Get the free Rpd-41335

Get, Create, Make and Sign rpd-41335

Editing rpd-41335 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rpd-41335

How to fill out rpd-41335

Who needs rpd-41335?

A Comprehensive Guide to the rpd-41335 Form

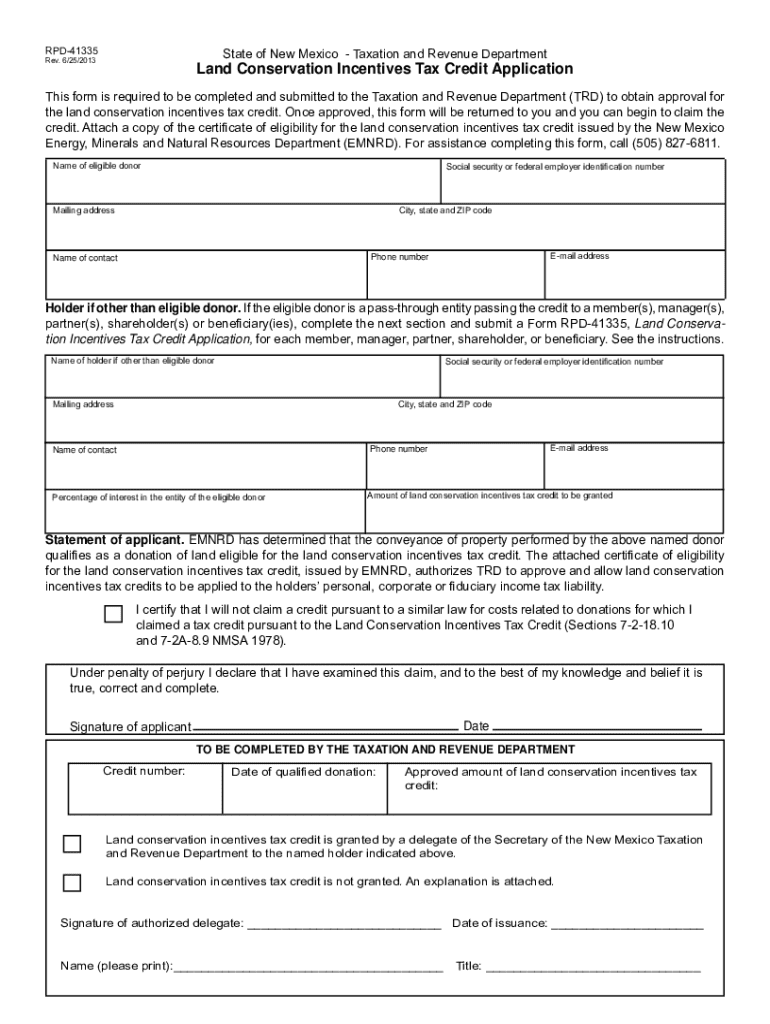

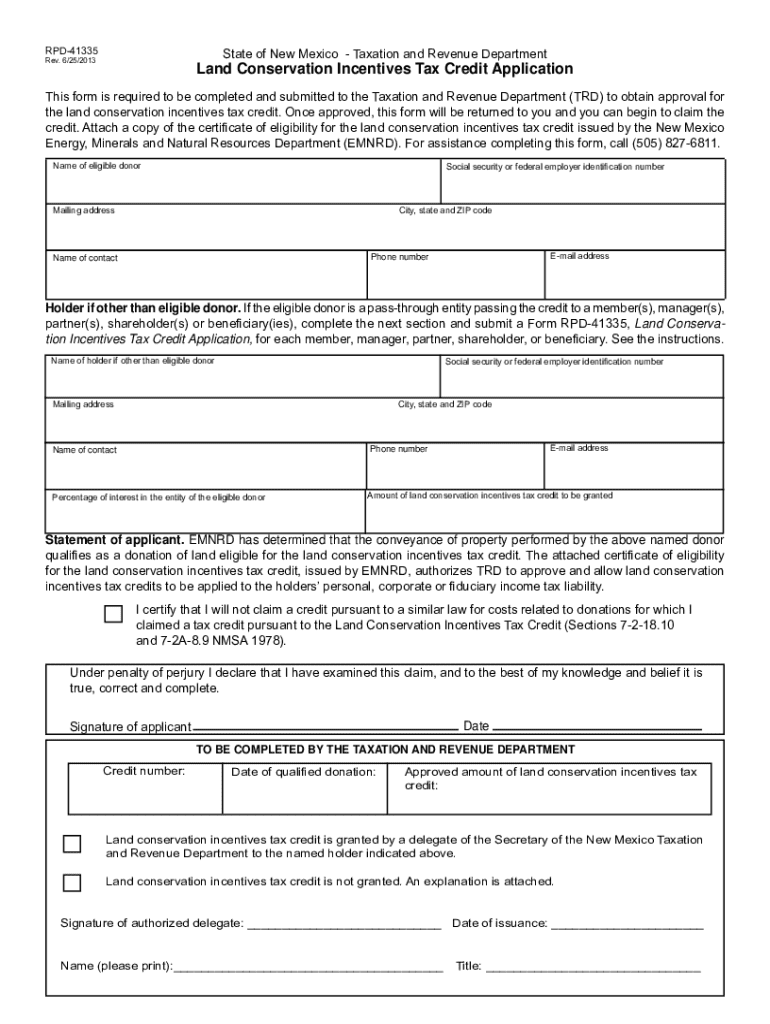

Understanding the rpd-41335 form

The rpd-41335 form plays a critical role in various administrative and compliance processes. It is a structured document used for multiple purposes, from tax submissions to regulatory reporting. Understanding the significance of this form is essential, as it can streamline processes and ensure that necessary information is accurately conveyed to relevant authorities.

Common applications of the rpd-41335 form are seen in tax filings, business registrations, and compliance reports. Its versatility makes it a go-to document for both individuals and organizations. Accurate completion of this form is vital to avoid delays and complications.

Importance of accurate completion

Errors and omissions in the rpd-41335 form can have serious ramifications, potentially leading to penalties or rejection of the submission. For instance, a misreported income figure could trigger audits, resulting in time-consuming investigations. When filling out the rpd-41335 form, precision is paramount to ensure swift approvals and maintain compliance.

Moreover, inaccuracies can impede the processing timeline, delaying critical approvals. Staying vigilant about every detail, from personal data to financial information, directly impacts the form's acceptance. Thus, it’s essential for users to approach the rpd-41335 form with diligence and attention to detail.

Getting started with the rpd-41335 form

Accessing the rpd-41335 form is straightforward. It can typically be found on the official website of the relevant government departments or regulatory bodies. Having a reliable means of downloading the form ensures that you're working with the most current version. Users should always obtain the document from verified sources to avoid any discrepancies that could arise from outdated forms.

After locating the form, it can be downloaded in PDF format for ease of use or printed if a hard copy is preferred. Ensure you have the necessary information on hand before starting the completion to make the process smoother.

