Get the free Invoice

Get, Create, Make and Sign invoice

How to edit invoice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out invoice

How to fill out invoice

Who needs invoice?

Comprehensive Invoice Form How-to Guide

Understanding invoice forms

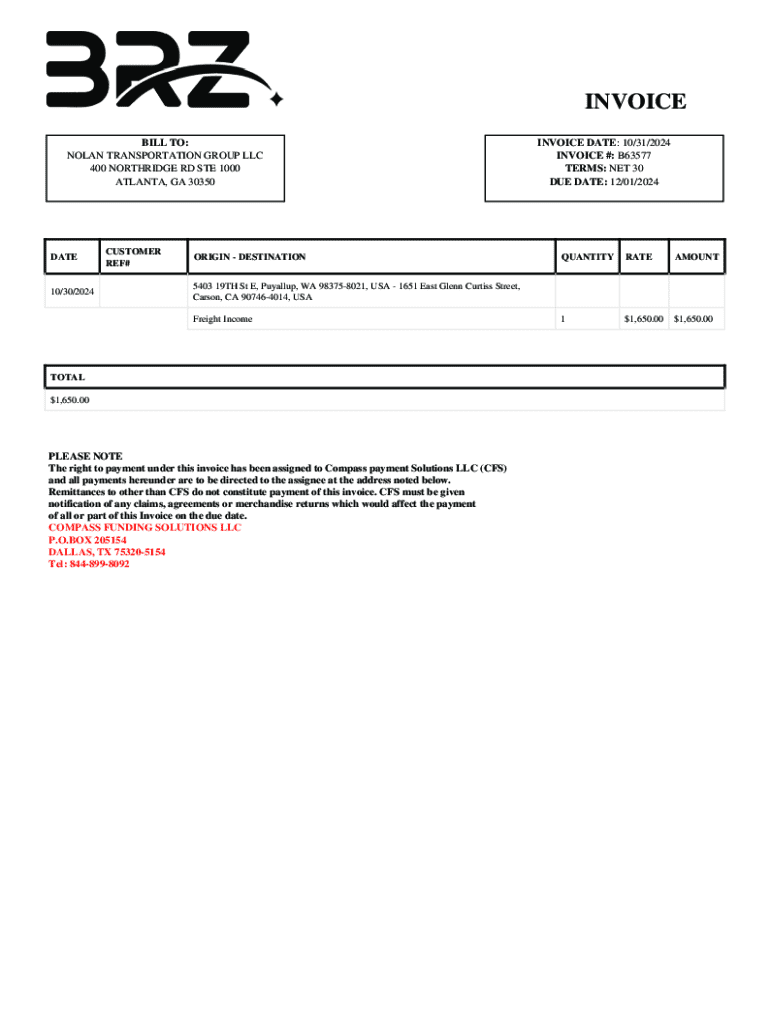

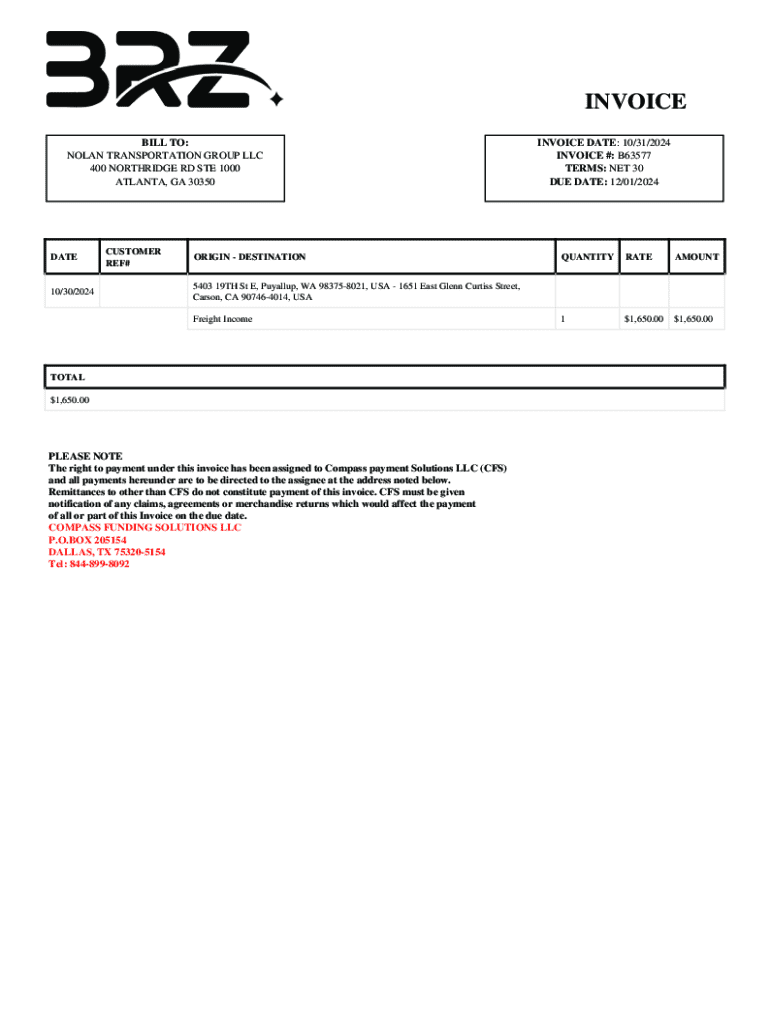

An invoice form is a crucial document that serves as a request for payment from a seller to a buyer, detailing the services rendered or products sold. These documents are not only vital for maintaining financial accuracy but also for establishing professional relationships between businesses and clients. Accurate invoice forms help in ensuring that businesses receive timely payments, reinforcing cash flow and operational efficiency.

