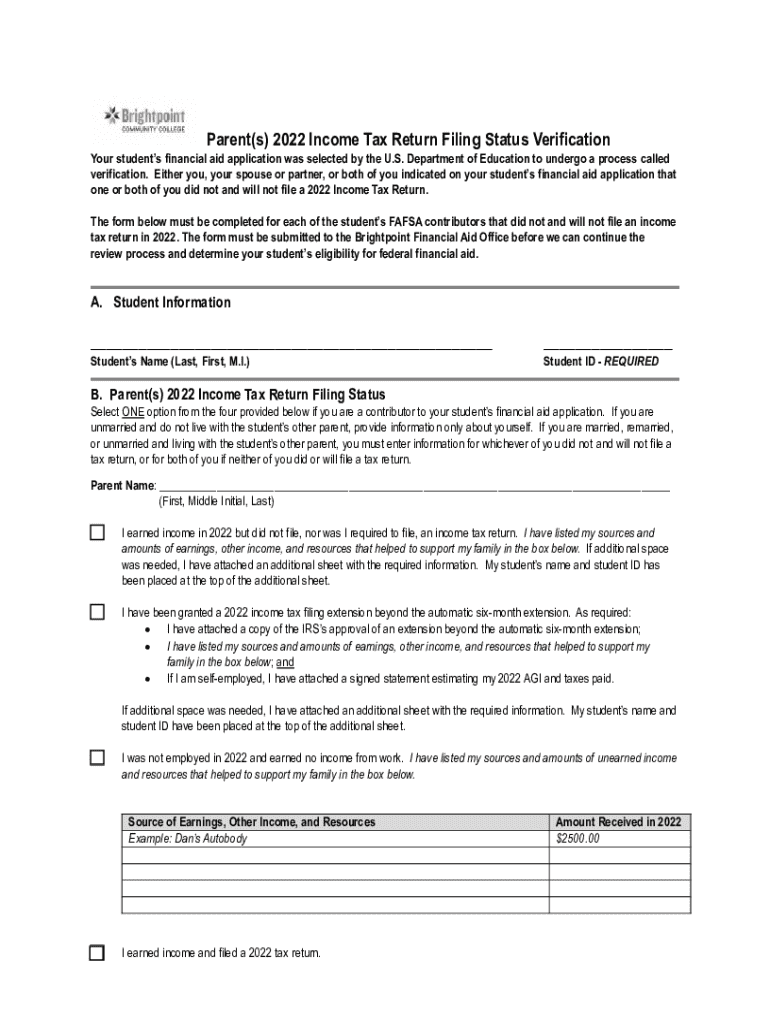

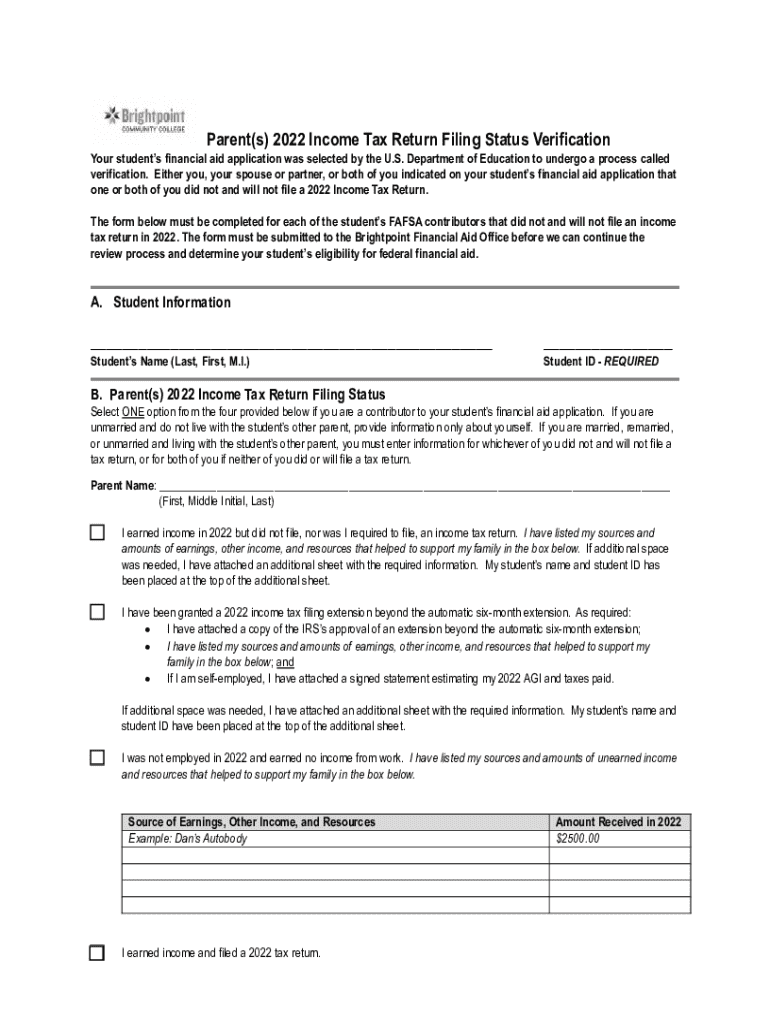

Get the free Parent(s) 2022 Income Tax Return Filing Status Verification

Get, Create, Make and Sign parents 2022 income tax

Editing parents 2022 income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out parents 2022 income tax

How to fill out parents 2022 income tax

Who needs parents 2022 income tax?