Necessary information and documentation

Filling out the rpd-41335 form correctly requires comprehensive information. Users should be prepared to provide their personal details, including full name, address, tax identification number, and any other required identifiers.

In addition, financial data is often needed, ranging from income figures to asset declarations. Depending on the purpose of the form, other supporting documents may be necessary, such as previous tax returns or compliance certificates. It's always wise to check the specific guidelines to ensure that all required information is gathered ahead of time.

Step-by-step guide to filling out the rpd-41335 form

Navigating the rpd-41335 form can be simplified by breaking it down section by section. The first part typically entails providing personal information. This includes your full name, contact details, and identification numbers. It is imperative that this information is accurate, as discrepancies can lead to processing delays.

The next section usually involves financial disclosures. Here, users must report income, deductions, and other financial matters relevant to the form's purpose. Ensuring that these figures are correct and substantiated with appropriate documentation is vital. Lastly, the form requires signatures and dates to validate the submission, emphasizing the importance of clarity and precision in these areas.

Tips for ensuring accuracy

To minimize mistakes, it’s crucial to take your time when filling out the rpd-41335 form. Common pitfalls include misplacing decimal points in financial sections or omitting required documents. Double-checking entries before final submission can save you from unwanted delays.

Additionally, having a second pair of eyes review the information can help catch potential mistakes. Utilizing tools like pdfFiller provides an added layer of convenience and assurance, where users can save their progress and return later to verify the data.

Editing and managing the rpd-41335 form

Once you have your rpd-41335 form ready, managing it is essential for effective document handling. pdfFiller offers a user-friendly platform for editing the rpd-41335 form with ease. Features such as auto-fill can expedite the process by automatically filling in known information based on your previous entries.

