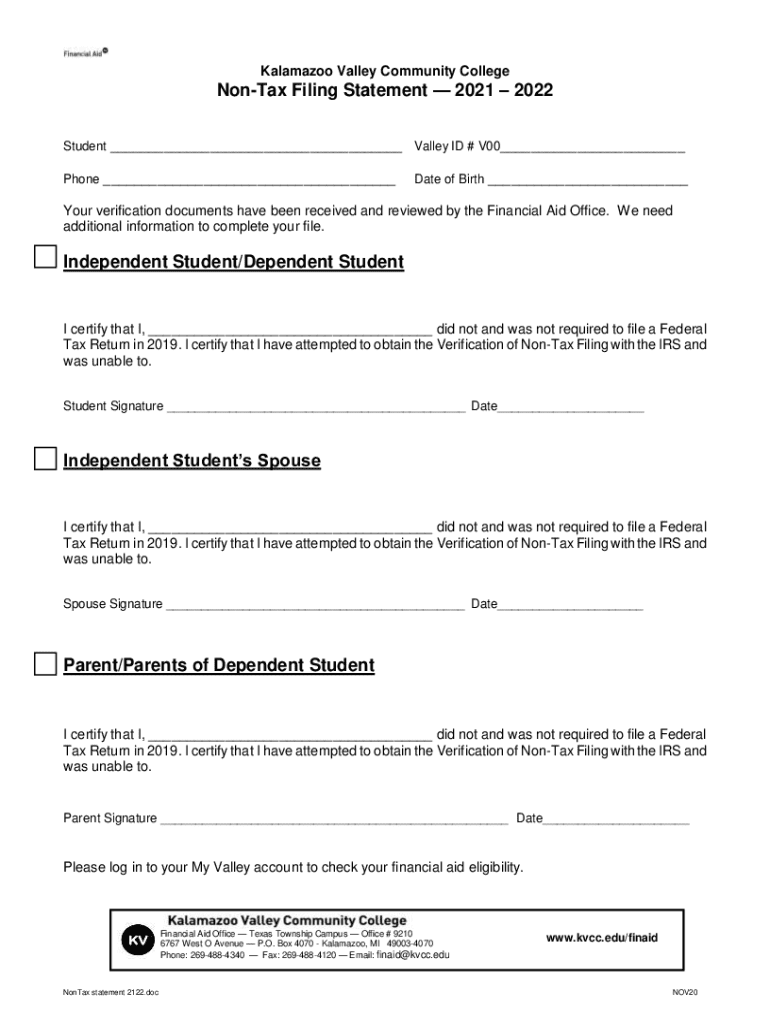

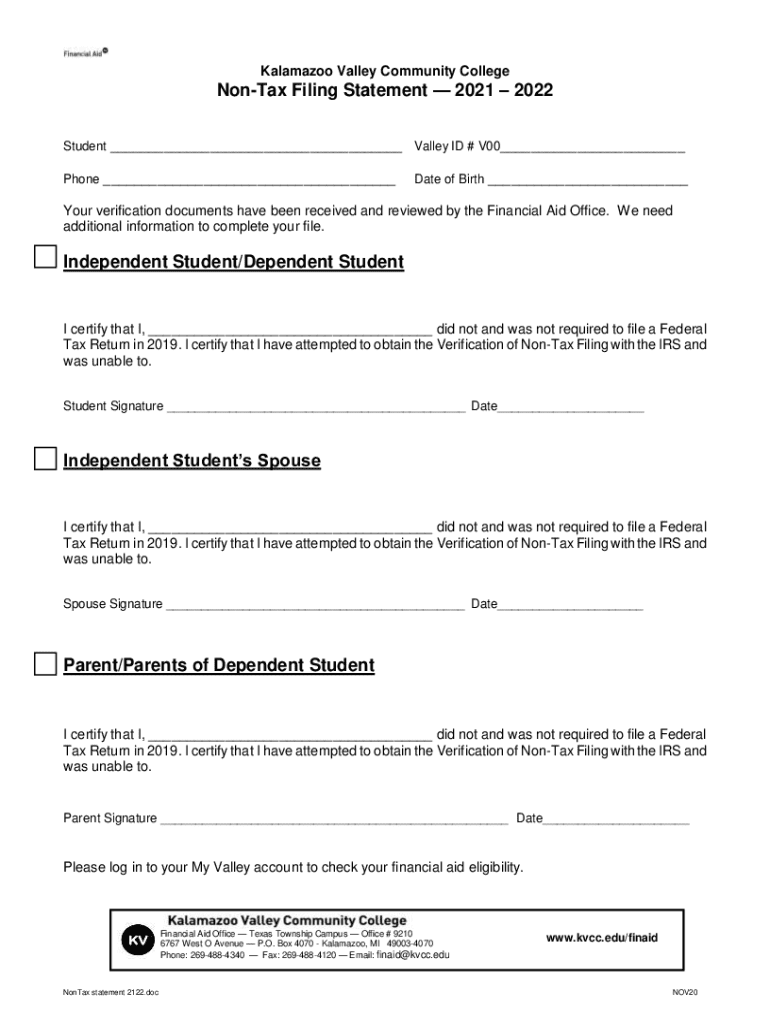

Get the free Non-tax Filing Statement — 2021 – 2022

Get, Create, Make and Sign non-tax filing statement 2021

Editing non-tax filing statement 2021 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-tax filing statement 2021

How to fill out non-tax filing statement 2021

Who needs non-tax filing statement 2021?