Parents 2022 Income Tax Form: A Comprehensive Guide

Understanding the importance of the Parents 2022 Income Tax Form

The Parents 2022 Income Tax Form plays a crucial role in determining eligibility for various financial aid programs, including federal and state aid. This form provides colleges and universities with essential information about a family’s financial standing, enabling them to make informed decisions about awarding aid. Failure to accurately complete this form can lead to significant consequences, such as reduced financial aid or increased out-of-pocket expenses for educational costs.

Understanding key tax terms and processes related to the form is vital for parents. Familiarizing oneself with terms like 'Adjusted Gross Income (AGI)', 'tax deductions', and 'credits' can help parents navigate their financial situation effectively while ensuring they provide the necessary documentation for their child's college application.

Overview of parent income verification

Income verification is the process of confirming the income reported by parents on their tax forms. This verification is essential for accurately assessing a student’s financial aid eligibility. Various scenarios may trigger the need for income verification, including applying for income-based aid, scholarship opportunities, or even during the FAFSA process. Understanding this process helps ensure compliance with financial aid requirements.

Several institutions might request additional income verification documentation, particularly if the reported income seems inconsistent with other information provided. Parents should be prepared to present detailed income statements and additional financial documentation to avoid any delays in the aid process.

Gathering required documentation

To accurately complete the Parents 2022 Income Tax Form, it’s essential to gather all relevant documentation. The key documents required include:

Different situations may require specific documentation such as filing jointly vs. separately, reporting foreign income, or managing finances if residing abroad or in U.S. territories. Understanding these nuances can prevent complications during the filing process.

Who needs to file a parent income tax form?

Not every parent needs to file an income tax form; however, it’s crucial to assess the circumstances that apply to individual families. Generally, parents whose dependents are pursuing higher education will need to submit income information. Special considerations exist for families experiencing divorce, separation, or significant life changes, which can complicate filing strategies.

If one or both parents do not file taxes due to low income or other factors, it is still necessary to report that status on the income tax form. Providing clear explanations with adequate documentation can help satisfy aid requirements and avoid complications.

Step-by-step process for completing the 2022 income tax form

Completing the Parents 2022 Income Tax Form entails a systematic approach that ensures accuracy and completeness. Here is a simple three-step guide:

This structured approach enables parents to complete the form efficiently with minimal errors.

Submitting your parent income tax form

Submission methods for the Parents 2022 Income Tax Form may vary depending on preference and circumstances. Parents can choose between e-filing and traditional paper filing. While e-filing is faster and often leads to quicker refunds, paper filing can be cumbersome and slower.

Deadlines for submission are crucial; missed deadlines can severely impact financial aid considerations. Parents should be aware of these dates and ensure they submit the form well in advance. Keeping confirmation of submission and organizing documentation enhances accountability and helps in case of later disputes.

Requesting additional documentation if necessary

If additional documentation is needed for processing income verification, parents can easily obtain a Tax Return Transcript (TRT) from the IRS, which serves as an official record of their filed tax returns. This is crucial if the original documents have been lost or misplaced.

For parents facing discrepancies or disputes regarding reported income, clear communication with the financial aid office is essential. Gathering any supporting documentation swiftly can resolve misunderstandings and ensure a smoother process.

Special situations concerning parent income tax forms

Parents living outside the U.S. ride a different wave in terms of documentation. They must ensure compliance with unique reporting requirements, particularly around foreign-earned income. This often includes using different forms or declarations tailored for expatriates.

Families who have recently experienced significant life changes, such as job loss, divorce, or marriage, must report these changes accurately on their tax forms. The financial implications of these transitions can affect tax liability and, by extension, financial aid qualifications.

Troubleshooting common issues

Completing the Parents 2022 Income Tax Form is not without challenges. Common pitfalls include missing fields, miscalculating tax liabilities, or incorrect reporting of income types. A proactive approach to reviewing entries can minimize these mistakes and ensure accuracy.

If the IRS flags the submission for review, it’s essential to remain calm and responsive. Collecting any necessary documentation promptly can prevent further delays. Utilizing tools like pdfFiller can simplify the correction process and streamline document management.

Utilizing pdfFiller for efficient document management

pdfFiller empowers users to seamlessly fill out, edit, and eSign their tax forms using a user-friendly interface. This cloud-based platform allows parents to collaborate efficiently with family members when gathering and submitting documentation.

Accessing cloud-based storage helps in keeping tax documents organized and retrievable. Users can retrieve these documents from anywhere, making it convenient to manage paperwork without the hassle of physical files.

Frequently asked questions (FAQs)

Several inquiries arise surrounding the Parents 2022 Income Tax Form. Common questions include how to determine the appropriate filing status and clarifications regarding potential tax benefits that may arise from reported income. Understanding these elements can significantly impact financial aid considerations.

Moreover, parents often seek to understand the implications of reported income on financial aid eligibility and how any changes in economic situations can affect outcomes.

Interactive tools and resources

To further support families in navigating the Parents 2022 Income Tax Form, pdfFiller offers interactive tools such as calculators for estimating tax brackets and potential refunds. These resources guide parents in making more informed fiscal decisions.

An interactive checklist can assist families in ensuring that all necessary documentation is prepared accurately, while step-by-step video tutorials on using pdfFiller for tax documents can enhance user understanding and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit parents 2022 income tax in Chrome?

How do I fill out the parents 2022 income tax form on my smartphone?

Can I edit parents 2022 income tax on an iOS device?

What is parents income tax?

Who is required to file parents income tax?

How to fill out parents income tax?

What is the purpose of parents income tax?

What information must be reported on parents income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.