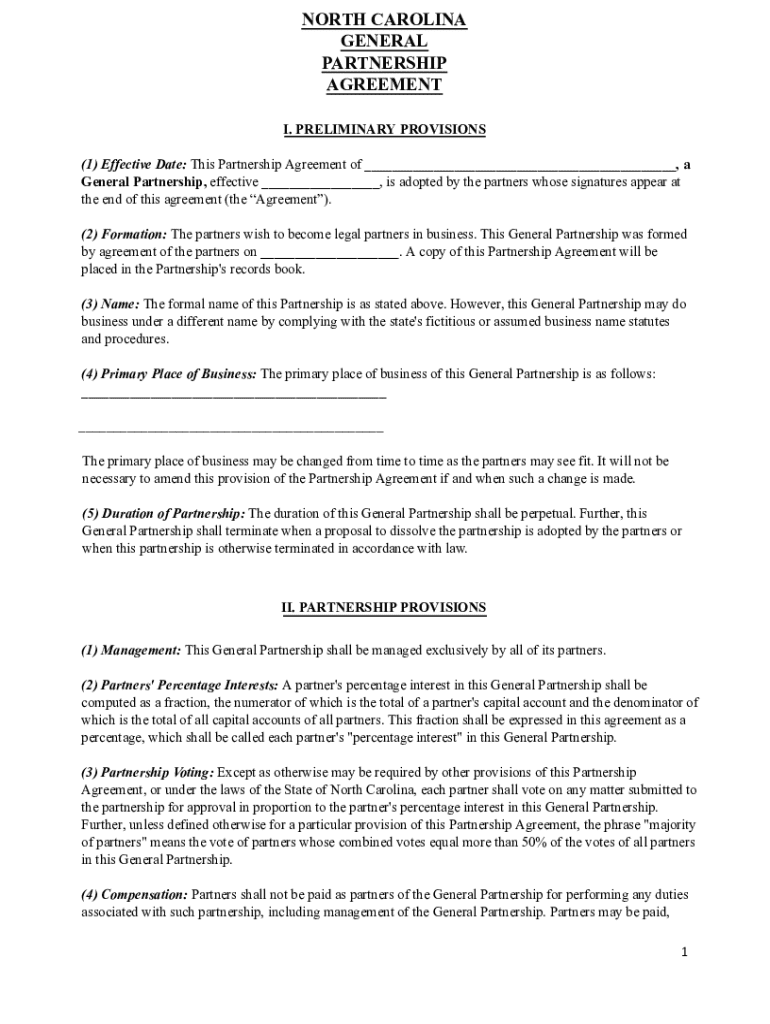

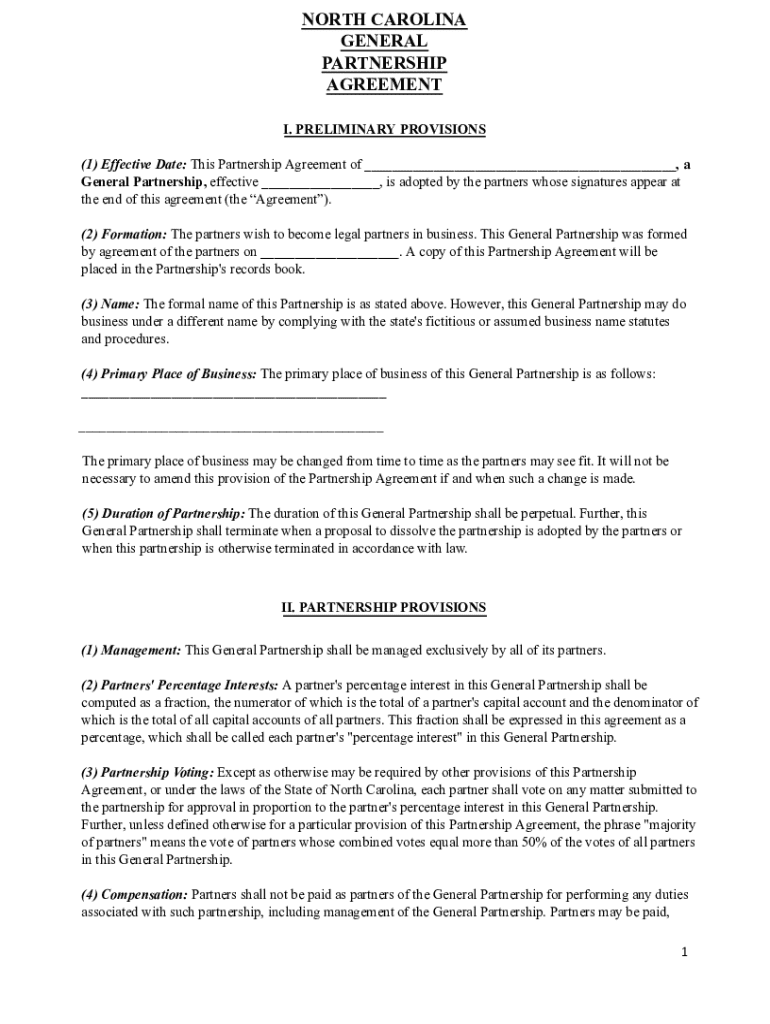

Get the free North Carolina General Partnership Agreement

Get, Create, Make and Sign north carolina general partnership

How to edit north carolina general partnership online

Uncompromising security for your PDF editing and eSignature needs

How to fill out north carolina general partnership

How to fill out north carolina general partnership

Who needs north carolina general partnership?

North Carolina General Partnership Form: A Comprehensive Guide

Understanding general partnerships in North Carolina

A general partnership in North Carolina is a business structure where two or more individuals collaborate to operate a business for profit. Forming a general partnership is straightforward, requiring little formal documentation compared to other business entities, making it an attractive choice for many entrepreneurs. Each partner not only shares in the profits but also bears the responsibility for the business's debts and liabilities.

Key features of general partnerships include shared control, mutual decision-making, and the personal liability of each partner for the business's obligations. It’s crucial for partners to establish a comprehensive partnership agreement, which clarifies roles, responsibilities, and procedures for handling disputes and profit distribution, ensuring smoother operations.

Advantages and disadvantages of a general partnership

General partnerships offer various benefits that can make them appealing for small businesses. One of the primary advantages is the ease of setup, as forming a general partnership requires minimal legal formalities and can be started with just a verbal agreement. Furthermore, general partnerships benefit from pass-through taxation, meaning income is only taxed on the individual partners’ tax returns, avoiding the double taxation faced by corporations.

However, general partnerships are not without their drawbacks. One major concern is personal liability; each partner is personally responsible for the partnership's debts, which could lead to financial risk. Additionally, decision-making can become challenging if partners have differing visions for the business, and disputes can arise regarding profit sharing or operational strategies.

Steps to form a general partnership in North Carolina

To establish a general partnership in North Carolina, partners must follow several strategic steps. Begin by assessing compatibility with potential partners by discussing shared goals, expectations, and evaluate whether professional advice is required to ensure all angles are covered.

Next, create a comprehensive general partnership agreement, detailing the roles, responsibilities, profit-sharing arrangements, and procedures for resolving disputes. A well-structured agreement mitigates misunderstandings in the future.

Tax considerations for general partnerships in North Carolina

Understanding tax implications is crucial for partners in a North Carolina general partnership. The unique advantage of pass-through taxation enables business profits to flow directly to the partners without facing corporate tax, simplifying the taxation process. Each partner must report their share of the business income on their personal tax returns, and this method allows for potential tax savings.

Additionally, partners should be aware of their obligations to pay self-employment taxes, as their earnings from the partnership are considered self-employment income. It's recommended that partners maintain accurate records of income distributions and expenses to ensure compliance with IRS regulations and to facilitate smooth tax filings.

