Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Understanding Form 10-Q: A Comprehensive Guide

Understanding Form 10-Q

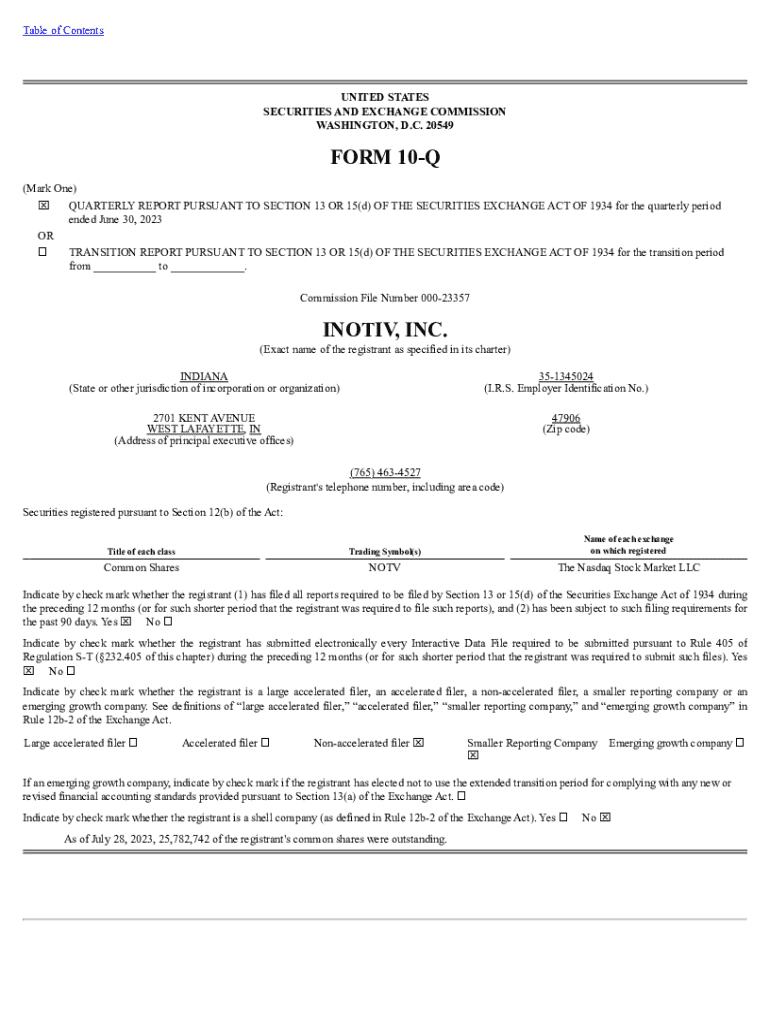

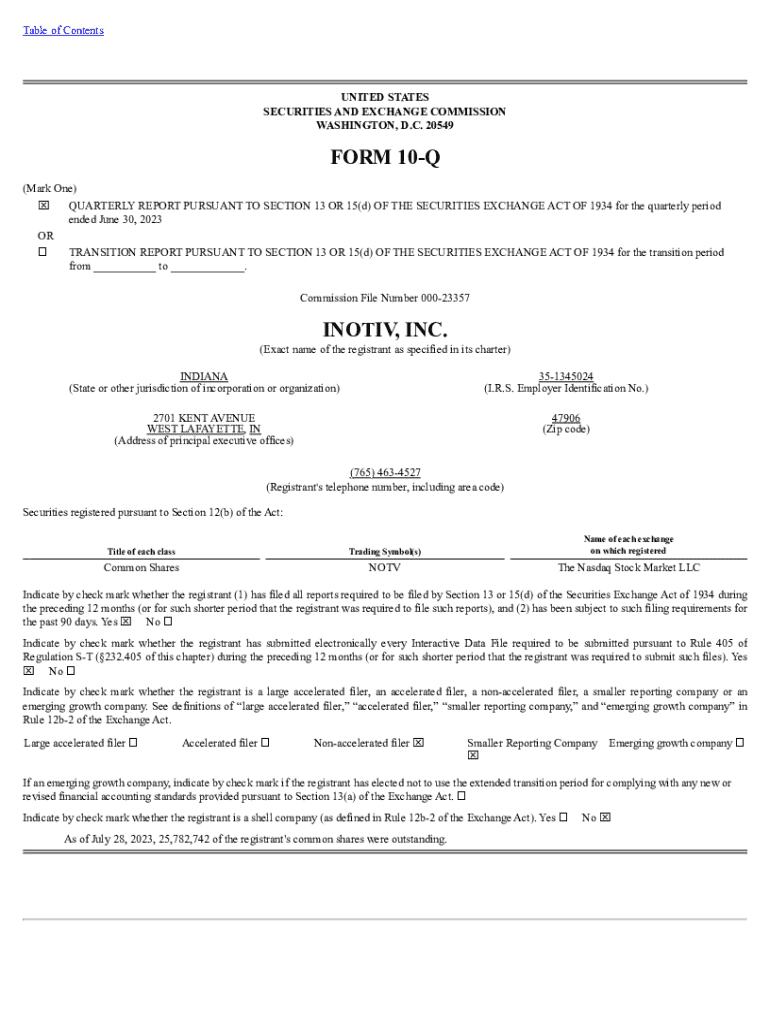

Form 10-Q is a quarterly report mandated by the U.S. Securities and Exchange Commission (SEC) for public companies. This filing provides a comprehensive overview of a company's financial performance, detailing its financial statements and management's analysis of its current financial position since the end of the last fiscal quarter. Unlike the annual Form 10-K, which requires exhaustive information, the Form 10-Q offers a more succinct, quarterly snapshot of a company's performance.

