Get the free Approval of Payroll Disbursements

Get, Create, Make and Sign approval of payroll disbursements

How to edit approval of payroll disbursements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out approval of payroll disbursements

How to fill out approval of payroll disbursements

Who needs approval of payroll disbursements?

Approval of Payroll Disbursements Form: How-to Guide Long-Read

Understanding the payroll disbursements process

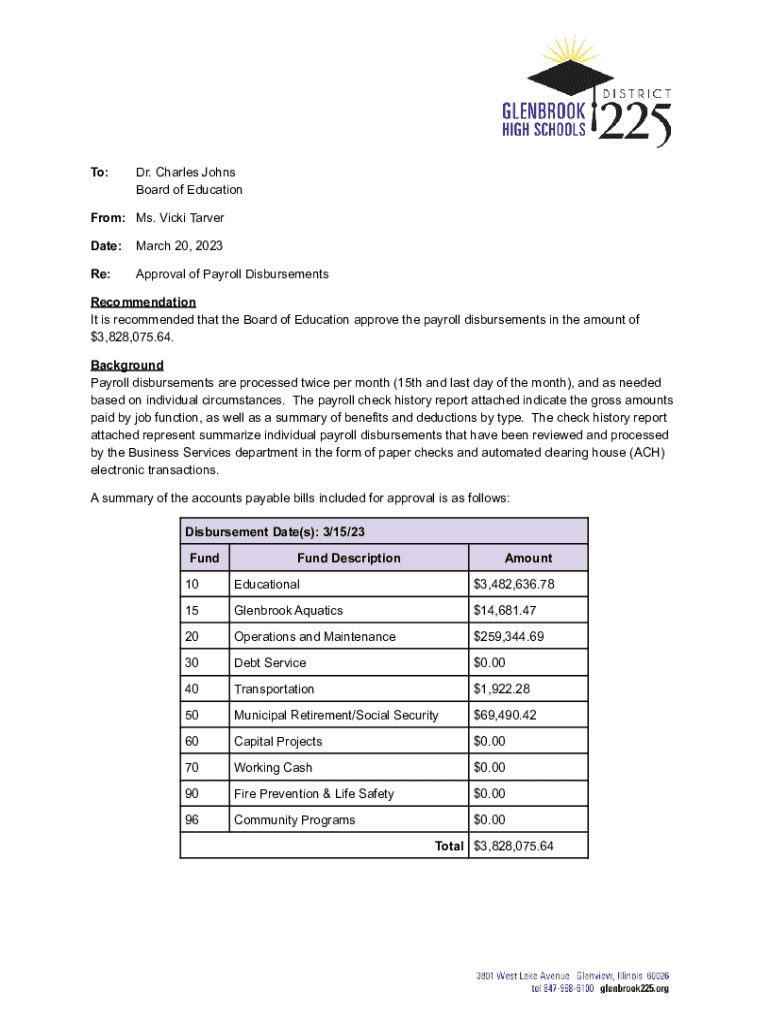

Payroll disbursements refer to the process by which companies distribute employee salaries and wages. This process is crucial for maintaining workforce satisfaction and productivity. The accuracy and timing of these disbursements influence employee morale and compliance with regulations.

Approval in payroll management acts as a necessary checkpoint in this process, leading to increased accountability and transparency. Both employees and employers play significant roles in ensuring that payroll disbursements are processed correctly and in a timely manner.

Overview of the payroll disbursements form

The payroll disbursements form typically includes sections for essential details about employees, their compensation, applicable deductions, and tax information. This form acts as a record of all transactions related to employee payments and is essential for both internal and external audits.

The primary purpose of the payroll disbursements form is to capture all the particulars of payroll processing, ensuring that all required parties are informed and that appropriate approvals are documented.

Preparing to fill out the form

Before filling out the payroll disbursements form, it is vital to gather essential employee details, including their names, positions, and identification numbers. You also need to have the pay period information, detailing the timeframe for which the payment is being processed.

Additionally, employer authorization is necessary to comply with company policies and regulations. Verification ensures that all figures included in the disbursement are correct and justifiable.

A critical step is gathering necessary documentation such as timesheets or previous payroll records. Failing to present correct records can lead to errors in payroll processing and delays in disbursement.

Step-by-step instructions for completing the form

Completing the payroll disbursements form involves careful attention to detail. Below is a breakdown of each section to help streamline the process.

When completing the form, accuracy is paramount. A single error can have cascading effects on payroll processing and compliance with tax obligations. Always double-check your calculations and the completeness of information.

Utilizing pdfFiller for efficient form management

pdfFiller provides a user-friendly platform for efficiently managing the payroll disbursements form. To access and edit the form on pdfFiller, begin by navigating to the template library and selecting the payroll disbursement form template.

Once you access the form, you can easily edit it as needed, adding employee information and pay details. One of the notable features of pdfFiller is its collaborative functionality, allowing team members to work simultaneously on the document, promoting an efficient flow of information.

Submitting the payroll disbursements form

Upon completing the payroll disbursements form, it’s essential to choose your preferred submission method. Options typically include digital submissions through email or a secure document management system and paper submissions to the finance department.

Before submission, verify that all necessary signatures are in place, and all information is accurate. Ensuring this will help prevent any delays in processing. Also, consider the follow-up procedures post-submission to track the approval and disbursement processes.

Troubleshooting common issues

Mistakes happen, and knowing how to handle them effectively can save time and frustration. For missing information, promptly reach out to relevant departments to fill in gaps in your data.

Disputes over payroll amounts can arise due to computation errors or misreporting of hours worked. It's advisable to maintain open lines of communication between departments to resolve discrepancies swiftly. Furthermore, if adjustments need to be made after approval, ensure that all changes are properly documented and approved again.

Maintaining compliance and best practices

Complying with payroll regulations and laws is paramount for any organization. Companies must be aware of local, state, and federal payroll laws applicable to their operations, ensuring compliance to avoid legal issues.

Maintaining good record-keeping practices is critical as well. It involves not only storing payroll disbursement forms but also tracking changes, approvals, and communications associated with payroll processes. Regular audits can help uncover any errors or inconsistencies in payroll management.

Case studies of effective payroll disbursement management

Examining real-world examples helps illustrate the principles discussed. Company A implemented an efficient approval workflow by incorporating a digital system that allowed for easy tracking of the payroll approval process. As a result, they saw a 30% reduction in payroll discrepancies.

Conversely, Company B faced significant challenges due to manual payroll processes that led to delays and conflicts with employee payments. By shifting to a software-based solution that integrated the payroll disbursements form and improved communication among departments, they mitigated these issues effectively.

Conclusion on the importance of streamlined payroll practices

A streamlined payroll process is critical not only for compliance but for maintaining employee trust and satisfaction. The approval of payroll disbursements form stands as a vital document in this journey, ensuring accurate records and timely disbursement.

By embracing efficient workflows and utilizing tools like pdfFiller, organizations can enhance productivity while minimizing the risk of error—fostering a culture of proactive management in payroll processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find approval of payroll disbursements?

How do I fill out the approval of payroll disbursements form on my smartphone?

How do I complete approval of payroll disbursements on an Android device?

What is approval of payroll disbursements?

Who is required to file approval of payroll disbursements?

How to fill out approval of payroll disbursements?

What is the purpose of approval of payroll disbursements?

What information must be reported on approval of payroll disbursements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.