Get the free Payroll Time Clock Correction Form

Get, Create, Make and Sign payroll time clock correction

Editing payroll time clock correction online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll time clock correction

How to fill out payroll time clock correction

Who needs payroll time clock correction?

Payroll Time Clock Correction Form - How-to Guide

Understanding payroll time clock corrections

Accurate timekeeping is crucial for businesses and employees alike, directly impacting payment accuracy and overall workplace morale. When hours worked are not recorded correctly, it can lead to disputes over pay, dissatisfaction among employees, and possible legal ramifications for employers. Adhering to timekeeping standards is not just a matter of convenience; it's an essential aspect of compliance with labor laws and regulations.

Common reasons for payroll time clock corrections often stem from human error or system issues. Employees may accidentally clock in or out incorrectly, or timekeeping systems may experience glitches. Additionally, changes in shift schedules or adjustments due to overtime can lead to the need for corrections. Recognizing the typical scenarios necessitating a payroll time clock correction form equips employees and managers to address issues promptly.

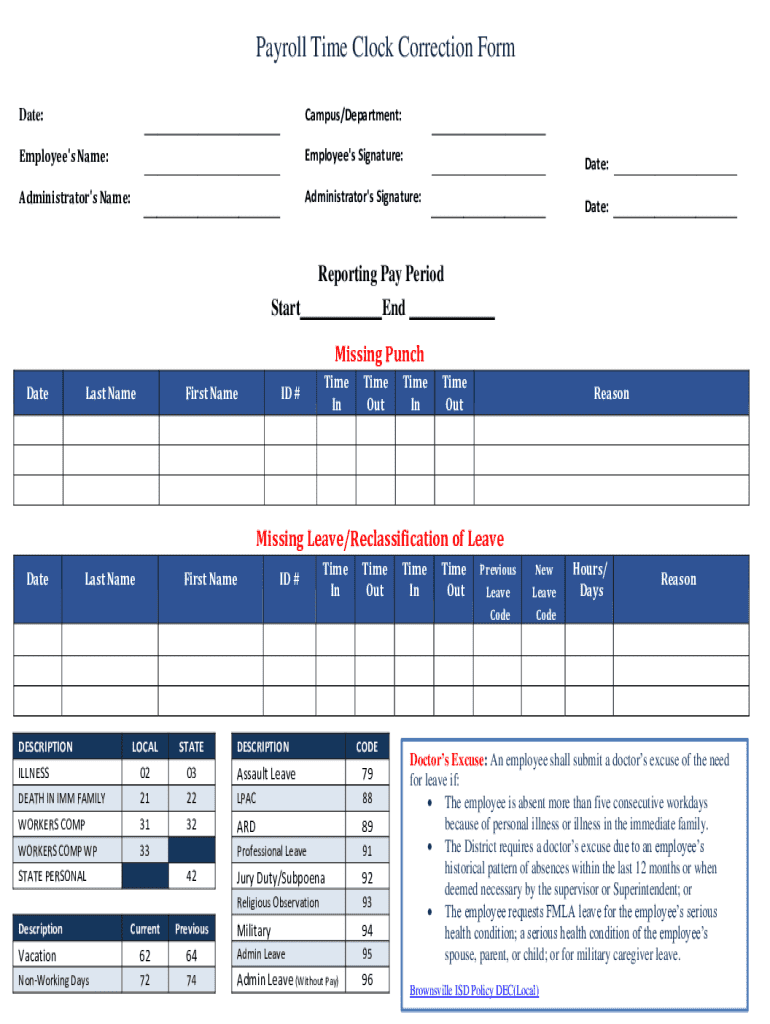

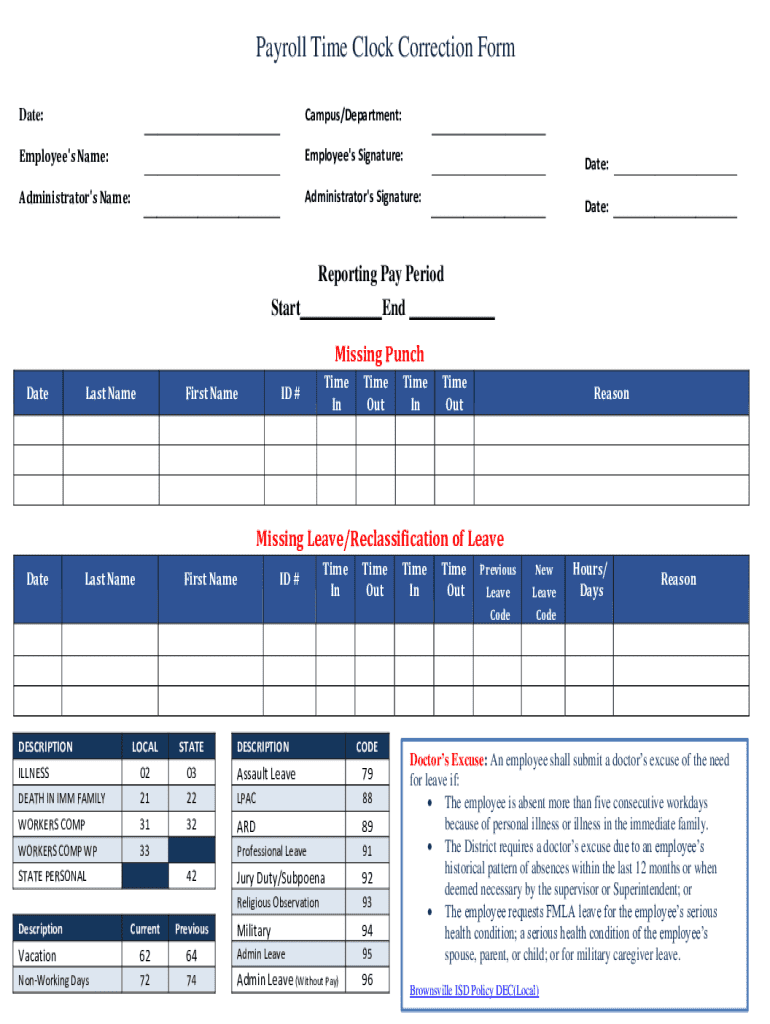

Overview of the payroll time clock correction form

The payroll time clock correction form serves a fundamental purpose in maintaining accurate employee time records. This document is specifically designed to address various time-related corrections such as missed clock-ins, incorrect clock-outs, or adjustments for overtime hours worked. Utilizing this form enables a structured process for addressing discrepancies, ensuring that payroll departments can rectify errors efficiently.

Key components of the payroll time clock correction form include essential employee information, dates, times, and detailed correction reasons. The form typically features sections for the employee's details, specific correction notes, and a mandatory manager approval section. This structured approach facilitates a smooth workflow, ensuring that all corrections are documented and authorized properly before payroll adjustments are made.

Step-by-step guide to completing the payroll time clock correction form

Accessing the payroll time clock correction form is typically straightforward through your company’s internal systems or digital platforms such as pdfFiller. To find the form, simply navigate to the designated section for payroll or human resources documents, and download it in your preferred format or fill it out digitally. Practicing digital form entry not only saves time but also minimizes the chances of human error.

When filling out the employee information section, always ensure all required fields are completed meticulously. Double-checking this information is crucial to avoid unnecessary delays. Specify correction details clearly. Clearly articulate the nature of the corrections, highlighting specific dates and times for accuracy. It's essential to be as specific as possible to prevent confusion or misinterpretation once the form is reviewed.

Before submitting, ensure you have acquired any necessary approvals. Generally, the immediate supervisor or manager must sign off on the corrections requested. Following best practices, ensure that signatures are obtained promptly to minimize payroll processing delays. Having a two-step approval process can enhance accuracy and accountability in payroll corrections.

