity generally may cover medical expenses and lost wages, while permanent incapacity might lead to ongoing compensation.

Other commonly asked questions include clarifications around provisional payments that occur before the official claim decision is made. Ensuring clarity on these points can significantly assist in managing expectations throughout the compensation process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my accident compensation workcover insurance directly from Gmail?

How can I send accident compensation workcover insurance to be eSigned by others?

Can I sign the accident compensation workcover insurance electronically in Chrome?

What is accident compensation workcover insurance?

Who is required to file accident compensation workcover insurance?

How to fill out accident compensation workcover insurance?

What is the purpose of accident compensation workcover insurance?

What information must be reported on accident compensation workcover insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.