Get the free Form 315

Get, Create, Make and Sign form 315

How to edit form 315 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 315

How to fill out form 315

Who needs form 315?

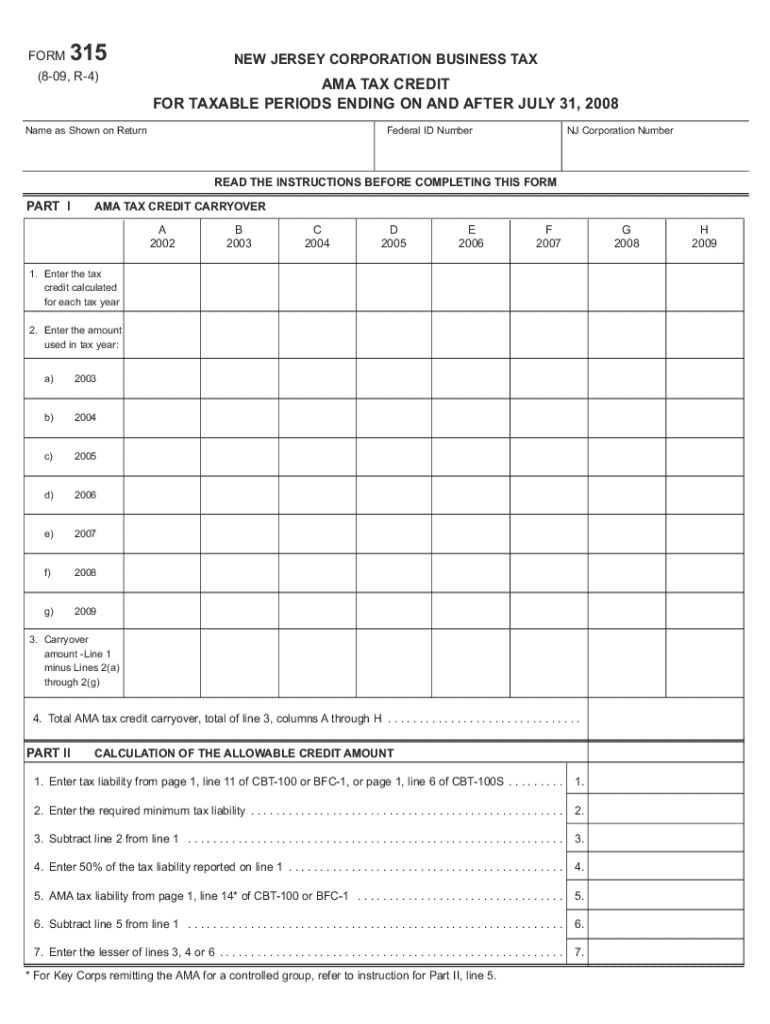

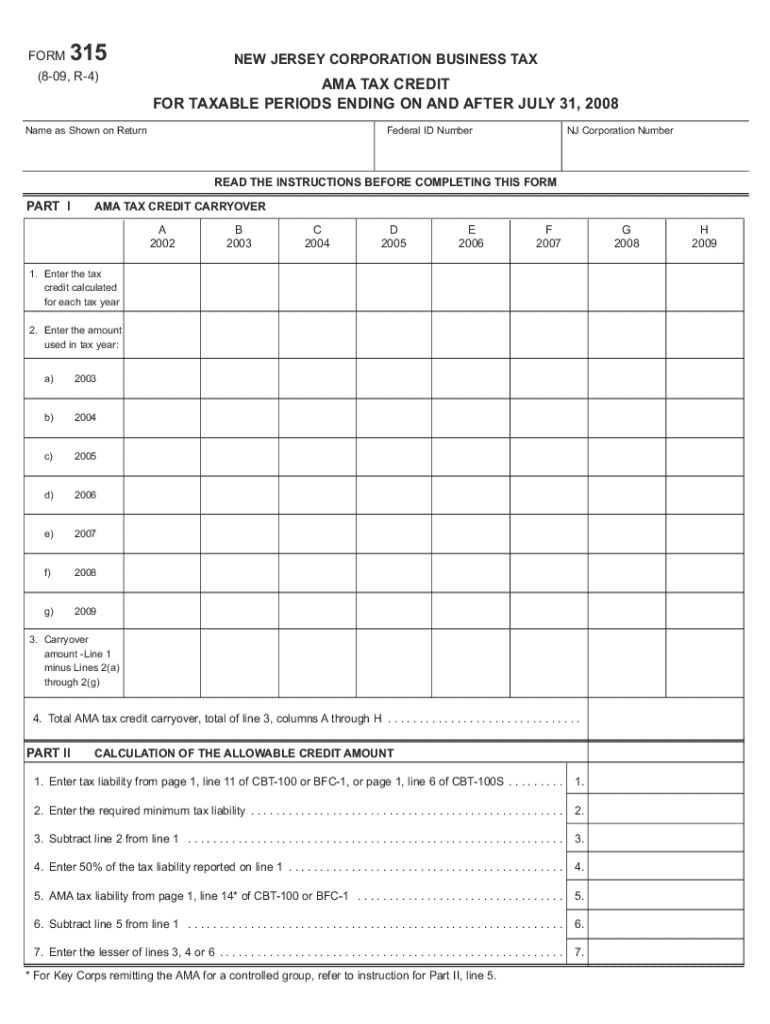

A Comprehensive Guide to Form 315

Understanding the Form 315

The Form 315 is an essential document used primarily by various regulatory authorities for specific reporting and compliance purposes. It's crucial for individuals and organizations to understand its structure and function.

The purpose of the Form 315 is to collect detailed information, including personal and financial details, which help authorities assess compliance with relevant laws or regulations. Its importance cannot be overstated; failure to fill it out correctly can lead to delays or penalties.

Generally, anyone who is involved in a transaction or activity regulated by a specific authority that requires Form 315 must fill it out. This could include property purchasers, financial borrowers, or entities engaged in legal activities requiring regulatory oversight.

Key elements of Form 315

Form 315 comprises several key sections that need to be completed accurately. These sections collect various types of information that regulatory bodies require.

Familiarize yourself with common terminology used in Form 315 to ensure accurate and effective communication. Understanding terms like 'regulatory compliance' and 'financial disclosure' is essential.

Step-by-step instructions for filling out Form 315

Filling out Form 315 correctly requires methodical preparation. Here’s a step-by-step guide to ensure successful completion.

Editing Form 315 in pdfFiller

