Get the free Property Tax Bill

Get, Create, Make and Sign property tax bill

Editing property tax bill online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax bill

How to fill out property tax bill

Who needs property tax bill?

Property Tax Bill Form - A Comprehensive How-to Guide

Understanding property tax bills

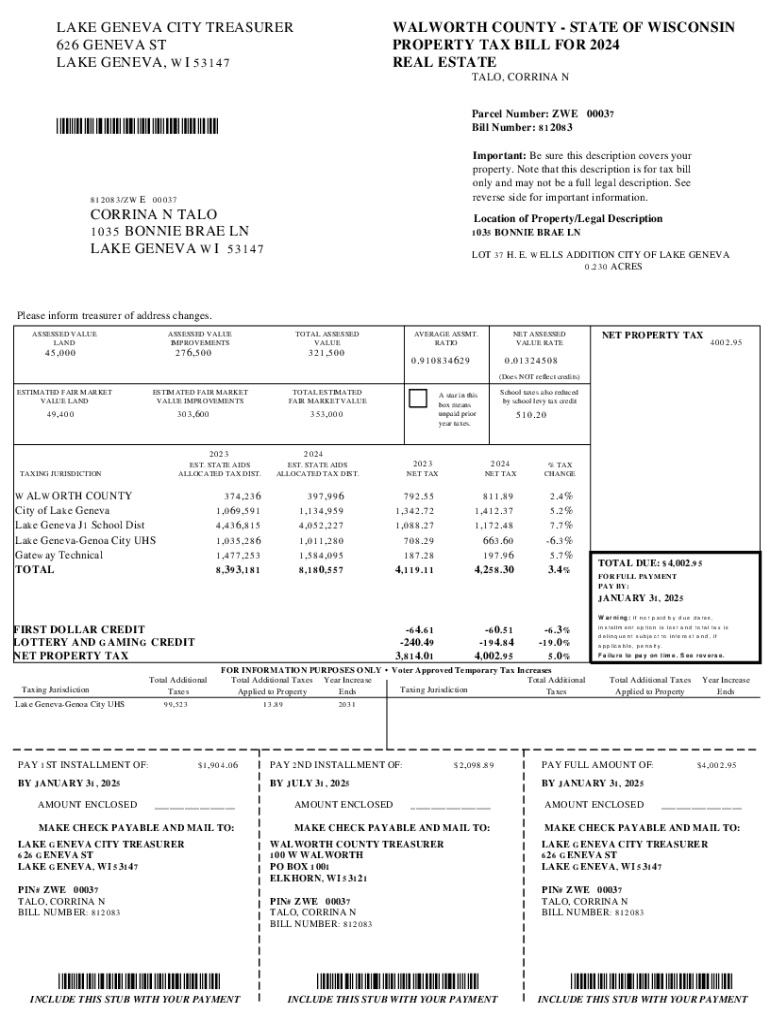

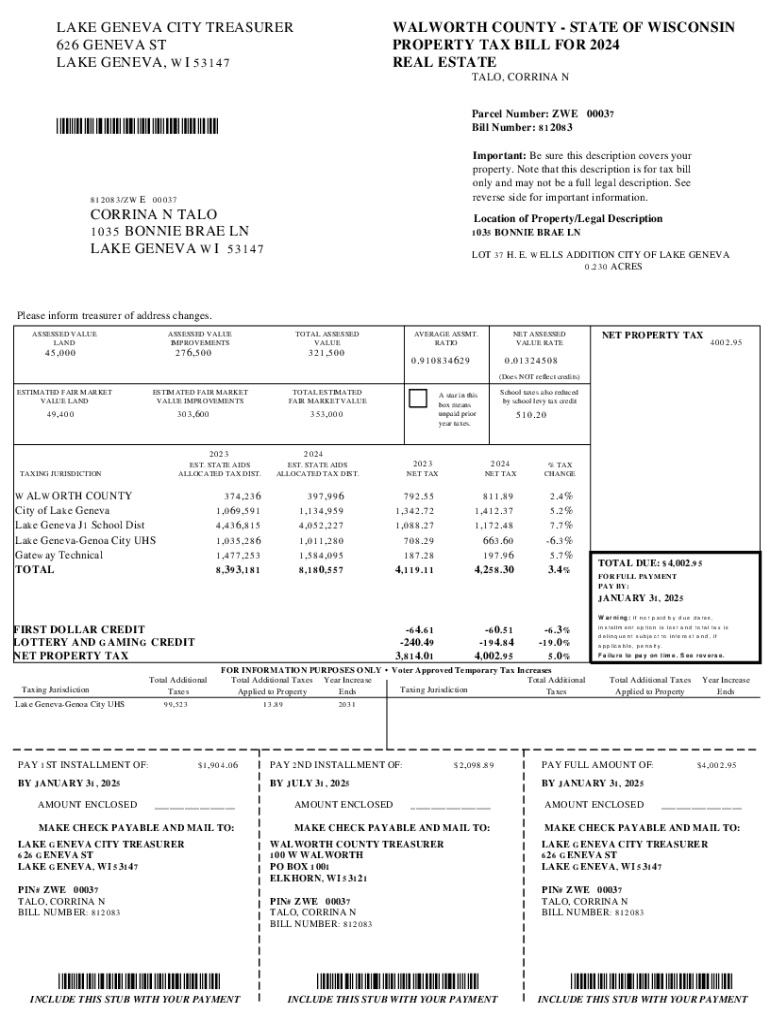

A property tax bill is a statement issued by local governments to property owners detailing the amount of tax owed for the property they own. This tax is crucial as it funds essential public services such as education, transportation, and emergency services. Understanding the property tax bill is vitally important, as it not only informs property owners of their tax obligations but also provides insight into how local fiscal policies directly affect their communities.

There are key components to any property tax bill that need attention: property assessment details, tax rates, and payment instructions. The assessment details provide information regarding the value of the property assessed by the local tax authority, which is crucial for calculating the total property taxes due. Tax rates, often expressed in mills, define the amount charged per $1,000 of assessed property value. Lastly, the payment instructions guide you on how and where to remit payment, be it online, by mail, or in-person.

Navigating your property tax bill

When examining your property tax bill, it’s essential to know the key sections that provide valuable information. Typically, these include owner information, property description, and tax breakdown. The owner information section lists the name and address of the property owner, ensuring that all information is correct and up-to-date. The property description gives details about the property type and its assessed value, while the tax breakdown itemizes how the total tax amount is derived.

Additionally, it is vital to familiarize yourself with common jargon associated with property taxes. For instance, 'millage rates' refer to the dollars per $1,000 of assessed property value, while 'exemptions and deductions' can lower your taxable property value, ultimately reducing your tax liability. Understanding such terms can simplify the management of your property tax bill.

Filling out the property tax bill form

Completing a property tax bill form may seem daunting, but it can be simplified through a step-by-step approach. Start by gathering necessary documents, including previous bills and assessment notices, which provide a reference for current taxes. Ensure you have these documents handy as they will be critical for accurate completion.

Next, complete the property information section accurately. This typically requires entering your property’s account number, address, and taxable value. Afterward, it's crucial to calculate the tax amount based on the assessed value and the applicable tax rate. Finally, include any payment details, ensuring that the method and schedule of payment are clearly indicated. Completing these steps correctly will help avoid delays and potential penalties.

Editing and managing your property tax bill

Document management is made straightforward with solutions like pdfFiller, which allows you to edit and manage your property tax bill effectively. First, upload your property tax bill to the platform. The user-friendly interface simplifies the process of editing fields; corrections can be done easily by clicking on the relevant sections of your document.

