Understanding the Certificate of Exemption AGAR 202425 Form

Understanding the Certificate of Exemption

The Certificate of Exemption AGAR 202425 is an essential document for smaller local councils and community organizations in the UK. It signifies that an organization is exempt from the requirement of having a full audit for the financial year, mainly due to its income not exceeding set thresholds. Designed to ease administrative burdens, the Certificate of Exemption allows localized bodies to operate without the extensive scrutiny that more substantial organizations might necessitate, promoting efficiency and reliability.

This certificate not only enhances the organization’s reputation by demonstrating adherence to financial governance but also frees up valuable resources that can be redirected towards community projects and services. Efficiently managing finances becomes crucial for smaller entities that often struggle to fulfill robust governance requirements due to limited manpower and financial resources.

Who needs the certificate of exemption?

Eligibility for the Certificate of Exemption centers primarily on income thresholds, making it crucial for small councils and organizations. For instance, to qualify, a council must have an annual gross income not exceeding £25,000. This allows local entities that function within tight financial boundaries to bypass tedious audits, thereby maintaining operational focus on community services.

Organizations that can apply for this exemption include parish councils, charities, and community interest groups. The advantages associated with obtaining a Certificate of Exemption are manifold; notably, it encourages organizational growth, promotes financial accountability, and reduces administrative overhead. By keeping governance processes streamlined, these organizations can dedicate more resources to their primary objectives, which ultimately benefits the community.

Detailed overview of the AGAR 202425 form

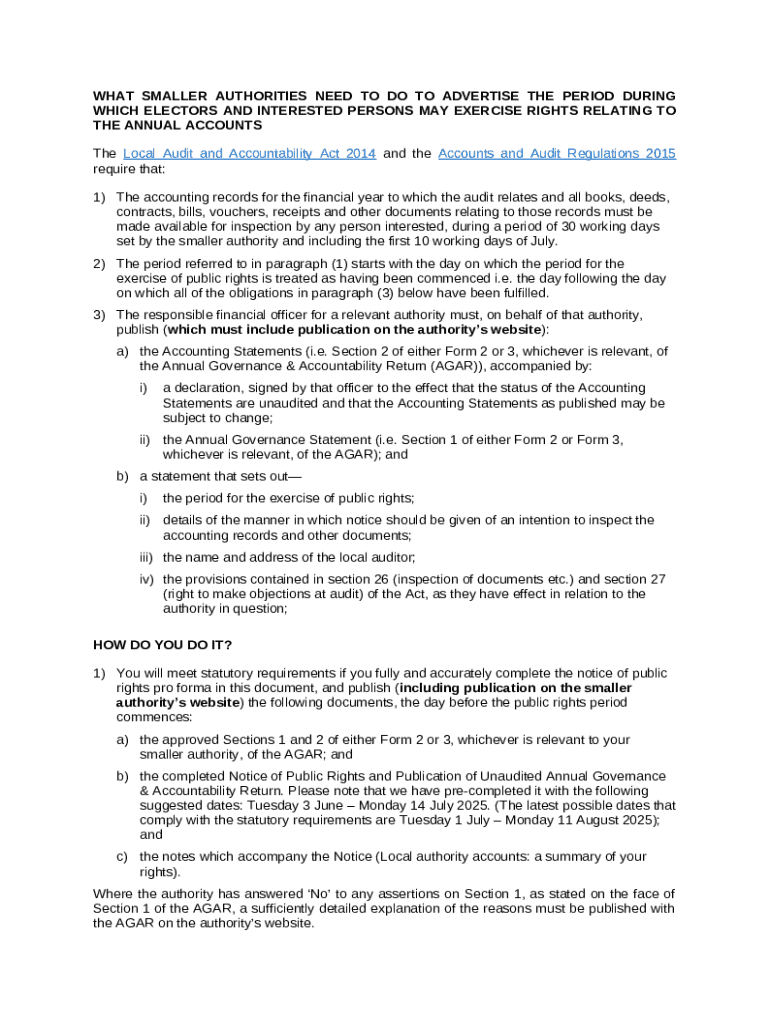

The AGAR (Annual Governance and Accountability Return) serves as the key reporting mechanism for local councils and community organizations to demonstrate adherence to financial regulations and accountability standards. The 202425 version of the AGAR form has been specifically tailored to encapsulate changes in community financial management practices and align with updated compliance requirements. It consists of several key sections that organizations must fill out comprehensively to submit an accurate return.

The structure of the AGAR form generally entails three primary segments: key organizational information, a summary of financial affairs, and detailed scrutiny and reporting requirements. Important dates and deadlines for submissions typically align with the financial year-end, often concluding in the autumn. Timely completion and submission are crucial to avoid penalties, ensuring organizations maintain their certificate of exemption status.

