Get the free Hotel/ Motel Tax Discretionary Fund Grant

Get, Create, Make and Sign hotel motel tax discretionary

How to edit hotel motel tax discretionary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hotel motel tax discretionary

How to fill out hotel motel tax discretionary

Who needs hotel motel tax discretionary?

Understanding the Hotel Motel Tax Discretionary Form

Understanding Hotel Motel Tax Discretionary Form

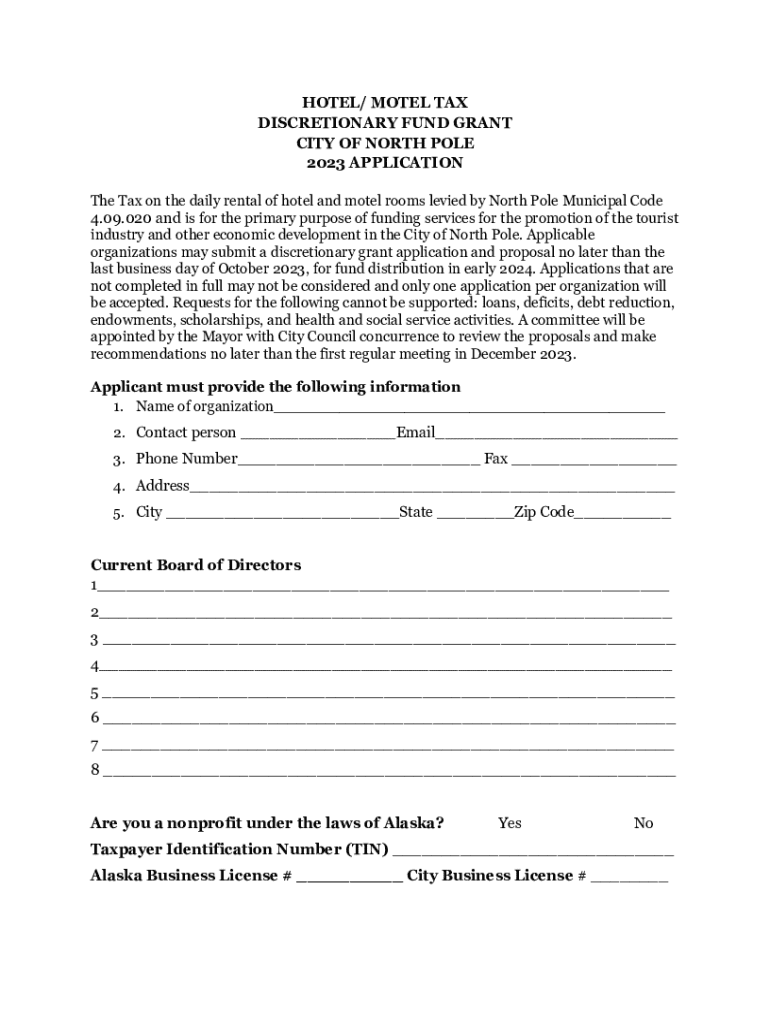

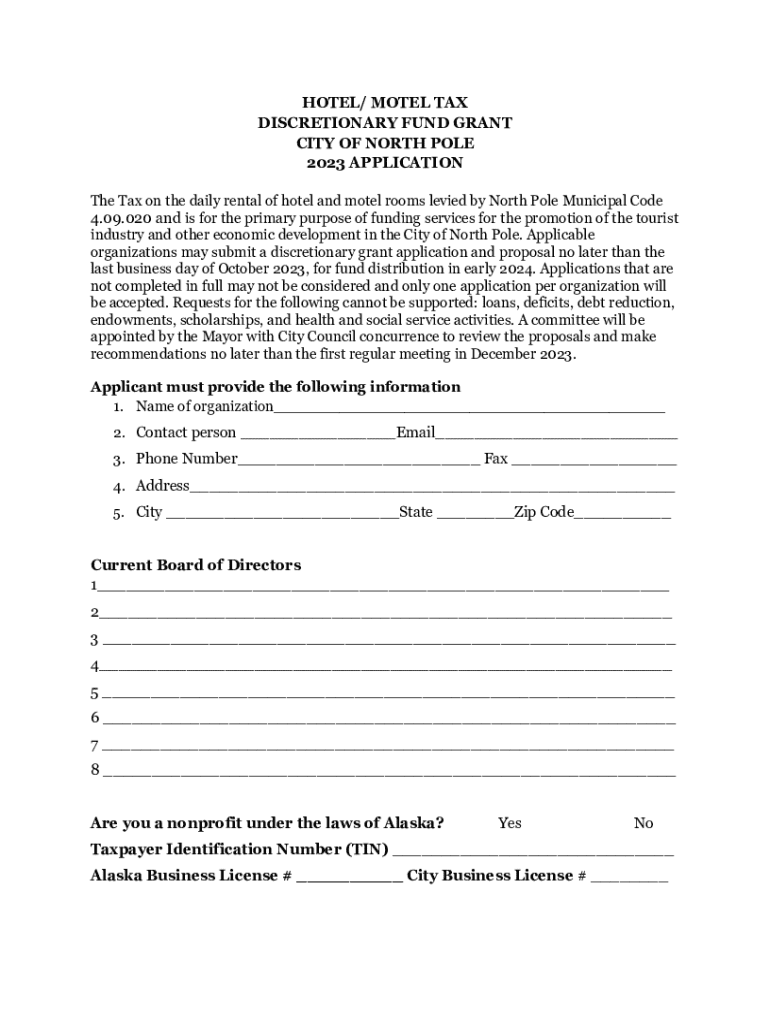

The hotel motel tax discretionary form is an essential document for lodging operators and local governments alike. It represents a financial obligation that not only affects the revenue of hotels and motels but also plays a pivotal role in sustaining community services and development. The hotel motel tax, often referred to as transient occupancy tax, is levied on guests who stay in commercial lodging establishments, including hotels and motels. This form caters to the specific requirements of calculating, reporting, and paying this tax, streamlining processes for both operators and municipalities.

By accurately using the discretionary form, local governments can allocate funds generated from these taxes towards vital community services such as infrastructure improvement, tourism promotion, and more. For hotel and motel operators, this form is not just an obligation but a means to ensure proper compliance, thus avoiding penalties or audits.

Key information about hotel motel tax

The hotel motel tax is part of a broader structure known as discretionary sales surtax. This surtax is typically added on top of the base sales tax and is determined by local jurisdictions. Each locality may impose a different rate, reflecting their budgetary needs and service requirements. Transactions subject to this surtax include daily room rentals, vacation home fees, or any operation that provides temporary lodging in exchange for payment.

Examples of taxable transactions under this framework are nightly rates charged at hotels and fees collected for additional services such as room upgrades. However, there are common exemptions, which include lodging provided by nonprofit organizations or accommodations offered without charge for certain public purposes. Understanding these essentials is crucial for compliance and financial planning.

Tax rates for hotel motel taxes can vary greatly by jurisdiction, with local governments sometimes adjusting these to cater to their unique economic circumstances. For instance, in Florida, the average rate varies from 4% to 6% depending on the county. Awareness of these rates can significantly impact pricing strategies for lodges and hotels, as well as their competitive edge in the market.

Filing the hotel motel tax discretionary form

Completing the hotel motel tax discretionary form involves several clear steps that ensure accuracy and compliance. First, preparation is key. Gather all necessary documentation such as sales records, occupancy rates, and previous tax filings. This will provide a comprehensive background for filling out the form accurately.

When filling out the form, there are specific fields that need attention, including property information like hotel name, address, and license number, alongside sales figures and calculated taxes. It's essential to double-check calculations to prevent common mistakes, which may include incorrect rates or omitted exemptions. Remember that meticulous attention at this stage can save time and prevent complications later in the process.

