Get the free Dr 729

Get, Create, Make and Sign dr 729

How to edit dr 729 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dr 729

How to fill out dr 729

Who needs dr 729?

Comprehensive Guide to the DR 729 Form

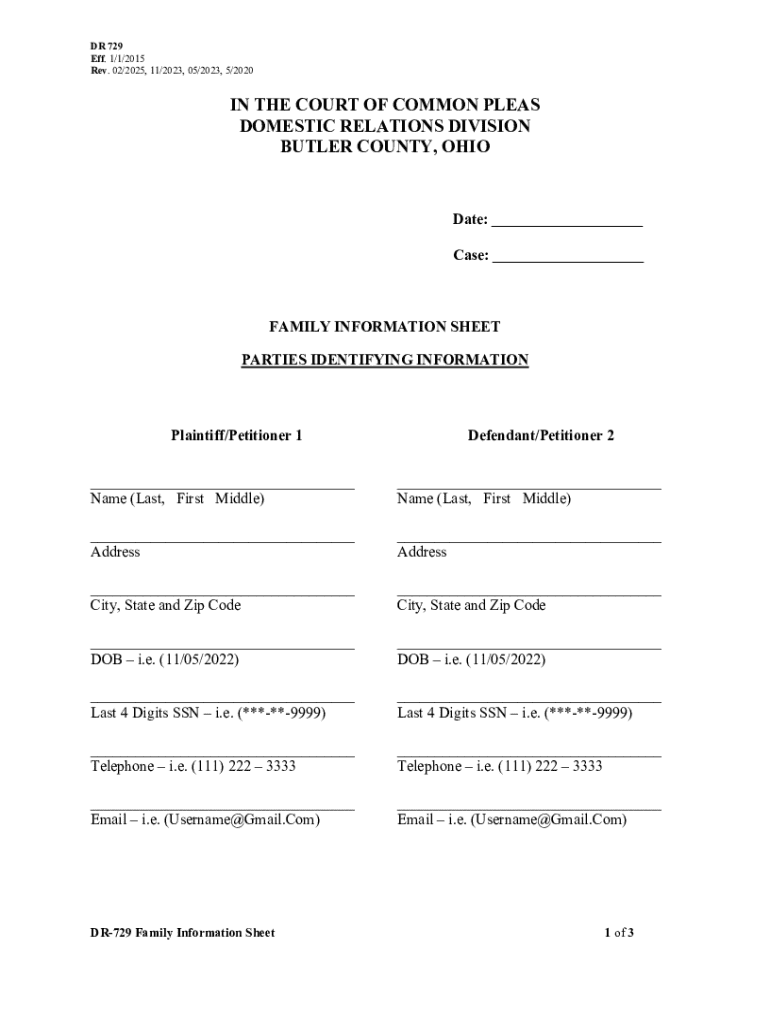

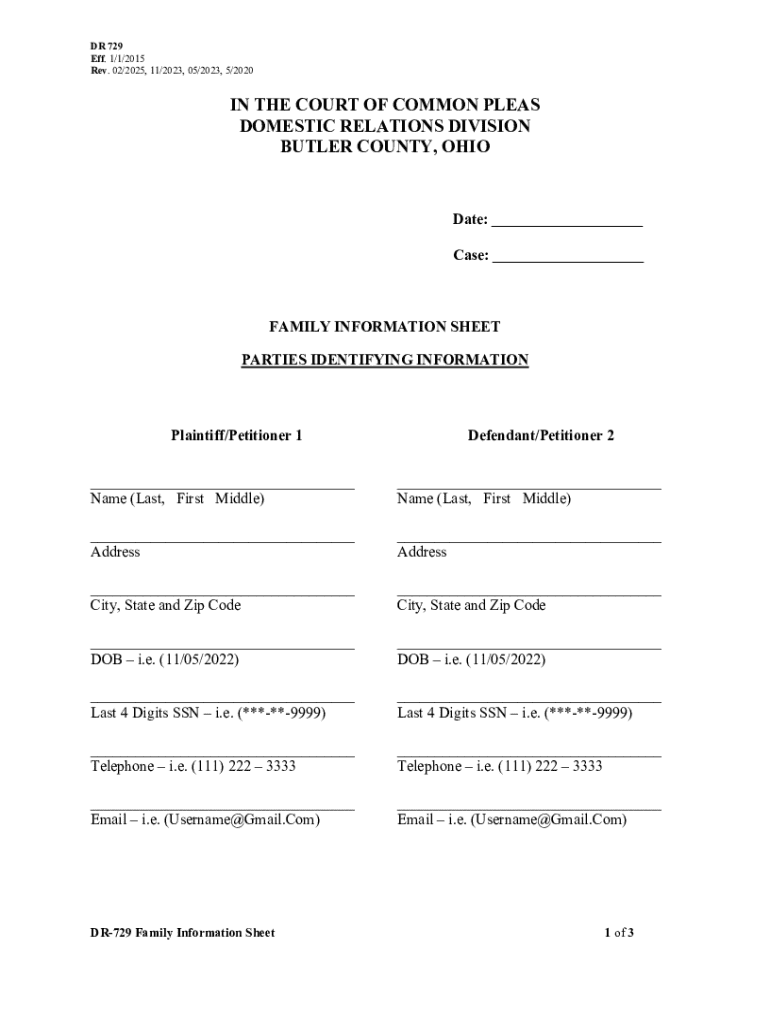

Overview of the DR 729 Form

The DR 729 form is an essential documentation tool used in various administrative and legal processes. This form is designed to collect necessary information for specific transactions, applications, or legal procedures, facilitating accurate documentation and compliance.

