Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Form 8-K Guide: How to Understand and Complete This Important Filing

Understanding Form 8-K

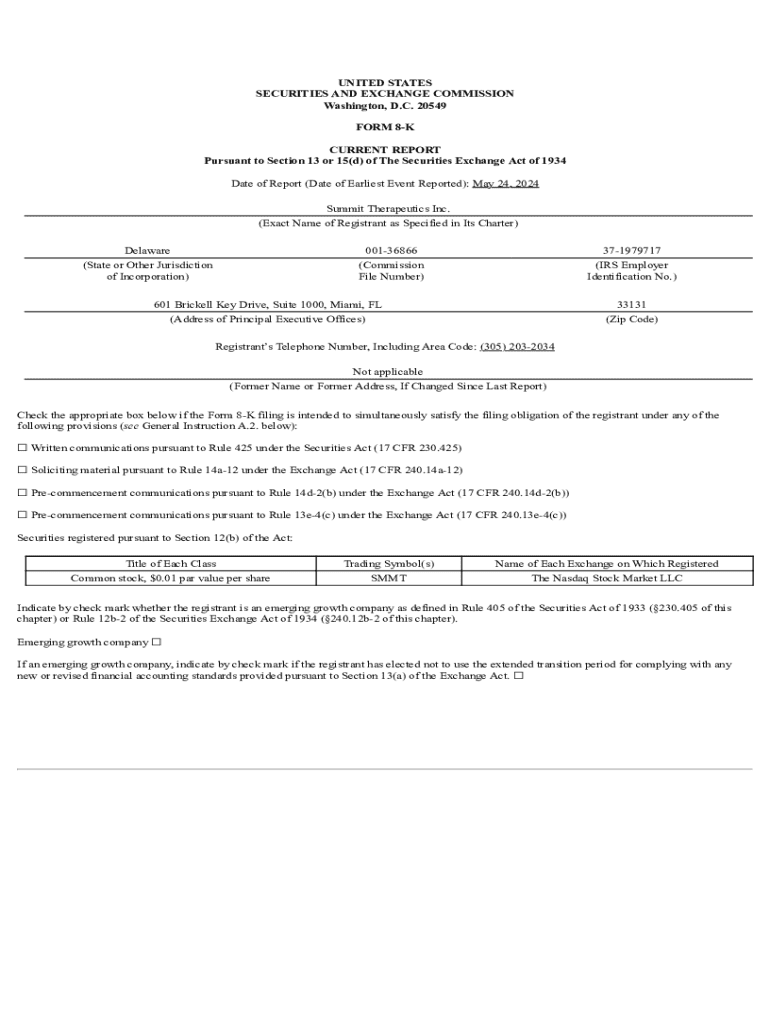

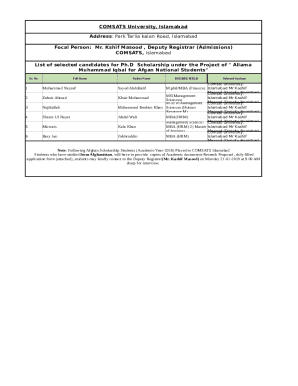

Form 8-K is a key regulatory document that public companies in the United States must file with the U.S. Securities and Exchange Commission (SEC) to disclose major events that shareholders should know about. This form serves as a tool for maintaining transparency in corporate governance and ensures that investors have timely access to material information that could influence their investment decisions.

Its importance in corporate regulatory compliance cannot be overstated. Form 8-K is not just a bureaucratic obligation; it plays a crucial role in maintaining stakeholder trust and confidence. Inside this form, companies report events like mergers, financial condition changes, and leadership changes, making it imperative for investors and stakeholders to stay informed.

Key components of the form often include details about significant agreements, changes in corporate governance, and financial results. Therefore, it's essential for those engaged in investment or corporate decision-making to understand how to interpret this form.

Overall, the critical role of Form 8-K in providing snapshots of significant corporate developments makes it indispensable for anyone involved in corporate finance or investment strategies.

When is Form 8-K required?

Form 8-K must be filed whenever a company experiences a significant event that shareholders need to be aware of. Examples of events that trigger a Form 8-K filing include mergers, asset sales, bankruptcy, significant acquisitions, financial restatements, and changes in executive management. Each of these events represents a crucial moment for shareholders, indicating potential shifts in company strategy or financial health.

The timeline for submitting this form is also strictly defined. Companies generally have four business days following the triggering event to file Form 8-K. This timeline emphasizes the urgent need for corporate transparency and ensures that investors have the most current information available.

Timeliness in these filings not only complies with legal standards but also fosters an environment of trust between a corporation and its investors. Companies that fail to adhere to the Form 8-K filing deadlines risk regulatory scrutiny and damage to their reputation.

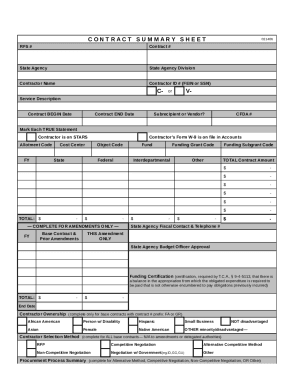

Disclosures and information in Form 8-K

Form 8-K necessitates a comprehensive array of disclosures. At a minimum, companies must disclose critical financial information, changes in corporate governance, and events of significant importance. This usually includes details that allow investors to assess the effects of these developments on their financial interests.

Mandatory disclosures encompass various categories, such as:

In addition to mandatory disclosures, companies may choose to include elective disclosures that could provide further context or insights into their operational status. This could range from strategic updates to forward-looking statements that articulate upcoming initiatives.