A comprehensive guide to the non-tax filing statement 2021 form

Understanding the non-tax filing statement

The non-tax filing statement 2021 form is designed for individuals who do not need to file a traditional tax return. This form serves as an official declaration that the individual had no requirement to file taxes in the given year. This is especially important for specific demographics, such as low-income earners, students, or retirees, who may have earned below the minimum threshold necessitating a formal tax filing.

Understanding the significance of this form is crucial. It provides a clear record of non-filing status, which can be beneficial for various official purposes such as applying for loans, government assistance, or healthcare benefits. Filing this statement acts as documentation that can help individuals establish their financial circumstances.

Typically, individuals who should consider filing a non-tax filing statement include those reporting minimal income, dependents under a certain age, or individuals who have no taxable income due to specific exemptions. These individuals may be leveraging other financial aids or benefits, which require clear documentation of non-filing status.

Key features of the 2021 non-tax filing statement form

The 2021 non-tax filing statement form has been structured to gather essential information in a straightforward manner. The overall layout is user-friendly, designed to guide filers through the process without overwhelming them. Each section is intended to capture critical details such as name, Social Security Number, and the reason for non-filing.

Key information required includes personal identification details and a clear explanation of the reasons behind the non-tax filing status. It is essential to differentiate between this statement and other tax forms. A non-tax filing statement does not involve calculations of tax owed or refunds due; instead, it confirms the absence of a tax obligation for the year.

Step-by-step guide to filling out the non-tax filing statement

Completing the non-tax filing statement can be performed efficiently by following a systematic approach. The first step involves downloading the 2021 form, which is readily accessible through platforms like pdfFiller. Users can choose from several formats, including printable PDF or editable online versions, ensuring accessibility.

Upon accessing the form, the required personal details must be entered. This includes basic identification information like your name, contact details, and your Social Security Number or your ITIN. This data is crucial for verifying your identity as well as for administrative purposes.

Next, it’s important to indicate your non-tax filing status. This can be achieved by reviewing the listed criteria on the form and selecting the most appropriate category for your situation, such as being a full-time student or having no income.

Following this, any additional sections should be completed. This could involve answering specific questions regarding your financial situation or providing further details if relevant. Once all sections are filled out, conduct a final review to ensure accuracy and completeness before submission.

Utilizing pdfFiller to enhance your experience

Using pdfFiller not only simplifies the process of completing the non-tax filing statement 2021 form but also enhances overall user experience with its interactive features. The fillable PDF options allow users to input data directly into the form, which greatly reduces paper clutter and streamlines information entry.

Additionally, pdfFiller provides eSignature capabilities, making it easier for users to sign and submit their statements electronically. This feature is particularly useful for individuals who are on the go or managing multiple submissions, saving both time and effort.

Collaboration is another strength of pdfFiller. Users can share forms with team members for review or make edits collaboratively in real-time. The tracking of comments and changes ensures that everyone stays on the same page, thus enhancing the accuracy and reliability of submissions.

Special considerations and FAQs

When filing a non-tax filing statement 2021 form, some common questions are frequently asked. Many individuals are unclear about who exactly needs to file this statement, especially in cases of shared financial situations or varying income levels throughout the year. It is important to note that if you earn less than the IRS established thresholds for your filing status, you likely qualify for non-filing.

Clarifications regarding the distinctions between tax filings and non-tax filings are also essential. Unlike a regular tax return that might involve complex calculations, the non-tax filing statement serves solely to establish your status of non-filing, without any financial implications.

It is advisable to keep records of this non-tax filing statement. Such documentation might be required by lenders, insurance companies, or for future government benefits. Regular monitoring of your financial and tax status can also help you stay compliant with any obligations.

Seeking assistance with your non-tax filing statement

For further assistance, pdfFiller provides customer support that is readily accessible. Users can contact support via the website, where live chat or email options are available. Knowing the office hours can also help manage expectations regarding response times.

Should you require alternative platforms, several other services offer similar capabilities for filling out forms online. However, pdfFiller’s unique features—like collaborative editing and comprehensive document management—create a seamless experience that sets it apart from competitors.

Related resources and further reading for 2021 forms

Exploring additional resources related to the non-tax filing statement and general tax forms can provide further clarity. Valuable links to IRS resources are helpful for staying updated on any changes in tax regulations or filing requirements. Supplementary tools for document management can aid individuals in efficiently organizing their financial affairs.

Moreover, as the tax landscape changes yearly, being informed on other forms and filings relevant to non-tax statements is crucial for anyone navigating financial responsibilities. Continuous education through reliable resources ensures that individuals remain compliant and well-prepared for their financial engagements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit non-tax filing statement 2021 online?

How do I fill out non-tax filing statement 2021 using my mobile device?

How do I complete non-tax filing statement 2021 on an iOS device?

What is non-tax filing statement?

Who is required to file non-tax filing statement?

How to fill out non-tax filing statement?

What is the purpose of non-tax filing statement?

What information must be reported on non-tax filing statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.