Primarily, the DR 729 form serves various purposes, including financial declarations, property transactions, and compliance with state regulations. It is crucial for users to understand the importance of this form as any errors or incomplete information can lead to delays or legal complications.

Detailed instructions for completing the DR 729 Form

Completing the DR 729 form requires attention to detail. The form is typically divided into sections, each requesting specific information. Understanding each section's requirements is vital to avoid potential issues down the road.

Section-by-section breakdown

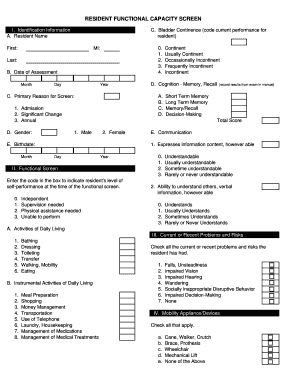

The first section usually gathers personal information such as your name, address, and contact details. Make sure this information is accurate, as it will be used for official communications.

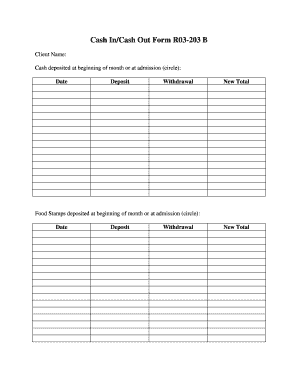

The next section covers financial information and assets. Include all necessary details concerning income, expenses, and assets. Be honest and precise; discrepancies may lead to complications.

Finally, many forms allow space for additional notes or comments. Use this space wisely to clarify any unique circumstances related to your situation.

Common mistakes to avoid

Tips for clear and accurate entries

To ensure the DR 729 form is filled out correctly, use legible handwriting or digital entry tools. Double-check each entry and consider having someone else review your form before submission.

Editing and customizing your DR 729 form with pdfFiller

pdfFiller offers a robust platform for managing forms like the DR 729. You can upload the form in various supported formats, streamlining the editing process, making it accessible and user-friendly.

Uploading your DR 729 form

Uploading the DR 729 form is straightforward. Supported formats include PDF, DOCX, and images. Follow these steps for a seamless upload:

Editing features of pdfFiller

Once uploaded, pdfFiller's editing features allow you to add text, check marks, and digital signatures easily. This makes it possible to convert your DR 729 form into a fully editable document. Utilize templates and pre-filled data to save time.

Collaborating on the form

Collaboration is easy with pdfFiller. Share the DR 729 form with team members by sending a link or inviting them to collaborate directly within the platform. Real-time editing allows teams to contribute and give feedback effortlessly.

Signing the DR 729 form

Signing is an integral component of finalizing your DR 729 form. With pdfFiller, eSigning is straightforward and offers various options.

eSigning your DR 729 form

Choose from multiple eSigning options, including digital signatures, uploaded signatures, or drawing your own. It's crucial to ensure that your signature is verified to confirm authenticity.

Sending the signed form for review

After signing, you can easily send the DR 729 form for review. Simply email the form directly from pdfFiller or download it for sharing. It’s also important to understand the document security features that pdfFiller provides to protect your sensitive information.

Managing your DR 729 form

Once you have submitted your DR 729 form, managing it properly is essential for tracking and record-keeping. pdfFiller’s cloud storage offers numerous benefits.

Cloud storage benefits with pdfFiller

With pdfFiller, you can access your documents anywhere, at any time, provided you have internet access. Organize your forms and related documents systematically for easy retrieval.

Tracking document status

Stay informed about your document's progress. pdfFiller sends notifications when documents are viewed or signed, ensuring you’re always updated.

Future editing and updates

If you need to revise your DR 729 form later, pdfFiller's platform allows for easy updates. You simply open the document, make any changes as needed, and resubmit it.

Accessing additional resources and support

For any questions or issues related to the DR 729 form, pdfFiller provides ample resources. Frequently asked questions can help clarify common concerns, while customer support is ready to assist with specific queries.

Support options available through pdfFiller

To access support, you can contact customer service directly through the platform. Additionally, valuable tutorials and user guides are available to help you navigate the form and utilize pdfFiller effectively.

Real-world applications of the DR 729 form

Understanding the impact of the DR 729 form in real-world scenarios is significant. Various case studies highlight how accurate and timely submission can streamline processes.

User testimonials on the impact of using pdfFiller

Many users have reported success after utilizing pdfFiller to manage their DR 729 forms. Testimonials showcase how the platform has simplified their documentation process and improved compliance.

Legal implications of properly executing the DR 729 form

Properly filling and executing the DR 729 form can have significant legal implications. Ensuring accuracy and completeness safeguards against potential disputes and upholds compliance within legal frameworks.

Related forms and templates

In addition to the DR 729 form, several related forms may be necessary depending on your circumstances. Understanding these related documents can assist in providing a comprehensive approach to your needs.

Overview of similar forms

Several documents compare closely with the DR 729, especially concerning financial declarations and real estate transactions. This juxtaposition can aid in understanding where and how each form fits into various processes.

How to find other relevant forms on pdfFiller

Finding other relevant forms on pdfFiller is intuitive. Use the search functionalities on the website to locate specific forms or browse related categories to discover additional templates.

Creating custom templates for future use

Furthermore, pdfFiller allows users to create and save custom templates. This feature ensures that your most-used forms, including the DR 729, are readily available for future submissions, significantly enhancing efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete dr 729 online?

Can I create an electronic signature for the dr 729 in Chrome?

Can I edit dr 729 on an iOS device?

What is dr 729?

Who is required to file dr 729?

How to fill out dr 729?

What is the purpose of dr 729?

What information must be reported on dr 729?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.