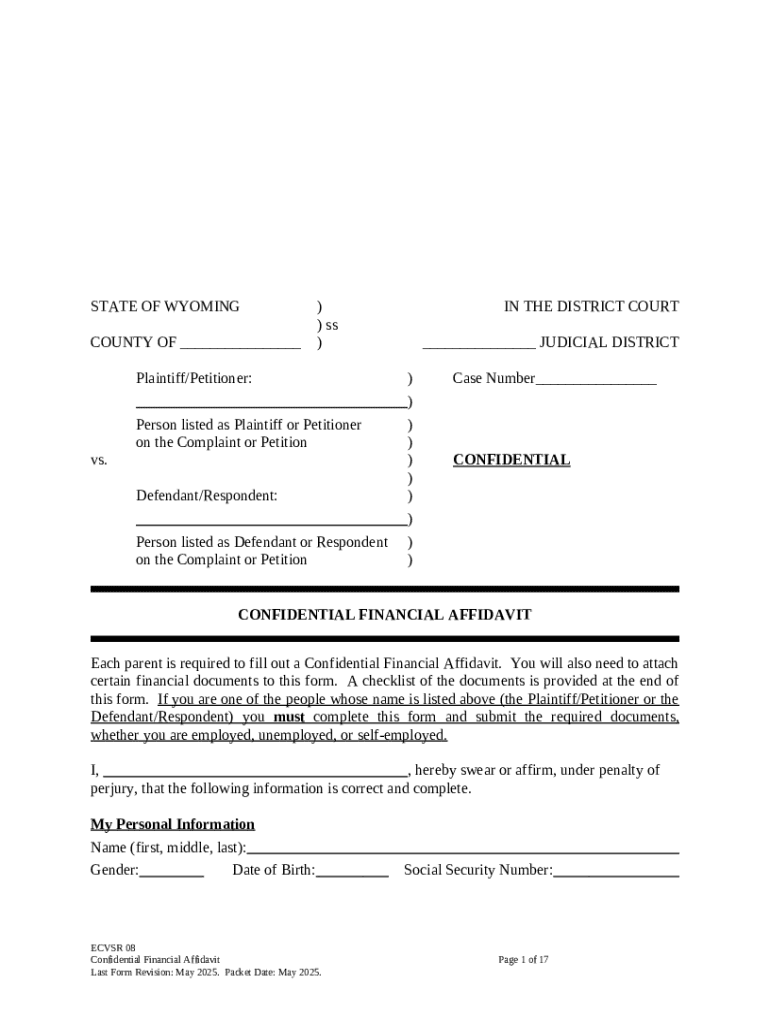

Confidential Financial Affidavit Template Form: A Comprehensive How-to Guide

Understanding financial affidavits

A financial affidavit is a legal document that provides a sworn statement of an individual's financial condition. It typically includes comprehensive details about income, expenses, assets, and liabilities. Understanding this document's intricacies is crucial, especially in challenging times, such as divorce proceedings, bankruptcy filings, or court cases involving child support.

Financial affidavits play a pivotal role in both legal and financial processes. Courts often require these documents to determine a party's financial capacity and obligations. Thus, presenting an accurate and thorough affidavit not only influences legal decisions but also protects one's financial interests.

Common situations where a financial affidavit is necessary include divorce proceedings, where parties are required to outline their financial status for fair asset division and support obligations. Additionally, some lenders require financial affidavits when applying for loans, ensuring borrowers have the capacity to repay.

Key components of a financial affidavit

A comprehensive financial affidavit contains several essential components that must be filled out accurately to ensure its validity in legal contexts. Understanding each section helps in gathering the right information and presenting a complete financial picture.

Personal information section: This includes your full name, address, and contact details. Identification numbers such as Social Security and tax ID must also be included for verification.

Income details: Clearly outline all sources of monthly income, including salary, business income, and investment returns. Documentation to support these claims, like pay stubs and bank statements, is often necessary.

Asset disclosure: This section should list all significant assets such as real estate, vehicles, savings accounts, and any other valuable items. It’s important to provide a fair market value for each asset to ensure transparency.

Liabilities overview: Here, report any debts, including loans, credit card debt, and other financial obligations. It's critical to be honest in this section, as discrepancies can negatively impact proceedings.

