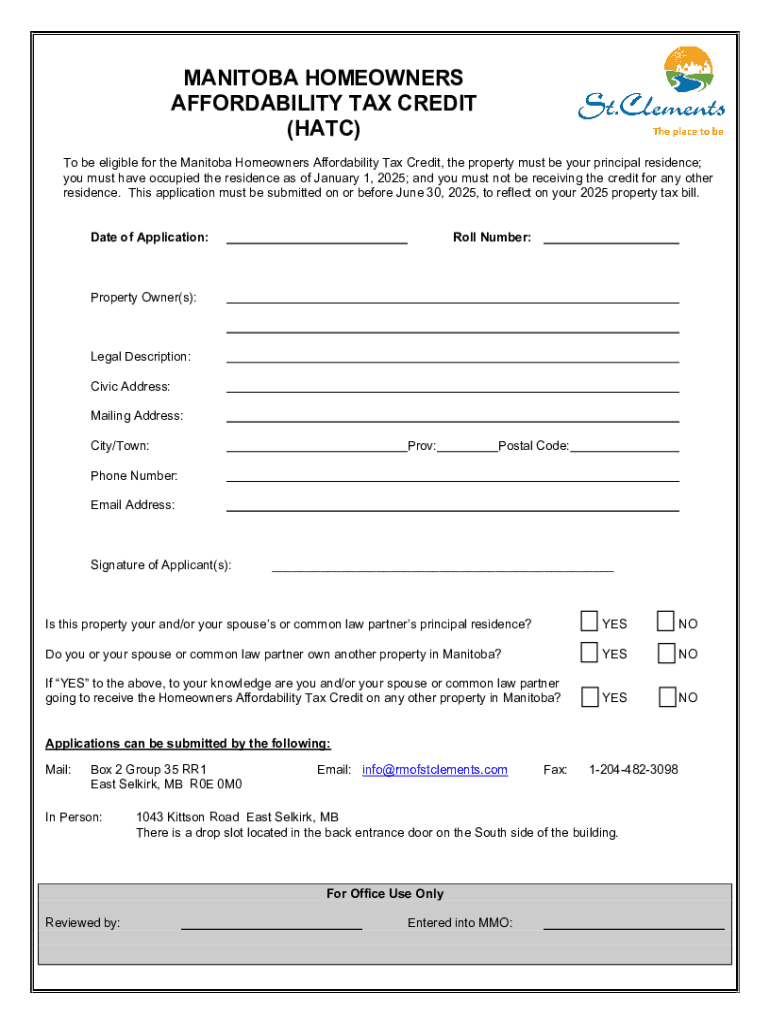

Get the free Manitoba Homeowners Affordability Tax Credit (hatc)

Get, Create, Make and Sign manitoba homeowners affordability tax

Editing manitoba homeowners affordability tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out manitoba homeowners affordability tax

How to fill out manitoba homeowners affordability tax

Who needs manitoba homeowners affordability tax?

Manitoba homeowners affordability tax form: A comprehensive guide

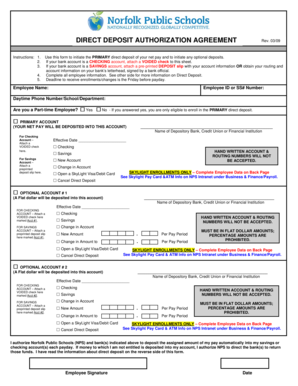

Understanding the homeowners affordability tax form

The Manitoba homeowners affordability tax form is an essential tool for residents seeking financial relief. Designed to assist homeowners in managing housing costs, this form provides access to benefits that can significantly lower annual property taxes.

This initiative is particularly crucial for Manitoba homeowners who may face rising living expenses. The form is part of a broader aim to enhance affordability within the housing sector, especially for those impacted by increasing utility costs and property values.

Eligibility is typically based on several factors, including property ownership, residence status, and income level. Understanding these criteria is pivotal for homeowners to successfully navigate the application process.

Step-by-step guide to completing the Manitoba homeowners affordability tax form

Filling out the Manitoba homeowners affordability tax form can seem daunting, but by following these steps, you’ll streamline the process and increase your chances of successful submission.