Editing and customizing the form with pdfFiller

Utilizing pdfFiller’s editing tools significantly enhances the efficiency of completing payroll time clock correction forms. The platform allows users to add text fields, dropdown menus, and checkboxes that simplify data entry. Customizing the document to suit your specific correction needs ensures clarity and reduces room for error. You can also add notes or annotations within the form, providing additional context where necessary.

Collaboration is made easy with pdfFiller as you can share the form with teammates, managers, or payroll departments in real time. This collaborative capability not only speeds up the correction process but also allows for updates and discussions on the specifics of the corrections as they happen. By leveraging real-time collaboration features, teams can ensure everyone involved is on the same page.

eSigning the payroll time clock correction form

Electronic signatures (eSignatures) have become a staple in modern document management due to their legal validity and security features. They provide a faster alternative to traditional signatures and eliminate the need for physical paperwork, which can be cumbersome in today’s fast-paced work environment. The use of eSignatures on the payroll time clock correction form ensures that the process remains efficient while maintaining compliance with legal standards.

To eSign the form on pdfFiller, simply access the eSignature feature within the editing tools. Here, you can create your signature by drawing, typing, or uploading an image of your handwritten signature. Once completed, you can send the form for signature requests, track who has signed and when, ensuring that all necessary approvals are secured efficiently.

Submitting the completed correction form

Best practices for submitting the payroll time clock correction form emphasize choosing the most appropriate submission route. This could include email or internal systems that the payroll department regularly checks. Confirming receipt of the form is essential to guarantee it will be processed, as delays in submission can lead to further complications in payroll operations.

After submission, it's important to know the follow-up procedures to make certain that your time clock changes are implemented adequately. Keeping a record of the submitted correction form and any related correspondence can serve as a personal tracking measure. This record can be invaluable in case you need to reference the correction in the future.

Troubleshooting common issues with payroll time clock corrections

Common mistakes encountered during the correction process often include incorrect time entries or omissions, such as missing signatures or approvals. Avoiding these errors is imperative to streamline the workflows in payroll processes. Double-checking every entry for accuracy before submission can significantly decrease the chances of delay or denials.

If the correction form is denied, consult with your manager or payroll department to understand the reasons for the denial. Often, feedback will guide you on how to improve future submissions. Learning from any mistakes ensures a smoother process the next time corrections are needed.

Maintaining compliance and best practices

To ensure compliance, understanding your organization’s time clock policies is key. Each company may have specific guidelines surrounding timekeeping and corrections, and being familiar with them can prevent issues down the line. It’s recommended that employees regularly review their time entries to identify discrepancies early. Frequent checks create a proactive approach, making it easier to address mistakes before they escalate.

Furthermore, offering training and resources to employees regarding timekeeping can equip them with the knowledge required to clock in and out correctly. Regular workshops or informational sessions can lead to better practices and help minimize the number of correction forms needed.

The role of technology in timekeeping

Digital timekeeping solutions present numerous advantages, including enhanced efficiency and improved accuracy in recording hours worked. Compared to traditional methods, digital platforms like pdfFiller provide real-time access to time records, allowing employees and managers to monitor entries effectively. This transition reduces manual errors and fosters a more streamlined payroll process.

Emerging trends in payroll and timekeeping indicate a strong movement towards smart technology integration. Automated systems, artificial intelligence, and mobile access are reshaping the landscape. As tools become more sophisticated, pdfFiller continues to adapt, ensuring that users have access to the latest features and solutions to meet their evolving documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify payroll time clock correction without leaving Google Drive?

How do I make edits in payroll time clock correction without leaving Chrome?

Can I create an eSignature for the payroll time clock correction in Gmail?

What is payroll time clock correction?

Who is required to file payroll time clock correction?

How to fill out payroll time clock correction?

What is the purpose of payroll time clock correction?

What information must be reported on payroll time clock correction?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.