There are various types of invoice forms utilized in business transactions, including standard invoices that itemize specific services or goods, pro forma invoices which provide estimated costs before the sale, and commercial invoices which fulfill certain export requirements. Understanding these types allows users to choose the appropriate invoice form based on their transaction needs.

Key components of an invoice form

Every invoice form contains specific components that ensure clarity and completeness. Starting with the header information, it should include the business name, contact information, an invoice number, the date of issuance, and the payment due date. These elements help in organizing and tracking invoices efficiently.

The billing information is critical, encompassing the customer's name, contact details, and billing address, which again streamlines the invoicing process. Following this, invoice details such as a description of products or services provided, an itemized list of charges, and the breakdown of taxes and discounts should be meticulously included to prevent misunderstandings.

Lastly, notes on acceptable payment methods and the total amount due provide essential guidance for clients on how to fulfill their payment obligations.

How to create an invoice form

Creating an invoice form may seem daunting, but following a few simple steps can streamline the process. First, choose the right invoice template from pdfFiller that suits your business style. Next, enter your business details, including name, address, and contact information, in the header. Accuracy is key; ensure that you fill in customer billing information correctly to avoid delays in payment.

List all products or services provided along with detailed descriptions to add transparency. After that, ensure you calculate taxes and any applicable discounts meticulously to avoid miscalculations. Lastly, it’s essential to clearly state the payment terms and conditions, which should include deadlines and methods of payment accepted.

For branding purposes, consider customizing your invoice form by adding your logo, choosing suitable colors, and adjusting fonts to align with your company’s identity.

Editing an invoice form

With pdfFiller’s robust editing tools, managing your invoice forms becomes a straightforward task. You can easily add or remove items from the invoice as business needs change. Adjusting prices, taxes, and totals is effortless, allowing you to keep your records accurate and current.

In addition, there are formatting options available to enhance the visual appeal of your invoice. A well-formatted invoice not only looks professional but also improves readability for your clients. Once finalized, you can save and store your invoices for easy retrieval in the future, ensuring that you’re never without a record when needed.

Signing and approving invoice forms

The inclusion of signatures on invoice forms can play a significant role in confirming transactions. To facilitate this process, pdfFiller allows users to electronically sign invoices conveniently. This feature not only saves time but also reduces the hassle of printing, signing, and scanning physical documents.

Moreover, for teams requiring approval workflows, pdfFiller supports setting up such processes, ensuring that team members can collaborate effectively. Compliance with legal electronic signature requirements is also critical, making digital signatures a legally valid option that simplifies transactions and enhances security.

Managing invoice forms

Efficient management of invoice forms is essential for businesses of all sizes. Keeping track of invoices sent and received can be simplified through organized digital storage. Using pdfFiller’s cloud-based tools, users can manage all invoices in one secure location, making them easily retrievable for reference.

Automation features are also available to help in managing follow-ups and reminders regarding unpaid invoices, which can significantly enhance cash flow management. With these features, businesses can operate with increased organization and efficiency.

Common mistakes to avoid with invoice forms

Understanding common pitfalls associated with invoice forms is crucial for avoiding costly mistakes. Frequent errors include misspelled customer names, incorrect item descriptions, and miscalculations of totals. Such inaccuracies can lead to delays in payment and strain business relationships.

To prevent these errors, thorough verification of invoice accuracy before sending is suggested. Consistently reviewing invoices against prepared quotes or contracts can help ensure that all information matches precisely. Best practices include leveraging checklists and peer reviews to eliminate chances of oversight.

Frequently asked questions about invoice forms

Many users have inquiries regarding the use of invoice forms. One common question is what to do if an invoice needs to be amended after it's been sent. The recommended approach is to communicate transparently with your client, issue a corrected invoice, and mark the original as void.

Another common concern is how to handle disputed invoices. Promptly addressing the issue by reviewing the details, discussing discrepancies with the client, and agreeing on a resolution can ensure that both parties maintain a productive relationship. Finally, be mindful of legal considerations surrounding invoicing, such as including required disclosures and adhering to tax regulations.

Utilizing interactive tools and resources

pdfFiller offers several interactive features aimed at enhancing the invoicing experience. Users can leverage templates and design tools that allow for easy customization, keeping branded invoices consistent and recognizable to clients. Interactive elements, such as dropdown menus for payment methods, can also improve user experience by providing clearer options for clients.

Sharing invoices with clients for feedback is seamless through pdfFiller’s platform. The ability to enable real-time feedback on invoices can expedite approvals and reduce back-and-forth communication, making the invoicing process smoother and more efficient.

Final thoughts on invoice forms

Well-crafted invoices play an essential role in streamlining payment processes for businesses. Taking the time to ensure your invoice forms are accurate and professional can profoundly impact your cash flow and overall business efficiency. By adopting efficient invoicing solutions like those offered by pdfFiller, teams can enhance their productivity, ensuring invoices are not only sent but are also tracked and managed effectively.

Encouraging teams to embrace these tools fosters a culture of attention to detail and excellence in financial documentation, essential elements for sustained business success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my invoice in Gmail?

How do I execute invoice online?

Can I create an electronic signature for signing my invoice in Gmail?

What is invoice?

Who is required to file invoice?

How to fill out invoice?

What is the purpose of invoice?

What information must be reported on invoice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.