pdfFiller offers powerful editing tools, which enhance the overall user experience while working with Form 315. Editing forms digitally can save time and prevent common mistakes.

Collaboration features in pdfFiller are particularly useful for teams, allowing for real-time edits and discussions about Form 315.

eSigning Form 315

The significance of electronic signatures (eSigning) in modern document management can’t be overlooked. eSigning adds efficiency and legality to the signing process.

Managing your Form 315 submissions

Efficient document management is critical, especially for important forms like Form 315. Leveraging pdfFiller’s capabilities, users can store and keep their forms organized and easily accessible.

Troubleshooting common issues with Form 315

Even the most diligent users might face issues while filling out Form 315. Understanding common mistakes can save a lot of frustration.

Best practices for form management

Implementing best practices for managing your forms, particularly Form 315, can lead to increased efficiency and compliance.

Case studies: Successful usage of Form 315

Analyzing real-life examples can provide valuable insights into effectively using Form 315. Cases vary by industry and specific regulatory needs.

Interactive tools for Form 315 users

To further enhance the user experience while handling Form 315, interactive tools can be invaluable. These resources provide instant solutions tailored to user needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 315 directly from Gmail?

How can I send form 315 to be eSigned by others?

How can I get form 315?

What is form 315?

Who is required to file form 315?

How to fill out form 315?

What is the purpose of form 315?

What information must be reported on form 315?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.