Get the free Homeowners Affordability Tax Credit (hatc)

Get, Create, Make and Sign homeowners affordability tax credit

Editing homeowners affordability tax credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out homeowners affordability tax credit

How to fill out homeowners affordability tax credit

Who needs homeowners affordability tax credit?

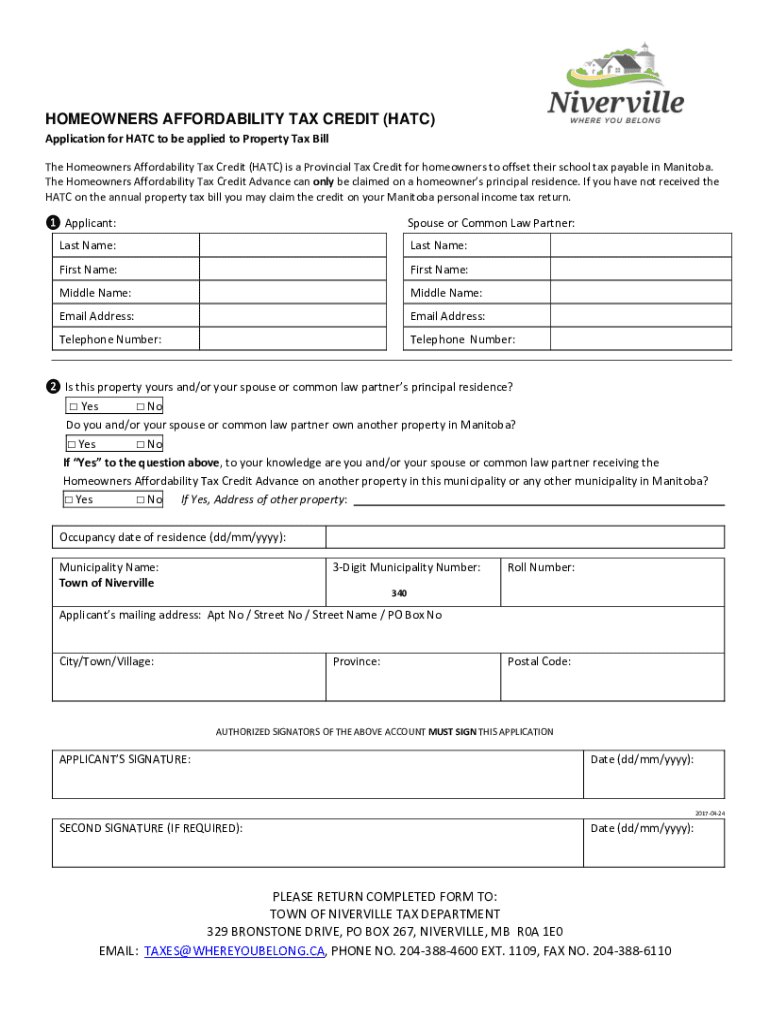

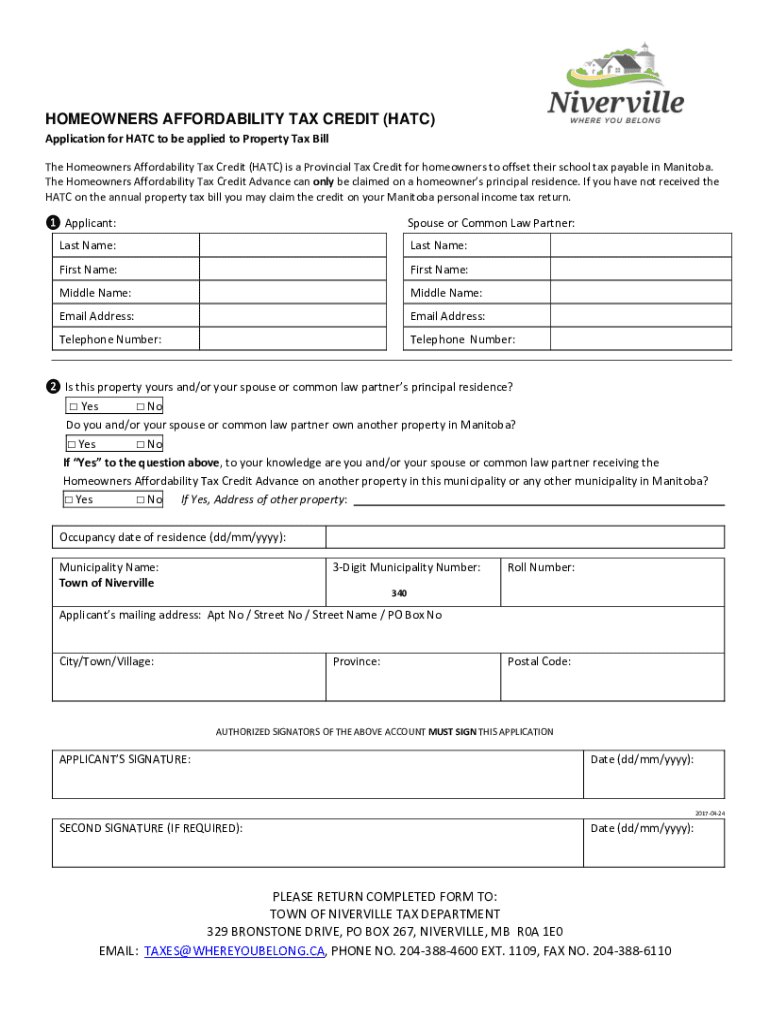

Understanding the Homeowners Affordability Tax Credit Form

Overview of the homeowners affordability tax credit

The homeowners affordability tax credit is a vital financial relief instrument designed to assist individuals in mitigating the financial burden of homeownership. This tax credit aims to make homeownership more accessible, especially for lower- and middle-income families. By reducing tax liabilities, the credit provides direct financial benefits that are crucial for maintaining housing stability. Given the rising costs of living and housing prices, the importance of this credit cannot be overstated, as it helps homeowners keep their homes affordable in the face of economic fluctuations.

Eligibility for the homeowners affordability tax credit typically includes several criteria. To qualify, the homeowner must reside in the property, meet specific income thresholds, and own the home outright or be financing it through a mortgage. Understanding these criteria is essential for individuals to accurately assess their eligibility for assistance. Furthermore, the credit can lead to significant savings that can be redirected toward other essential expenses, such as education, healthcare, or household maintenance.

Key benefits of filing the homeowners affordability tax credit form

Filing the homeowners affordability tax credit form can yield substantial financial relief for homeowners. By lowering the amount owed during tax time, homeowners can allocate more funds toward essential needs like food, healthcare, and education. This shift in financial capacity enables families to invest in their future instead of merely covering immediate costs, thus promoting long-term financial wellness.

Additionally, the impact of this tax credit stretches beyond the individual homeowner. By fostering affordability, it often leads to an increase in homeownership rates. As more people secure homes without overextending their finances, entire communities can experience revitalization. Increased homeownership contributes to stable neighborhoods, improved school systems, and reduced crime rates. Hence, this credit is not just an individual benefit; it has the potential to stimulate broader economic growth.