Reading and interpreting Form 8-K

Understanding how to read a Form 8-K is essential for investors and analysts alike. The form is structured into several sections, each carrying distinct types of information relevant to stakeholders. To navigate this document effectively, one can follow a systematic approach.

Key sections of Form 8-K include:

Identifying critical information quickly requires familiarity with the form's structure and a focus on keywords that signal critical events, such as 'acquisition,' 'resignation,' or 'restatement.' This strategic reading can provide a comprehensive understanding of the implications surrounding each filing.

Form 8-K items explained

Within Form 8-K, various specific items are frequently reported, each signifying distinct events or changes that companies must disclose. Understanding these items is vital for readers to evaluate the context and implications of the reported events.

Real-world examples can help illustrate the importance of these items. For instance, if a company reports under Item 2.02, investors immediately know there has been a significant change in financial performance, providing them with an opportunity to reassess their holdings.

Navigating historical Form 8-K filings

Reviewing historical Form 8-K filings can be invaluable for understanding pattern changes over time or corporate behavior in response to different market conditions. Access to these archived documents can shed light on how companies have evolved concerning their regulatory requirements and corporate strategies.

Several online resources offer archives of Form 8-K filings, allowing users to filter and search documents by date, company name, or event type. Utilizing these databases can yield insights such as:

Insights drawn from previous filings can lead to more informed investment decisions and a deeper understanding of market trends.

Benefits of filing Form 8-K

Filing Form 8-K provides numerous benefits for public companies. Primarily, it enhances investor confidence by ensuring transparency in operations and governance. When investors can access accurate, timely information, they are more likely to maintain their trust in the company's management.

Moreover, promoting transparency aids in avoiding potential regulatory penalties stemming from failures in disclosure. Consistent and accurate Form 8-K filings signal a company's commitment to corporate governance principles, strengthening its accountability to stakeholders.

Ultimately, the act of filing Form 8-K not only fulfills a legal obligation but also represents a proactive approach in fostering a trusting relationship between a company and its investors, resulting in a positive corporate reputation.

Key highlights and best practices for filing Form 8-K

Companies can follow certain best practices to ensure that their Form 8-K filings are both compliant and informative. This includes thorough preparation, accurate reporting, and timely submissions. Organizations must ensure that they establish clear protocols for monitoring events that may require a filing to avoid delays that could compromise their regulatory stance.

Common pitfalls to avoid include failing to file within the stipulated timeframe or providing incomplete information. Such lapses can not only lead to penalties but can also affect shareholder trust adversely.

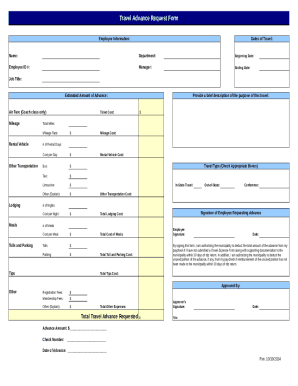

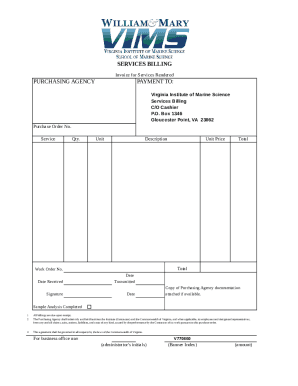

Interactive tools for Form 8-K preparation

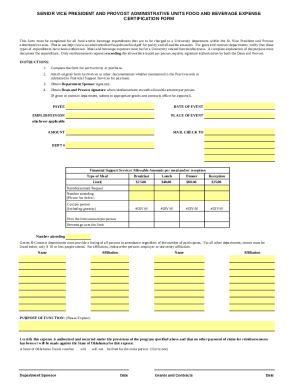

Using interactive tools can simplify the process of preparing Form 8-K. Platforms like pdfFiller offer templates tailored for this specific filing, making the drafting and editing process user-friendly. These tools are designed to cater to the unique needs of companies looking to streamline their compliance documentation.

Notably, pdfFiller includes interactive features such as collaborative editing and eSigning capabilities. This allows teams to work on Form 8-K filings in real-time, ensuring that multiple perspectives are incorporated, and the document is accurate and comprehensive before submission. The ability to eSign also facilitates faster submissions — a vital factor given the tight filing deadlines for Form 8-K.

Frequently asked questions about Form 8-K

Many individuals and teams may have specific queries surrounding Form 8-K, especially regarding compliance procedures and penalties associated with failures to file. Common questions that arise include:

Sector-specific insights

The requirements for filing Form 8-K can vary across different industries. Certain sectors, such as healthcare and finance, may face unique challenges concerning compliance due to regulatory scrutiny or the nature of their operations. For example, a healthcare company may require more detailed disclosures related to product approval processes or clinical trials.

Case studies showcase how these sector-specific regulations impact Form 8-K filing practices. For instance, tech startups often file for funding rounds, mergers, or key executive hirings, while mature companies in banking might focus on regulatory compliance events, effects of changing interest rates, or major legal issues. Understanding how these discrepancies play out can provide valuable insights to investors and corporate strategists.

Staying updated on regulatory changes

With regulations surrounding Form 8-K frequently evolving, it is critical for companies and investors to stay updated on changes that may impact filing requirements. Regularly monitoring updates from the SEC through their official communications or newsletters can help stakeholders remain informed of any regulatory shifts.

Moreover, subscribing to insights and updates from platforms like pdfFiller can keep users in the loop about ongoing changes in corporate filing regulations, ensuring they are always prepared to maintain compliance and adapt to new standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 8-k in Chrome?

How do I edit form 8-k straight from my smartphone?

How do I edit form 8-k on an iOS device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.