Additionally, pdfFiller allows for eSignature integration, enabling you to securely sign the document digitally. Collaboration options are also available, making it easier to work with your team on form completion, ensuring everyone’s input is accounted for and mistakes are minimized.

Saving and sharing options

In a world where time is money, being able to save your progress on the rpd-41335 form is invaluable. pdfFiller allows users to save their ongoing work without submitting it. This option is particularly useful when dealing with complex forms that require careful consideration. You can return to the form later to complete it without fear of losing any data.

Once completed, sharing the rpd-41335 form is also streamlined. pdfFiller offers secure options for sharing, ensuring that your sensitive information remains protected while ensuring that necessary parties have access.

eSigning the rpd-41335 form

With the shift toward digital documentation, understanding eSignature legality is crucial. In most jurisdictions, electronic signatures are recognized as valid, provided certain conditions are met. This recognition streamlines processes and reduces the reliance on paper, offering a more convenient approach to signing important documents like the rpd-41335 form.

The eSigning process with pdfFiller is straightforward. Users can easily add their electronic signature directly into the rpd-41335 form, verifying their identity while ensuring that the document is authenticated and official. Furthermore, it facilitates adding multiple signers if needed, accommodating collaborative needs seamlessly.

Submitting the rpd-41335 form

When you're ready to submit the rpd-41335 form, understanding your submission options is essential. There are generally two pathways available: online submission and traditional paper submission. Online submission is often faster and more efficient, allowing for immediate processing and reduced mailing times.

It is also critical to keep deadlines in mind. Each jurisdiction may have specific due dates for submission, which must be adhered to for compliance. Using pdfFiller can further ensure that you maintain timeliness, as it helps track submission statuses and reminders effectively.

Tracking the submission status

Being able to monitor the status of your rpd-41335 form submission can alleviate much of the anxiety associated with the waiting period. With pdfFiller’s tracking features, users can receive updates on their submissions, including whether they have been accepted, rejected, or require further action. This capability is essential, as it keeps you informed and allows you to respond promptly to any requests.

Common FAQs about the rpd-41335 form

Numerous questions often arise regarding the rpd-41335 form. A frequent concern includes clarity around what specific information needs to be included, especially for first-time users. Additionally, people tend to inquire about penalties for late submissions and the implications of errors on the form.

For ongoing support, users are encouraged to connect with support teams or consult online resources and forums where information can be shared. These platforms often provide real-world examples and insights that can clarify any uncertainties.

Advanced features for managing rpd-41335 forms

Enhancing your experience with the rpd-41335 form can be made easier through advanced features available in pdfFiller. For collaborative environments, pdfFiller allows multiple users to edit a document simultaneously. This feature is particularly beneficial for teams that need to work together on form completion, enabling real-time updates and comments.

Moreover, integration with cloud services like Google Drive or Dropbox can further streamline workflows. This integration facilitates seamless document retrieval and management from various platforms, ensuring that your form access remains hassle-free and organized.

User testimonials and success stories

Users of the rpd-41335 form have shared numerous success stories reflecting the efficiencies gained through its use. Many report that employing pdfFiller has significantly reduced their administrative workload, allowing them to focus more on critical tasks rather than paperwork.

These testimonials highlight the convenience of digital form submission and management, citing clearer tracking of submission status as a key benefit. Real-time collaborative features have also been praised, making form filling a much simpler and faster process.

Final thoughts on the rpd-41335 form

Embracing digital tools for handling documents like the rpd-41335 form can significantly improve efficiency. pdfFiller empowers users with the ability to edit, sign, collaborate, and manage their documents within a single cloud-based platform. This all-in-one solution enhances productivity while easing challenges commonly associated with traditional paperwork.

As we move further into the digital age, utilizing innovative technologies for document management will only become more essential. Users are encouraged to leverage platforms like pdfFiller to stay ahead of the curve and streamline their workflows considerably.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit rpd-41335 online?

How can I edit rpd-41335 on a smartphone?

Can I edit rpd-41335 on an Android device?

What is rpd-41335?

Who is required to file rpd-41335?

How to fill out rpd-41335?

What is the purpose of rpd-41335?

What information must be reported on rpd-41335?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.