Understanding the homeowners affordability tax credit form

The homeowners affordability tax credit form consists of several key components that must be completed accurately to ensure approval. The first section, the Personal Information Section, requires basic details such as the homeowner's name, tax identification number, and contact information. Accurate entry of this information is crucial as discrepancies can delay the application process.

The Property Information Section follows, where homeowners must provide specifics about the property, including the address, type of property, and how long it has been owned. Additionally, the Eligibility Confirmation Section is where applicants verify that they meet the necessary criteria for the tax credit. Proper understanding of common terms, such as 'qualified homeowner' and 'ownership documentation,' is vital in this context. Ensuring accurate completion of these sections minimizes the risk of application rejection due to common pitfalls.

Step-by-step guide to completing the homeowners affordability tax credit form

Completing the homeowners affordability tax credit form requires meticulous attention. Here’s a step-by-step guide to streamline the process:

Tips for editing and managing your homeowners affordability tax credit form

pdfFiller enhances the experience of editing the homeowners affordability tax credit form. Utilizing pdfFiller's robust editing capabilities, users can easily upload their forms and make necessary adjustments without hassle. The platform allows for efficient editing through a user-friendly interface, ensuring that the form's integrity is maintained. Moreover, take advantage of the eSignature features available on pdfFiller to authenticate your submission seamlessly.

Collaboration becomes second nature with pdfFiller as team members can access and edit documents from anywhere. This ensures that all parties involved are on the same page. Additionally, users can save and manage different versions of their forms in the cloud, making it easy to track changes and retrieve previous versions whenever needed. Utilizing these features reduces errors and enhances document management efficiency.