Monthly expenses breakdown: Categorize your expenses into fixed (rent, mortgage) and variable (entertainment, groceries) to provide an accurate assessment of your financial obligations.

Using the confidential financial affidavit template

Accessing a confidential financial affidavit template is made simple with pdfFiller’s platform. With just a few clicks, individuals can find a template that suits their needs and start filling it out.

Where to find a template: You can easily access pdfFiller’s Confidential Financial Affidavit Template by navigating their extensive library of forms.

Choosing the right format: Determine whether a PDF format or an editable online version best suits your needs. PDF offers a professional finish, while a web-based form allows for easy modifications.

Filling out the template step-by-step: Start by downloading or opening the template in pdfFiller. Input your personal information, disclose income and assets accurately, complete your liabilities section, and finalize monthly expenses.

Reviewing for accuracy and completeness: Once you have filled out all relevant sections, thoroughly review the document to ensure every detail is accurate and complete.

Editing and customizing your financial affidavit

pdfFiller provides robust tools for editing and customizing your financial affidavit. Its user-friendly interface allows for quick changes and annotations to enhance clarity and comprehension.

Techniques for editing within pdfFiller: Utilize the editing tools to make adjustments easily. You can modify text, add entire sections, or rearrange elements to fit your needs.

Adding comments or notes for clarity: If collaborating with others, such as attorneys or financial advisors, you can insert comments or notes directly onto the document for enhanced discussions.

Collaborating with others for review: Share the document seamlessly through pdfFiller, allowing multiple parties to review and provide feedback without the hassle of email chains.

eSigning your financial affidavit

eSigning is increasingly becoming a standard practice for legal documents, including financial affidavits. This electronic signature process speeds up the submission phase and ensures documents are signed in a secure environment.

Importance of eSigning in legal documents: Electronic signatures provide a legally binding method of signing documents, which can simplify and accelerate the signing process.

How to use pdfFiller’s eSigning features: Users can initiate the eSigning process directly within pdfFiller. Follow prompts to add your signature, and invite others to sign, maintaining a clear audit trail.

Ensuring compliance with legal standards: pdfFiller’s technology adheres to established eSignature laws, ensuring your documents comply with legal requirements in your jurisdiction.

Submitting your financial affidavit

Submitting your financial affidavit accurately and in a timely manner is essential in legal or financial contexts. Depending on your situation, there are various methods for submission.

Different submission methods: You may need to submit directly to a court, present it to a financial institution, or keep it for your personal records.

Importance of timeframes and deadlines: Missing a deadline for submission can have significant legal repercussions. Ensure you are aware of the relevant timeframes associated with your case.

Keeping a copy for your records: Always retain a copy of your completed financial affidavit for future reference and personal documentation.

Frequently asked questions (FAQs)

Understanding the nuances of financial affidavits can raise several questions. Addressing common queries can simplify the process and provide clarity for individuals in need.

What are the most common mistakes to avoid? Ensure accuracy in reporting information, as discrepancies can lead to legal challenges.

Can a financial affidavit be revised? Yes, revisions can be made if circumstances change or errors are discovered.

How does a financial affidavit impact legal proceedings? Properly completed affidavits can significantly affect rulings in financial disputes.

Is legal assistance necessary for completing a financial affidavit? While not mandatory, consulting with a legal professional is advisable to ensure compliance with local regulations.

Maximizing document management with pdfFiller

To streamline document management, pdfFiller offers tools that enable users to store, organize, and manage their financial affidavits effectively. Leveraging these features enhances productivity and secure access to documents.

Storing and organizing your affidavit: Cloud storage ensures your documents are accessible anywhere, protecting them from loss or damage that physical copies might encounter.

Using interactive tools for document management: pdfFiller allows you to track changes and versions of your affidavit, ensuring you can revert to previous iterations if necessary.

Leveraging pdfFiller’s collaboration features: The platform simplifies collaboration, allowing for real-time input and feedback from multiple collaborators.

Conclusion

Using a confidential financial affidavit template effectively can have significant implications in legal and financial matters. It’s essential to be thorough, accurate and organized in your approach.

Empowering yourself with the right tools, such as pdfFiller’s all-in-one platform, can facilitate smoother document creation, management, and submission processes. As you engage with financial affidavits now and in the future, leveraging these resources will prove invaluable.