Step-by-step guide to completing the Certificate of Exemption AGAR 202425 form

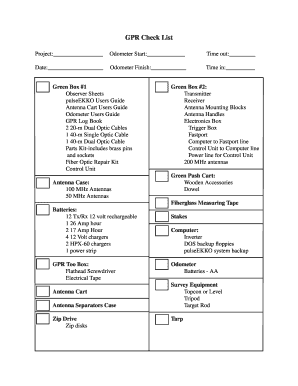

Completing the Certificate of Exemption AGAR 202425 form requires careful preparation and attention to detail. Begin by gathering all necessary information, including financial records, bank statements, and a summary of receipts and payments. This documentation serves as the backbone of your submission, ensuring that all figures accurately reflect the organization’s financial activities.

When filling out the form, follow these key steps for precision:

1. **Section 1: Basic organizational details**. Enter the organization's name, address, and contact information precisely.

2. **Section 2: Financial information**. Accurately disclose your income and expenditure for the fiscal year for transparency.

3. **Section 3: Scrutinizing the accounts and reporting**. This section requires providing a summary of how finances were managed and ensuring compliance with governance standards.

Avoid common pitfalls, such as misplacing figures or missing mandatory details, as these can delay processing and possibly jeopardize your exemption.

Editing and finalizing your submission

After filling out the Certificate of Exemption AGAR 202425, it's crucial to review your form meticulously. Look for accuracy in all figures, spelling of names, and organizational detail to avoid returning the form for correction. Utilizing tools such as pdfFiller can streamline this process by providing functionalities for easy editing and finalization of documents. Ensuring your submission is clear and correct bolsters the likelihood of swift approval.

Signature requirements, particularly for official documentation, are another integral aspect. Using eSign capabilities within pdfFiller allows for a secure and legally binding signature process, facilitating efficient and compliant submissions.

Submitting the Certificate of Exemption

Organizations can choose between online options or traditional paper submissions when submitting the Certificate of Exemption AGAR 202425. Opting for online submission often results in faster processing times and immediate confirmation of receipt. However, if you prefer physical documentation, ensure you check specific mailing addresses and submission guidelines to avoid delays.

Critical deadlines must be adhered to, as failure to submit on time can lead to penalties or loss of the exemption. After submission, organizations should anticipate communications from governing bodies, confirming receipt or requesting further information if necessary. Staying proactive in monitoring submission statuses can alleviate concerns and maintain compliance.

Managing your documents with pdfFiller

pdfFiller offers a comprehensive suite of features tailored for effective certificate management, making it easier to manage key documents like the AGAR 202425 form. The platform's cloud-based accessibility ensures documents can be accessed and edited from anywhere, fostering collaboration among team members. Its sharing capabilities allow for seamless communication and feedback during the completion process.

Utilizing pdfFiller also brings forth organizational benefits through efficient document organization and rapid retrieval. By categorizing your files and maintaining an organized digital workspace, you ensure easy access to historical data or supporting documents, which can expedite future submissions and ongoing compliance.

Keeping track of future requirements

Remaining compliant involves careful monitoring of annual scheduling for submissions and renewals associated with the Certificate of Exemption AGAR 202425. Creating a calendar reminder for key dates helps avoid last-minute scrambles and ensures proactive financial governance. Additionally, staying informed about any changes to regulations or requirements is vital for maintaining your organization's exemption status.

Engaging in regular training sessions, accessing community forums, or utilizing professional guidance can empower your organization to navigate changes effectively. Continuous learning surrounding financial governance will fortify your organization’s ability to adapt and thrive within evolving compliance landscapes.

Common FAQs about the AGAR 202425 form

Organizations sometimes face questions about the Certificate of Exemption AGAR 202425. Common inquiries include:

- **What if my organization does not qualify for the exemption?** In such cases, entities must prepare for a full audit and adapt to comprehensive reporting obligations, ensuring they have sufficient resources to manage these processes.

- **How to handle mistakes made on the form?** If errors are discovered post-submission, organizations should act quickly to submit corrections or clarifications, thereby demonstrating accountability.

- **Where to get help if you’re unsure about the process?** Many resources are available, including online forums, professional accounting services, and community support networks dedicated to assisting local councils and similar entities.

Special considerations and updates for 2024-25

The AGAR requirements for 2024-25 may see updates that impact the audit exemption process. Staying ahead of any regulatory changes is fundamental for organizations to ensure compliance and maintain their Certificate of Exemption. Continuous engagement with official government resources and participation in relevant training can equip teams with the knowledge to navigate these changes efficiently.

As the landscape of local governance evolves, securing financial transparency and compliance in future annual returns becomes integral. Organizations should actively review their practices to ensure alignment with the latest requirements, fostering long-term sustainability and community trust.

Links to additional resources

For further clarification on the Certificate of Exemption AGAR 202425, organizations can consult various official resources and community support networks. Accessing government guidelines, local council websites, and financial management forums can provide invaluable insights. Professional advice services are also available and can aid in navigating complex financial requirements, ensuring your organization remains robust and compliant.