Common mistakes to avoid when filling out the form

Navigating the homeowners affordability tax credit form can be challenging, and avoiding pitfalls is crucial for success. Common mistakes that applicants should watch out for include misinterpreting eligibility criteria, which might lead to submitting an application when they do not qualify. Another frequent error is incorrect data entry; filling out the form inaccurately can delay processing or result in application rejection.

Failing to provide necessary supporting documents is also a significant mistake. Applications with missing paperwork can be put on hold, leading to frustrating delays. Furthermore, applicants should ensure they adhere to submission guidelines meticulously. Neglecting even small details, like signatures or submission methods, might hinder the application's acceptance. Stepping through each part of the form methodically can significantly reduce these risks.

Frequently asked questions (FAQs)

Understanding the nuances of the homeowners affordability tax credit can often lead to additional questions. Here are several common queries:

Real-life case studies and success stories

Hearing from real homeowners provides a valuable perspective on the impact of the homeowners affordability tax credit. For instance, one family in Austin successfully navigated the application process and received a significant credit amount that alleviated their housing costs. This immediate financial relief allowed them to save for future educational expenses for their children, thus altering their financial trajectory.

Moreover, stories from families who escrow the savings from the tax credit often highlight how it has enabled them to tackle other financial goals, such as retirement savings or home improvements. The transformational effects of the credit can often ripple throughout families and communities, demonstrating its broader significance.

Staying up-to-date with homeowners affordability tax credit changes

Tax laws are continually evolving, including those related to the homeowners affordability tax credit. Regularly monitoring these changes is essential for current and prospective homeowners alike. Staying updated can save individuals not only a lot of time but also ensure they take full advantage of tax benefits.

pdfFiller provides tools to help users stay informed about relevant tax law changes, thereby enhancing their ability to manage and maximize their tax credit submissions effectively. Users can set up alerts and notifications through the platform, keeping them in the loop and prepared for any updates that may affect their applications.

Interactive tools and resources available on pdfFiller

pdfFiller offers a range of interactive tools that empower users in managing their homeowners affordability tax credit form effectively. One essential feature is the document management tool, which allows users to create, edit, and store forms securely online. The platform also provides access to various templates and examples that guide users in properly gathering their information.

In addition, pdfFiller’s collaborative features facilitate teamwork by enabling multiple users to work together on documents. This ensures that applications can be completed more efficiently, with all necessary details captured accurately. Enhanced tools for tracking changes and managing document versions further simplify the submission process, leading to improved accuracy and fewer errors.

Related forms and templates you may need

Homeowners often require various forms and templates in addition to the homeowners affordability tax credit form. These might include forms related to mortgage agreements, property tax exemptions, and maintenance records. pdfFiller provides easy access to these documents, allowing users to remain organized and up-to-date.

For example, users may find it beneficial to download a property tax exemption application or a maintenance log template that helps keep track of home repairs. By having these related documents readily available, homeowners can streamline their financial planning while further understanding their responsibilities as property owners.

User testimonials and feedback

Feedback from users who have utilized pdfFiller for their homeowners affordability tax credit form shows a positive trend in user experience. Many customers highlight the platform's ease of use, especially in the form editing and collaborative aspects. Users appreciate how the streamlined process has saved them both time and effort, enabling them to focus on other essential tasks.

In testimonials, homeowners express gratitude for the clarity provided by the pdfFiller platform when filling out complex forms. These appreciations underline the impact that user-friendly tools can have on overcoming administrative hurdles, allowing individuals to navigate the often daunting landscape of tax credits and homeownership seamlessly.

How to contact pdfFiller for support

When navigating the homeowners affordability tax credit form, assistance may be needed from time to time. pdfFiller offers comprehensive customer service options to support users in their application journey. Whether through live chat or email support, help is readily available for users seeking guidance.

Additionally, pdfFiller provides a range of tutorials that can walk users through various aspects of form completion. These resources empower users to handle the complexities of their homeowner tax credit form proficiently, making the entire process smoother and more manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify homeowners affordability tax credit without leaving Google Drive?

How do I execute homeowners affordability tax credit online?

How do I make edits in homeowners affordability tax credit without leaving Chrome?

What is homeowners affordability tax credit?

Who is required to file homeowners affordability tax credit?

How to fill out homeowners affordability tax credit?

What is the purpose of homeowners affordability tax credit?

What information must be reported on homeowners affordability tax credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.