Step 1: Gather necessary documentation

Prepare the following documents to simplify the application process:

Step 2: Access the tax form

The tax form can be accessed online through various official provincial websites or downloaded directly from pdfFiller, which simplifies form management with user-friendly tools.

At pdfFiller, you can find the form easily by searching for 'Manitoba homeowners affordability tax form' in the document library.

Step 3: Filling out the form

Follow these guidelines while completing the form to prevent common errors that could delay your processing:

Step 4: Review your entries

Once you’ve filled out the form, it’s critical to review all entries for accuracy. Utilize pdfFiller's editing tools to correct any errors before final submission.

Taking the time to verify your information not only maintains accuracy but also ensures your application is successful and processed in a timely manner.

Utilizing pdfFiller for efficient form management

pdfFiller stands out as an exceptional resource for managing the Manitoba homeowners affordability tax form, providing an array of features designed to streamline your document experience.

Editing PDFs made easy

With pdfFiller, editing PDFs is a breeze. You can easily modify existing text, delete unnecessary sections, and add new information without hassle. These features eliminate the need to start from scratch, significantly reducing the time spent on filling out forms.

eSigning made simple

Incorporating digital signatures is straightforward with pdfFiller. After filling in your form, you can add your eSignature effortlessly, ensuring your submission is legally binding and accepted by authorities.

Collaboration features

If you're applying alongside family members or seeking advice from friends, pdfFiller's collaboration tools allow for real-time editing and sharing. You can invite others to review your form and make necessary changes, enhancing the overall accuracy of your application.

FAQs about the Manitoba homeowners affordability tax form

Navigating tax forms can bring many questions, especially for first-time applicants. Here are some frequently asked questions regarding the Manitoba homeowners affordability tax form.

What if miss the submission deadline?

If you miss the deadline, you will likely not qualify for benefits for that year. However, it’s advisable to contact your local tax office for potential remedies or options available based on your circumstances.

How do check the status of my application?

You can check the status of your application by contacting the Manitoba tax office where you submitted your form. They can provide updates and clarify any outstanding requirements.

Can amend my submissions after filing?

Yes, amendments can be made after filing. Reach out to your local tax authority, explain the amendments needed, and follow their instructions to adjust your submission.

Local resources and support for homeowners

Homeowners in Manitoba should take advantage of various local resources designed to assist with tax-related issues. Here are a few key sources of support:

Stay informed: Relevant updates and changes

It's crucial for homeowners to stay informed about changes in tax regulations and programs. Recent amendments can impact eligibility and benefits, making awareness necessary for maximizing your tax relief.

Each year, the Manitoba government reviews homeowner assistance programs, and updates may affect submission processes. pdfFiller ensures that users are notified of significant tax form changes, providing timely information directly within the platform.

User experiences and testimonials

Many Manitoba homeowners have successfully navigated the homeowners affordability tax form, sharing valuable insights about their experiences. These testimonials often highlight how easy it is to use pdfFiller for filling out, editing, and submitting required forms.

For instance, one user reported, 'Using pdfFiller made my submission straightforward. I was worried about making mistakes, but their tools helped me catch errors before sending everything off.' Such feedback underscores the positive impact that the form and its associated management tools can have on personal budgeting.

Interactive tools for personal budgeting

With financial pressure often looming for homeowners, incorporating budgeting tools can help alleviate stress. pdfFiller not only facilitates tax document management but also offers budgeting calculators and resources.

You can leverage insights from your tax return to inform your budgeting decisions. Using pdfFiller's financial documents, it becomes easier to assess your overall financial health and make informed decisions about spending and savings.

By accessing all required documents from a single platform, you can efficiently manage your finances, ensuring that the intricate web of tax and personal expenses is more manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete manitoba homeowners affordability tax online?

Can I sign the manitoba homeowners affordability tax electronically in Chrome?

How do I fill out manitoba homeowners affordability tax on an Android device?

What is manitoba homeowners affordability tax?

Who is required to file manitoba homeowners affordability tax?

How to fill out manitoba homeowners affordability tax?

What is the purpose of manitoba homeowners affordability tax?

What information must be reported on manitoba homeowners affordability tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.