Once completed, submission methods may vary. Most jurisdictions allow electronic submissions via their official online platforms, while others may still accept mailed copies. Ensure you follow the guidelines provided by your locality and retain copies of your submitted forms for future reference. If you encounter issues during submission, contacting local tax authorities or utilizing online help resources can provide clarity and assistance.

Paying the hotel motel tax

Payment methods for the hotel motel tax can range from electronic systems to traditional payments through checks or cash. Many local authorities now offer online payment gateways to streamline the process, significantly reducing time and potential errors. Ensure that payments are made in accordance with the deadlines established by your municipality, as these can vary depending on the frequency of the tax cycle.

Deadlines for filing and paying can be categorized into monthly, quarterly, or annual cycles. It's crucial to stay on top of these due dates, as late payments or incorrect filings can lead to financial penalties such as late fees or interest on overdue amounts. Therefore, setting reminders can help manage your obligations effectively.

Managing your hotel motel tax obligations

Effective management of hotel motel tax obligations involves a combination of diligent record-keeping and utilization of tax management software. Implementing best practices in documentation can simplify the tracking of tax responsibilities, ensuring that all records are up-to-date and readily accessible for audits or reviews. Many operators find that using management software tailored for the hospitality industry helps in keeping accurate sales records, filing forms, and making timely payments.

A common misconception surrounding hotel motel taxes is that all properties are subject to the same requirements. In reality, obligations can vary based on the property's type, location, and specific local laws. Understanding these variances can help operators avoid unnecessary penalties and leverage local tax benefits.

Address/jurisdiction database

Locating the accurate tax rates for your jurisdiction is a crucial step in ensuring compliance with hotel motel tax obligations. Local government websites often provide updated information about current tax rates and any changes in regulations. Utilizing local databases or interactive tools designed for tax calculations can help streamline this research and ensure you have the necessary information to fulfill your tax duties accurately.

It is also important to ensure compliance with local regulations by considering key factors that can influence tax rates, such as location-specific laws or seasonal adjustments. For nuanced guidance, reaching out to local tax authorities can clarify any uncertainties regarding compliance or specific local practices.

Resources for hotel motel tax filers

Filing the hotel motel tax discretionary form is supported by a variety of resources and tools that can facilitate compliance and improve efficiency. For instance, government websites provide links to official forms and additional resources, helping operators navigate their specific tax obligations seamlessly. Additionally, online tools for calculating surtax amounts can ease the daunting task of ensuring accurate tax calculations.

Utilizing platforms designed for document management, such as pdfFiller, can transform the way you handle your tax forms. Through pdfFiller’s comprehensive features, users can easily edit PDFs, eSign documents, and store their tax records securely in the cloud. This technology empowers hotel and motel operators to manage their documents effectively, reducing the fear of compliance mishaps.

FAQs for hotel motel tax

Frequently asked questions surrounding the hotel motel tax discretionary form revolve around issues like corrective measures after submission errors and consequences of unpaid taxes. If a mistake occurs in your submitted form, promptly contact your local tax authority for guidance on how to correct the error. Meanwhile, negligence in paying the surtax can lead to penalties, including fines and increased interest rates, so maintaining vigilance is crucial.

Moreover, property owners may wonder what steps to take in the event of an audit. It’s advisable to have all relevant documents organized and accessible, ensuring you can provide the appropriate information smoothly and effectively. For anyone unsure about the process, consulting with local tax professionals can provide personalized guidance and support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the hotel motel tax discretionary in Chrome?

Can I create an eSignature for the hotel motel tax discretionary in Gmail?

How do I fill out hotel motel tax discretionary using my mobile device?

What is hotel motel tax discretionary?

Who is required to file hotel motel tax discretionary?

How to fill out hotel motel tax discretionary?

What is the purpose of hotel motel tax discretionary?

What information must be reported on hotel motel tax discretionary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.