Form 10-Q is critical for ensuring transparency in the financial markets. It allows investors, analysts, and stakeholders to track the company’s performance, assess its financial health, and make informed decisions. Each 10-Q filing serves not only as a compliance requirement but also as a platform to communicate insights about the organization's operational changes, financial fluctuations, and projections.

Purpose and key elements of Form 10-Q

The primary objectives of filing a 10-Q encompass regulatory compliance and fulfilling the informational needs of investors. Publicly traded companies must adhere to SEC regulations, ensuring that all material changes that could influence an investor's decision are disclosed in a timely fashion.

10-Q filing requirements

Entities mandated to file Form 10-Q include all publicly traded companies in the United States, including large corporations and small businesses. This requirement ensures that all such organizations maintain transparency and provide up-to-date information to their investors.

Companies must file their Form 10-Q within 40 days of the end of each fiscal quarter. Timely filing is essential; failure to do so can result in penalties from the SEC, including fines and suspension of trading on stock exchanges. Non-compliance can severely damage a company's credibility with investors.

Key highlights of Form 10-Q

Analyzing trends within 10-Q filings can unveil important insights into market behaviors and potential future outcomes for companies. For instance, frequent fluctuations in revenue and expenses may signal operational challenges or changing market dynamics.

Tools for managing 10-Q filings

pdfFiller enhances the 10-Q filing process through a suite of user-friendly features. The platform allows users to create, edit, and manage all aspects of their Form 10-Q filing while maintaining compliance with SEC requirements. One of the key functionalities of pdfFiller is its ability to streamline document revision and approvals, leading to a more efficient filing process.

Collaborative tools within pdfFiller enable teams to work together in real-time. This is particularly beneficial for companies with multiple stakeholders involved in the filing process. Having an interactive platform facilitates smoother communication and reduces the time spent on version control.

Step-by-step guide to filling out a Form 10-Q

Before initiating the filing process, businesses must prepare by gathering all necessary data such as financial statements, operational updates, and previous 10-Q filings.

Filling out financial statements involves reporting accurate numbers on assets, liabilities, and shareholder’s equity. Companies should refer to trial balances and accounting records completed up to the reporting date.

The Management's Discussion and Analysis (MD&A) should be drafted with careful articulation of the company's performance, addressing key drivers of fiscal trends and future projections to give context to the raw numbers.

Risk disclosures require drafting with precision. Companies should present both quantitative risk metrics, appealing to investors’ analytical needs, and qualitative insights to contextualize risk within the broader market landscape.

How to submit and track your filing

Submitting Form 10-Q is done electronically through the SEC's EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system. The submission is straightforward: log in to your EDGAR account, upload your completed Form 10-Q, review for accuracy, and submit.

Tracking your filing status is crucial for ensuring compliance. The EDGAR system allows users to monitor their filed documents, making it easy to confirm that your Form 10-Q has been processed and is publicly accessible.

Finding Form 10-Qs

Searching for existing Form 10-Q filings is easy via the SEC database. Users can search by company name or ticker symbol to access their required filings. This is invaluable for investors prospective buyers to undertake comparative analysis with other companies.

Key takeaways from existing Form 10-Q filings may include financial performance insights, risk disclosures, and strategic developments that have occurred over the quarter. By reviewing multiple filings, stakeholders can glean best practices and benchmarks pertinent to their industry.

Common challenges and solutions

Completing a Form 10-Q can come with challenges, such as ensuring accurate financial reporting or meeting deadline requirements amid operational changes. Companies may struggle with data consistency or management consensus on analytical narratives.

Utilizing pdfFiller can help businesses mitigate these typical issues. Features allowing document versioning, collaborative editing, and integrated compliance checks empower companies to navigate the complexities of filing successfully.

Related products and solutions

In addition to Form 10-Q, pdfFiller supports related SEC filings and various document templates. This functionality creates a seamless filing experience—ensuring consistency across filings while simplifying the entire reporting process.

The broader ecosystem of document management within pdfFiller encourages efficient document handling across multiple filing types, enabling companies to streamline reporting and enhance productivity.

Interactive features offered by pdfFiller

Real-time collaboration and editing are key strengths of pdfFiller. Team members can work concurrently on different sections of the Form 10-Q, allowing for faster completion and comprehensive input from multiple perspectives.

E-signature integration further simplifies the submission process. With legally binding e-signatures available within the platform, users can quickly obtain necessary approvals, enhancing workflow and compliance with filing requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 10-q?

How do I make edits in form 10-q without leaving Chrome?

How do I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.