Potential liability and risk mitigation strategies

In a general partnership, each partner's personal assets are at risk due to unlimited liability for business debts. This risk can be substantial, particularly in industries with high liability exposure. To mitigate this risk, partners may consider various strategies, including obtaining liability insurance to protect against claims, and developing solid business practices to minimize exposure to legal actions.

Furthermore, in some cases, partners might want to explore alternative business structures, such as forming a limited liability partnership (LLP) or a corporation, where personal liability is limited. These alternatives can provide additional protection and may be more suitable as the partnership grows and faces increased risks.

Navigating partnerships: Responsibilities and contributions

Clearly defining partner roles and expectations is vital to a successful general partnership. Each partner should be aware of their responsibilities to avoid overlap and conflict. Aligning goals from the outset prevents misunderstandings and promotes a cohesive team dynamic.

Contributions, whether financial or otherwise, should be valued appropriately and documented within the partnership agreement. It’s essential to recognize both monetary investments and non-financial contributions, like expertise or industry connections, as each plays a critical role in the partnership's overall success.

Handling disputes in a general partnership

Disputes can arise in any partnership due to conflicting priorities, differing visions, or unmet expectations. Common sources of conflict include disagreements over financial decisions, operational strategies, and profit distribution. Effective dispute resolution strategies are necessary to handle conflicts constructively.

Understanding profit and loss sharing

Profit and loss sharing in a general partnership should be carefully structured within the partnership agreement. Typically, profits and losses are shared according to the percentage of investment or the agreed-upon terms among partners. Establishing clear methods for distribution ensures that all partners understand their financial rights and obligations, reducing potential conflicts down the line.

It's important to note how contributions—both financial and non-financial—impact profit shares. An equitable approach ensures that all partners feel valued and understood, essential for fostering a healthy partnership dynamic.

Partnership dissolution: Process and considerations

Dissolution of a general partnership requires careful navigation to ensure all legal and financial matters are addressed. Partners may decide to dissolve the partnership for various reasons including changing dynamics, business difficulties, or mutual agreement on a better direction. The process typically begins with discussing intentions among partners and agreeing on a course of action.

Once a decision is reached, partners should follow specific steps to dissolve the partnership legally, including settling debts, liquidating assets, and crafting a final accounting of profits. Understanding the legal implications of dissolution and handling partner exits respectfully is crucial for maintaining relationships and reputations in the business community.

Future considerations for general partnerships

Businesses should regularly evaluate growth opportunities and determine if the current partnership structure continues to serve their goals effectively. As the business evolves, partners may need to revisit the partnership agreement, amending it to reflect new roles or changes in contributions.

Conversely, partners should also stay vigilant and consider when it may be appropriate to transition to a different business structure as the business scales. Recognizing warnings signs early can help in strategically maneuvering through challenges.

North Carolina general partnership forms: Resources and tools

One useful resource for individuals forming a general partnership in North Carolina is pdfFiller, which provides a cloud-based platform for managing essential documents. When creating a general partnership agreement, pdfFiller allows users to easily edit, eSign, and share their forms securely online. This simplifies the documentation process and provides a reliable method of keeping all partnership documents organized and accessible.

FAQs on North Carolina general partnerships

When starting a general partnership, individuals often have many questions. One common inquiry is, 'What is the first step I should take?' The answer typically involves finding and discussing potential partners to establish mutual goals. Another frequent question is whether a written partnership agreement is necessary; while not legally required, having a written agreement significantly benefits clarity and understanding among partners.

Concerns regarding liability and tax obligations are also prevalent. Understanding the scope of personal liability and the implications of pass-through taxation can help partners make informed decisions about their business structure. Additionally, clarifying misconceptions about the nature and responsibilities of partnerships fosters better decision-making for prospective partners.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in north carolina general partnership without leaving Chrome?

Can I edit north carolina general partnership on an iOS device?

How do I fill out north carolina general partnership on an Android device?

What is north carolina general partnership?

Who is required to file north carolina general partnership?

How to fill out north carolina general partnership?

What is the purpose of north carolina general partnership?

What information must be reported on north carolina general partnership?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.