Moreover, pdfFiller provides secure options for digitally adding signatures. This feature not only saves time but also ensures your document maintains its integrity when modifications are made. These tools equip property owners with the resources needed to handle their property tax forms confidently.

eSigning your property tax bill

The convenience and security of eSigning a property tax bill cannot be overstated. With pdfFiller, users can seamlessly eSign their documents, staying compliant without the need for physical mailing. The eSigning process begins by selecting the eSign option within the document. Users can then add their signatures and initials at designated points, ensuring all stipulations are met.

After completing the signing process, confirming and saving the document is crucial to ensure that all changes are recorded. By utilizing modern eSigning solutions, property owners can expedite their tax management process while maintaining secure and verifiable records.

Payment instructions for your property tax bill

A property tax bill typically details multiple payment options. Understanding these can help you select the most suitable method. Common options often include online payments, where property owners can securely remit their payment through the local tax authority’s website. Mail-in options are also available, where individuals send a check along with their bill to the tax office.

For those who prefer face-to-face interactions, in-person payments can be made at local tax offices. In many jurisdictions, property owners can also set up payment plans to manage their tax liabilities more effectively, spreading the cost over several months. In cases of overpayment, it's essential to know the correct procedures for requesting refunds to ensure that funds are handled appropriately.

Addressing common concerns

It is not uncommon for property owners to feel concerned about discrepancies in their tax bills. If you disagree with your bill, contacting your local assessor's office is the first step. They can clarify any misunderstandings and guide you on the appeal process if necessary. Filing an appeal may involve submitting forms that detail your reasons for disputing the assessed value.

Additionally, management of missing or late bills is critical. Always verify that your local tax authority has your current information on file. To avoid interest and penalties, set reminders for payment due dates. Understanding your rights and obligations, particularly regarding interest and penalties for late payments, can empower property owners to manage their tax responsibilities effectively.

Interactive tools and resources

Leveraging interactive tools can enhance your property tax management experience significantly. Accessing property tax calculators is beneficial for estimating your potential tax obligations based on assessed values and local rates. Furthermore, locating your local tax office’s website offers additional resources and essential information regarding your tax situation.

Resources for tax assistance, such as information on available exemptions, can provide users with crucial knowledge to potentially lower their tax bills. Understanding the options available for property tax exoneration can lessen financial burdens and contribute to better fiscal planning.

Additional considerations

Property tax regulations and procedures can vary significantly by state and even by county. It is advisable for property owners to familiarize themselves with local property tax laws and guidelines. Some states offer specific deductions for seniors, veterans, or individuals with disabilities, which may significantly alleviate tax responsibilities.

Planning for future tax bills is also essential. Keeping up with changes in local tax rates and reassessment schedules will help property owners budget more effectively. Understanding the role of local governments in tax assessments can also provide insight into how property values are determined, aiding in better long-term property management strategies.

Frequently asked questions

Many property owners have common queries regarding their property tax bills. For instance, knowing how to read your tax bill includes understanding all its components, such as millage rates and fee structures. Property owners should also be aware of payment deadlines to avoid unnecessary penalties and interest.

In terms of tax deductions and exemptions, understanding what is available can significantly benefit property owners financially. Familiarize yourself with local regulations to maximize potential savings on your property tax bill.

Support and assistance

Having access to support is crucial when managing your property tax bill. Local tax authorities usually provide contact information for inquiries, and utilizing platforms like pdfFiller can offer additional assistance if you encounter any issues with documentation or forms. Furthermore, engaging with community forums dedicated to property tax discussions can offer insights and support from fellow property owners experiencing similar challenges.

Constructing a support system involving professionals and peers can empower property owners, ensuring all questions are addressed, and fostering a better understanding of property tax responsibilities. In the realm of property taxation, knowledge is power.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find property tax bill?

Can I create an eSignature for the property tax bill in Gmail?

How do I fill out the property tax bill form on my smartphone?

What is property tax bill?

Who is required to file property tax bill?

How to fill out property tax bill?

What is the purpose of property tax bill?

What information must be reported on property tax bill?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.