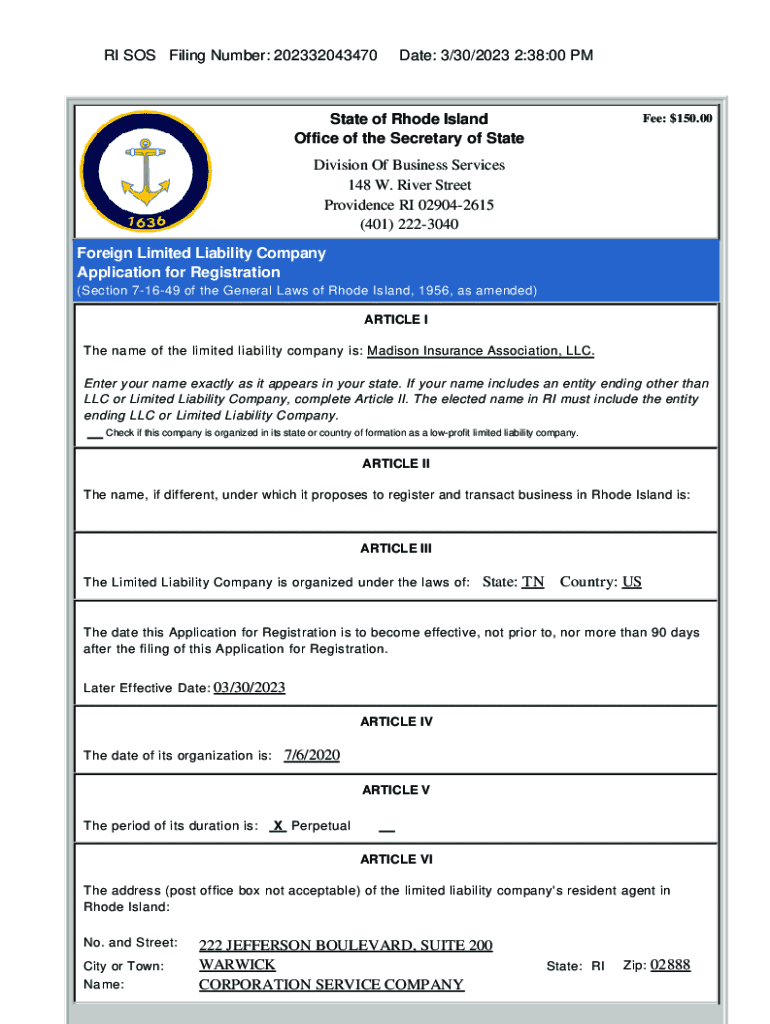

Get the free Foreign Limited Liability Company Application for Registration

Get, Create, Make and Sign foreign limited liability company

Editing foreign limited liability company online

Uncompromising security for your PDF editing and eSignature needs

How to fill out foreign limited liability company

How to fill out foreign limited liability company

Who needs foreign limited liability company?

Comprehensive guide to foreign limited liability company form

Overview of foreign limited liability companies

A Foreign Limited Liability Company (LLC) is an LLC that operates in a state other than the one where it was originally formed. This structure allows businesses to expand and conduct operations across state lines while providing limited liability protection to its owners.

Establishing a Foreign LLC comes with substantial benefits, including flexibility in management, pass-through taxation, and protecting personal assets from business liabilities. Furthermore, a Foreign LLC can offer an avenue for businesses to reach new markets and tap into different customer bases.

Key differences exist between Domestic and Foreign LLCs. While a Domestic LLC is formed and operates within the same state, a Foreign LLC is a business entity that is recognized in a different state from its registration. Understanding these distinctions is crucial for compliance and operational success.

Statutory provisions for foreign LLCs

Each state in the U.S. has specific statutory provisions governing Foreign LLCs, primarily found in their business and corporate codes. These statutes delineate the requirements foreign businesses must meet to operate legally within the state.

Many states require Foreign LLCs to register before transacting business, which often includes filing specific forms and fees. Each state also regulates how Foreign LLCs must report their operational activities, taxation obligations, and compliance measures.

Understanding the legal framework is essential; some states may have stricter regulations than others. For instance, Delaware is known for its business-friendly laws while California has more extensive compliance obligations, making it vital to research each state’s specific rules.

Steps to establish a foreign limited liability company

Establishing a Foreign LLC involves several critical steps:

Completing the foreign limited liability company form

Filling out the Foreign Limited Liability Company form can be daunting, but understanding the information required simplifies the process.

You will need to prepare various details such as the company name, principal business address, registered agent’s information, and ownership structure. Member information is also crucial, particularly if the LLC has multiple owners.

To effectively complete the form, follow these steps:

Utilizing interactive tools like pdfFiller can streamline this process, as their editing tools allow for easy form completion, and their eSignature feature ensures legal compliance.

Filing the foreign limited liability company form

Once the form is completed, the next step is filing it with the appropriate agency.

You can submit your application either online or by mail, depending on the state’s requirements. Online filing is often quicker, receiving immediate confirmation. However, mail submissions may be necessary in some instances.

Filing fees vary significantly by state; for example, Delaware has a lower filing fee compared to California. It's advisable to check the exact fees and consider any additional costs for expedited processing.

Additional considerations for foreign LLCs

Post-registration, maintaining compliance with state regulations is paramount. Many states require Foreign LLCs to file annual reports, which help keep your business in good standing.

Adding complexity, changing business addresses or registered agents necessitates updated filings with the state to avoid legal complications. Additionally, it is vital to be aware of the tax obligations that may arise, including income tax and state-specific requirements.

Consider maintaining up-to-date records of all filings and requirements to ensure smooth operation, making it easy to adapt to any emerging regulations or changes.

Common myths about foreign limited liability companies

Misconceptions about Foreign LLCs abound, often causing confusion among business owners. One of the most common myths is that LLCs operating in a foreign state do not enjoy liability protection.

In reality, a Foreign LLC retains the same liability protections as a Domestic LLC, safeguarding personal assets during legal challenges. Misunderstanding business operations is another area of concern; foreign entities can conduct business legally in their chosen state provided they follow regulatory requirements.

Resources and support for foreign registrants

Resources are available to assist individuals looking to establish a Foreign LLC. Each state’s Secretary of State office is a primary point of contact for specific guidance on regulatory requirements and compliance.

Considering legal advice can offer additional insights on navigating complex state laws. It's essential to maintain good records on all documentation and annual filings, which is simplified with tools available on pdfFiller.

Managing your foreign limited liability company

Effective management of your Foreign LLC documentation is critical to ensure compliance and operational efficiency.

Utilizing document management systems like pdfFiller allows business owners and teams to keep their documents organized and accessible. Collaboration features also enable team members to share and review documents without the hassle of email chains.

Frequently asked questions (FAQ) about foreign forms

Business owners frequently have questions regarding the foreign limited liability company form. Addressing common queries can alleviate concerns and foster a better understanding of the process.

By having clear answers to these questions and similar scenarios, business owners can navigate their registration process with greater confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get foreign limited liability company?

How do I edit foreign limited liability company online?

How do I edit foreign limited liability company on an iOS device?

What is foreign limited liability company?

Who is required to file foreign limited liability company?

How to fill out foreign limited liability company?

What is the purpose of foreign limited liability company?

What information must be reported on foreign limited liability company?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.