Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Comprehensive Guide to Sec Form 4

Overview of Sec Form 4

Sec Form 4 is a crucial document required by the U.S. Securities and Exchange Commission (SEC) for the reporting of insider trades. This form allows corporate insiders — including executives and directors — to register transactions involving their company's securities. As part of regulatory reporting, the primary aim of Sec Form 4 is to enhance transparency and accountability within the financial markets.

The importance of Sec Form 4 in regulatory reporting cannot be overstated. It serves as a mechanism for keeping investors informed about significant transactions that could impact stock prices. When insiders buy or sell shares, it can signal their confidence or concerns regarding the company's future performance.

Understanding the components of Sec Form 4

Sec Form 4 consists of various components that ensure comprehensive reporting of insider transactions. Learning these components is essential for accurate completion and compliance with SEC regulations.

Transaction codes explained

The form utilizes specific transaction codes to categorize the nature of each trade. Common transaction codes might include 'P' for purchases and 'S' for sales. Understanding these codes helps in correctly reporting the type of transaction and its implications for market activity.

Required information for completion

In completing Sec Form 4, insiders must provide personal details such as name, address, and their relationship to the company. Additionally, they need to report details of the securities involved, including the class of securities, transaction dates, and types. This comprehensive approach ensures every transaction is adequately documented, which is essential for compliance.

Filing dates and deadlines

Insiders are required to file Sec Form 4 within two business days following the execution of a relevant transaction. Adhering to this timeline is critical for compliance, and failure to do so can result in penalties from the SEC. Keeping a structured filing calendar is advisable to avoid any compliance issues.

Step-by-step guide to filling out Sec Form 4

Filling out Sec Form 4 accurately is pivotal for compliance. This step-by-step guide will help insiders navigate the filing process efficiently.

Gathering necessary information

Begin by gathering all pertinent documentation. This includes previous filings, transaction records, and any additional background information relevant to the securities involved. Having all necessary documentation at hand helps streamline the process and reduces the chance of errors.

Filling out the form: a detailed walkthrough

Once the necessary information is assembled, start filling out the Sec Form 4. The first step is inputting personal information, such as the insider's name and address. Ensuring this information is accurate is crucial as any mismatch can lead to compliance issues.

Next, provide transaction details, including the type of transaction and the date. After completing this section, review and verify the data entered to ensure accuracy and completeness before submission.

Tips for efficiently completing Sec Form 4

To optimize the filling process of Sec Form 4, consider using templates and digital tools available on [pdfFiller](). These resources can significantly enhance efficiency and ensure accuracy.

Avoid common pitfalls, such as overlooking transaction codes or deadlines. Double-checking your information is vital to prevent errors that can complicate regulatory processes.

Navigating the eFiling process

Filing Sec Form 4 electronically is a straightforward process, and it is vital for ensuring timely submissions. To file online, visit the SEC's EDGAR database where the form can be submitted.

How to submit Sec Form 4 electronically

Follow these steps for online submission:

Upon submission, you should receive a confirmation receipt. Additionally, you can track your filing status through the EDGAR system for peace of mind.

Handling amendments and corrections

In cases where an error is discovered in Sec Form 4 after submission, it is essential to address it promptly. The SEC allows for the form to be amended, which requires filing a new version with corrections noted.

When and how to amend a Sec Form 4

Amendments must be filed as soon as possible, alongside an explanation of the corrections made. This transparency helps maintain regulatory compliance and fosters trust with investors.

When engaging with the SEC regarding amendments, maintain clear communication and provide any supporting documentation when necessary.

Compliance and regulatory considerations

Understanding SEC regulations related to Sec Form 4 is crucial for maintaining compliance. The SEC expects insiders to adhere strictly to outlined rules, including timely filings and accurate reporting.

Non-compliance can result in substantial penalties, impacting not only the individual but also the company’s reputation. Additionally, keeping accurate records facilitates future audits and potential reviews by regulators.

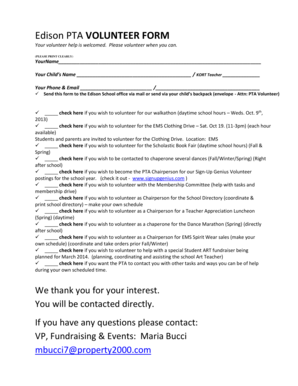

Interactive tools available on pdfFiller

Using pdfFiller provides numerous interactive features that streamline the process of completing Sec Form 4. From document editing to electronic signing, these tools simplify what can often be a daunting task.

Collaboration tools available on the platform can enhance team efforts, allowing multiple users to work on the document simultaneously and efficiently.

Resources for further assistance

Managing Sec Form 4 can seem challenging, but there are numerous resources available to assist you. Utilizing the right tools and software can streamline the process, making it easier to comply with SEC regulations.

Additionally, consider reaching out to support at [pdfFiller]() if you encounter difficulties while using their platform. They also provide educational resources and tutorials to enhance your understanding of how to fill out Form 4 effectively.

Case studies and examples

Real-world applications of Sec Form 4 illustrate its importance in market dynamics. Noteworthy company filings often reveal trends and insights into investor confidence, influencing market behavior.

Users who have successfully utilized pdfFiller for completing Sec Form 4 have reported enhanced efficiency, reduced errors, and improved compliance management. Their testimonials highlight how leveraging digital tools can significantly ease the burden of regulatory paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sec form 4 without leaving Google Drive?

Where do I find sec form 4?

How do I edit sec form 4 in Chrome?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.